Effectively responding to fast-moving changes requires robust rewards strategies in the pharmaceutical and life sciences industry.

The pharmaceutical and life sciences industry has quickly transformed in the past few years with new roles on the rise, changes in organizational structures and deepening talent deficits in areas that have been understaffed for some time. Additionally, M&A activity – which is expected to increase – is ramping up the competition for talent, and supply chain disruptions have kept the biopharmaceutical industry from reaching its full potential.

To respond appropriately and effectively, industry organizations must develop robust rewards strategies that not only meet employees' demands but also mitigate rising costs. Following are just some of the strategies and areas of focus that organizations need to explore and develop to compete for talent and achieve business goals.

ESG, with an emphasis on people and planet

Life science organizations are not alone in their need to meet stakeholders' demands for a focus on environmental, social and governance (ESG) initiatives. Along with demonstrating a commitment to solving ESG-related issues, setting ESG goals are helpful for attracting and retaining talent from a labor market that is increasingly keen to see social responsibility reflected in their organizations' priorities.

Broadly, biopharmaceutical companies are increasingly setting ESG goals, with large, global firms leading the way. However, medium- and smaller-sized organizations also are looking at ways to integrate a bigger commitment to ESG initiatives.

Talent

Clinical trials are an area in which pharmaceutical companies will continue to invest. As such, we anticipate an increase in recruitment activities in this space. Life-science candidates are characterized by only moderate attachment to their current jobs; they are willing to be recruited. Because of the dynamic development of clinical trials, many companies are restructuring and reorganizing, leading to a sense of instability and discontinuity.

Recruiting new talent creates high costs for companies. To identify premiums paid in the market, we compared the compensation of recent hires vs. employees with longer service. In China, the difference is higher than in other Asian countries, and we have made similar observations in Germany and the U.S. In these countries, premiums seem to be linked to seniority but, contrary to what's happening in China, these premiums don't increase with the level.

Conversely, companies in Brazil do not offer any new-hire premiums, yet some jobs do stand out such as those in clinical research, medical writing, medical technology product development or pricing, and reimbursement. Higher premiums also are seen in roles like data analyst, real-world data or AI. This demand in the pharmaceutical and life sciences industry mirrors that of other industries where we also observe growing demand for and shortage of talent.

Inflation

In response to a competitive job market coupled with inflationary pressures, many life sciences organizations have increased their emphasis on the nonfinancial elements of compensation or allocated additional funds for salary adjustments. Typical non-financial offerings include things like fringe benefits, language courses, global recognition programs, employee assistance programs and so on. It is unclear at this time which programs – whether financial or non-financial – will be kept and which are temporary.

Pay competitiveness

Across all geographies, biotech and contract research organizations (CRO) sub-industries remain the top payers within life sciences. Medical technology is still slightly below other sectors, except in the UK and Brazil. In China, pharmaceuticals is the best-paid sector among all pharmaceutical and life sciences organizations.

The pandemic significantly influenced the importance of specialization within therapeutic areas. Though oncology retains the highest volume of research and clinical trials, jobs focused on respiratory, immunology and central nervous system were the highest paid in 2022.

Flexible work arrangements

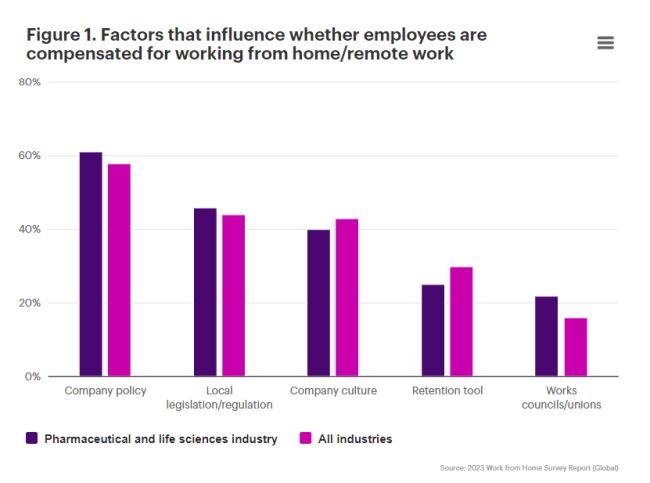

COVID-19 also forced companies to review their work-from-home policies. Most life science organizations opted for alternative or flexible work arrangements. About half are compensating or considering compensating employees for the cost of working from home. In most cases, all employees who work from home are entitled to compensation, but this does vary by function and job level (Figure 1).

Our research found that most companies buy or reimburse the equipment employees need to work from home or, alternatively, they provide allowances (Figures 2 and 3)

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]