- within Strategy topic(s)

- with readers working within the Environment & Waste Management and Utilities industries

Nike's lawsuit against online retail platform StockX offers plenty of food for thought for rights holders and practitioners considering involvement in non-fungible tokens (NFTs) (see part one of this article for background into NFTs and associated trademark law).

On Feb. 3, 2022, Nike filed a complaint in a federal district court in the Southern District of New York, alleging that StockX was infringing on Nike's trademarks by:

- minting NFTs that prominently use Nike's trademarks;

- marketing those NFTs using Nike's goodwill; and

- selling those NFTs at heavily inflated prices to unsuspecting consumers who believe or are likely to believe that the NFTs are, in fact, authorized by Nike when they are not (Complaint, Paragraph 4, Case Number 1:22-cv-00983).

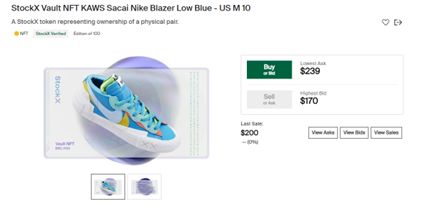

StockX operates an online retail platform selling sneakers, apparel and electronics. It recently launched an NFT offering called StockX Vault NFTs, that allows purchasers to secure ownership of an NFT, as well as the physical product depicted in it.

Nike NFT offered for sale on StockX's website

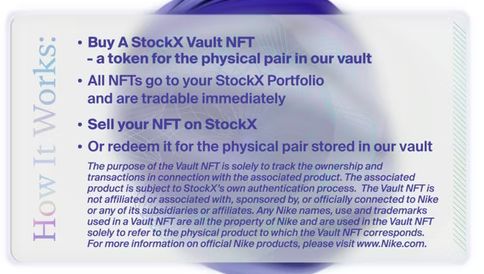

On the back side of the NFT, StockX includes the following text

StockX disputes that its Vault NFTs violate Nike's trademark rights, arguing that the NFTs displaying the Nike logo merely track ownership of a physical Nike product stored securely in StockX's Vault (Answer p3, Case Number 1:22-cv-00983). In addition, StockX advises purchasers that "[a]ny Nike names, use and trademarks used in a Vault NFT are all the property of Nike".

StockX is, in other words, invoking the nominative fair use defense. In its view, using images of Nike sneakers and descriptions of Nike products "is not different than major e-commerce retailers and marketplaces who use images and descriptions of products to sell physical sneakers and other goods" (Answer, pp7-8).

According to Nike, however, StockX's Nike-branded Vault NFTs do more than simply track ownership; they also allow purchasers to trade, collect and gain access to a bundle of other StockX services, such as releases, promotions and events (Complaint, Paragraph 5). Nike also claims that StockX boasts that Nike products produce more sales than any other brand on its platform (Id Paragraph 3).

In the Court of Appeals for the Second Circuit, in which the Southern District of New York sits, judges will consider the following factors in addition to the traditional likelihood-of-confusion factors to determine whether a claim of nominative fair use is legitimate:

- Whether the use of the plaintiff's mark is necessary to describe both the plaintiff's and defendant's product or service.

- Whether the defendant uses only so much of the plaintiff's mark as is necessary to identify the product or service.

- Whether the defendant did anything that would, in conjunction with the mark, suggest sponsorship or endorsement by the plaintiff/rights holder.

In other words: whether the defendant's conduct or language reflects the true or accurate relationship between plaintiff's and defendant's products or services (Certification Consortium Inc v Security University LLC, 823 F3d 153, 168, 2nd Circuit 2016).

Under the second factor, courts analyze whether the alleged infringer "step[ped] over the line into a likelihood of confusion by using the senior user's mark too prominently or too often, in terms of size, emphasis, or repetition" (Id ). Under the third, courts must consider confusion in the context of "affiliation, sponsorship, or endorsement by the mark holder" (Id ).

Nike will likely argue that StockX has stepped over the line into a likelihood of confusion by prominently displaying its trademarks, offering for sale Nike-branded NFTs and marketing those NFTs as being "100% Authentic". It will also likely argue that the NFTs create an affiliation, sponsorship or endorsement by Nike where none exists.

StockX will likely counter by pointing to all other brands on its platform and arguing that it only uses the Nike trademarks to describe the products available on its retail website.

Whether nominative fair use ultimately applies raises significant questions of fact. If this case reaches the summary judgment stage, NFT enthusiasts and their trademark attorneys will be eager to see how the court rules.

This article originally appeared in World Trademark Review Weekly on May 19, 2022 and is reprinted with permission.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.