The Corporate Sustainability Reporting Directive (CSRD) presents challenges and opportunities for HR, but there are implications across the organization.

What is the Corporate Sustainability Reporting Directive (CSRD)?

The European Directive on Corporate Sustainability Reporting (CSRD) came into force this year with a first disclosure obligation in 2025 for large European companies. In the midterm, listed small and medium-sized companies, as well as large non-European parent companies with major operations in Europe, will be subject to it.

The CSRD aims to improve the consistency, comparability, relevance and reliability of corporate sustainability reporting.

Many organizations have not yet tackled the social requirements comprehensively. But time is running out.

The centerpiece of the directive is the introduction of 12 mandatory European sustainability reporting standards (ESRS), covering Environmental, Social and Governance (ESG) aspects.

These standards can add up to 95 publication requirements and more than 1,000 possible data points! Fortunately, there are approaches to take that will limit the reporting work. The application of double materiality will allow companies to publish only the requirements deemed material and the use of step-by-step inventories, particularly for social protection programs, will facilitate the publication of certain social requirements.

Double materiality

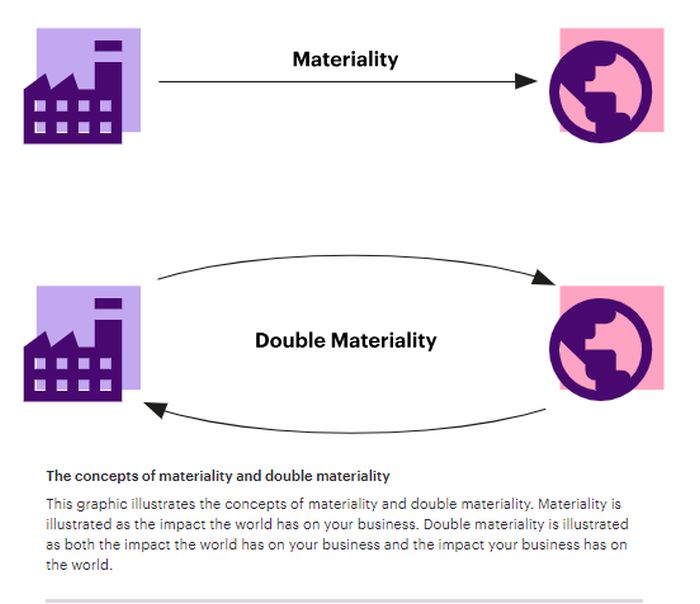

The directive introduces a transformative approach to sustainability reporting, at the heart of which is the concept of double materiality.

Companies are allowed to publish only those requirements that they deem material under this approach.

The CSRD defines double materiality by referring to two distinct but interrelated dimensions: financial materiality and impact materiality.

01

Financial materiality

Often referred to as "outside-in" materiality, involves identifying and assessing the impact of external environmental, social, and economic factors on the business. This perspective is closer to traditional financial reporting, where the focus is on the risks and opportunities posed by external factors to the financial health and operational stability of the company.

02

Impact materiality

Or "inside-out" materiality, is a new approach and shifts the focus to the impact that the company can have on its wider environment (natural resources, its employees, its customers, its suppliers, its community involvement, etc.).

This two-pronged approach recognizes that the interactions between the company and its environment can have significant consequences both inside and outside the company.

The CSRD is not just about compliance

If the CSRD is primarily a compliance exercise, it would be a mistake to use it only as a regulatory constraint. The normative framework of the CSRD disclosure requirements is also a formidable strategic tool for better coordinating the various ESG initiatives in the organization and providing them with better visibility among the various stakeholders (investors, employees, customers, service providers, etc.).

Many companies will want to structure their sustainability programs, minimum global standards, and readiness for the upcoming Pay Transparency Directive within the framework provided by the CSRD.

The social component of the CSRD

While environmental issues have received a lot of attention since the introduction of the CSRD (and with good reason), the social component of the CSRD has been somewhat sidelined, even though it accounts for 40% of the total publication requirements.

Many organizations have not yet tackled the social requirements comprehensively. But time is running out. The data points to be gathered to prepare the requirements on these topics are numerous and can be complicated to consolidate.

Of the four social standards of the CSRD that we have seen above, the S1-Own Workforce will concentrate the largest share of the work. It covers 17 disclosure requirements. We would like to draw your attention to four of these requirements in particular.

Disclosure requirements of the S1-Own Workforce Standard

| Disclosure requirement | ||

|---|---|---|

| Impacts, risks, opportunities | S1.1 | Policies related to own workforce |

| S1.2 | Processes for engaging with own workers about impacts | |

| S1.3 | Processes to remediate negative impacts and channels for workers to raise concerns | |

| S1.4 | Taking action on material impacts on own workforce and effectiveness of those actions | |

| Metrics and targets | S1.5 | Targets related to managing material negative impacts and advancing positive impacts |

| S1.6 | Characteristics of employees in workforce | |

| S1.7 | Characteristics of non-employee workers in own workforce1 | |

| S1.8 | Collective bargaining coverage and social dialogue2 | |

| S1.9 | Diversity metrics | |

| S1.10 | Adequate wages | |

| S1.11 | Social protection3 | |

| S1.12 | Persons with disabilities4 | |

| S1.13 | Training and skills development metrics5 | |

| S1.14 | Health and safety metrics | |

| S1.15 | Work-life balance metrics6 | |

| S1.16 | Remuneration metrics (pay gap and total remuneration) | |

| S1.17 | Incidents, complaints and severe human rights impacts |

Four social disclosure requirements

The four disclosure requirements that we believe will require significant preparation work for HR teams are:

- S1.10: Adequate wages

- S1.11: Social protection

- S1.15: Work-life balance metrics (family leaves)

- S1.16: Remuneration metrics (pay gap and total remuneration)

Let's look at them in more detail.

S1.10: Adequate wages

This disclosure requires documenting that all employees of the company are paid above a decent living wage threshold (the Adequate Wage). If that is not the case, the percentage of employees below this threshold must be indicated.

It is the responsibility of the company to define its appropriate Adequate Wage threshold, but this must be done within the framework of the CSRD. It is rather prescriptive, at least for the countries of the European Economic Area (EEA). See the insert.

We can hope that with the CSRD, we are (finally) moving towards a standardization of the definition of decent living wages.

| For EEA countries at national level | For Non-EEA countries at sub national level when necessary |

|---|---|

Minimum Wage as per Directive 2022/2041 of 19 October 2022. If

not:

|

Any existing international or national legislation, official

norms, collective agreement on decent wage. If none:

|

S1.11: Social protection and S1.15: Work-life balance metrics

It will be necessary to demonstrate that all employees of the company throughout the world are covered by social protection programs including health, unemployment, accidents and disability at work, parental leave and retirement.

As a first step, an inventory of public social security programs in the various countries in which the company operates will be sufficient to confirm the proper coverage of employees in many countries. Only a few countries will remain for which this analysis will have to be supplemented by private enterprise programs.

Similarly, for S1.15, the starting point will be the inventory of public policies and collective agreements on maternity, paternity, parental and carers' leaves in different countries to meet this publication requirement.

S1.16: Remuneration metrics (pay gap and total remuneration)

The calculations of the gender pay gap and the total pay equity ratio (the highest total compensation in relation to the company's average compensation) are sensitive issues that will require evaluating the benefits components of total compensation.

What should HR do next with the CSRD?

The CSRD's disclosure requirements make it mandatory for companies to recognize both the risks and opportunities associated with sustainability issues. Their strategic implications are profound, encouraging the adoption of a medium and long-term visions of sustainability and understanding the interconnections of this with the company's business model.

While CSRD presents many opportunities, it also poses challenges, especially when it comes to data management and reporting. Ensuring that a wide range of environmental, social and governance indicators and targets are reported annually in different countries of activity will require the development of more sophisticated data collection, verification and management systems. The comprehensive nature of CSRD disclosures will also mean harmonizing existing reporting processes to adapt to new standards.

Despite these challenges, robust sustainability reporting has many strategic benefits: an enhanced understanding of the business, bringing together different ESG initiatives in a streamlined manner, improved transparency that could enable better market positioning, stronger employee engagement and productivity, better stakeholder relations and increased access to capital.

These benefits provide an incentive to overcome these hurdles and embrace the strategic possibilities CSRD represents.

To take advantage of the opportunities offered by the social component of the CSRD and facilitate your disclosure work, contact our compensation and benefits specialists.

Footnotes

1. These Disclosures can be deferred 1 year

2. This Disclosure can be deferred 1 year for non-EEA countries

3. These Disclosures can be deferred 1 year

4. These Disclosures can be deferred 1 year

5. These Disclosures can be deferred 1 year

6. These Disclosures can be deferred 1 year

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.