- within Energy and Natural Resources and Criminal Law topic(s)

Workforce data not only shapes how employment decisions are made — but how they're scrutinized. Whether addressing pay equity, evaluating AI tools or managing reorganizations, 2026 is a good year for employers to anticipate risk early, align with compliance obligations and support decisions that hold up under scrutiny.

Takeaway

"Employers are not facing entirely new risks, but familiar practices are being examined in new ways."

Christopher T. Patrick

Principal | Co-Leader, Workplace Analytics & Preventive

Strategies Practice

Decision Areas

Pay Equity + Transparency

Expanded Efforts at State + Local Levels

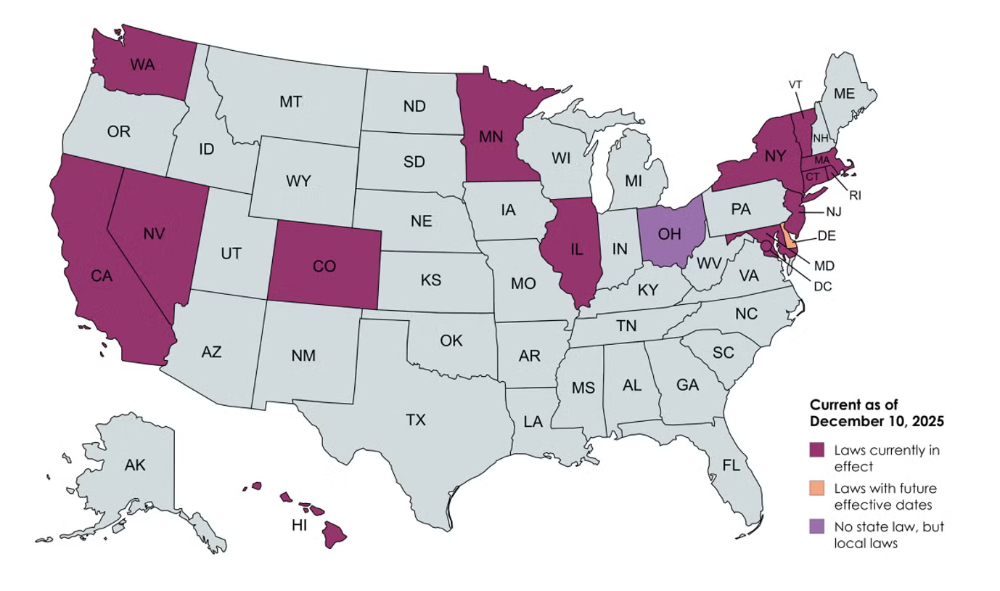

Legal requirements surrounding pay equity are expected to continue expanding at the state and local levels. An area that once centered on federal law now includes a patchwork of state laws, international mandates and growing pay transparency and pay data reporting obligations. At the same time, data-driven analysis can be a helpful tool in evaluating compensation systems, adding to employers' compliance complexity. Here's what employers need to know for 2026:

State-Level Pay Transparency

Differences in Pay Range Disclosure Requirements

- Washington: "Full" pay range.

- California, Colorado, other states: Reasonable starting pay range in job postings.

- Connecticut, Nevada, Rhode Island: Other conditional triggers (upon request, post-interview).

- New Jersey (proposed rules): Would cap range at no more than 60 percent of the minimum.

Fragmented State Job Posting Disclosure Requirements Create Implementation Challenges

- Inconsistent definition of "pay range"; some states require full, starting, "reasonable" ranges.

- Some states require disclosure of promotion and transfer opportunities and pay ranges.

- Requirements vary on whether benefits must be disclosed and to what level of specificity.

- Pay data reporting requirements are increasing at state and local levels.

Pay Transparency Requirements for International Employers Are Developing in the EU

- Employers are encouraged to see the EU Pay Transparency Directive section of this report for further information.

Local Considerations

- Local laws typically operate in addition to state requirements, not in place of them.

Pay Transparency Strategy

Looking forward, multistate employers should consider a harmonized disclosure approach and consistent practices to help ensure compliance.

- Build a unified disclosure approach to reconcile differing state formulas to reduce likelihood of noncompliance.

- Use automation to align postings, requests and internal-mobility disclosures as well as with reporting obligations.

- Prepare for expanding reporting obligations across states and localities.

- Rely on compliance framework for monitoring current and developing obligations.

Pay Equity Enforcement Trends and Data-Driven Defenses

Agencies and plaintiffs allege pay differs because of protected status or activity

- Generally, clearly defined, consistent pay structure, ranges

and/or

levels can help provide a legitimate, nondiscriminatory explanation for pay differences. - Can provide a framework for defending claims of discriminatory pay practices.

Allegations of unfair pay also cover incentive, bonus and equity compensation

- Developing, communicating and following clear compensation plan(s) based on objective criteria can mitigate risk.

- Conducting routine proactive pay analyses can help ensure pay is implemented fairly.

Restructuring/Reduction in Force Analytics

Thoughtful Strategies for Broader Anticipated Restructuring Activities

Organizations can anticipate increased restructuring activities in 2026 as they pursue automation and cost containment. A key to any strategic workforce change is to have legally defensible, data-informed support.

Plan Items

Employers seeking a unified framework for supporting multistate compliance in this area should make sure their restructuring/RIF plans include:

- Adverse impact analyses to evaluate potential risks early.

- Federal WARN Act and state-level notice obligations.

- Selection criteria review for consistency, job-relatedness and defensibility.

- OWBPA release compliance.

- A review of separation agreements to ensure compliance with state law nuances.

Pressure on AI Hiring Tools

Regulatory Focus on Validity + Transparency

Validity + Transparency

Selecting, auditing and validating AI and other employment decision tools will be more challenging for employers in 2026.

Here's why:

- Bias-audit mandates are expanding across states and cities:

- California: Regulations under Fair Employment and Housing Act.

- Colorado: Effective 2026.

- Illinois: Effective 2026.

- New York City: Local Ordinance.

- EU: Classifies employment-related AI as a high risk.

- Employers must ensure transparency, notice and measurable fairness.

- Employers have responsibilities to protect applicant and employee data.

Tip 1: Ensure Tools Are Valid, Job-Related + Defensible

- Conduct formal validation studies tied to essential job functions.

- Document vendor due diligence, data sources and testing methodology.

- Comply with recordkeeping rules.

Tip 2: Engage in Proactive Risk Mitigation

- Inventory all AI tools and determine which laws are applicable.

- Implement periodic adverse-impact testing and bias auditing.

- Establish cross-functional governance to oversee AI-driven decisions.

- Implement AI use policies.

- Monitor impact of EO 14365 ("Ensuring a National Policy Framework for Artificial Intelligence") focused on state and local AI law preemption.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.