- within Media, Telecoms, IT and Entertainment topic(s)

- with readers working within the Retail & Leisure industries

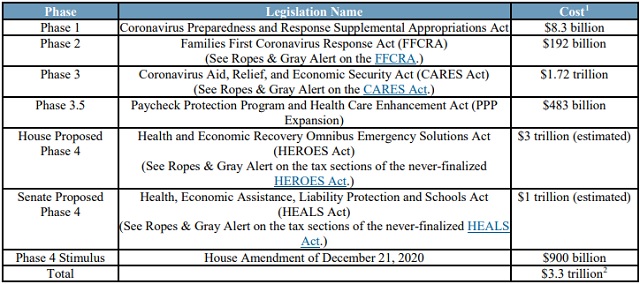

On December 21, 2020, a bipartisan agreement was reached on the Consolidated Appropriations Act 2021 (Phase 4 Stimulus), in furtherance of the fourth phase of the federal government's response to the COVID-19 crisis. (The bill was passed on December 21, 2020 by both the House of Representatives and the Senate.) The full text of the bill is published here. The key tax provisions of the Phase 4 Stimulus are summarized in this Alert, and include an expansion of the employee retention credit, an additional deferral of payroll taxes, additional economic impact payments for individuals, and a second round of the Paycheck Protection Program (PPP).

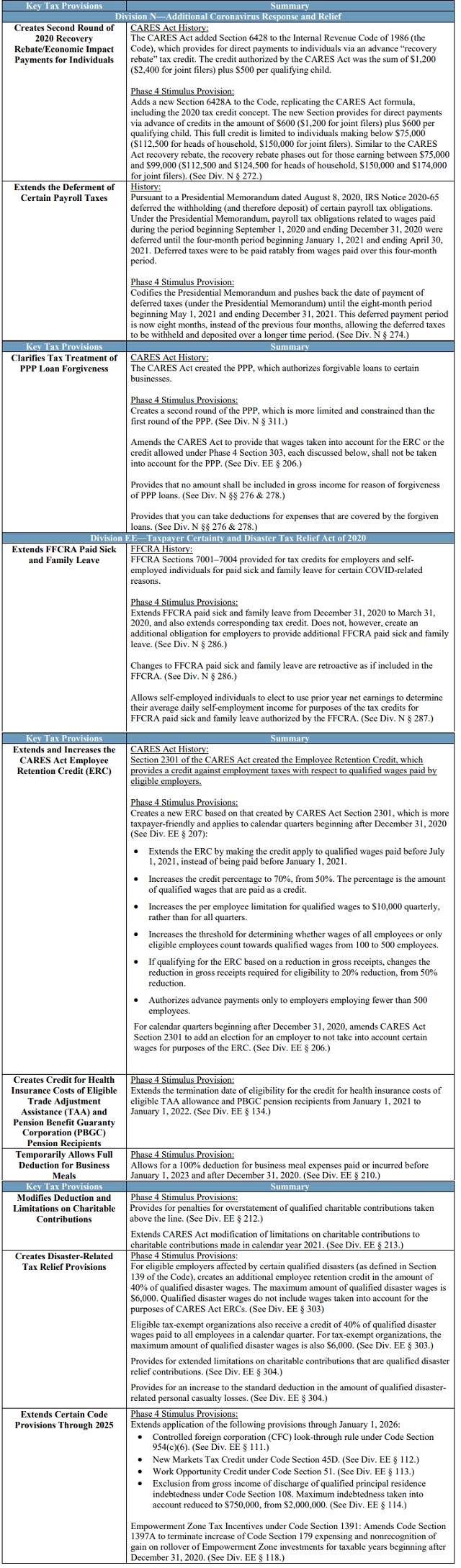

Key amongst its relief provisions, the bipartisan Phase 4 Stimulus will:

- Give a second round of recovery rebates/economic impact payments for individuals in the amount of $600 ($1,200 for joint filers), plus $600 per qualifying child.

- With the CARES Act Employee Retention Credit (ERC) expiring December 31, 2020, create a new, more taxpayer-friendly ERC that applies after December 31, 2020 through July 1, 2021. The new ERC is increased by (i) changing the percentage of the credit to 70% of qualified wages (from 50%) and (ii) changing the amount of qualified wages to $10,000 per employee per quarter (from $10,000 per employee for all quarters).

- Extend availability of the FFCRA credit for paid sick and family leave to March 31, 2021.

- Codify and extend the deferral of employee payroll taxes previously deferred by Presidential Memorandum. Payroll tax obligations related to wages paid during the period beginning September 1, 2020 and ending December 31, 2020 are now deferred until the period beginning May 1, 2021 and ending December 31, 2021.

- Create a second round of the PPP, more limited and constrained than the first round of the PPP. Confirm that PPP loans that are forgiven do not give rise to taxable income, consistent with CARES Act. Also amend CARES Act to allow deductibility of expenses giving rise to PPP loan forgiveness.

Certain key highlighted tax-related provisions of the Phase 4 Stimulus are summarized below, with more detailed descriptions:

Footnotes

1 According to CBO's "The Budgetary Effects of Laws Enacted in Response to the 2020 Coronavirus Pandemic, March and April 2020" (https://www.cbo.gov/system/files/2020-06/56403-CBO-covid-legislation.pdf)

2 Total excludes amount from HEROES Act and HEALS Act.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]