- within Law Department Performance topic(s)

- in United States

- within Law Department Performance topic(s)

- in United States

- within Compliance and Insurance topic(s)

This is the first installment of a multi-part series that takes a look at the data that the State of California gathers in regard to the Private Attorney General's Act (PAGA).

What is PAGA?

The Private Attorney General's Act (PAGA) is a unique law in California.1 It allows employees, typically through private practice attorneys, to sue on behalf of the State of California's Attorney General.These types of actions can be combined with lawsuits seeking other remedies, such as the recovery of unpaid wages.2 The law provides for private practice attorneys to recoup penalties on behalf of the state when there is a violation of California labor and employment regulations. A class action is not required to file a lawsuit under PAGA, and penalties can be very large. The law changed in June 2024 with new provisions allowing employers to cure potential violations in a timely manner before penalties are assessed, along with many other changes. This article examines trends in PAGA-related litigation and how those trends may change based on the change in the law. The goal of this series of articles is to explore the data and documents gathered by the State of California and see what has happened one year after the change in regulations.

Summary of Changes

On June 19, 2024, the PAGA rules were changed. Employers now have more opportunities to cure issues and, in some instances, mitigate exposure to civil penalties.

For PAGA notices filed before June 19, 20243:

- 75% of the recovered penalties go to the state, and 25% go to the aggrieved employees.

- Penalties started at $100 for the first violation per employee pay period and grew to $200 for every subsequent employee pay period with a violation.

For PAGA notices filed on or after June 19, 20244:

- 65% of the recovered penalties go to the California Labor & Workforce Development Agency (LWDA), and 35% go to the aggrieved employees.

- Employers have an opportunity to reduce the number of civil penalties recoverable against them by taking all reasonable steps to comply with the law. The penalties can be capped if reasonable steps are taken to comply with the law. Additional cure options to limit penalty amounts depending on the size of the employer.

- The employee must personally experience each alleged violation that is being claimed within one year of the PAGA notice,

- Penalties are reduced to $100 per employee, pay period, unless the violations are determined to be "malicious, fraudulent, or oppressive." There are other potential reductions depending on how pervasive the violations are and how frequently they occur.

- For employers using a weekly payroll system, penalties can be applied on a bi-weekly or semi-monthly basis.

Given these changes, there is potential that PAGA actions are less attractive to plaintiff counsel due to employers being able to cure violations, and having limited potential liability depending on the nature of the violations. So far, there has been little change in the number of filings.

Data Used for Analysis5

The State of California maintains an extensive database of PAGA actions.6This database covers PAGA actions from 2004 to the present and includes structured and unstructured information.7 The documents are legal briefings with a wide array of information. They cover PAGA notices, documents related to attempts to cure violations, proposed settlements, and approved judgments.

To capture key information, we deployed a specialized large language model (LLM) to read the documents and extract information related to key pieces of information that are only contained within the documents, such as judgment amount, fees, expenses, and the number of employees. The information from the documents was combined with the information from the structured data to create a database of PAGA actions and how the action proceeded until final resolution.

Initial Findings

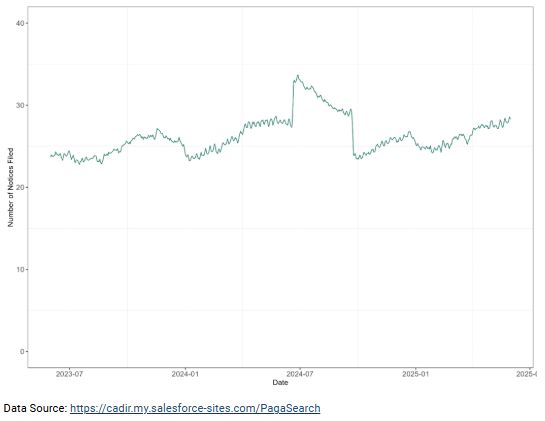

The big spike in June 2024 occurred as law firms rushed to file before the change in the law, and then, naturally, a sizable decrease in July. Since the time from filing to judgment is approximately two and a half years,8 this surge will likely not be resolved with a judgment, if at all, until 2026 or 2027. However, it appears that filings have been significantly diminished after July 2024, but the trend in filings appears to be on the rise once again.If we ignore the spike in filings that occurred in June 2024, then we see very little year-over-year change in the number of filings (less than 1%).9

Graph 1 – 90-Day Moving Average of Filings Based on PAGA Submission Date.10

Next Time

In the next article, we will explore PAGA notices as they relate to the number of employees at issue and the types of companies that are regularly targeted. We are also going to explore if companies are taking advantage of the expanded ability to cure violations.

Labor and Employment Advisory Services

Ankura's experts have extensive consulting experience in labor and employment litigation, settlement procedures, and compliance reviews. Our experts are adept at analyzing data from disparate sources that are not easily linked, distilling volumes of data and complex issues into meaningful and defensible conclusions, and quickly communicating a message through data visualizations.

Ankura's labor and employment advisory services include accounting, finance, economic, and big data specialists, as well as industry and class certification experts. Our experience covers the entire spectrum of services from discovery management and class certification defense to expert testimony and liability, damages assessments, and compliance audits. Our experts assist companies in class action matters as well as calculate lost income due to personal injury, medical malpractice, discrimination, and wrongful termination allegations.

We assist companies in reviewing their payroll process and

systems to assess potential risk areas in companies' policies

and procedures, processes, and payments. Our experts have deep

experience reviewing benefits and payments, including whether

workers' compensation related to disability payments were paid

appropriately.

Footnotes

1 https://www.dir.ca.gov/Private-Attorneys-General-Act/Private-Attorneys-General-Act.html

2 https://www.labor.ca.gov/resources/paga/paga-faqs/

3 https://web.archive.org/web/20240524020146/https://www.labor.ca.gov/resources/paga/ andhttps://web.archive.org/web/20221005211141/http://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=LAB&division=2.&title=∂=13.&chapter=&article=

4 https://www.labor.ca.gov/resources/paga/paga-faqs/

5 https://cadir.my.salesforce-sites.com/PagaSearch

6 https://cadir.my.salesforce-sites.com/PagaSearch

7 The structured information is stored in rows and columns (similar to an Excel spreadsheet). The unstructured information is legal briefings with key data points found in various places. The unstructured information is not standardized.

8 The average is based on the average difference in years between the PAGA notice date and the judgement data for PAGA filing that had a judgement.

9 The number of PAGA Notices filed between July 1, 2023 to May 31, 2024 compared to the number of filings between July 1, 2024 and May 31, 2025.

10 This plot is based on the raw number of filings, and not the number of filings that reach a settlement or a judgement.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.