European Union: Internal Schengen Border Checks Situation

Europäische Union: Interne Schengen-Grenzkontrollen Situation

Below we would like to give you an overview of the current situation at the borders of the countries of the European Union and the current measures:

Internal border controls are currently being carried out in the following countries in May and are expected to continue until June 2025: Bulgaria and Slovenia.

The following countries have internal border controls in place until September-December 2025: Austria, Denmark, France, Germany, Italy, the Netherlands, Norway and Sweden.

Due to concerns about foot-and-mouth disease (a viral disease in livestock farming), Slovakia introduced border controls at its borders with Austria and Hungary as early as April 2025. The controls, which were originally due to expire in May 2025, were recently extended until July 2025.

Nachfolgend möchten wir ihnen eine Übersicht über die aktuelle Situation an den Grenzen der Länder der Europäischen Union und die aktuellen Massnahmen geben:

In den folgenden Ländern werden zurzeit im Mai und voraussichtlich bis Juni 2025 interne Kontrollen an den Grenzen durchgeführt: Bulgarien und Slowenien.

Die folgenden Länder haben interne Kontrollen an ihren Grenzen, die bis September-Dezember 2025 in Kraft sind: Österreich, Dänemark, Frankreich, Deutschland, Italien, die Niederlande, Norwegen und Schweden.

Aufgrund der Besorgnis über die Maul- und Klauenseuche (eine Viruserkrankung in der Tierhaltung) hat die Slowakei bereits im April 2025 Grenzkontrollen an ihren Grenzen zu Österreich und Ungarn eingeführt. Die Kontrollen, die ursprünglich im Mai 2025 auslaufen sollten, wurden kürzlich bis Juli 2025 verlängert worden.

Italy: New law governing citizenship by descent

Italien: Neues Gesetz über die Staatsbürgerschaft durch Abstammung

On 20 May, the Italian Parliament converted DecreeLaw no. 36 into an ordinary law, thereby significantly reforming the regulations on citizenship by descent.

The most important points are as follows:

- Italian citizenship by descent can now only be applied for through a parent or grandparent

- Previously, anyone who had Italian ancestors who lived after 17 March 1861 could obtain citizenship by descent

- Children of Italian citizens born abroad are not automatically granted citizenship

- Applications for citizenship by descent submitted to an Italian authority before 27 March 2025 will be processed in accordance with the previous provisions.

Am 20. Mai hat das italienische Parlament das Gesetzesdekret Nr. 36 in ein ordentliches Gesetz umgewandelt und damit die Vorschriften über die Staatsbürgerschaft durch Abstammung erheblich reformiert.

Die wichtigsten Punkte sind die Folgenden:

- Die italienische Staatsbürgerschaft durch Abstammung kann nur noch über einen Eltern- oder Großelternteil beantragt werden

- Zuvor konnte jeder, der italienische Vorfahren hatte, die nach dem 17. März 1861 lebten, die Staatsbürgerschaft durch Abstammung erhalten

- Kinder italienischer Staatsbürger, die im Ausland geboren wurden, erhalten nicht automatisch die Staatsbürgerschaft

- Anträge auf Staatsbürgerschaft durch Abstammung, die vor dem 27. März 2025 bei einer italienischen Behörde eingereicht werden, werden nach den bisherigen Bestimmungen bearbeitet.

UAE: Reminder of the 2025 deadline for private sector employers on the mainland to increase the emiratization rate

VAE: Erinnerung an die Frist 2025 für Arbeitgeber des privaten Sektors auf dem Festland zur Erhöhung der Emiratisierungsrate

Private sector companies in the United Arab Emirates with 50 or more employees are reminded that they must increase their current Emiratization rate by a further 1% by 30 June 2025. According to these policy measures, all eligible companies in the Emirates must have an Emiratization rate of at least 7% by 30 June 2025. Companies with a higher Emiratization rate must increase their rate by 1% by 30 June 2025.

A fine of AED 9,000 (approx. AED 2,000 / approx. EUR 2,170 / appr. USD 2,450) per month will be imposed for each position that is filled by a foreigner, even though it should be filled by an Emirati according to the Emiratization rules. In 2026, this fine will be increased by AED 1,000. Companies may also be barred from using government portals, which will affect the hiring of employees.

Unternehmen des privaten Sektors in den Vereinigten Arabischen Emiraten mit 50 oder mehr Beschäftigten werden daran erinnert, dass diese ihre derzeitige Emiratisierungsrate bis zum 30. Juni 2025 um weitere 1 % erhöhen müssen. Gemäss dieser politischen Massnahmen müssen in den Emiraten alle in Frage kommenden Unternehmen bis zum 30. Juni 2025 einen Emiratisierungsgrad von mindestens 7 % aufweisen. Unternehmen, die einen höheren Emiratisierungsgrad haben, müssen ihren Anteil bis zum 30. Juni 2025 um 1 % erhöhen.

Für jede Stelle, die mit einem Ausländer besetzt wird, obwohl sie gemäss den Emiratisierungsregeln mit einem Emirati besetzt werden sollte, wird eine Geldstrafe von 9.000 AED (ca. 2'000 CHF / ca. 2'170 EUR / ca. 2'450 USD) pro Monat verhängt. Im Jahr 2026 wird diese Strafe um 1'000 AED erhöht. Unternehmen können auch von der Nutzung staatlicher Portale ausgeschlossen werden, was sich auf die Einstellung von Mitarbeitern auswirken wird.

Fokus: Richtige Versicherungsunterstellung – ausreichender Versicherungsschutz & steuerliche Komplikationen vermeiden

Compliance wird immer wichtiger. In diesem Praxisseminar werden Lösungsansätze für die richtige (sozial-)versicherungsrechtliche Unterstellung aufgezeigt.

Bei Entsendungen von der Schweiz ins Ausland werden zudem verschiedene Optionen für einen ausreichenden Versicherungsschutz während eines Auslandeinsatzes besprochen. Auch die steuerrechtliche Beurteilung steht bei Entsendungen weiterhin im Mittelpunkt, sodass die gesetzlichen Regelungen anhand von Praxisbeispielen behandelt werden.

Procedure for Tax Equalisation

FRIEDERIKEV.RUCH, CONVINUS

Tax equalisation is generally a key component of global mobility programmes to ensure that seconded employees are neither advantaged nor disadvantaged from a tax perspective compared to a similar role in their home country.

The objective is to ensure the employee's tax burden remains equivalent to what it would be if they worked and were taxed solely in their home country. Tax equalisation becomes relevant whenever employees become subject to tax in the host country.

How can this be achieved in a company?

1. Defining the Hypothetical Home Country Tax ("Hypotax")

The first step is to calculate how much tax the employee would hypothetically pay if working only in the home country.

Typically, this is based on pre-assignment employment income, marital status, number of children, and standard deductions. The calculated 'hypotax' is then withheld monthly from the salary.

In Switzerland, the question arises whether this should be done via the withholding tax method or through actual tax calculation. Each company is free to define which types of income and assets are included in the hypothetical tax calculation.

2. Determining the Actual Tax Burden in the Host Country

In the second step, the actual tax liability in the host country is calculated, taking into account all applicable deductions. Often, the actual tax burden is only known once the tax return has been filed and fully assessed in the host country. This highlights one of the key challenges: timing. Tax returns are typically filed in the following year, and it may take 1–2 years before the final tax liability is known. If only employment income is considered in the hypotax calculation, then only the effective tax burden on this income will be used for comparison.

Another frequent discussion point is whether employee share schemes should be included in the equalisation.

If the entire income and assets are used in the hypothetical calculation, then the full tax liability on income and assets in the host country should also be considered.

3. Tax Comparison & Equalisation

Following the principle that employees should be tax neutral, the employer covers any difference.

In practice, there are two common approaches:

- Tax Equalisation: The host country tax is higher than the hypotax: The employer pays the difference.

- Tax Protection: The host country tax is lower than the hypotax: The employee benefits from the lower tax.

Which option a company adopts is its own decision. The tax equalisation option is often used for companies based in low-tax countries (Switzerland) and the tax protection option for companies based in high-tax countries (e.g. Germany, Austria). An important aspect to keep in mind: the tax difference paid by the employer is considered a taxable benefit and is subject to social security contributions. Typically, the employer also covers the social security costs arising from it.

4. Tax Filing & Compliance

It is essential that tax returns are completed accurately and assessed correctly. Since employees are often not familiar with local tax rules, it is advisable for companies to provide a local tax adviser and cover the associated costs. This also helps prevent excessive tax liabilities due to missed deductions or incorrect reporting.

5. Final Tax Reconciliation

At the end of the calendar year or upon completion of the assignment, a final reconciliation of the hypothetical and actual tax is carried out.

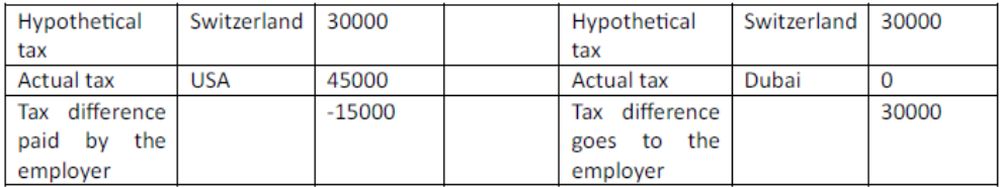

Thereafter a simplified example for the option - Tax Equalisation:

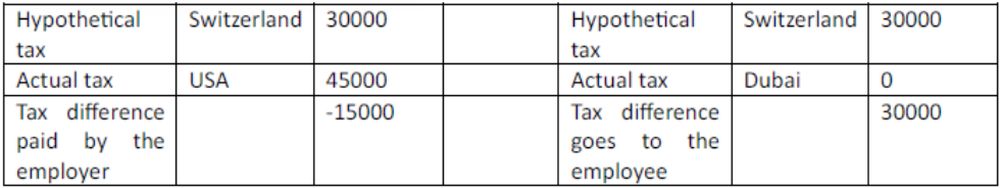

Thereafter a simplified example for the option – Tax Protection:

It is important that the framework conditions for this are included in the expat policy or global mobility policy.

Conclusion

Although the tax equalisation process involves significant administrative effort and complex calculations across jurisdictions, it enables employers to manage tax costs effectively. The tax differential is often the largest cost factor in an international assignment, making employer coverage essential and fostering a sense of fairness for the employee.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.