- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in China

- with readers working within the Media & Information and Law Firm industries

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in China

- with readers working within the Chemicals, Healthcare and Oil & Gas industries

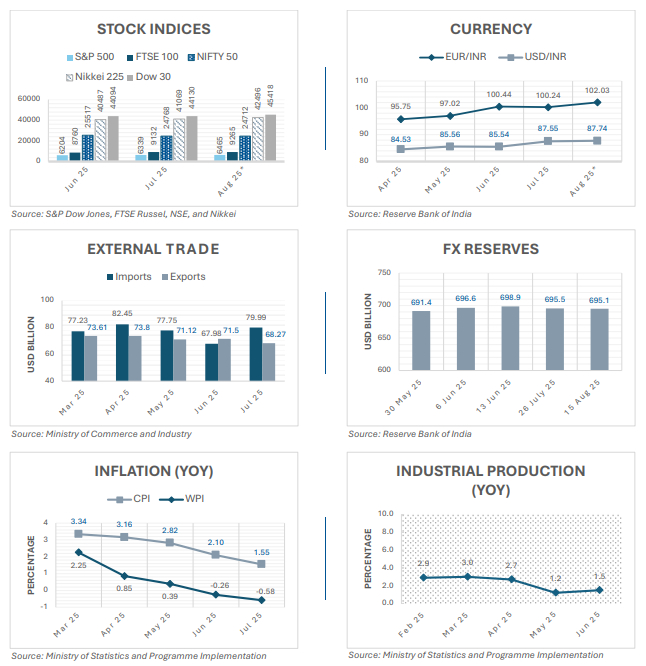

Indian economy | Snapshot of key indicators

HIGHLIGHTS

- In July 2025, CPI (1.55%) and WPI (-0.58%) recorded the lowest inflation rates since June 2017 (1.46%) and July 2023 (-1.36%), respectively. This was driven by deflation in vegetables (20.69%); pulses and products (13.76%); spices (3.07%); meat and fish (0.61%); and transport and communication (-2.12%). Conversely, the highest inflation was observed in oils and fats (19.24%); personal care and ePects (15.12%); fruits (14.42%); non-alcoholic beverages (4.6%); and health (4.57%).

- India's merchandise trade deficit widened to USD 27.35 billion in July 2025, a sharp increase from June's USD 18.78 billion. Highest export growth was seen in cereals other than rice, wheat, maize, and millet (71.97%); coPee (67.46%), electronic goods (33.89%); meat, dairy, and poultry products (31.19%); and gems and jewellery (28.95%).

- The top 5 positive contributors for industrial production in June 2025 were fabricated metal products, except machinery and equipment (15.2%); furniture (10.3%); basic metals (9.6%); electrical equipment (6.45); and motor vehicles, trailers, and semitrailers (4.7%). Indian economy | Snapshot of key indicators August 2025 Source: S&P Dow Jones, FTSE Russel, NSE, and Nikkei Source: Reserve Bank of India Source: Ministry of Commerce and Industry Source: Reserve Bank of India Source: Ministry of Statistics and Programme Implementation Source: Ministry of Statistics and Programme Implementation

RBI streamlines the regulatory framework for non-fund- based credit facilities

RBI (Non-Fund Based Credit Facilities) Directions, 2025

The Reserve Bank of India (RBI) recently consolidated the regulatory framework governing guarantees, coacceptances, Partial Credit Enhancement (PCE) facilities, and related instruments that play a key role in credit intermediation and business transactions (Directions). The Directions will come into ePect from April 1, 2026, or on an earlier date adopted by a Regulated Entity (RE).

Key aspects of the Directions

- Applicability: The Directions apply to REs, including commercial banks, primary (urban) co-operative banks, as well as All India Financial Institutions (AIFIs).

- Exceptions: While, as a general rule, REs are prohibited from issuing Non-Fund Based (NFB) credit facilities to customers who have not availed a fund-based credit facility from them, the Directions carve out certain exceptions. These include derivative contracts, PCE facilities, NFB credit facilities backed by counter-guarantees from another RE, cases where the obligor has no fund-based exposure from any RE, cases where a no-objection certificate has been obtained from an RE providing fundbased facilities, and transactions that are fully secured by eligible financial collateral.

- Guarantees: The conditions applicable to

guarantees are as follows:

- Guarantees (or counter-guarantees) issued must be irrevocable, unconditional, and incontrovertible, with clear procedures for honouring on invocation.

- Electronic guarantees are recognised, subject to SOPs framed by REs in line with RBI's guidelines.

- For guarantees involving overseas transactions, the REs permitted as authorised dealers may extend NFB credit facilities for bona fide current or capital account transactions under the Foreign Exchange Management Act, 1999.

- Authorised dealer banks can issue guarantees to or for foreign entities (or their step-down subsidiary controlled by an Indian entity), provided these are backed by collateral or counterguarantees from the Indian entity or its group.

- Only Scheduled Commercial Banks (SCBs) can issue guarantees on behalf of stock/commodity brokers instead of a security deposit to the extent it is acceptable in the form of a bank guarantee as laid down by exchanges.

- Co-acceptances: The Directions require REs to restrict such facilities strictly to genuine trade bills, with an obligation to ensure that the underlying goods are duly reflected in the borrower's stock accounts.

- PCE facility: The PCE facility can be provided

by SCBs (excluding regional rural banks), AIFIs, NonBanking

Financial Companies (NBFCs), including Housing

Finance Companies (HFCs) in the middle layer and

above. The following are key features of the PCE facility:

- The facility must be built into the REs' credit policies and structured as an irrevocable, subordinated, contingent line of credit (revolving at the discretion of the PCE providing RE) available only for bond servicing.

- Binding contractual arrangements must be entered into between all stakeholders (issuers, bondholders/trustees, lenders, and PCE REs).

- Aggregate PCE exposure is capped at 50% of the bond issue size, and it cannot be sanctioned post-issuance or in the form of guarantees.

- Bonds must carry at least a BBB pre-enhancement rating (from 2 external credit assessment institutions) and, in case of NBFC/HFC bonds, a minimum tenor of 3 years.

- REs must ensure that project assets and cash flows from the bond issue backed by PCE are protected through an escrow account managed under a bond trustee arrangement.

The Directions provide much-needed clarity and uniformity for REs, enabling them to frame robust internal policies while reducing risk through clear restrictions on impermissible transactions. At the same time, they enhance accountability and monitoring standards across the system. Importantly, the comprehensive PCE framework strengthens investor confidence by oPering a structured mechanism, thereby deepening the bond market and encouraging wider participation, including from NBFCs and HFCs.

SEBI proposes streamlining of RPT compliance

Consultation paper on amendments to the LODR Regulations

The Securities and Exchange Board of India (SEBI) has proposed certain amendments to the Related Party Transactions (RPT) framework outlined in the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR Regulations), in order to streamline compliance under its 'Ease of Doing Business' policy.

Key proposed changes to LODR Regulations

- Scale-based materiality thresholds: The

current materiality threshold for RPTs – INR 1000 crore or

10% of a listed entity's annual consolidated turnover,

whichever is lower – has been criticised as an overly rigid

benchmark, particularly for high-turnover companies where such

transactions may be insignificant in the context of overall

operations. To address this, SEBI has proposed a graduated,

turnover-linked threshold mechanism under Schedule XII of the LODR

Regulations, aimed at reducing unnecessary shareholder approvals:

Applying the proposed scale retrospectively to RPTs of the top 100 NSE companies shows a nearly 60% drop in material RPT approvals in FYs 2023-24 and 2024-25. This significant reduction highlights how the current framework may be imposing an excessive regulatory burden by over-classifying transactions as material.Turnover slab (annual consolidated) (INR) Proposed threshold Ceiling (INR) Up to 20,000 crore 10% of turnover 2,000 crore 20,000 to 40,000 crore INR 2,000 crore + 5% of turnover above INR 20,000 crore 3,000 crore Above 40,000 crore INR 3,000 crore + 2.5% of turnover above INR 40,000 crore 5,000 crore - Enhanced oversight of subsidiary transactions:

Currently, audit committee approval for RPTs of unlisted subsidiary

companies is required only if they exceed 10% of the

subsidiary's standalone turnover, creating gaps where large

transactions escape scrutiny. The proposed amendments plug this gap

by introducing a dual threshold, requiring approval for subsidiary

RPTs above INR 1 crore if they breach the lower of:

- The listed entity's proposed scale-based material RPT threshold

- 10% of the subsidiary's standalone turnover (per last audited statements). For subsidiaries without audited financials, 10% of the standalone net worth (certified by a chartered accountant within 3 months of seeking approval), or, in case the net worth is negative, the sum of paid-up capital plus securities premium, is used

- Tiered disclosure requirements: Building on SEBI's 26 June 2025 Circular, which

introduced a waterfall disclosure approach for RPTs above INR 1

crore (ISN), the consultation paper now proposes a

3-tier structure, seeking to ease compliance for small and moderate

RPTs:

Transaction value Disclosure requirement Up to INR 1 crore Exempt from ISN requirements Above INR 1 crore but below the moderate value threshold (1% of annual consolidated turnover or INR 10 crore, whichever is lower) Simplified disclosures as per Annexure 2 of the paper Above the moderate value threshold Complete ISN compliance - Omnibus approval clarifications: Omnibus approvals for RPTs by audit committees already last up to 1 year under Regulation 23(3) of the LODR Regulations. SEBI now proposes similar clarity for shareholder approvals – those granted in an Annual General Meeting (AGM) will remain valid until the next AGM or 15 months (maximum statutory period between 2 AGMs), whichever is earlier, while approvals in non-AGM meetings will be valid for 1 year.

- Clarifications on exemptions: The retail purchase exemption under the proviso to Regulation 2(1)(zc) will now be limited to directors, Key Managerial Personnel (KMPs), and their relatives – subject to no business relationship and uniform terms – explicitly excluding employees, who are not classified as related parties. Further, for exemptions on RPTs involving wholly owned subsidiaries, the proposed clarification specifies that the relief applies only to listed holding companies, thereby excluding unlisted parents.

MeitY proposes consent artifacts, dashboards, and withdrawal protocols under the data protection framework

Business Requirement Document on Consent Management System

The Ministry of Electronics and Information Technology (MeitY) released a Business Requirement Document (BRD) outlining its proposed approach to consent management under the Digital Personal Data Protection Act, 2023 (DPDP Act).

At the core of the BRD is the creation of a Consent Management System (CMS), a modular framework that enables individuals to seamlessly provide, track, and withdraw consent across digital platforms. Though not finalised yet, the BRD provides the first detailed insight into how the Government expects consent flows to be operationalised across sectors.

Key features of the BRD

- Consent lifecycle: Consent must be captured, tracked, and withdrawn in real time, with withdrawal being ePective immediately.

- Consent artifacts: Every consent action is to be recorded as a secure and immutable 'artifact' that can be shared between the data fiduciary, consent manager, and the individual.

- User-facing controls: The framework requires dashboards, standardised cookie banners, and alerts to ensure individuals have visibility and control over their data usage.

- Standardisation: Pre-defined purposes for processing are proposed, along with a prohibition on bundled or broad consents. Each change in data use would require fresh consent from the individual.

Implications for businesses

If the BRD is translated into a binding framework, companies will need to undertake significant operational changes, including:

- Redesigning consent flows and user interfaces to align with pre-defined purposes.

- Revisiting contracts with consent managers to allocate responsibilities and liabilities.

- Updating internal systems for real-time consent withdrawal and synchronisation.

- Preparing for higher monitoring and reporting requirements.

While the framework is aimed at strengthening user autonomy, certain concerns remain:

- Its highly prescriptive design may burden businesses. Granular consent requirements, mandatory re-approvals for even minor changes, and the ban on bundled consent, though wellintentioned, are likely to drive up compliance costs and risk causing user 'consent fatigue'.

- Moreover, although the DPDP Act places accountability on data fiduciaries, the BRD reallocates several operational responsibilities to consent managers, creating uncertainty around liability.

Given that the BRD is only at a draft stage, stakeholder feedback will play a crucial role in shaping the final regulations. Businesses should closely monitor developments and proactively assess the potential impact on their data protection architecture.

Pooling of debts by multiple operational creditors is not permissible

INR 1 crore threshold limit must be satisfied independently

In a recent ruling, the National Company Law Tribunal, New Delhi (NCLT) clarified that while multiple financial creditors can file a joint application under Section 7 of the Insolvency and Bankruptcy Code, 2016 (IBC), such pooling of debts is impermissible for multiple operational debts under Section 9.1

Section 9 envisions an application being filed by a single operational creditor in respect of its own debt, with the statutory process requiring that the demand notice, the opportunity to dispute, and the filing before the Adjudicating Authority be undertaken individually by that creditor. While the scheme of Section 7 permits joint applications by financial creditors due to the collective nature of a financial debt, no such provision exists under Section 9. Such pooling is impermissible under Section 9, and each creditor must independently satisfy the maintainability conditions, including the individual minimum monetary threshold of INR 1 crore under Section 4 and the issuance of a notice of demand under Section 8.

The decision reinforces the strict interpretation of Section 9 of the IBC and underscores the need for operational creditors to carefully assess whether their individual claims meet the statutory threshold before initiating proceedings. In this regard, this ruling will help prevent misuse of the IBC by multiple small creditors combining debts to pressurise otherwise solvent companies.

Proposal to empower the Bureau of Energy ECiciency to enforce energy conservation compliance

Draft Energy Conservation (Compliance Enforcement) Rules, 2025

The Ministry of Power released a draft framework under the Energy Conservation Act, 2001 (Act), proposing to empower the Bureau of Energy EPiciency (BEE) to detect, verify, assess, and present cases of noncompliance of the provisions of the Act before the adjudicating oPicers appointed by State Commissions (Draft Rules).

Key takeaways of the Draft Rules

- Compliance norms: The BEE will oversee adherence to the norms and standards prescribed by the Central Government, which, in the case of minimum share of renewable energy consumption for designated consumers under Section 14(x) of the Act, will prevail over the State-level standards. This clarification avoids duplication or conflicting obligations and firmly aligns compliance and enforcement with the Central Government's renewable energy targets.

- Reporting obligations: The entities must submit periodic compliance reports to BEE in respect of specified provisions of the Act.

- Verification: The BEE shall verify compliance and forward reports to the Central Government for certification.

- Adjudication and jurisdiction: The State Electricity Regulatory Commissions will adjudicate specified cases of non-compliance. The proceeds shall be credited to the Central Energy Conservation Fund, with 90% transferred to the concerned State Government and 10% retained by the Centre.

- Enforcement mechanism: The BEE may issue notices, verify compliance, and authorise oPicers or legal practitioners to represent cases before adjudicating oPicers.

- Regulatory role of BEE: The BEE will frame regulations and issue guidelines to operationalise the Rules.

These Draft Rules establish a structured statutory framework for enforcing compliance with energy ePiciency obligations. By positioning the BEE at the core of detection and oversight, the Government aims to strengthen enforcement while ensuring transparency in the allocation of penalties between the Centre and the States.

RBI outlines guiding principles for responsible and ethical AI adoption

FREE-AI Committee Report

Recently, the Reserve Bank of India (RBI) released the Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI) Committee Report, outlining principles for safe and inclusive AI adoption in the financial sector. To ensure innovation is pursued without compromising financial stability or consumer protection, the framework is anchored in 7 guiding Sutras – trust, people first, innovation over restraint, fairness, accountability, understandable by design, and safety, resilience and sustainability.

Key features of the Report

- A graded liability model that encourages responsible innovation. It suggests tolerance for first-time AI errors if firms have adequate safeguards, encouraging responsible experimentation without fear of immediate penalties.

- A dedicated AI fund and a multi-stakeholder standing committee under the RBI to oversee AI adoption and ensure inclusive governance.

- Support for India-centric AI models and integration with the IndiaAI Mission.

- 6 strategic pillars underpinning the Committee's 26

recommendations for ePective implementation:

- The first 3 pillars are infrastructure, policy, and capacity, and focus on enabling innovation. This includes creating a financial-sector data infrastructure and an AI Innovation Sandbox to provide smaller firms access to data and computing power.

- The remaining 3 pillars are governance, protection, and assurance, which address risk management. This includes boardapproved AI policies, AI-specific evaluations as part of product approvals, enhanced consumer protection safeguards, AI-related cybersecurity protocols, incident reporting, and stronger audit mechanisms to mitigate systemic risks.

The FREE-AI framework is viewed as a pragmatic step that balances innovation with caution. By providing shared infrastructure and regulatory flexibility, it empowers smaller firms to participate in AI-driven innovation, while also setting guardrails for accountability and security. However, challenges remain around operational readiness and translating principles into enforceable standards, which will likely require phased implementation and continuous stakeholder engagement.

RBI streamlines the co-lending framework

RBI (Co-Lending Arrangements) Directions, 2025

The Reserve Bank of India (RBI) has recently established a uniform regulatory framework for Co-Lending Arrangements (CLAs) across sectors, ensuring borrower protection, operational clarity, and prudent risk-sharing (Directions). The Directions will be ePective from January 1, 2026, with optional early adoption permitted.

Key changes introduced by the Directions

- Scope: The Directions cover both priority sector (e.g. agriculture, MSMEs, education, aPordable housing) and non-priority sector lending, superseding the 2020 co-lending Circular, which only addressed priority-sector lending.

- Risk retention and Default Loss Guarantee (DLG): Each Regulated Entity partnering in the co-lending arrangement (Partner RE) must now maintain a minimum 10% share in every loan, reduced from the earlier 20% threshold. The Originating RE may also provide a DLG of up to 5% of the outstanding portfolio.

- Borrower protection and transparency: Loan agreements must now clearly outline each lender's responsibilities and identify a single customer interface point. Any changes in customer-facing arrangements must be communicated to borrowers beforehand. Separately, mandatory Key Facts Statement (KFS) disclosures have been introduced for greater transparency.

- Operational controls: The Directions require that the Partner RE must irrevocably assume its agreed share of loans on a back-to-back basis. The respective loan exposures of both the Originating RE and the Partner RE must be reflected in their books within 15 days from the date of disbursement by the Originating RE. Further, all disbursements and repayments are to be routed through an escrow account, and each RE is required to maintain separate borrower accounts for its respective share of the exposure.

- Asset classification and reporting: Borrower-level asset classification has been mandated, requiring real-time synchronisation between lenders – by the next working day. Each lender must independently report to Credit Information Companies (CICs).

- Disclosure requirements: Lenders must publish details of all active Partner REs on their websites. Financial disclosures relating to CLAs, including quantum, weighted average interest rates, fees, sectoral exposure, loan performance, and DLGs, are required on a quarterly/annual basis.

As co-lending as a model has evolved rapidly over the last few years, with increasing collaboration between banks, Non-Banking Financial Companies (NBFCs), and financial institutions, the Directions mark a significant regulatory milestone by harmonising requirements across lending segments and enhancing borrower protection through stronger disclosures, a single point of contact, and improved grievance redressal. However, operational challenges remain, particularly around realtime synchronisation, borrower-level asset classification, and multiple reporting obligations to CICs. Further, the treatment of DLGs, though capped at 5%, may require alignment with RBI's digital lending framework to ensure consistency.

SEBI proposes a distinct regulatory framework for AIFs exclusively comprising of Accredited Investors

Consultation paper on amendments to the AIF Regulations, 2012

The Securities and Exchange Board of India (SEBI) has recently proposed the introduction of a distinct, more relaxed regulatory framework governing Alternative Investment Funds (AIF) schemes exclusively catering to and comprised of Accredited Investors (AIs).

AIFs channel private capital from high-risk appetite investors to enterprises needing growth or restructuring capital, oPering greater flexibility than mutual funds. To mitigate risks, a minimum INR 1 crore commitment per investor was mandated as the criterion for investor sophistication. However, as actual deployments often fell short of declared commitments, SEBI introduced objective income and net-worth benchmarks for accreditation in 2021. Certain institutional investors – such as sovereign funds, government bodies, and qualified institutional buyers – are deemed accredited by default.

Recognising that AIs possess greater financial sophistication, access to expert advice, and higher risk-bearing capacity, SEBI has proposed the following key amendments to the SEBI (AIF) Regulations, 2012 for AI-only schemes:

- Investor rights: The existing requirement for pari passu rights would be relaxed, subject to individual investors' explicit waiver, enabling diPerential rights, governance terms, and tailored arrangements based on risk appetite or management roles.

- Fund tenure: The current maximum extension period for closed-ended AIFs – funds with a fixed tenure and no ongoing redemption facility – capped at 2 years, would be extended to 5 years, subject to the approval of at least 2/3rds of the investors in the fund.

- Certification requirements: The requirement for at least 1 key executive of the fund manager to hold National Institute of Securities Markets (NISM) certification would be removed, as accredited investors are considered capable of independently assessing managerial credentials.

- Investor limitations: The cap of 1,000 investors per scheme would be removed, enabling larger and more diverse investor participation without triggering additional regulatory requirements.

- Governance and oversight: In trust-structured AIFs, trustee duties may be delegated to fund managers through clear agreements. While this simplifies governance for sophisticated investors, it raises concerns as trustees traditionally act as independent fiduciaries safeguarding investor interests.

These relaxations mirror benefits already available to Large Value Funds (LVFs) – AI-only AIFs with an INR 70 crore investment threshold. The paper outlines the roadmap for a market where AI-only schemes coexist with traditional AIFs, balancing practical transition needs and avoiding abrupt regulatory disruptions, while signalling a long-term shift toward accreditation, rather than minimum investment size, as the defining criterion for investor sophistication.

While SEBI's proposal is a progressive step towards harmonisation, it must strike a balance between easing compliance and preserving essential disclosures, systemic risk safeguards, and overall market integrity. Some key challenges that may arise are as follows:

- The transition phase may pose operational hurdles, requiring managers and regulators to oversee 2 parallel AIF regimes with distinct compliance norms.

- As accreditation is tied mainly to financial metrics, investors lacking the necessary literacy or experience could still qualify, leading to misallocation into complex or high-risk AIFs and unexpected losses.

- Exemptions from safeguards – such as pari passu rights, investor caps, and certified management requirements – may reduce checks and balances, creating risks of diPerential treatment, opaque structures, or conflicts of interest.

- Upholding market integrity requires robust accreditation standards, continuous disclosures, ePective grievance redressal, and periodic reviews of the regime as the market evolves.

Insurance Surety Bonds extended to consultancy contracts

NHAI mandates immediate acceptance of ISBs as performance security for AE/IE contracts

Recently, the National Highways Authority of India (NHAI) permitted the use of Insurance Surety Bonds (ISBs) as a valid form of performance security for consultancy contracts of Authority Engineers (AE) and Independent Engineers (IE), thereby widening the scope of ISBs within the infrastructure contracting framework (Circular).

To operationalise the Department of Expenditure's amendments to General Financial Rules (GFR), 2017, which allowed both e-Bank Guarantees (e-BGs) and ISBs as acceptable instruments for bid security and performance security, the NHAI revised its standard bidding documents – Request for Proposals (RfPs) and Concession Agreements – in June 2023 to incorporate ISBs and e-BGs for project execution contracts under Engineering, Procurement, and Construction (EPC), Build-Operate-Transfer (BOT) (Toll), and Hybrid Annuity Model (HAM) structures. The Circular broadens the earlier framework by explicitly extending the facility to consultancy assignments, marking a systematic integration of ISBs across multiple categories of contracts.

The Circular aligns with broader reforms under the GFR, reflecting a strategic shift towards market-driven, capital-ePicient instruments in infrastructure contracting. The Ministry of Road Transport and Highways' (MoRTH) 2023 clarification on replacing BGs with ISBs in ongoing projects remains applicable, ensuring continued flexibility for all stakeholders. Consequently, all consultancy contracts must be amended to incorporate ISBs as valid performance security, following the standardised model formats provided in Annexures A and B to the Circular. This change is ePective immediately, promoting consistency and streamlined adoption across contracts.

Shareholding in subsidiaries forms part of a corporate debtor's assets

Exclusion of subsidiary investments undermines CIRP's integrity

The National Company Law Tribunal, Bengaluru (NCLT) held that the shareholdings of a corporate debtor in its subsidiaries and step-down subsidiaries are an integral part of its financial assets and cannot be excluded from valuation reports during the Corporate Insolvency Resolution Process (CIRP).2

The Resolution Professional (RP) had acknowledged that the corporate debtor invested INR 448 crore in its subsidiaries and step-down subsidiaries, but this investment was not reflected in the it's valuation reports. The NCLT clarified that only the equity shareholding of the corporate debtor in such subsidiaries forms part of the CIRP estate – under Section 36(3)(d), the underlying assets are only included once liquidation begins (not during the resolution phase). Given that the nonconsideration of these investments had led to an incorrect valuation, which undermined the integrity of the CIRP, the NCLT allowed the application for fresh and independent valuation of the corporate debtor's equity shareholding in its subsidiaries and step-down subsidiaries. The ruling will help prevent artificial dilution of the debtor's value, thereby bringing more certainty and accuracy to insolvency proceedings.

Footnotes

*As per the latest available data for August 2025

1 Invoice Discounters of Adaptio Facility Management Pvt Ltd v. CBRE South Asia Pvt Ltd, 2025 SCC OnLine NCLT 4090

2 HDFC Bank Ltd v. Opto Circuits (India) Ltd, 2025 SCC OnLine NCLT 4023

Recent Developments In India's Corporate & Commercial Laws - August 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.