- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Basic Industries, Chemicals and Oil & Gas industries

HIGHLIGHTS

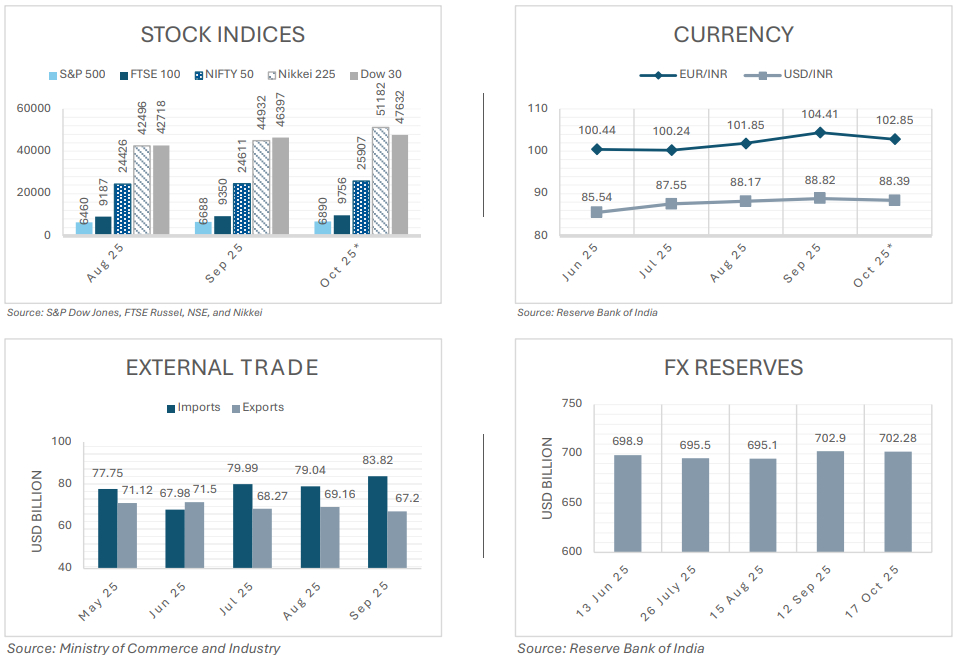

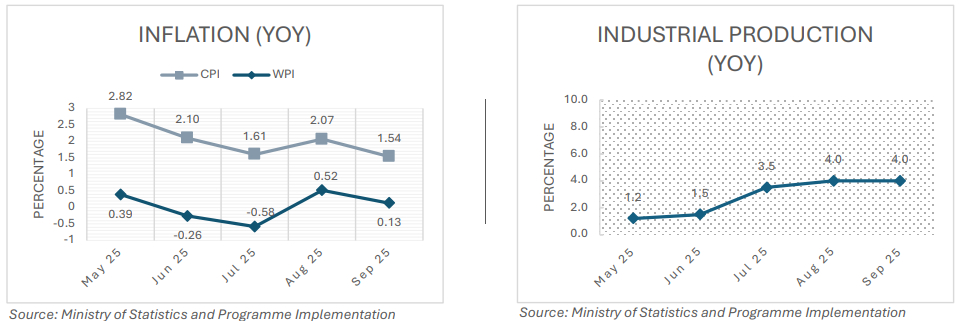

- The top 5 positive contributors for industrial production in September 2025 were manufacture of electrical equipment (28.7%); motor vehicles, trailers and semi-trailers (14.6%); basic metals (12.3%); wood and products of wood and cork, except furniture (11.5%); and computer, electronic, and optical products (10.2%).

- Vegetable and animal oils, and fats (14.5%); oil seeds (9.48%); minerals (6.77%); manufacture of food products (4.56%); and cement, lime, and plaster (3.72%) witnessed the highest inflation (WPI) in September 2025.

- In September 2025, the highest export growth was seen in cashew (106.41%); cereals other than rice, wheat, maize, and millet (58.19%); iron ore (52.25%); electronic goods (50.54%); and rice (33.18%). Correspondingly, the top 5 export destinations are Spain (150.81%); Egypt (67.29%); China (34.18%); the UAE (24.33%); and Bangladesh (23.06%).

- Gold reserves surged by USD 6.2 billion to exceed USD 108.5 billion for the first time, driving the rise in forex reserves.

Enhanced transparency in AIFs' NAV reporting

SEBI's consultation paper on reporting the value of units of AIFs to depositories

The Securities and Exchange Board of India (SEBI) has issued a consultation paper seeking comments on its proposal requiring Alternative Investment Funds (AIFs) to report the value of their units to depositories. This is part of SEBI's continuing efforts to refine the regulatory architecture governing AIFs in India.

The present practice – AIFs communicate the Net Asset Value (NAV) of units primarily through direct investor reporting – does not provide a centralised mechanism for regulators or investors to access or verify valuation data. Given the rapid growth of the AIF industry and its increasingly complex asset structures, such decentralised reporting hinders supervisory oversight and transparency. The consultation paper recognises this gap and proposes a mechanism to capture and display NAV data through the depository system. This ensures consistency, traceability, and regulatory visibility, thereby aligning AIF operations more closely with the standardised and technologydriven mechanisms already prevalent in the mutual fund and listed securities space.

Key provisions

- AIFs or their Registrar and Transfer Agents (RTAs) must upload the NAV corresponding to each International Securities Identification Number (ISIN) of their issued units on the depository platform within 15 days of performing the investment valuation. For existing AIFs, the latest NAV data must be uploaded within 45 days of the circular's implementation.

- The date of valuation will depend on whether the assessment was conducted by an external valuer (the date of the report) or internally (the date of internal documentation).

- Depositories such as National Securities Depository Ltd (NSDL) and Central Depository Services (India) Ltd (CDSL) are instructed to create necessary system capabilities, amend their byelaws and regulations, and display the uploaded data for investor access.

The paper represents a major step in technology-led regulatory supervision of private pooled vehicles, as SEBI aims to create a centralised, auditable layer of information that benefits investors, fund managers, and regulators alike. This is expected to improve operational consistency, reduce information asymmetry, and align AIF governance standards. Investors would be able to view the updated value of their holdings in their demat accounts, thus enhancing transparency and confidence in fund management activities. For SEBI, the initiative will improve market oversight by providing real-time access to valuation data and detecting irregularities promptly.

SEBI simplifies disclosure framework for RPT approvals

Circular implementing ISF recommendations on RPT standards

Based on a representation by the Industry Standards Forum (ISF), on October 13, 2025, the Securities and Exchange Board of India (SEBI) revised the disclosure framework for Related Party Transactions (RPTs) with immediate effect.

Key changes

- Disclosure requirements for Audit Committee

approval

- Basic details: Type, material terms, and key particulars of the proposed transaction

- Parties involved: Name of the related party and nature of its relationship or interest, financial or otherwise, with the listed entity or subsidiary

- Tenure of the proposed transaction

- Value of the proposed transaction

- Turnover impact: Percentage of the listed entity's annual consolidated turnover, and where applicable, the subsidiary's standalone turnover, represented by the RPT value

- Loans/advances/investments: Details of source of funds; nature, cost, and tenure of any indebtedness; applicable terms, interest rate, repayment schedule, and security; and purpose of utilisation by the ultimate beneficiary

- Justification as to why the transaction is in the interest of the listed entity

- Valuation/external report on the transaction o Percentage of the counterparty's annual consolidated turnover represented by the RPT

- Any other relevant information deemed material

- Disclosure requirements for shareholder approval: Along with the details of the last 5 points disclosed to the Audit Committee, a summary of all other information provided should also be included.

- Threshold-based relaxation

- For transactions that do not exceed 1% of the company's annual consolidated turnover or INR 10 crore (whichever is lower), a simplified set of disclosures as detailed in Annexure 13A applies

- ransactions not exceeding INR 1 crore are exempt from these detailed requirements altogether

- The Circular applies to all pending and future RPTs.

The revised framework represents a continued effort to make compliance more practical without diluting governance standards and necessitates prompt internal alignment of governance processes. Through this amendment, SEBI has reduced duplication, enabling Audit Committees and shareholders to focus on the substance of RPTs.

Key changes to QIP disclosures, IPO dematerialisation, and OMer- For-Sale holding period

SEBI (ICDR) (Second Amendment) Regulations, 2025

In September 2025, the Securities and Exchange Board of India (SEBI) introduced significant amendments to the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (ICDR Regulations). These changes refine multiple aspects of capital raising and disclosure norms across the frameworks for Qualified Institutions Placements (QIPs), Initial Public Offerings (IPOs), Offers-For-Sale (OFS), promoter contribution, and Social Stock Exchanges (SSEs).

Key changes

- Streamlined disclosure requirements for QIPs:

The amendments revamp the disclosure requirements in QIP documents

under Schedule VII of the ICDR Regulations, recognising that QIPs

are issued only to sophisticated institutional investors (Qualified

Institutional Buyers/QIBs) who already have access

to extensive public information on listed issuers. Key changes

include:

- Reduced financial disclosures: Companies raising funds via QIPs are no longer required to include full financial statements of the last 3 years. Instead, only a summary of key financial line items is mandated, eliminating repetitive information already available through quarterly reports and annual filings. The traditional 'Management's Discussion and Analysis' section (analysing the financial condition and results of operations) has been removed, since listed issuers' financial performance is continuously disclosed under SEBI's listing framework.

- Risk factors and other content revisions: The QIP placement document must now include more focused risk factor disclosures, specifically related to the issue and the issuer's business, along with any mitigation measures for those risks. The format aligns with IPO prospectus standards by updating definitions and terminology, and reframing certain sections. For instance, the 'Use of Proceeds' section is now termed 'Objects of Issue and Use of Issue Proceeds', emphasising clarity on how QIP funds will be utilised. Additionally, disclosures about the board of directors have been elaborated, and requirements for disclosing material legal proceedings have been clarified with specific materiality thresholds for litigation to be reported.

- Expanded dematerialisation requirements for

IPOs: SEBI has broadened the scope of mandatory

dematerialisation of shares in preparation for an IPO. Previously,

only the shares held by promoters needed to be in demat form before

the company filed its offer document. Now, a much wider category of

shareholders is required to dematerialise their securities before

the draft offer document (DRHP) is filed. The categories of

stakeholders who must ensure their shares are in demat form

include:

- Promoters and members of the promoter group

- Directors and Key Managerial Personnel (KMP) of the company

- Senior management of the company

- Selling shareholders (any existing shareholders offering shares in the IPO)

- Employees (including those formally designated as employees and working exclusively in India, and employees of the issuer's holding, subsidiary or associate companies)

- QIBs participating as pre-IPO investors

- Shareholders holding equity shares with special rights

- Entities regulated by financial sector regulators such as banks and insurers

- Relaxation of OFS holding period for scheme

shares: The amendments also ease certain holding period

requirements for shares offered in an IPO via an OFS. Generally,

any shareholder selling shares in an IPO must have held those

shares for at least 1 year prior to the DRHP filing (to prevent

quick flips), with an exception for shares that were acquired

through a Court- or Governmentapproved scheme of arrangement,

provided the underlying business or assets existed for over a year

before the scheme's approval. Now, SEBI has extended this

exemption to cover shares that arise from the conversion of

convertible securities acquired via an approved scheme.

In other words, if a company had issued convertible instruments (like warrants or debentures) under a Court-approved scheme (with the business having been in existence for more than 1 year), the equity shares resulting from those instruments' conversion will now be eligible for sale in the IPO even if the conversion happened within the last year. - Expanded definition of QIBs to include accredited investors: QIBs are a select class of large, sophisticated investors (like institutions) who can participate in certain placements and are presumed to understand investment risks. SEBI has tweaked. The amendment to the definition of QIBs under the ICDR Regulations adds SEBI-registered Accredited Investors (AIs) as QIBs, but only in the context of their investment in angel funds. This is a cross-linking change aligning with simultaneous amendments in the SEBI (Alternative Investment Funds) Regulations, 2012 (AIF Regulations). In essence, high-net-worth individuals or entities who obtain AI status (per AIF Regulations) can now be treated as QIBs when they invest in Category-I angel funds. This is likely to boost the angel investment ecosystem while ensuring participants meet certain wealth or expertise criteria. For angel fund managers, this widens the pool of eligible investors who can be approached, as AIs will count toward the sophisticated investor base. For investors, achieving accredited status now carries the perk of accessing deals typically reserved for QIBs. Market participants should closely monitor SEBI's detailed guidelines for accreditation and ensure compliance when onboarding such investors.

The amendments to the ICDR Regulations are largely facilitative, representing a comprehensive update to India's capital markets regulatory framework, as they streamline processes for seasoned issuers and investors, while upholding market integrity and investor protection.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.