- within Tax topic(s)

- with readers working within the Pharmaceuticals & BioTech industries

For the German version, please read here >>

Tax equalisation is generally a key component of global mobility programmes to ensure that seconded employees are neither advantaged nor disadvantaged from a tax perspective compared to a similar role in their home country.

The objective is to ensure the employee's tax burden remains equivalent to what it would be if they worked and were taxed solely in their home country. Tax equalisation becomes relevant whenever employees become subject to tax in the host country.

How can this be achieved in a company?

1. Defining the Hypothetical Home Country Tax ("Hypotax")

The first step is to calculate how much tax the employee would hypothetically pay if working only in the home country.

Typically, this is based on pre-assignment employment income, marital status, number of children, and standard deductions. The calculated 'hypotax' is then withheld monthly from the salary.

In Switzerland, the question arises whether this should be done via the withholding tax method or through actual tax calculation. Each company is free to define which types of income and assets are included in the hypothetical tax calculation.

2. Determining the Actual Tax Burden in the Host Country

In the second step, the actual tax liability in the host country is calculated, taking into account all applicable deductions. Often, the actual tax burden is only known once the tax return has been filed and fully assessed in the host country. This highlights one of the key challenges: timing. Tax returns are typically filed in the following year, and it may take 1–2 years before the final tax liability is known. If only employment income is considered in the hypotax calculation, then only the effective tax burden on this income will be used for comparison.

Another frequent discussion point is whether employee share schemes should be included in the equalisation.

If the entire income and assets are used in the hypothetical calculation, then the full tax liability on income and assets in the host country should also be considered.

3. Tax Comparison & Equalisation

Following the principle that employees should be tax neutral, the employer covers any difference.

In practice, there are two common approaches:

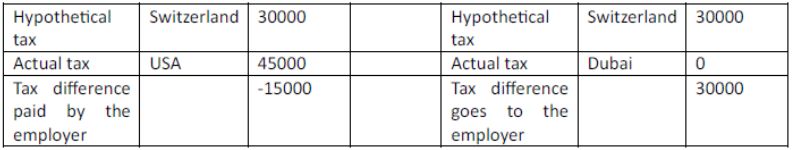

- Tax Equalisation: The host country tax is higher than the hypotax: The employer pays the difference.

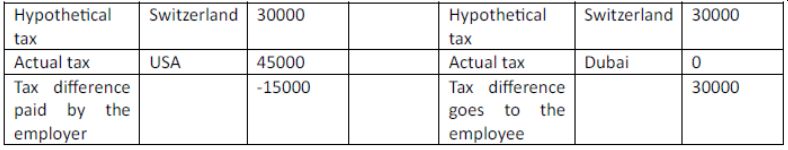

- Tax Protection: The host country tax is lower than the hypotax: The employee benefits from the lower tax.

Which option a company adopts is its own decision. The tax equalisation option is often used for companies based in low-tax countries (Switzerland) and the tax protection option for companies based in high-tax countries (e.g. Germany, Austria). An important aspect to keep in mind: the tax difference paid by the employer is considered a taxable benefit and is subject to social security contributions. Typically, the employer also covers the social security costs arising from it.

4. Tax Filing & Compliance

It is essential that tax returns are completed accurately and assessed correctly. Since employees are often not familiar with local tax rules, it is advisable for companies to provide a local tax adviser and cover the associated costs. This also helps prevent excessive tax liabilities due to missed deductions or incorrect reporting.

5. Final Tax Reconciliation

At the end of the calendar year or upon completion of the assignment, a final reconciliation of the hypothetical and actual tax is carried out.

Thereafter a simplified example for the option - Tax Equalisation:

Thereafter a simplified example for the option – Tax Protection:

It is important that the framework conditions for this are included in the expat policy or global mobility policy.

Conclusion

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.