The wine and spirits financial performance playbook has aged well, until now

Margin improvement and cost reduction efforts are common practice across many sectors of the economy but have not been typically part of the financial performance playbook among distillers and wine producers, particularly in the premium segment. It's a missed opportunity, and one that a tougher operating environment is turning into an imperative.

Well-managed consumer products companies will typically achieve steady 4-5% in year-over-year productivity through purposeful and well-structured financial fitness or margin management programs. These often come in the form of productivity gains across supply chain, procurement, manufacturing, G&A, sales, and marketing. The ability to drive such programs across functional areas is critical to maximizing impact.

In general, however, the wine & spirits industry has lagged CPGs on this capability for a number of reasons:

- Historically, high gross margins masked inefficiencies

- The practice runs counter to business heritage, culture, and tradition

- A view towards the long term creates the belief that (financial) adversities are temporary

- Lack of management experience (and incentives) in driving productivity programs

- Fear of "tainting" the perception of premium and luxury

Challenging market dynamics are likely to persist

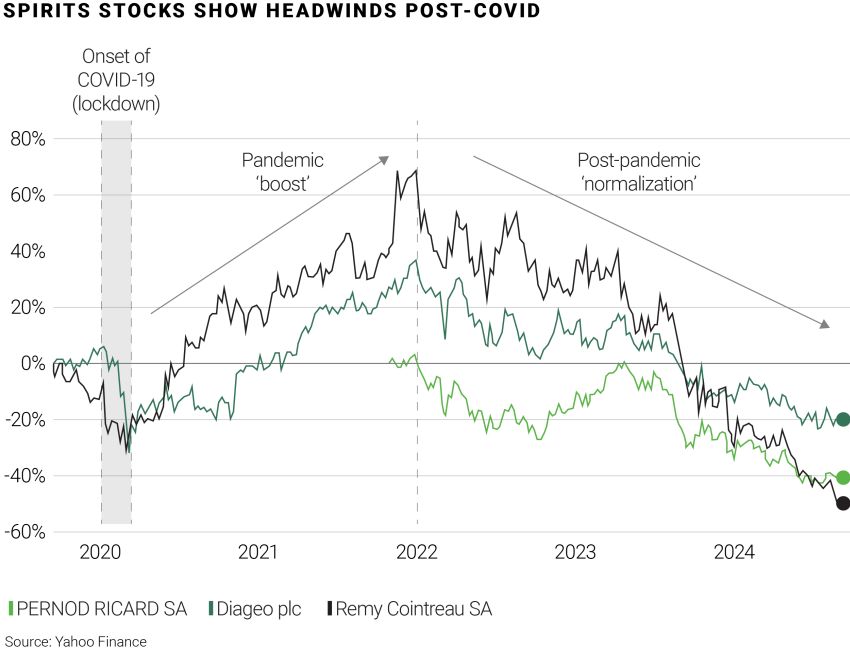

Post-pandemic "normalization" has resulted in persistent softness in the U.S. wine and spirits market. The 2% volume decline recorded by spirits in 2023 was the first setback seen in the U.S. for almost 30 years, according to IWSR. Wine continues to face structural headwinds, with overall volumes declining 4% in 2023 over the previous year.

Volume stagnation in the U.S. wine & spirits sector may be the new norm (with limited exceptions). In fact, the fundamental undercurrents reshaping the market are not transitory; rather, they will continue to affect consumer dynamics in years to come. For example:

- Younger consumers have become less brand loyal and more likely to shift preferences across alcoholic categories , particularly as ready-to-drink offerings (RTDs) continue to disrupt the market

- Consumers—and Gen Z in particular—continue to increasingly embrace moderation

- The premiumization trend ("drink better, not more") has tapered

- Lower headroom (if any) for price increases limits the ability to generate revenue growth on stagnant or declining volumes

- On-premise recovery hasn't been as strong as expected

IWSR projects that spirits volume will grow at a modest rate of 1% a year and wine volume will continue to decline at a rate of 1% a year through 2028.

A no/slow growth environment is likely to put greater pressure on margin realization, expose cost inefficiencies, and even drive liquidity challenges across the U.S. wine & spirits sector.

"The profitability pressure is real across the industry in the U.S., and public and private investors are becoming more anxious. Cash flow tightness may even become a factor if dampened volumes persist for longer, particularly for mid-size players." –Bernardo Silva, global co-lead, AlixPartners Beverage practice

Performance pressure is mounting

Rémy Cointreau reported a sharp drop in revenue as sales fell 19.2% year-over-year on an organic basis at end-FY2023-24, thanks in large part to U.S. inventory adjustments--. Cognac sales, in particular, has taken a tumble, dropping 33% year-over-year. The story was similar for Diageo, which reported a 5% drop in volume globally and a 12% decline in share value for FY2024. Constellation Brands VP & CFO, Garth Hankinson cited a range of factors that had crimped margins for the wine and spirits categories in the July 5, 2024, earnings call, including "unfavorable cost of goods sold, lower volumes and unfavorable product mix due to category headwinds extending into higher-priced segments."

The profitability pressure is real across the U.S. industry. Public and private investors are becoming more anxious, and cash flow challenges may begin to mount if dampened volumes persist for longer, particularly for mid-size players.

The recent Chapter 11 bankruptcy protection filing from Vintage Wine Estates may be an indication of times to come. Two other wineries have sought Chapter 11 bankruptcy protection late this summer: Meier's Winery—the largest in Ohio—and Arizona's Two Vines. The trend is similar in spirits: recent distilleries filing for bankruptcy include Colorado-based Lee Spirits Co., a distiller of premium gin, vodka, and liqueurs, and Montana Distillery, which produces a dozen varieties of vodka, gin, and whiskey.

"Financial fitness programs are not one-size-fits-all. There are sensible ways to go about the exercise and help wine & spirits producers drive margin benefits while protecting their aura of premium and luxury, and while being respectful to their culture and heritage." —Randy Burt, global co-leader of AlixPartners' Beverage practice

The productivity imperative: It's about financial fitness

Given the current environment and medium-term outlook, wine and spirits producers must embrace financial fitness. Indeed, all evidence points to this being a critical moment for U.S. wine and spirits companies to embrace (or evolve existing) productivity programs.

Financial fitness programs are not one-size-fits-all. There are sensible ways to go about the exercise and help wine and spirits producers drive margin benefits while protecting their aura of premium and luxury, and while being respectful to their culture and heritage.

Based on AlixPartners' sector-specific margin expansion and cost reduction experience, here are some thought-starters for wine and spirits companies initiating or accelerating their financial fitness agenda:

Customer and product profitability (size of opportunity 🟢🟢🟢🟢🟢)

Not all customers and SKUs are equally valuable to a wine and spirits business, but they are often treated as if they were. Greater (and more granular) visibility into profitability typically helps uncover specific margin improvement opportunities, both by addressing underlying sources of gross-to-net margin leakage, as well as by rationalizing unprofitable customers and SKUs. Of course, the 3-tier system in the U.S. imposes constraints on what producers themselves can act upon, but greater data exchange and closer collaboration with Distributors can yield mutually beneficial results.

Direct procurement (size of opportunity 🟢🟢🟢🟢🟢)

To reduce business risk and organizational hesitance, don't focus (initially) on raw materials that "touch the liquid" Primary packaging (e.g., glass, cork, caps, labels) and secondary packaging (e.g., shipping cartons, partitions) typically represent 25-45% of total cost of goods in wine and spirits, and they are target-rich areas for cost reduction. Diageo boosted productivity by renegotiating contracts on glass, labels, grain neutral spirits, and other key inputs. Cooperage is another area to explore. For producers leveraging contract manufacturing, tolling rates may also present opportunity.

Organizational and operating models (size of opportunity 🟢🟢🟢🟢🟢)

Evaluating the current organization (lines and boxes) and operating model (how it all works) – and redesigning a fit-for-purpose structure aimed at enabling profitable growth can offer a significant value unlock. Done right, such an effort examines and reimagines both the work undertaken by the organization as well as the organizational structure, decision rights, processes, metrics, and systems used by the business. This includes evaluating current spans and layers, speed and quality of decision making, the role of AI-enabled process automation, and shared services. Successful operating model resets result in a lean organization with faster decision-making capabilities, and clear accountability. It also enables responsible SG&A right-sizing that allows for margin opportunity and frees up investment dollars.

Indirect procurement (size of opportunity 🟢🟢🟢⚫⚫)

Transportation and logistics (e.g., outbound freight rates, 3PL agreements) and other service contracts often offer low-hanging-fruit opportunity.

Sales and marketing (size of opportunity 🟢🟢🟢⚫⚫)

Brand marketing and trade marketing investments are another area to assess for margin expansion opportunity, not only by reducing unproductive spend (e.g., non-working dollars, such as agency fees) but also by shifting spend towards higher ROI marketing activities.

Production efficiency (size of opportunity 🟢🟢🟢⚫⚫

Most of the opportunity to drive manufacturing cost reduction and operational efficiency (e.g., overall equipment effectiveness—OEE improvement) in wine and spirits is typically in bottling operations, not in the grape processing, wine production, or distillation processes. Some of the areas of opportunity include labor scheduling, preventative maintenance, waste reduction, and energy and water conservation.

All those areas of opportunity can be attacked immediately. However, productivity initiatives are best architected as part of an integrated, multi-year program that enables greater value to be unlocked well beyond simpler tactical actions. Embedding financial fitness into the annual operating planning (AOP) process can help institutionalize the practice and ensure that margin improvement opportunities are aligned with the enterprise-level financial algorithm and functional-level goals.

Finding a smooth finish

Performance in the wine and spirits market has been challenging as sales slowed down and inventories grew amid shifts in consumer attitudes and behaviors, including moving to RTDs and to low and no-alcohol alternatives, and otherwise startling at the high prices of premium products. The shift is structural, and hence unlikely transitory. Embracing financial fitness represents a much-needed change in the value creation playbook for wine and spirits producers, but it needs to be done in a way that not only preserves the essence of the business but also is true to the company's legacy, tradition, and culture—and those things are not in conflict.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.