- within Government and Public Sector topic(s)

- in United States

- with readers working within the Securities & Investment industries

- within Government, Public Sector, Insolvency/Bankruptcy/Re-Structuring, Food, Drugs, Healthcare and Life Sciences topic(s)

EDITORIAL:

Foreign direct investment plays a key role in national economies, and current observations undoubtedly point to a major shift towards comply with the ESG (environmental and social governance) and sustainable development. This shift leads to new trends in infrastructure, particularly in green and sustainable infrastructure. The shift has similar impacts on Türkiye's infrastructure development. We therefore decided to cover major trends in global and Türkiye's infrastructure in this issue,

In this issue, we are featuring three major topics in infrastructure, which are also directly related to sustainable development and ESG. The first article presents an overview of infrastructure trends in Türkiye and the world. Another article covers the anticipated investment stimulated by Germany's special governmental funding for renovation of infrastructure.

The third article points out to development of agricultural infrastructure. Our last article in this edition of the Quarterly discusses the possible impacts of the calculation of green asset ratio by banks, pursuant to the Communiqué on the Calculation of Green Asset Ratio of Banks ("Communiqué"), published in the Official Gazette dated April 11, 2025 and numbered 32515.

Infrastructure Investment Needs and Trends in Türkiye and the World

- Introduction

Infrastructure plays a pivotal role in driving economic growth. As populations expand and urbanization accelerates, the demand for modern and resilient infrastructure intensifies. In both Türkiye and the global landscape, infrastructure needs are rapidly evolving in response to technological advances, environmental concerns, and shifting societal demands.

From the rise of electric vehicles to breakthroughs in information technology, infrastructure investment priorities are transforming. Green infrastructure, in alignment with the United Nations Sustainable Development Goals (SDGs), is increasingly at the forefront of national agendas, in fact the new draft Climate Law of Türkiye promotes green infrastructure. This article explores Türkiye's infrastructure investment landscape in comparison with global trends, focusing on emerging priorities, sectoral gaps, and financing challenges.

- Türkiye's Infrastructure Legal Framework

Türkiye's infrastructure development is governed by a combination of constitutional provisions, sector-specific laws, and strategic investment frameworks. At the core is the Public Procurement Law No. 4734, which regulates the tendering of public infrastructure projects and ensures transparency and competition. For large-scale infrastructure investments involving private sector participation, Public-Private Partnership ("PPP") mechanisms are primarily regulated through sectoral laws (e.g., the Health PPP Law, the Electricity Market Law) and administrative regulations, rather than a unified PPP law. These fragmented legal provisions are coordinated under the oversight of the Ministry of Treasury and Finance and the Presidency of Strategy and Budget, which review project feasibility, financing models, and risk allocation frameworks.

A critical aspect of Türkiye's legal infrastructure environment is the Build-Operate-Transfer ("BOT") model, which has been widely used in transportation, energy, and airport projects. BOT contracts often incorporate international arbitration clauses, reflecting investor preferences for neutral dispute resolution mechanisms. Additionally, the Environmental Law No. 2872 and the Environmental İmpact Assessment Regulation are other important legal frameworks governing infrastructure investments. In contrast to the existing legal regime, the Climate Law integrates sustainability and environmental compliance into project approvals—aligning national practices with global ESG standards.

As Türkiye seeks to increase the share of long-term foreign infrastructure investment it has been attracting for decades, there is also a vivid discussion on improving its already comprehensive PPP legislation, whichhas been shaped, albeit in a somewhat scattered manner, by decades of experience that brought together domestic and international contractors as well as various financing parties in a wide range of PPP projects across numerous sectors.In line with global trends, sustainability,encompassing both environmental and socialdimensions,together with the introduction of newfinancial and legislative tools to expand the pool of financing for infrastructure projects, will be the primary driver of improvements to the legislation.

- Türkiye's Growing Infrastructure Needs

Türkiye has experienced robust economic growth over the past decade, averaging 4.5% annually. Rapid urbanization, population increase, and industrial expansion have fuelled a corresponding rise in infrastructure demand. To bridge the gap between need and available resources, Türkiye has relied heavily on public-private partnerships ("PPP"s). Yet, this strategy has not fully closed the investment gap.

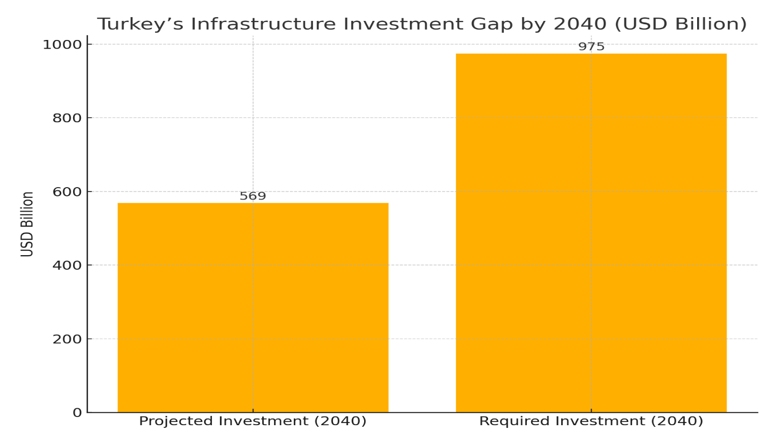

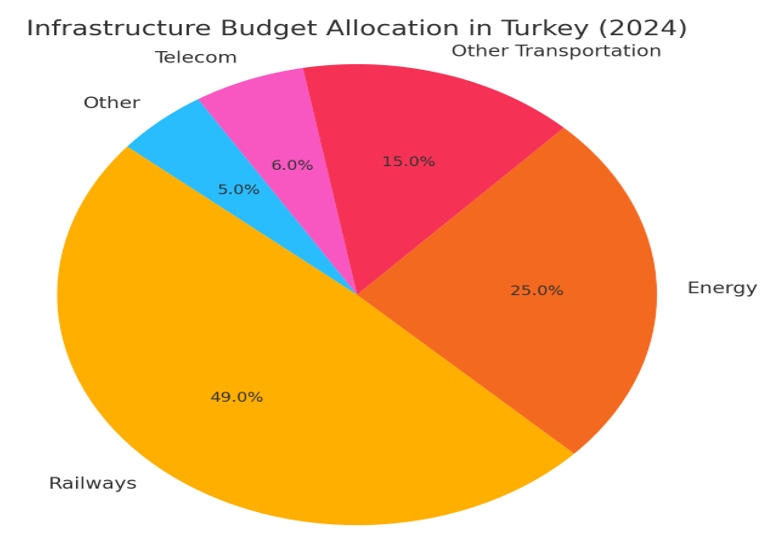

Projections suggest that Türkiye will invest approximately USD 569 billion in infrastructure by 2040 (Chart 1). However, actual infrastructure needs are estimated at USD 975 billion—a substantial shortfall. Over half of this demand is attributed to the transportation sector, with energy accounting for roughly a quarter. As of 2024, nearly half (49%) of Türkiye's infrastructure budget is allocated to railway projects, underscoring the central role of transportation in the country's development strategy. (Chart 2)

3.a. Telecom Infrastructure: Lagging Behind

While transportation dominates Türkiye's infrastructure agenda, the telecommunications sector remains underdeveloped. By 2040, Türkiye is expected to require approximately USD 100 billion in telecom infrastructure. Globally, digitalization has surged, particularly post-pandemic, prompting companies to significantly expand digital capacity.

Türkiye, however, trails behind. The country ranks 111th out of 181 nations in fixed internet speed and continues to operate largely on 4.5G networks while many developed countries transition to 5G and explore 6G. This lag signals a critical area for policy attention and investment.

3.b. Sustainability and the Green Infrastructure Agenda

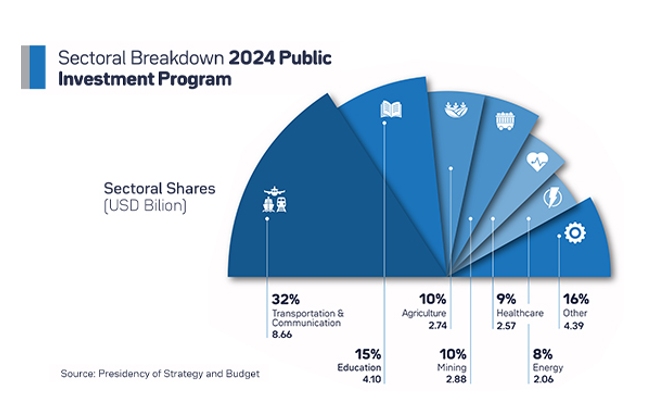

Sustainability is reshaping infrastructure priorities worldwide. Carbon pricing mechanisms, such as the EU's carbon border adjustment mechanisms, the proliferation of electric vehicles ("EV"s), and the shift toward renewable energy all point to a growing emphasis on green infrastructure. The draft Climate Law of Türkiye is expected to establish the carbon taxonomy and increase investment in green infrastructure. In that regard, the 2024 public investment breakdown programme contained sustainable development goals-related investments and divestments in the agenda.

Based on the 2024 programme, Türkiye has made notable strides in this area. For instance, the emergence of TOGG, a domestic EV brand, has catalyzed EV adoption. By 2035, Türkiye is projected to have between 5 and 11 million EVs on the road. In renewable energy, Türkiye ranks among the top 10 countries globally in terms of capacity growth. Between 2022 and 2027, renewable capacity is expected to grow by 64% to reach 90 gigawatts. Solar energy will account for 49% of this expansion, with wind contributing 24%.

With the Decision No. 32613 published in the Official Gazette dated July 26, 2024, the implementation procedures and principles of the Green Transformation Support Program have been outlined by The Ministry of Industry and Technology. This program aims to support investments in Türkiye that are aligned with the circular economy approach, protect natural resources, contribute to climate and sustainability goals, and promote resource-efficient and low-carbon production. Investors wishing to benefit from the advantages provided by the relevant regulation are required to prepare a report outlining the green transformation practices roadmap to be implemented at the facility level in line with their green transformation strategy. In this report, the investor must define one or more project goals for the proposed investment that include concrete and either quantitatively or proportionally measurable improvements.

For a project to be eligible for support, the roadmap report must be approved, the project must align with the objectives of the program, include measurable targets, incorporate green transformation practices, and meet the conditions in regulations.

The General Directorate of the Ministry of Industry and Technology evaluates the application based on the Application Assessment Report, which the investor prepares. It communicates its acceptance, rejection, or revision decision to the investor via the program portal. Investors whose projects are approved will be granted the types of support defined under the program.

The Capital Markets Board of Türkiye (SPK) published the Guide on Green Debt Instruments, Sustainable Debt Instruments, Green Lease Certificates, and Sustainable Lease Certificates on September 22, 2022 for financing of green infrastructure, and subsequently released the Draft Guide on Green, Sustainable, and Social Capital Market Instruments on September 6, 2024 to contribute to the financing of projects with significant environmental and social impact.

- Global Infrastructure Trends and Investment Gaps

Securing adequate financing remains one of Türkiye's most pressing infrastructure challenges. Domestic savings are insufficient to meet investment needs, and external financing has become more difficult to access due to global economic volatility and rising interest rates.

Between 1986 and 2023, Türkiye secured USD 204 billion in infrastructure investment through PPPs. However, the scale of future requirements—USD 569 billion by 2040—means PPPs alone will not suffice. Innovative financing solutions and diversified funding sources are urgently needed. Globally, the majority of infrastructure investment demand through 2040 is expected to originate from Asia. China alone faces a USD 2 trillion gap between its USD 28 trillion infrastructure needs and current investment trends.

In addition to Türkiye's domestic market circumstances, the global investment has been decreasing according to United Nations Trade and Development (UNCTAD) reports. However, the investments in renewable energy projects and green and sustainable infrastructure projects lead the global investment and hold the biggest potential both globally and in Türkiye, according to the same report.

This global competition for investment capital poses additional risks for Türkiye. While the country's strategic location between Europe and Asia is an asset, increased competition for global financing may further complicate efforts to close its infrastructure gap.

- Conclusion

Türkiye's infrastructure expansion and renewal needs will continue to rise in the coming decades. Transportation remains the dominant sector, but there are also urgent needs in telecom and sustainability-related infrastructure. While Türkiye has made commendable progress in renewable energy and electric vehicles, substantial challenges remain, particularly in financing and digital infrastructure.

To remain competitive and resilient, Türkiye must diversify its funding models beyond PPPs and align infrastructure priorities with global trends in digitalization and sustainability. Achieving this will be essential for ensuring long-term economic growth and national competitiveness in an increasingly interconnected world.

Investing in the Future: Germany's Infrastructure Spending Surge

- Introduction

The European Union ("EU") and its member states continue to advance sustainable trade and investment policies under the Green Deal. Against this backdrop, Germany took a historic step in March and April 2025 by amending its constitution to allow more flexible public borrowing in defined investment areas. This change has unlocked an extraordinary €500 billion programme dedicated to strengthening defence, upgrading infrastructure, and enhancing climate resilience over the next decade.

A substantial portion of this package is directed toward long-overdue infrastructure upgrades. These include improvements to defence industry, ageing motorway tunnels, the expansion of public transport and rail capacity, and the development of new university campuses, care facilities, and energy-efficient urban projects. The reform also presented opportunities for public-private partnerships ("PPPs") in various sectors, which are expected to play a pivotal role in implementing major projects. Taken together, these initiatives reflect a comprehensive strategy to modernize Germany's essential systems, ranging from defence, energy and transport to healthcare, education, and digital networks, while also advancing the country's target of climate neutrality by 2045. Over the next decade, unprecedented levels of investment will flow into projects that require not only advanced technical expertise, but also strong legal, regulatory, and contractual frameworks.

- Blueprint for Germany's €500 Billion Transformation

Germany's €500 billion programme, spread over a 12-year horizon, represents a fundamental shift away from traditional fiscal limits. Established as a separate vehicle outside the federal budget, the fund is exempt from the strict borrowing rules that normally apply, thus making room for large-scale infrastructure financing, especially in the defence industry. Of this amount, €100 billion will be transferred to federal states (Länder) and municipalities to co-finance projects such as heating systems and local energy networks. Another €100 billion is channelled through the Climate and Transformation Fund to support energy transition priorities. The remaining €300 billion will be managed at the federal government level and directed to a broad portfolio of projects in transport, hospitals, schools and universities, energy grids, digitalisation, and defence. Importantly, spending must exceed 10% of the regular federal budget in any year, ensuring that this programme adds fresh capital rather than replacing existing expenditure.

Much of the fund will be devoted to modernising Germany's defence systems, infrastructure base. Priorities include upgrading defence spending, transport corridors, expanding renewable energy and rail networks, and constructing environmentally efficient public facilities. PPP structures are expected to be widely used in delivery, creating opportunities for private sector involvement and shared risk allocation. Collectively, these measures signal a determined push to renew Germany's backbone systems, while at the same time supporting its 2045 climate neutrality commitment. Over the next decade, the mobilisation of capital at this scale will require not only engineering capacity, but also a sound legal, regulatory, and governance environment.

Germany's constitutional change, enabling greater borrowing for defined investment priorities, represents a decisive break from the restrictive "debt brake" (Schuldenbremse). While aligned with EU Green Deal objectives, the reform primarily responds to Germany's own pressing need to replace and upgrade critical infrastructure. It has effectively reset fiscal priorities and ushered in a new era of procurement for Europe's largest economy. The policy also aligns with wider EU efforts to reach climate neutrality by 2050, where sustainable mobility, energy efficiency, and decarbonisation are at the centre of national development plans. For Germany, this means electrifying rail systems, expanding renewable generation, and retrofitting public buildings to meet high environmental standards. These initiatives are well-suited to European Investment Bank (EIB) financing criteria, potentially enabling blended finance that can further accelerate project pipelines.

The geopolitical environment also adds urgency. Germany's investment surge is not only about economic growth but also about reducing exposure to supply chain disruptions and geopolitical risks in sectors like energy and transport. Projects such as renewable power expansion, intermodal logistics hubs, and smart infrastructure will strengthen both resilience and strategic autonomy. In addition, innovation will play an essential role: the programme is expected to promote advanced construction methods such as building information modelling, modular construction, and smart digital systems.

- Conclusion

Germany's €500 billion investment plan represents a rare alignment of national and political will, market needs, and financing capacity. It is a turning point for European infrastructure policy, combining large-scale renewal with ambitious climate targets. By committing unprecedented resources, Germany aims not only to modernize its defence, energy, transport, healthcare, and education sectors, but also to bolster economic resilience and strategic independence. The success of this blueprint will depend on effective cooperation between public and private actors, innovative financing tools, and the integration of technical expertise with robust legal, regulatory, and sustainability standards.

Sustainability of Agricultural Infrastructure and Food Security in Türkiye

- Introduction

The agricultural sector is not merely an area of economic activity, but also a security component that directly affects the quality of life. Therefore, ensuring food security through sustainable agricultural practices is among the policy goals of contemporary regulatory frameworks. Sustainable agriculture, as a system that balances the environmental, economic, and social dimensions of agricultural production, plays a vital role in preserving natural resources and ensuring the secure fulfillment of the growing food demand associated with population increase.

Today, challenges such as climate change, loss of biodiversity, reduction of agricultural land, and instability in food prices threaten the sustainability of agricultural infrastructure. Consequently, food security emerges as a key area of public policy. Türkiye, actively participates in this process by implementing national regulations and aligning with international standards, and takes parallel steps with numerous frameworks, particularly the European Union's Common Agricultural Policy.

- The Conceptual and Legal Framework of Sustainable Agriculture

Agriculture constitutes the initial link in the food supply chain and plays a central role in the economic and social well-being of societies. However, this sector has faced the need for restructuring in line with sustainability principles due to environmental pressures, climate change, and population growth. In this context, sustainable agriculture represents a multidimensional approach that encompasses not only productivity and economic profitability but also environmental protection, social justice, and the long-term management of natural resources.

The concept of sustainable agriculture first appeared in international documents through the 1987 Brundtland Report and subsequently gained global attention at the 1992 Rio Summit in the context of environment and development. Today, the Principles for Sustainable Agriculture developed by the Food and Agriculture Organization of the United Nations ("FAO") define the core framework in this field. According to these principles, sustainable agriculture requires integrated policies addressing (i) conservation of natural resources, (ii) economic viability, (iii) social equity, (iv) resilience, and (v) governance.

In line with this approach, nature-based solutions gain prominence in response to the problems caused by industrial agriculture's intensive use of resources, such as soil degradation, depletion of water resources, and loss of biodiversity. In countries like Türkiye that possess rich agricultural diversity, sustainable agricultural models hold critical importance not only for environmental protection but also for food security. In this context, ensuring that production processes remain traceable, reliable, and are not harmful to human health transforms sustainability into a legal necessity.

The Turkish legal system does not establish a unified framework that directly defines sustainable agriculture; however, various legislative instruments make indirect references to this concept. Notably, the agricultural policy principles set forth in the Agricultural Law No. 5488 promote agricultural activities from the perspective of sustainable development and environmental sensitivity. In addition, under Law No. 5403 on Soil Conservation and Land Use, the protection of agricultural lands functions as an essential legal mechanism for sustainable production. Sustainable agriculture represents not merely a production technique, but also a legal approach directly linked to ecosystem rights, rural justice, and the right of future generations to access food. Therefore, enhancing national regulations and establishing a system aligned with international standards reinforce the relationship between sustainable agriculture and food security.

- The Relationship Between Agricultural Infrastructure, Legislative Development, and Food Security in Türkiye

Türkiye possesses the capacity to produce a wide range of agricultural products thanks to its potential in agriculture and climatic diversity. However, the sustainable utilization of this potential depends not only on natural advantages but also on the presence of strong agricultural infrastructure and effective regulations. In this regard, agricultural infrastructure entails a multidimensional structure that includes not only physical investments but also legislative frameworks, institutional capacity, and digitalization.

Within the Turkish legal system, the Agricultural Law No. 5488 establishes the general principles for the planning and support of agricultural activities. Law No. 5403 on Soil Conservation and Land Use, on the other hand, prescribes land classifications and conservation measures with the aim of ensuring the sustainable use of agricultural lands. Irrigation infrastructure, as a fundamental element of agricultural production, falls under the regulation of Law No. 167 on Groundwater.

In addition to this legal framework, Türkiye has taken significant steps toward digitalization to enhance agricultural productivity. The information booklet for the Agricultural Information System ("TARSEY"), published by the Ministry of Agriculture and Foresty in 2015, summarizes and includes all of the databases developed, achievements, and outcomes . Digital platforms such as TARSEY play a key role in the monitoring and management of agricultural activities. To improve agricultural services, various national data sets and digital services have been created and developed, including the National Geographic Information Systems, Farm Accountancy Data Network, Land Parcel Identification System, Integrated Administration and Control System, Agricultural Information Network, Farmer Registration System, Animal Registration System, Agricultural Land Registry System, and the Rural Database. These digital databases provide informational support to producers and enhance the public administration's capacity to monitor and regulate agriculture. Such systems play a critical role in product verification, traceability, and environmental impact assessment.

Despite all these infrastructural developments, various structural challenges persist in practice. In particular, the integration of small-scale producers into new systems, the inability to establish support policies fully aligned with environmental sustainability, and the insufficient capacity for climate change adaptation remain among Türkiye's primary policy concerns. Therefore, rendering agricultural infrastructure sustainable is not solely a technical matter; it also constitutes a process that necessitates legal, institutional, and societal alignment.

- Harmonization Process of Türkiye with International and European Union ("EU") Legal Norms

Food security has become not only an agricultural production issue on a global scale but also a fundamental concern of international law and multilateral cooperation. In the face of climate change, depletion of natural resources, and food crises, national measures prove insufficient; consequently, states increasingly turn to international norms and non-binding standards.

In this context, FAO stands out as one of the most effective international institutions addressing sustainable agriculture and food security. The Principles for Sustainable Agriculture and Guidelines for Food Security developed by FAO serve as guiding instruments for the protection of natural resources, the safeguarding of producers' rights, and the adoption of climate-resilient agricultural policies. Under the Partnership Programme between Türkiye and FAO (FTPP), projects focus on food quality, nutritional security, and the sustainable use of natural resources.

Another significant international mechanism is the European Union's Common Agricultural Policy ("CAP"). CAP encompasses not only production subsidies but also adopts a comprehensive policy framework addressing environmental protection, rural development, and food security. Recently, with the adoption of the "European Green Deal" and the "Farm to Fork" strategies, the CAP has evolved toward a structure that prioritizes climate change mitigation and the transition to sustainable food systems.

Although Türkiye's agricultural sector remains outside the scope of the Customs Union, it continues its alignment process with the CAP through the Accession Partnership Document and National Programs. In particular, efforts focus on aligning organic farming, environmental standards, and support schemes with EU norms. However, certain technical and administrative alignment challenges persist. These challenges primarily concern the restructuring of agricultural support mechanisms, the improvement of transparency in farmer registration systems, and the enforcement of environmental obligations. The slow progress in adopting EU standards imposes cost pressures and creates a competitive disadvantage for domestic producers. Moreover, deficiencies in traceability and food safety criteria hinder Türkiye's ability to secure a sustainable position in the EU agricultural market. Therefore, the current alignment process must go beyond legislative amendments and be supported by strengthened institutional capacity and structural reforms that prioritize rural development.

- Future Perspective on Agricultural Infrastructure

The sustainability of agricultural infrastructure and food security constitutes a multidimensional issue with not only technical and economic, but also legal and political dimensions. In addition to developing its own legislative framework, Türkiye strives to align with the standards established by international organizations such as the European Union and the United Nations. However, this alignment process requires more than legal reforms; it also depends on enhancing implementation capacity, promoting digital transformation, and supporting small-scale producers. In this regard, the effective implementation of sustainable agricultural policies necessitates a multi-actor and multi-level governance approach. Agricultural infrastructure encompasses more than physical investments; it also includes legal regulations, governance structures, information systems, and support mechanisms as part of a comprehensive system. Achieving food security depends on the sustainable restructuring of this system in its environmental, social, and economic dimensions.

Although Türkiye has taken significant steps in recent years regarding irrigation, soil conservation, databases, and farmer registration systems, overcoming structural challenges remains essential for these developments to yield lasting and inclusive outcomes in practice. Key obstacles to sustainable infrastructure include the integration of small-scale farmers into digital systems, the fragmented structure of agricultural lands, the shortage of technical personnel in rural areas, and the institutional capacity deficiencies of local administrations. Within this framework, the establishment of sustainable agricultural infrastructure requires the development of data-driven and region-specific agricultural policies as a primary step. Moreover, legal regulations must not only set rules but also serve guiding and supportive functions to ensure effective implementation.

At this point, addressing the current alignment challenges will require more comprehensive regulations in the field of agricultural law and further developments. In particular, the creation of new legal structures in areas such as agricultural digitalization, climate change adaptation, and food traceability is inevitable These developments must both safeguard producers' rights and incorporate effective enforcement mechanisms to monitor environmental impact. At the same time, it will be critical to devise legal mechanisms that redefine the powers and responsibilities of local authorities, facilitate legal processes in rural areas, and promote public-private partnerships.

In conclusion, ensuring the sustainability of agricultural infrastructure requires not merely the preservation of existing structures, but the construction of a new system that is climate-resilient, environmentally sensitive, and producer-oriented. In line with both its national legal framework and international obligations, Türkiye must undertake this transformation as a strategic necessity—not only to secure food supply, but also to advance rural development and ensure the sustainable management of natural resources.

Possible Impacts of the Communiqué on the Calculation of Green Asset Ratio by Banks on Their Lending Practices

The Communiqué on the Calculation of Green Asset Ratio of Banks ("Communiqué"), published in the Official Gazette dated April 11, 2025 and numbered 32515, represents an important regulation in terms of financial transformation focused on environmental sustainability in Turkey. With the Communiqué, an environmentally-based financial indicator called the Green Asset Ratio ("GAR"), is adopted, which was not previously in the legislation, through which the ratio of the funding allocated by banks to environmentally sustainable activities within the total assets will be measured and the measurement results will be reported to the Banking Regulation and Supervision Agency ("BRSA"). The Communiqué also represents a first in terms of having objective criteria for the taxonomy of environmentally sustainable economic activities.

- What is Green Asset Ratio?

GAR refers to the ratio of assets related to environmental economic activities in banks' balance sheets to total assets. The Communiqué also draws attention to the concept of "appropriate assets" when calculating this ratio. Parallel with the European Union Taxonomy, the determination of assets appropriate to and compliant with environmental standards is based on the conditions that an economic activity both makes a significant contribution to environmental objectives, does not harm other environmental objectives and complies with minimum social security standards.

In this context, for banks, GAR may become not only a performance metric but also a guiding factor for financial strategy and risk management. As a matter of fact, it is likely that the BRSA will set lower limits for banks' GAR ratios or introduce incentive/penalty mechanisms based on these ratios in the future.

- Compliance with the European Union Taxonomy

The application of GAR in Turkey is in line with the "Green Asset Ratio" in the European Union ("EU") regulation. In addition, the GAR reflects the EU legal framework by being calculated on the basis of triple criteria based on a significant contribution to the protection and restoration of biodiversity and ecosystems, no significant harm to other environmental goals, and minimum social security standards. Similar to the regime in the EU where financial institutions report annually to the European Securities and Markets Authority, the Communiqué requires banks to report annually to the BRSA. However, while in the EU this obligation applies to banks, insurance companies, asset managers and large corporations, the BRSA regulation is limited to banks only. At the same time, unlike the intensive technical screening and detailed activity classification on a sectoral basis in the EU regulation, the Communiqué does not yet contain focused and particular regulations in terms of technical criteria, sectoral distinctions and compliance practices. Even if complete harmonization with the EU legislation and practice could not yet be achieved, a noteworthy approach in parallel with the EU legislation is taken.

- Auditing and Reporting Mechanisms

While reports are subject to independent auditing in the EU system, the Communiqué only stipulates the reporting regime to be made to the BRSA and does not indicate a clear procedure for independent audit and compliance practices.

The environmental compliance reporting planned to be made to the BRSA by deposit banks and participation banks does not constitute a scientific reporting, but will rather be carried out by determining whether the assets in the balance sheet of the banks contribute to the financing of environmentally sustainable activities.

The fulfillment of the technical screening criteria must be documented through "emission reports, feasibility reports, energy efficiency study reports and similar reports, nationally or internationally recognized certificates, green technology selection tools or investment expenditure documents" which are to be prepared by independent verifying parties and made available for inspection by banks. According to the Communiqué, the starting date for the first reporting is set as June 30, 2025.

During the compliance process, various certification processes, particularly environmental impact assessment (EIA) and environmental management systems certifications such as ISO 14001, may also become a condition for loans. In addition, in line with EU practice, in cases where non-compliance is detected as a result of reporting, the BRSA may issue correction notices, warnings, guidance letters or, if necessary, administrative sanctions. Also, the obligation for banks to regularly report their green asset ratios may make it possible to monitor the environmental impact of their loan portfolios in a more transparent manner.

What Kind of Changes Can Be Expected?

As the Green Asset Ratio (GAR) increases are targeted, it becomes inevitable for banks to align their loan portfolios with environmental taxonomy. This is expected to enhance interest in loans directed toward areas such as energy efficiency, renewable energy investments, sustainable transportation, and environmentally friendly buildings, as such loans will offer both regulatory and reputational advantages.

In this context, it is foreseeable that credit agreements for projects falling under these categories may increasingly include provisions such as early repayment clauses, interest rate hikes, or penalties in cases of breaches of environmental commitments. Furthermore, the degree to which borrowers comply with sustainability standards is expected to become a criterion considered in banks' credit evaluation processes.

It is anticipated that the Communiqué will have a positive impact on companies' alignment with sustainability policies by facilitating access to financing for their projects. As environmental compliance becomes more prominent in financing conditions, companies may be encouraged to prioritize environmentally sustainable activities in their investment projects.

The Communiqué is expected to contribute to the development of a sustainability-oriented culture within the banking sector and to enable a stronger linkage between environmental performance and financial decision-making. Systematically integrating environmental criteria into lending processes is expected to yield positive outcomes for both financial stability and the fight against climate change.

In conclusion, the implementation of GAR calculation and reporting under the Communiqué is anticipated to enhance transparency and market discipline with respect to environmental impacts within the credit regime. This, in turn, is expected to strengthen awareness and motivation toward environmentally sustainable economic activities among banks and make a significant contribution to the achievement of Türkiye's climate change goals and international commitments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.