- within Government and Public Sector topic(s)

- in United States

- with readers working within the Securities & Investment industries

- within Government, Public Sector, Insolvency/Bankruptcy/Re-Structuring, Food, Drugs, Healthcare and Life Sciences topic(s)

1. Introduction

Infrastructure plays a pivotal role in driving economic growth. As populations expand and urbanization accelerates, the demand for modern and resilient infrastructure intensifies. In both Türkiye and the global landscape, infrastructure needs are rapidly evolving in response to technological advances, environmental concerns, and shifting societal demands.

From the rise of electric vehicles to breakthroughs in information technology, infrastructure investment priorities are transforming. Green infrastructure, in alignment with the United Nations Sustainable Development Goals (SDGs), is increasingly at the forefront of national agendas, in fact the new draft Climate Law of Türkiye promotes green infrastructure. This article explores Türkiye's infrastructure investment landscape in comparison with global trends, focusing on emerging priorities, sectoral gaps, and financing challenges.

2. Türkiye's Infrastructure Legal Framework

Türkiye's infrastructure development is governed by a combination of constitutional provisions, sector-specific laws, and strategic investment frameworks. At the core is the Public Procurement Law No. 4734, which regulates the tendering of public infrastructure projects and ensures transparency and competition. For large-scale infrastructure investments involving private sector participation, Public-Private Partnership ("PPP") mechanisms are primarily regulated through sectoral laws (e.g., the Health PPP Law, the Electricity Market Law) and administrative regulations, rather than a unified PPP law. These fragmented legal provisions are coordinated under the oversight of the Ministry of Treasury and Finance and the Presidency of Strategy and Budget, which review project feasibility, financing models, and risk allocation frameworks.

A critical aspect of Türkiye's legal infrastructure environment is the Build-Operate-Transfer ("BOT") model, which has been widely used in transportation, energy, and airport projects. BOT contracts often incorporate international arbitration clauses, reflecting investor preferences for neutral dispute resolution mechanisms. Additionally, the Environmental Law No. 2872 and the Environmental İmpact Assessment Regulation are other important legal frameworks governing infrastructure investments. In contrast to the existing legal regime, the Climate Law integrates sustainability and environmental compliance into project approvals—aligning national practices with global ESG standards.

As Türkiye seeks to increase the share of long-term foreign infrastructure investment it has been attracting for decades, there is also a vivid discussion on improving its already comprehensive PPP legislation, which has been shaped, albeit in a somewhat scattered manner, by decades of experience that brought together domestic and international contractors as well as various financing parties in a wide range of PPP projects across numerous sectors. In line with global trends, sustainability, encompassing both environmental and social dimensions, together with the introduction of new financial and legislative tools to expand the pool of financing for infrastructure projects, will be the primary driver of improvements to the legislation.

3. Türkiye's Growing Infrastructure Needs

Türkiye has experienced robust economic growth over the past decade, averaging 4.5% annually. Rapid urbanization, population increase, and industrial expansion have fuelled a corresponding rise in infrastructure demand. To bridge the gap between need and available resources, Türkiye has relied heavily on public-private partnerships ("PPP"s). Yet, this strategy has not fully closed the investment gap.

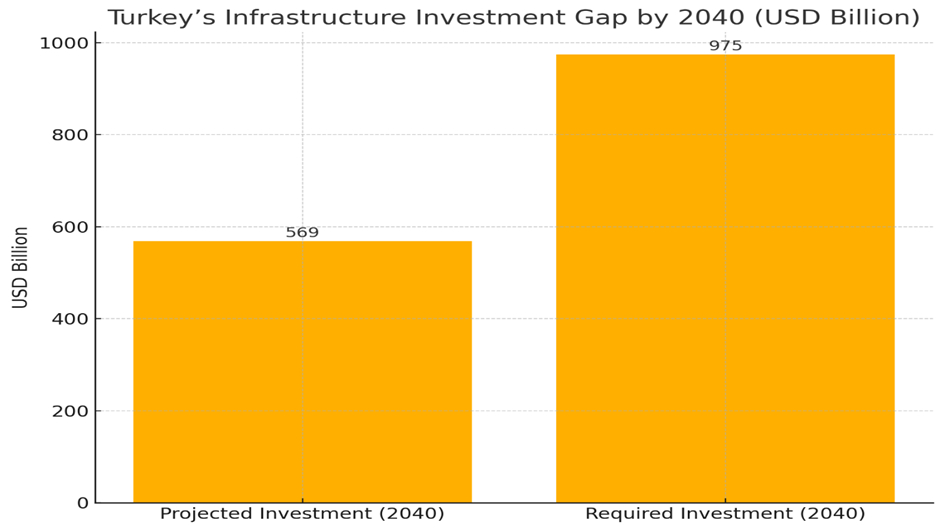

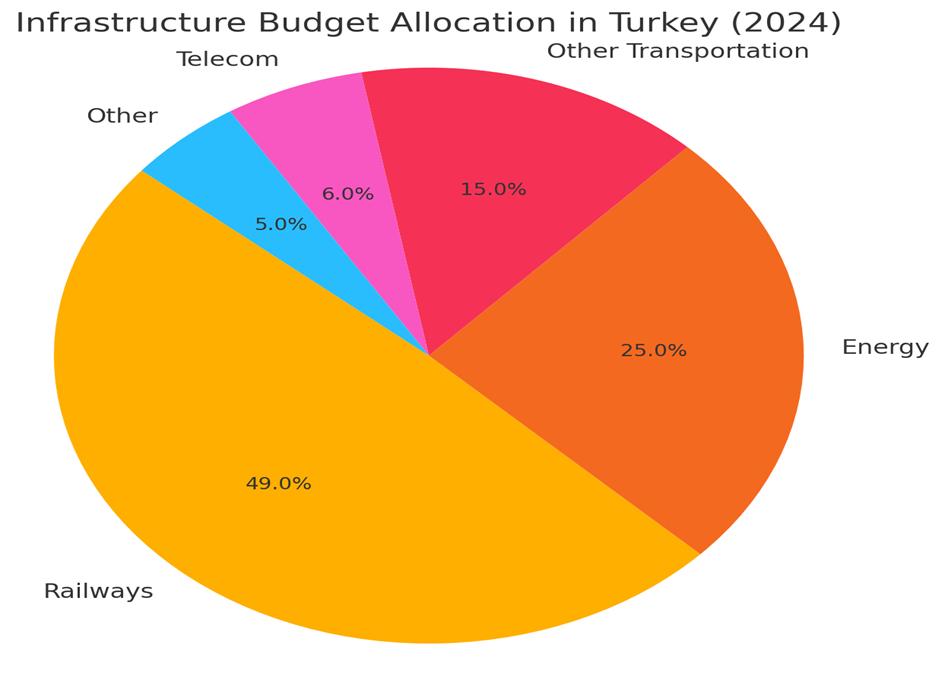

Projections suggest that Türkiye will invest approximately USD 569 billion in infrastructure by 2040 (Chart 1). However, actual infrastructure needs are estimated at USD 975 billion—a substantial shortfall. Over half of this demand is attributed to the transportation sector, with energy accounting for roughly a quarter. As of 2024, nearly half (49%) of Türkiye's infrastructure budget is allocated to railway projects, underscoring the central role of transportation in the country's development strategy. (Chart 2)

3.a. Telecom Infrastructure: Lagging Behind

While transportation dominates Türkiye's infrastructure agenda, the telecommunications sector remains underdeveloped. By 2040, Türkiye is expected to require approximately USD 100 billion in telecom infrastructure. Globally, digitalization has surged, particularly post-pandemic, prompting companies to significantly expand digital capacity.

Türkiye, however, trails behind. The country ranks 111th out of 181 nations in fixed internet speed and continues to operate largely on 4.5G networks while many developed countries transition to 5G and explore 6G. This lag signals a critical area for policy attention and investment.

3.b. Sustainability and the Green Infrastructure Agenda

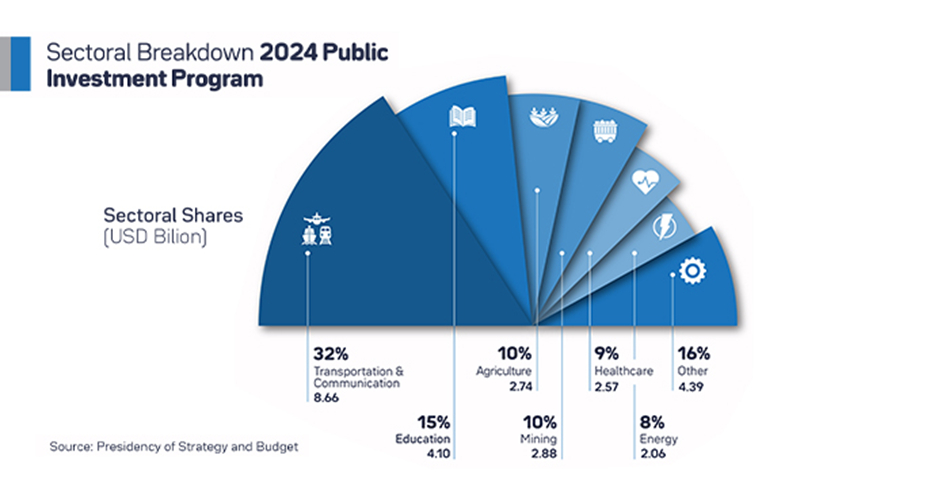

Sustainability is reshaping infrastructure priorities worldwide. Carbon pricing mechanisms, such as the EU's carbon border adjustment mechanisms, the proliferation of electric vehicles ("EV"s), and the shift toward renewable energy all point to a growing emphasis on green infrastructure. The draft Climate Law of Türkiye is expected to establish the carbon taxonomy and increase investment in green infrastructure. In that regard, the 2024 public investment breakdown programme contained sustainable development goals-related investments and divestments in the agenda.

Based on the 2024 programme, Türkiye has made notable strides in this area. For instance, the emergence of TOGG, a domestic EV brand, has catalyzed EV adoption. By 2035, Türkiye is projected to have between 5 and 11 million EVs on the road. In renewable energy, Türkiye ranks among the top 10 countries globally in terms of capacity growth. Between 2022 and 2027, renewable capacity is expected to grow by 64% to reach 90 gigawatts. Solar energy will account for 49% of this expansion, with wind contributing 24%.

With the Decision No. 32613 published in the Official Gazette dated July 26, 2024, the implementation procedures and principles of the Green Transformation Support Program have been outlined by The Ministry of Industry and Technology. This program aims to support investments in Türkiye that are aligned with the circular economy approach, protect natural resources, contribute to climate and sustainability goals, and promote resource-efficient and low-carbon production. Investors wishing to benefit from the advantages provided by the relevant regulation are required to prepare a report outlining the green transformation practices roadmap to be implemented at the facility level in line with their green transformation strategy. In this report, the investor must define one or more project goals for the proposed investment that include concrete and either quantitatively or proportionally measurable improvements.

For a project to be eligible for support, the roadmap report must be approved, the project must align with the objectives of the program, include measurable targets, incorporate green transformation practices, and meet the conditions in regulations.

The General Directorate of the Ministry of Industry and Technology evaluates the application based on the Application Assessment Report, which the investor prepares. It communicates its acceptance, rejection, or revision decision to the investor via the program portal. Investors whose projects are approved will be granted the types of support defined under the program.

The Capital Markets Board of Türkiye (SPK) published the Guide on Green Debt Instruments, Sustainable Debt Instruments, Green Lease Certificates, and Sustainable Lease Certificates on September 22, 2022 for financing of green infrastructure, and subsequently released the Draft Guide on Green, Sustainable, and Social Capital Market Instruments on September 6, 2024 to contribute to the financing of projects with significant environmental and social impact.

4. Global Infrastructure Trends and Investment Gaps

Securing adequate financing remains one of Türkiye's most pressing infrastructure challenges. Domestic savings are insufficient to meet investment needs, and external financing has become more difficult to access due to global economic volatility and rising interest rates.

Between 1986 and 2023, Türkiye secured USD 204 billion in infrastructure investment through PPPs. However, the scale of future requirements—USD 569 billion by 2040—means PPPs alone will not suffice. Innovative financing solutions and diversified funding sources are urgently needed. Globally, the majority of infrastructure investment demand through 2040 is expected to originate from Asia. China alone faces a USD 2 trillion gap between its USD 28 trillion infrastructure needs and current investment trends.

In addition to Türkiye's domestic market circumstances, the global investment has been decreasing according to United Nations Trade and Development (UNCTAD) reports. However, the investments in renewable energy projects and green and sustainable infrastructure projects lead the global investment and hold the biggest potential both globally and in Türkiye, according to the same report.

This global competition for investment capital poses additional risks for Türkiye. While the country's strategic location between Europe and Asia is an asset, increased competition for global financing may further complicate efforts to close its infrastructure gap.

5. Conclusion

Türkiye's infrastructure expansion and renewal needs will continue to rise in the coming decades. Transportation remains the dominant sector, but there are also urgent needs in telecom and sustainability-related infrastructure. While Türkiye has made commendable progress in renewable energy and electric vehicles, substantial challenges remain, particularly in financing and digital infrastructure.

To remain competitive and resilient, Türkiye must diversify its funding models beyond PPPs and align infrastructure priorities with global trends in digitalization and sustainability. Achieving this will be essential for ensuring long-term economic growth and national competitiveness in an increasingly interconnected world.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.