The technological challenges in the aircraft engine sector are, to put it mildly, considerable at present. Airframers are increasingly reliant on engine manufacturers to produce the bulk of efficiency gains for new civil aircraft, with a continuing trend towards re-engining lightly modified versions of existing airframe designs.

The pursuit of ever increasing efficiency in engine design has seen many important design trends over recent decades including ever increasing by-pass ratios, more efficient combustion, higher performance materials and bespoke architectures to improve compression efficiency. It is important to all of us that efficiency gains continue, both for cost and environmental reasons. But as existing engine design trends grow ever more mature, we seem to be approaching a point where more significant departures may be necessary to maintain the rate of improvement.

We are already seeing greater use of gearbox technology in the name of efficiency and it is likely that still more significant changes will be required in the coming years with, for instance, alternative fuels and electric/hybrid propulsion being investigated. The technological pressures and rate of change suggest that there should be a premium in the sector on innovation and protecting innovations. This being the case, one would expect to see relatively high numbers of new patent filings. However, we wonder whether the Covid-19 pandemic and/or other recent economic headwinds have negatively impacted innovation and/or innovation protection.

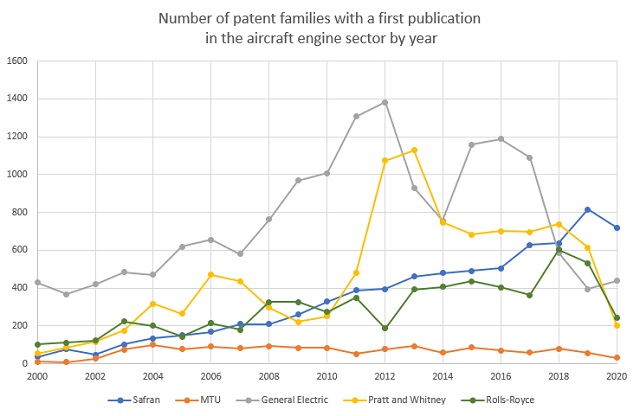

With help from across our aerospace sector team and our data scientist Gleb Kolpakov, we looked at first patent filings over a 20 year period for some of the most significant players in the aircraft engine sector, namely: General Electric, Rolls-Royce, Pratt and Witney/UTC, Safran/Snecma and MTU.

A word of caution… Collecting filing data of the type used in this article is inherently approximate. We have worked to capture only parts of the relevant businesses focusing on aircraft engines and associated technology, but a degree of error and uncertainty is inevitable. The data is therefore best considered in terms of relative changes over time and not in terms of absolute values.

Features which stand-out are:

- Filings generally trending downwards in 2020 (GE being the exception but coming from, for them, a relatively low starting point historically);

- Volatile filing numbers from GE and P&W with significant historic peaks and lower numbers recently.

- The generally steady rise in filings from Safran and (though somewhat more volatile) R-R.

The pandemic

The trend towards drops in 2020 appear too much of a coincidence not to be explained at least in part by the pandemic. Naturally, there are many possible mechanisms by which the pandemic might have affected patent application filing numbers. For instance, ‘unplanned consequences' (e.g. a reduction in innovation resulting from the disturbance to working practices and increased illness/absence) and/or ‘deliberate measures' (e.g. caution in terms of patent spend and/or prioritising other business areas). Some or all of these may well have played a part, but it would be unsurprising if the ‘unplanned consequences' played a particularly significant role.

We note for instance that the important process of invention harvesting from innovators for the drafting of patent applications can be fragile. Invention harvesting can be seen as a non-core activity for innovators and may therefore suffer when there is time pressure or disruption. Additionally, invention harvesting is typically dependent on communication and business relationships, which might be expected to suffer at least during adaptation to new and more isolated working practices. Such difficulties appear likely to be more acute in large complex organisations such as these.

It will be interesting to see if filing numbers rebound in coming years. Due to the nature of the patenting process, the data for 2021 and 2022 is as yet incomplete. Nonetheless, the data that we do have for 2021 seems to suggest that filing numbers will stay comparatively low, despite the relative maturity by that stage of business responses to the pandemic. It may be that companies will need to work hard to re-engage their innovators with the process of protecting inventions and/or further develop their processes for modified working practices. Given the important ongoing innovations in the sector, it seems unlikely that historically low filing numbers will be accepted for long.

Broader trends

Looking beyond the impact of the pandemic, the extent of the decrease in filings over the last decade from GE and P&W, from historical highs in around 2012, are eye catching. The gas turbine sector tends to be cyclical, which may be playing a role. Additionally, the relatively large historical fluctuations perhaps suggest a culture where applications are filed in response to particular projects, which may naturally wax and wane. Data for the next few years may be particularly revealing, but we are nonetheless surprised at the historically low filing numbers for these companies given the rate of technological change in the sector. The steady and consistent rise for Safran is also noticeable and its relative change in recent years by comparison with the others stands out. The trend in Safran filing numbers seems to broadly reflect the trend in its share price over the same period. Perhaps therefore this is simply a case of a developing business steadily increasing its innovation and corresponding protection. Other interesting developments may be on the horizon. For instance, will the 2020 takeover of UTC by Raytheon be accompanied by changes of significance in the P&W data?

Conclusions and the future

For the sector in general, recent trends seem to be of some concern in terms of protection for investment in innovation (and perhaps even the extent of innovation itself). Further, the pandemic may represent only part of the story. With the important drive for greater efficiency ongoing and the potential for paradigm shifts in technology, we suspect it will be important for most of these big players to reverse the downward trend in patent protection in the coming years.

We hope to update these results in the future and also look deeper to establish, in general terms, the subject matter of new filings over time. It will be interesting to analyse where these companies are innovating as they strive to continue to make significant efficiency gains and address other market needs. For instance, will there be evident shifts in emphasis from iterative improvements to existing technology towards technologies representing a significant departure e.g. electrical/hybrid propulsion, distributed propulsion and/or open rotor?

We may be able to form a view on which companies are proving best able to mobilise their innovators to assist them in protecting packages of high value innovations. In particular, will we see groups of filings in key future technology enablers, or a less focussed approach? Will we see the fruits of involvement with eVTOL companies, where much early work is ongoing in electrification? Will we see evidence a gradual uptick in innovation on the defence side as sixth generation fighter programs gather pace, especially with increased tension between major powers? It is certainly an interesting and dynamic time in the sector and we look forward to watching and reporting on further developments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.