- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Europe

- with readers working within the Accounting & Consultancy, Retail & Leisure and Law Firm industries

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Europe

- in Europe

- in Europe

- in Europe

- in Europe

- in Europe

- in Europe

- in Europe

- in Europe

- in Europe

- with readers working within the Chemicals, Healthcare and Oil & Gas industries

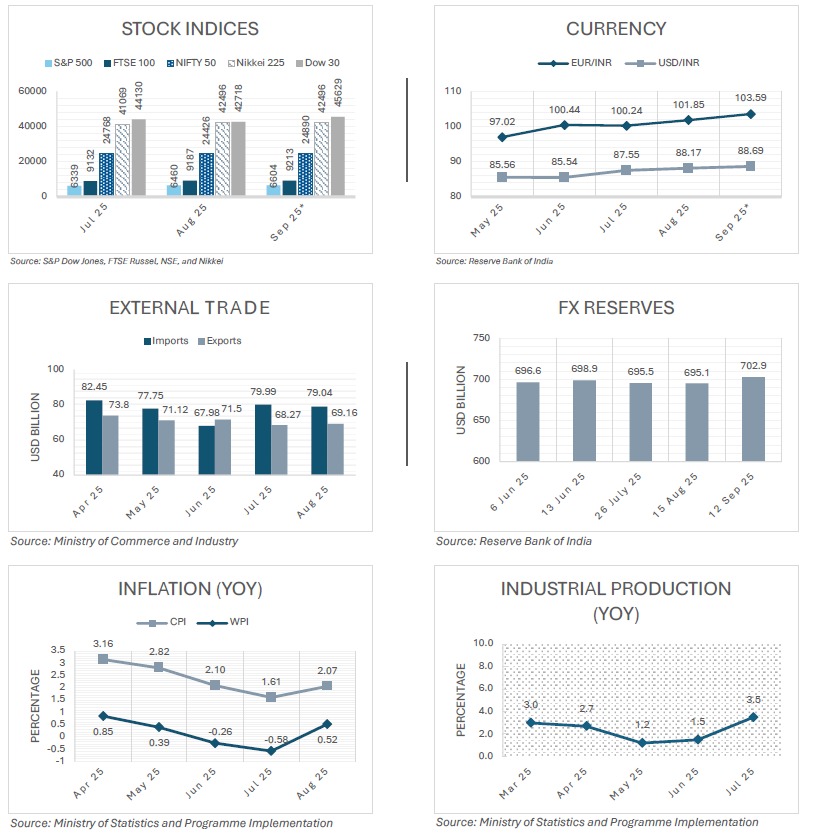

Indian economy | September 2025

Snapshot of key indicators

HIGHLIGHTS

- India's forex reserves grew by USD 4.7 billion to cross the USD 700 billion mark, shy of its all-time high of USD 704.8 billion, even as the rupee depreciated to a historic low against the US dollar at 88.82 in the same week (ending September 12).

- The top 5 positive contributors for industrial production in July 2025 were manufacture of wood and wood products except furniture (17.3%); electrical equipment (15.9%); basic metals (12.7%); transport equipment other than motor vehicles, trailers, or semi-trailers (11.5%); and tobacco products (10.8%).

- In August 2025, the highest export growth was seen in cereals other than rice, wheat, maize, and millet (89.69%); electronic goods (25.93%); mica, coal, and other ores/minerals (24.57%); tea (20.52%); and meat, dairy, and poultry products (17.69%).

Amendments to MPS, RPT, anchor investor, and FPI frameworks

SEBI's 211th board meeting

The Securities and Exchange Board of India (SEBI), in its board meeting held on September 12, 2025, approved a slew of important regulatory changes aimed at facilitating ease of doing business, broadening institutional participation, improving market governance, and supporting India's capital market evolution. These reforms are expected to enable larger Initial Public Offerings (IPOs), expand anchor investor pools, relax compliance for large issuers, and strengthen investor protections.

Key changes approved in SEBI's 211th board meeting

- Enhanced flexibility for large IPOs and Minimum Public Shareholding (MPS): SEBI introduced a refined framework for Minimum Public Offer (MPO), the minimum percentage of a company's equity which must be offered to the public when a company gets listed, and MPS, the minimum percentage of shares of a listed company which must be publicly held. This includes:

-

Post-issue market capitalisation (INR) Erstwhile provision Revised provision Up to 1,600 crore MPO of 25% Same as existing provision Above 1,600 crore up to 4,000 crore MPO of INR 400 crore MPS of 25% to be achieved within 3 years from date of listing Same as existing provision Above 4,000 crore up to 50,000 crore MPO of 10% Same as existing provision Above 50,000 crore up to 1 lakh crore MPS of 25% to be achieved within 3 years from date of listing MPO of INR 1,000 crore and at least 8% of the post-issue market capitalization

MPS of 25% to be achieved within 5 years from date of listing

Above 1 lakh crore up to 5 lakh crore MPO of INR 5,000 crore and at least 5% of the post-issue market capitalization

MPS of 10% to be achieved within 2 years and 25% within 5 years from date of listing

MPO of INR 6,250 crore and at least 2.75% of the post-issue market capitalization

In case public shareholding is less than 15% as on the date of listing, MPS of 15% to be achieved within 5 years and 25% within 10 years from date of listing

In case public shareholding is 15% or above as on the date of listing, MPS of 25% to be achieved within 5 years from date of listing

Above 5 lakh crore MPO of INR 15,000 crore and at least 1% of the post-issue market capitalisation, subject to a minimum dilution of 2.5%

In case public shareholding is less than 15% as on the date of listing, MPS of 15% to be achieved within 5 years and 25% within 10 years from date of listing

In case public shareholding is 15% or above as on the date of listing, MPS of 25% to be achieved within 5 years from date of listing

- Broadened anchor investor participation: Anchor investor participation has been widened to attract diversified, patient capital in line with global best practices, through the following amendments to the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018:

-

- Merging anchor categories and increasing permissible anchor count up to 15 for IPO portions up to INR 250 crore, scaling with issue size.

- Including life insurance companies and pension funds in the reserved anchor investor category alongside domestic mutual funds.

- Increasing anchor allocation reservation to 40%, with structured reallocation provisions for unsubscribed portions.

- Streamlined Related Party Transactions (RPT) compliance: SEBI has approved significant amendments to the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR Regulations), introduced vide its consultation paper dated August 4, 2025,1 aimed at easing compliance while maintaining investor protections:

-

- Scale-based thresholds: SEBI has approved scale-based thresholds for determining material RPTs, based on the listed entity's annual consolidated turnover, thereby creating a tiered system for shareholder approval.

- Enhanced subsidiary oversight: For RPTs by unlisted subsidiaries, a dual threshold for prior audit committee approval has been introduced – 10% of the subsidiary's standalone turnover, or the applicable scale-based material RPT threshold for the listed entity, whichever is lower – revising the erstwhile blanket threshold of 10% standalone turnover.

- ISN disclosure standards: The applicability of the ISN disclosure requirements2 for RPTs above INR 1 crore has been simplified for smaller RPTs not exceeding the lower of 1% of annual turnover or INR 10 crore, easing the compliance burden for minor transactions.

- Omnibus approvals: The validity period and conditions of omnibus RPT approvals by shareholders will be incorporated into the LODR Regulations, consolidating all requirements in a single regulatory location, ensuring clarity.

- Clarificatory amendments: Retail purchase by employees – not being related parties – will be removed from the statutory exemption to an RPT. Further, explicit clarification that the exemptions on RPTs involving wholly owned subsidiaries apply only to listed holding companies, not unlisted parents, will be incorporated.

- Reclassification of REITs as 'equity': SEBI approved amendments to the SEBI (Mutual Funds) Regulations, 1996, reclassifying REITs as 'equity' for mutual fund investments while retaining InvITs as 'hybrid'. Read together with the SEBI (REITs) (Second Amendment) Regulations, 2025, which refine governance and disclosure norms for REITs, these changes expand institutional participation, enhance liquidity, and support the inclusion of Indian REITs in benchmark indices, creating a clearer and more investor-friendly framework.

- Other notable regulatory updates: SEBI has doubled down on the following pre-IPO rules and regulatory compliance:

-

- Amendments to SEBI (Foreign Portfolio Investors) Regulations, 2019 (FPI Regulations) now allow IFSC retail schemes with resident sponsors to register as FPIs, align contribution norms with IFSC standards, and let overseas funds include Indian Mutual Funds (MFs) as constituents, thereby operationalising Indian MF overseas investments and easing cross-border participation.

- Introduction of the Single Window Automatic and Generalised Access for Trusted Foreign Investors (SWAGAT-FI) framework to unify market access for eligible foreign investors, offering single registration, faster timelines, simplified KYC, and reduced documentation.

- Introduction of a distinct regulatory framework governing Alternative Investment Funds (AIF) schemes exclusively comprised of Accredited Investors (AIs), involving relaxations on pari passu investor rights, extendable fund tenure, and no cap on the number of investors per scheme.

- Large Value Fund (LVF) threshold reduced from INR 70 crore to INR 25 crore, spurring risk capital formation under lighter regulation.

- Mandatory dematerialisation of pre-IPO shares and improvements in disclosure norms.

- Updated mutual fund exit load rules and incentives for distributor outreach to underserved segments.

- Regulatory overhaul of the framework for registrars to an issue and share transfer agents to clarify functions and compliance scope.

These regulatory reforms collectively signal SEBI's commitment to facilitating larger and more diverse market participation, improving compliance efficiency, strengthening governance, and nurturing India's position as a leading global capital market. Market participants must closely track the phased implementation of these changes, particularly around minimum public shareholding deadlines, IPO allocations, and institutional investor eligibility, to optimise capital raising strategies and compliance adherence.

MCA extends fast-track merger framework to unlisted companies

Companies (Compromises, Arrangements and Amalgamations) (Amendment) Rules, 2025

The Ministry of Corporate Affairs (MCA) has substantially widened the scope of companies eligible for the fast-track merger mechanism under Section 233 of the Companies Act, 2013 (Act) through amendments to the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 (Rules). Effective September 8, 2025, these changes will reduce reliance on the National Company Law Tribunal (NCLT), thereby making the process more efficient and business-friendly.

The fast-track merger route was originally conceived as an alternative to the time-consuming tribunal-driven process under Sections 230-232 of the Act, allowing small companies, start-ups, and wholly owned subsidiaries of holding companies to restructure through approvals from the Regional Director (RD) instead of the NCLT, within a prescribed 60-day timeline. In 2024, the regime was expanded to permit cross-border mergers of foreign holding companies with their Indian wholly owned subsidiaries. The recent amendments represent a continuation of this liberalisation, extending eligibility and simplifying compliance even further.

Key changes under the recent amendments

- Unlisted companies with higher thresholds: All unlisted companies (other than Section 8 companies) can now undertake fast-track mergers/demergers if their aggregate borrowings (loans, debentures, deposits) do not exceed INR 200 crore, and no repayment defaults exist. This is a 4-fold increase from the earlier proposed INR 50 crore limit, significantly broadening eligibility.

- Holding subsidiary mergers: The route has been extended to include mergers between holding companies and their subsidiaries, even if the subsidiary is not wholly owned, provided the transferor company is unlisted. This removes the earlier restriction that limited the benefit only to wholly owned subsidiaries.

- Fellow subsidiaries: Mergers and demergers between 2 subsidiaries of the same holding company are now permitted under the fast-track route, subject to the transferor company being unlisted. This facilitates smoother intra-group restructuring.

- Cross-border mergers: Provisions relating to mergers of foreign holding companies with their Indian wholly owned subsidiaries, earlier introduced separately under Rule 25A of the Rules, have now been consolidated into Rule 25, making the framework more streamlined and self-contained.

- Additional compliance requirements: These include mandatory notifications to sectoral regulators (Reserve Bank of India, Securities and Exchange Board of India, Insurance Regulatory and Development Authority of India, Pension Fund Regulatory and Development Authority) and stock exchanges in case of listed entities.

The broadened eligibility framework creates more practical and efficient restructuring options, offering greater opportunities for companies with minority shareholders, multi-subsidiary structures, or partially owned entities. By enabling a deemed approval within 60 days, the fast-track mechanism helps conclude transactions in months instead of years, cutting down on tribunal time and costs. Explicit provisions for inbound mergers and reverse flips also make cross-border alignment easier for multinational groups, while shifting simpler schemes away from the NCLT allows tribunals to focus on complex disputes and speed up resolution overall.

Key challenges

- The fast-track merger route remains limited to mergers and demergers, with other forms of restructuring like capital reorganisations or buybacks still requiring NCLT approval.

- The Income-tax Bill, 2025, excludes fast-track demergers from tax neutrality, creating uncertainty.

- The 90% shareholder approval requirement under Section 233 reduces the feasibility for listed entities.

- Administrative capacity is limited, with only 7 RDs to handle applications.

- Recognition of RD-approved property transfers may face delays, as local authorities are more accustomed to NCLT orders.

Even with the above challenges, the amendments mark a decisive step in modernising India's corporate restructuring regime, aligning with the Government's policy intent, as announced in the Union Budget. By broadening eligibility and strengthening procedural safeguards, the Government has struck a balance between efficiency and oversight. For businesses, the expanded fast-track route is more than just a compliance shortcut; it is a strategic enabler for growth, integration, and competitiveness in a globalised economy.

Framework for conversion of private-listed InvITs into public InvITs

SEBI's Circular sets out minimum contribution, lock-in, and FPO compliance requirements

The Securities and Exchange Board of India (SEBI) recently issued a Circular revising the extant framework for conversion of private-listed Infrastructure Investment Trusts (InvITs) into a public InvITs (Circular), envisaged under the Master Circular for InvITs dated May 15, 2024. These revisions have been introduced by SEBI pursuant to suggestions received from market participants and the recommendations of the Hybrid Securities Advisory Committee, constituted by SEBI.

An InvIT is defined as a trust registered under the SEBI (InvITs) Regulations, 2014 (InvITs Regulations). It is a collective investment vehicle established in the form of a trust, which raises funds from one or more investors and deploys such funds in accordance with its stated investment objectives, primarily in infrastructure projects or infrastructure assets. In India, InvITs can be structured either as private-listed InvITs (these InvITs are listed on the stock exchange, but the units are not offered to the general public; instead, they are issued through private placement to a select group of investors) or Public InvITs (these InvITs are listed on the stock exchange with units offered to the general public, including retail and institutional investors).

Key changes under the Circular

- Minimum contribution for sponsor holdings: Under the extant regime, the sponsors, which shall mean any company, LLP, or body corporate which sets up the InvIT, were required to ensure that they maintain the minimum contribution prescribed under law, i.e. 15% of the units issued through public issue or to the extent of 15% of post-issue capital. This was further subject to 2 conditions – an 18- month lock-in requirement for the units forming part of the minimum contribution, and a 1-year lock-in requirement for the sponsors holding in excess of the minimum contribution. The amendment removes these requirements, and sponsors and sponsor group(s) would henceforth be subject to the minimum unitholding requirements set out in Regulations 12(3) and 12(3A) of the InvIT Regulations.

- Lock-in requirements: Under the existing regime, upon the conversion of private-listed InvITs to public InvITs, the sponsor unitholders were required to observe a 1-year lock-in period. This is dispensed with under the amendment. In addition, the lock-in obligations for units held by sponsors and sponsor group(s) would be aligned with Regulation 12(5) of the InvIT Regulations, providing for post-conversion periods.

- Alignment with Follow-on Public Offer (FPO) procedures: Under the extant regime, when a private-listed InvIT was converted into a public InvIT, the issuance of units pursuant to such conversion was treated as an Initial Public Offering (IPO), thereby requiring compliance with IPO disclosure requirements set out under Chapter 2 of the Master Circular. The amendment aligns disclosure obligations for conversion-related offers with those applicable to FPOs, rather than treating them as IPOs. Such disclosures typically include details of the size and purpose of the issue, utilisation of proceeds, financial information and historical distributions, material risk factors, unitholding patterns, related party transactions, and compliance status under the InvIT Regulations and related SEBI circulars.

The Circular represents a measured effort to streamline the regulatory framework for InvIT conversions. By revising lock-in requirements and clarifying disclosure obligations, the amendments are designed to facilitate the transition from private to public InvITs while continuing to safeguard investor interests. Eliminating conversion-specific lock-in and minimum contribution norms provides greater operational flexibility to sponsors and reduces compliance burdens without undermining long-term sponsor commitment. Additionally, easing or removing lock-in periods for units during conversion is expected to enhance capital-raising capacity, encouraging broader participation from both existing and new institutional investors, including mutual funds and pension funds.

Consolidated framework for coastal trade

Coastal Shipping Act, 2025

With a target of moving 230 million tonnes of cargo by 2030, India's maritime sector has entered a decisive reform phase with the Coastal Shipping Act, 2025 (Act), replacing Part XIV of the Merchant Shipping Act, 1958.

Key features

- Streamlined framework: By consolidating the existing regulations into 6 chapters and 42 clauses, the Act removes outdated complexities, simplifies compliance for Indian vessels, and provides clear guidelines for foreign participation, serving as a strategic enabler of supply chain security, logistics efficiency, and domestic industry participation.

- Encouraging domestic capacity: A general trading license for Indian-flag vessels is no longer required, empowering Indian entrepreneurs – whether through ownership or chartering – to operate vessels more easily and cost-effectively, aiming to bolster domestic capacity, reduce dependency on foreign operators, and promote self-reliance in coastal trade.

- Regulating foreign participation: The Act requires foreign-flag vessels to secure a license from the Director General of Shipping, who is authorised to impose conditions such as employing Indian crew or encouraging domestic shipbuilding, ensuring adherence to national interests.

- Integrated connectivity: Within 2 years, the Government must prepare a National Coastal and Inland Shipping Strategic Plan to link waterways with coastal routes, creating a multimodal ecosystem for faster, greener, and more cost-effective cargo movement.

- Data-driven growth: The Act introduces a National Database for Coastal Shipping, providing real-time, authentic data on vessels, routes, and licensing requirements. This initiative enhances transparency, supports informed decision-making, and gives investors and industry stakeholders clear visibility into Government priorities. With improved access to information, private capital is expected to flow more readily into shipping, shipbuilding, and related infrastructure sectors.

- Enforcement and compliance: Updating penalties from the outdated 1958 law, the Act now imposes fines of up to INR 15 lakh or 4 times the payment received, whichever is higher, for operating without a license. The focus is on monetary penalties rather than imprisonment, except in serious cases, striking a balance between robust enforcement and a business-friendly environment.

India's dependence on foreign ships for coastal trade has long exposed supply chains to disruptions and external shocks. By promoting Indian vessel registration and operations, the Act aims to strengthen resilience, retain capital within the economy, and build long-term maritime capabilities through more sustainable and efficient transport solutions.

Increased flexibility in the proposed foreign investment regime of the insurance sector

Draft Indian Insurance Companies (Foreign Investment) Amendment Rules, 2025

The Department of Financial Services under the Ministry of Finance has released the draft amendments to the Indian Insurance Companies (Foreign Investment) Rules, 2015, aimed at aligning the foreign investment framework with the Government's push to permit 100% Foreign Direct Investment (FDI) in the insurance sector and easing operational restrictions on foreign-owned insurers and intermediaries (Draft Rules). Successive reforms have gradually raised the FDI cap from 26% to 49%, and then to 74% in 2021, with the Draft Rules representing the next stage of liberalisation.

Key proposed changes

- Investment limit: The 74% FDI ceiling in the existing Rules will be replaced with a reference to the limit under the Insurance Act, 1938 (Act), and an amendment to the Act allowing 100% FDI is pending with the Legislature.

- Removal of operational restrictions: To provide greater flexibility, several legacy conditions will be withdrawn:

-

- Requirement of a majority of directors and key managerial personnel to be resident Indian citizens removed. Only one among the Chairperson, MD, or CEO must remain a resident Indian citizen.

- Resident requirement for majority board and KMPs dropped, with only one among the Chairperson, MD or CEO needing to be a resident Indian citizen.

- Independent director requirements linked to foreign ownership thresholds scrapped.

- Profit retention in general reserves under solvency conditions removed.

- For intermediaries, conditions such as Insurance Regulatory and Development Authority of India (IRDAI)-approval for dividend repatriation, restrictions on payments to group entities, and residency requirements for senior management withdrawn. Instead, intermediaries must incorporate as Indian companies, adopt modern managerial/technological practices, and disclose related-party payments.

Insurance has long been considered a capital-intensive sector in India, with penetration levels still below global standards. The Draft Rules are therefore a welcome step toward unlocking capital, deepening penetration, and advancing the Government's 2047 vision. By lifting legacy constraints, the sector becomes more attractive to foreign investors and provides existing joint ventures the opportunity to recalibrate governance. Allowing up to 100% FDI is expected to bring fresh capital, global expertise, and product innovation, enhancing competition and consumer choice. That said, full implementation hinges on timely amendments to the Act and clear IRDAI guidance to ensure policyholder protection remains central. Concerns also persist around balancing foreign control with local accountability and clarifying supervisory oversight of foreign-majority insurers under a lighter compliance regime.

Offline Payment Aggregators included in RBI's new regulatory framework

RBI's Master Direction on the regulation of Payment Aggregators

The Reserve Bank of India (RBI) recently issued the Regulation of Payment Aggregators (PA) Directions, 2025 (Directions), a comprehensive framework consolidating and replacing earlier rules on digital payment intermediaries. The framework now regulates online, offline, and cross-border PAs, aiming to strengthen governance, transparency, and traceability of digital transactions.

PAs play a central role in India's fast-growing digital commerce ecosystem by facilitating payments between customers and merchants. Earlier regulatory measures issued in 2020 and 2023 covered online and cross-border activity, but left offline aggregators largely unregulated. Industry practices around merchant onboarding, escrow management, and settlement varied, leading to operational inconsistencies and risks. Recognising these gaps, the RBI initiated public consultations in 2024, culminating in the present Directions, which harmonise rules across all PA categories.

Key changes

- Categorisation of PAs: The framework distinguishes between PA-Online (remote transactions), PA-Physical (proximity transactions), and PA-Cross Border (international flows). Offline PAs are brought under the purview of regulations for the first time.

- Authorisation norms: Banks can continue PA operations without new approvals, while nonbanks must seek fresh RBI authorisation by December 31, 2025. Those unable to comply must exit by February 2026. Minimum net worth criteria of INR 15 crore (rising to INR 25 crore within 3 years) apply, along with statutory auditor certification.

- Merchant KYC and onboarding: Full KYC is mandatory for all merchants other than small merchants, with the Central KYC Records Registry (CKYCR) being the preferred mode. Small merchants, defined as those with a domestic turnover of up to INR 40 lakh or export turnover of up to INR 5 lakh, may undergo simplified checks, including PAN and contact point verification. All existing merchants must complete full KYC compliance by September 2026.

- Settlement restrictions: Funds may only be settled to entities directly dealing with customers – larger merchants can direct split settlements, while the smaller ones cannot – this limits flexibility in certain marketplaces and gig-economy structures.

- Direct PA-merchant relationship: Pas must contract directly with each merchant, assign unique IDs, and monitor ongoing transactions to ensure alignment with declared business activities.

- Escrow account operations: Escrow accounts must be maintained with scheduled commercial banks. Inter-escrow transfers are permitted in multi-PA chains, but cash-on-delivery transactions remain excluded. Only the 'core' domestic balance may earn interest; cross-border balances cannot.

- Cross-border clarifications: Export and import collection accounts are renamed Inward (InCA) and Outward (OCA) collection accounts. Pre-funding and inter-escrow transfers are disallowed, and PA-Cross Borders cannot engage in forex trading except via authorised dealers. Transaction caps of INR 25 lakh per inward/outward payment apply.

- Governance and compliance: Pas must appoint grievance officers, establish dispute resolution mechanisms, conduct annual Indian Computer Emergency Response Team (CERT-In) empanelled cybersecurity audits, and register with the Financial Intelligence Unit–India (FIUIND). Acquiring banks are now expressly responsible for overseeing PA compliance with their policies.

The 2025 Directions mark a decisive evolution in India's regulation of digital payments. Bringing offline aggregators under supervision closes a key regulatory gap, while stricter KYC and settlement norms enhance traceability and reduce fraud risks. The reforms are likely to strengthen credibility, improve consumer confidence, and support sustainable growth in digital payments. Industry players should align business models with the new norms and actively engage with the RBI for clarity on cross-border and marketplace-linked operations.

While progressive, the framework raises several challenges. Compliance timelines, particularly the requirement for non-bank PAs to reapply for authorisation and complete KYC of all merchants by 2026, may strain smaller players. The settlement restrictions could impact flexibility for marketplaces and gig-economy operators. Moreover, operationalising stricter KYC norms, including Contact Point Verification (CPV) and video KYC at scale, may pose logistical hurdles. Finally, PA-Cross Borders face stricter fund-flow restrictions, which may limit innovative cross-border payment models unless further clarity is issued.

Prohibition of online money gaming

Promotion and Regulation of Online Gaming Act, 2025

The Ministry of Electronics and Information Technology (MeitY) recently notified the Promotion and Regulation of Online Gaming Act, 2025 (Act), India's first central framework on online gaming, which seeks to regulate online gaming and impose a complete prohibition on online money games. In line with this development, several entities offering online money gaming services have already wound down their operations.

Key aspects of the Act

- Definition of gaming categories: The framework distinguishes between online games (any game offered on a digital or virtual platform), e-sports (competitive, skill-based events conducted online without wagering), online social games (casual or skill-enhancing games for entertainment or learning without monetary stakes), and online money games (games requiring entry fees, deposits, or stakes with potential monetary or equivalent rewards, excluding e-sports).

- Permissible games: E-sports (recognised as a legitimate sport) and online social or educational games are permitted, while all forms of online money games have been prohibited. Banks and financial institutions are barred from processing transactions related to online money gaming services.

- Online gaming authority: A national-level regulator will be set up to oversee the sector. Its role includes categorising and registering online games, determining whether a game qualifies as a money game, issuing codes of practice, and handling public grievances.

- Offences and punishments: The Act prescribes punishments for offering or operating an online money gaming service (up to 3 years imprisonment and INR 1 crore fine); and publishing or facilitating advertisements for online money games (up to 2 years imprisonment and INR 50 lakh fine); as well as stricter punishments for repeat offenders.

The recognition of e-sports and social games creates a new regulatory pathway for legitimate competitive and recreational gaming, opening opportunities for investment, infrastructure development, and integration with India's broader sports ecosystem. At the same time, with the prohibition on online money games, advertising agencies, digital platforms, broadcasters, and payment intermediaries must also exercise heightened caution, as even indirect facilitation of online money games or related promotions may attract liability.

Fraudulently initiated CIRP can be recalled at any stage

Expert Realty Professionals Pvt Ltd v. Logix Infrastructure Pvt Ltd

The National Company Law Appellate Tribunal (NCLAT) recently recalled a Corporate Insolvency Resolution Process (CIRP) that was initiated vide a collusion between the Corporate Debtor and the Financial Creditor.3

Logix Infrastructure Pvt Ltd (Logix) launched the 'Blossom County' project in Noida. By 2020, construction remained incomplete across several towers, with over INR 500 crore due to the Noida Authority. Expert Realty Professionals Pvt Ltd (Expert Realty) infused INR 15 crore under a buy-back agreement for part of the saleable area. In 2023, Expert Realty initiated insolvency proceedings against Logix for INR 12.88 crore. Homebuyers alleged fraud, collusion, and related-party connections. The National Company Law Tribunal (NCLT) found the initiation of CIRP fraudulent, recalled the CIRP, and imposed a penalty of INR 55 lakh on Expert Realty. On appeal, the NCLAT concluded that the insolvency application was a device for misappropriation, evasion of liabilities to the Noida Authority, and disruption of homebuyer registrations, based on the following findings:

- The MoU and minutes were not executed on stamp paper, casting doubt on the transaction's validity.

- The corporate debtor's unopposed admission of liability indicated collusion to evade obligations to genuine creditors and allottees.

- Expert Realty and Logix were related parties; common directorships and links through a separate entity revealed an ongoing connection, which fact was deliberately not disclosed.

- Director resignations and appointments were timed to circumvent disqualification under the Insolvency and Bankruptcy Code, 2016, evidencing a pre-planned arrangement.

The NCLAT rejected arguments that the homebuyer's application was belated, holding that fraud vitiates CIRP at any stage. The decision upholds the NCLT's jurisdiction to pierce the corporate veil, examine substantive relationships, and disregard disguised links. It is significant in curbing misuse of project-specific CIRP, strongly discouraging real estate developers and financiers from using insolvency proceedings to shield themselves from homebuyer claims, statutory dues, or to abandon projects.

Speculative investors can participate in but cannot initiate CIRP

Key indicators of speculative investment in housing projects

In a recent case, the Supreme Court set out key indicators of speculative investors in real estate insolvency proceedings.4 The case pertains to 2 insolvency petitions arising out of dishonoured buyback clauses.

While clarifying that speculative investors may file claims in ongoing Corporate Insolvency Resolution Processes (CIRPs) but cannot initiate insolvency proceedings to stall projects for profit motives, the Court distinguished genuine homebuyers from speculative investors

Indicators of speculative investment (non-exhaustive)

- Agreements replacing possession with buyback/refund options or special arrangements.

- Persistent demand for a refund with high interest, coupled with refusal to accept possession.

- Purchase of multiple units, especially in double digits (though not conclusive by itself).

- Allotment conferring special rights, preferential treatment, or unusual privileges.

- Significant deviation from the Model Real Estate Regulatory Authority (RERA) Agreement.

- Unrealistic promises of 20–25% short-term returns or excessively high interest rates.

The Court emphasised the long-standing plight of middle-class homebuyers, reaffirmed the fundamental right to shelter, and issued several directions.

Directions issued by the Court

- Insolvency and Bankruptcy Board of India (IBBI) to devise a mechanism to hand over possession to willing allottees where substantial construction is complete.

- Every new residential real estate transaction to be registered with the revenue authorities once at least 20% of the cost is paid.

- For senior citizens/allottees over 50 years of age, contracts deviating from the Model RERA Agreement or containing buyback/return clauses to be supported by an affidavit before the competent Revenue Authority confirming awareness of risks.

- IBBI and RERA to form a council to frame project-wise CIRP guidelines and safeguards.

- RERAs to conduct rigorous diligence before project approvals.

- Each RERA must include a legal/consumer expert, and vacancies in RERA and tribunals must be filled urgently.

- Real estate insolvency resolution to proceed project-wise, not for the entire corporate debtor, unless justified.

Recognising that policymaking lies within the Government's domain, the Court emphasised its constitutional duty to protect homebuyers and the economy, and made several suggestions.

Suggestions to the Government/Authorities

- IBBI to explore early warning systems such as pre-bankruptcy mediation and preventive restructuring.

- The Central Government to harmonise RERA rules across States.

- Housing Boards, Urban Development Authorities, and Public Sector Undertakings (PSUs) to set up dedicated units for reviving stalled projects under the Insolvency and Bankruptcy Code, 2016.

- Establishment of a revival fund – through National Asset Reconstruction Co Ltd (NARCL) or expansion of Special Window for Affordable and Mid-Income Housing Investment Fund (SWAMIH) – for bridge financing of stressed projects.

- Consideration of a PSU/Public-Private Partnership (PPP)-backed body corporate to take over and complete stalled projects; unsold units may be channelled into Government housing schemes.

Footnotes

* As per the latest available data for September 2025

1. https://bit.ly/Newsletter-August2025

2. https://bit.ly/Newsletter-July2025

3. Expert Realty Professionals Pvt Ltd v. Logix Infrastructure Pvt Ltd, CA (AT) (I) No. 383 of 2025

4. Mansi Brar Fernandes v. Shubha Sharma, Civil Appeal No. 3826 of 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.