- within Energy and Natural Resources topic(s)

- with readers working within the Banking & Credit industries

On 31 May, 2024, a new anti‑greenwashing rule is being introduced by the Financial Conduct Authority (the "FCA") as part of its Sustainability Disclosure Requirements ("SDR"). However, the FCA has only recently published their finalised anti‑greenwashing guidance, leaving firms with around a month's time to review and implement the final guidance to ensure compliance.

The anti‑greenwashing rule requires all FCA‑authorised firms to ensure that any reference to the sustainability characteristics of a product or service is consistent with the sustainability characteristics of the product or service, and is fair, clear and not misleading.

The rule applies when a firm communicates with clients in the UK in relation to a product or service; or communicates a financial promotion (or approves a financial promotion for communication) to a person in the UK.

The territoriality of the rule means that it does not apply to any non‑UK firms that are not authorized by the FCA, for example, an asset manager marketing a fund into the UK, and also does not apply to communications made to clients outside the UK, for example, non‑UK investors.

The range of communications captured is extremely broad and includes 'references to sustainability characteristics that could be present in (but are not limited to) communications that include statements, assertions, strategies, targets, policies, information and images relating to a product or service.'

The key area for most firms to focus on will be to ensure that their governance framework around verification is on a sound footing, including ensuring that firms have checks and balances in place and that they have people trained in this area to look out for any potential misalignment with claims and the underlying status of a product or service.

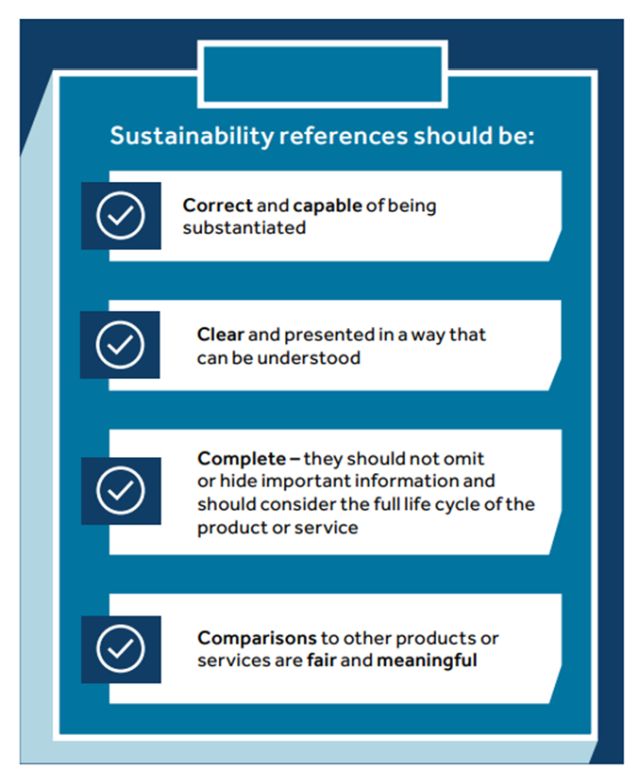

In the FCA's anti‑greenwashing, there is the following high‑level checklist to support with making sustainability‑related claims:

However, as the guidance is principles‑based applying to a broad range of financial services firms and the checklist is at a high level only, we have developed a comprehensive anti‑greenwashing guide for asset managers that can be tailored to your business.

One Month To Go Until The FCA's Anti‑Greenwashing Rule Comes Into Force

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.