- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in India

- with readers working within the Insurance and Law Firm industries

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in India

- with readers working within the Basic Industries, Chemicals and Oil & Gas industries

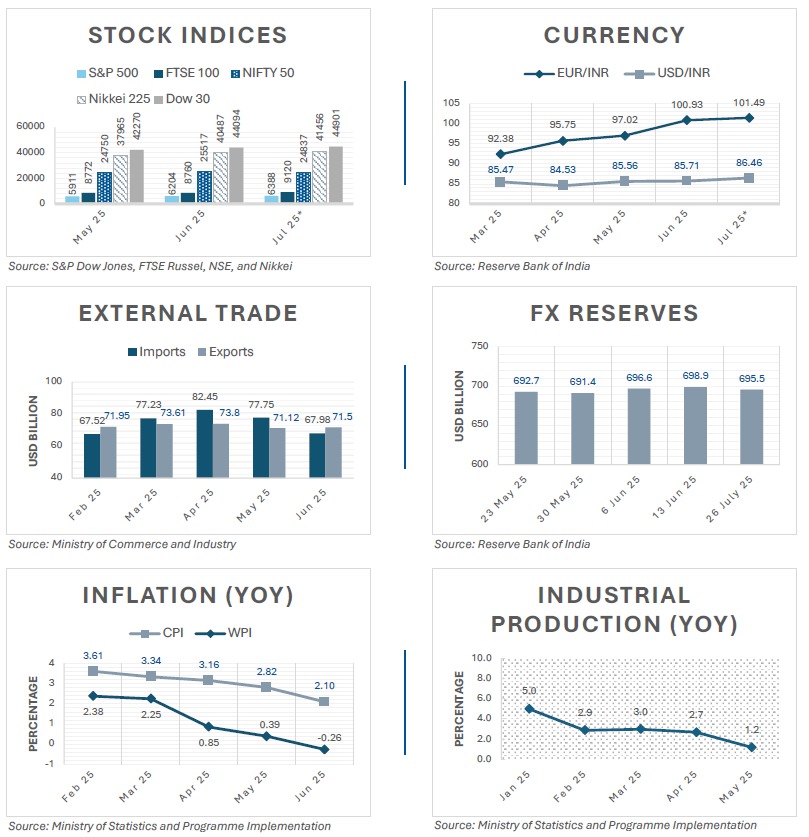

Indian economy | Snapshot of key indicators

HIGHLIGHTS

- In June 2025, retail inflation (CPI) dropped to 2.1%, while WPI inflation (–0.13%) and food inflation (CFPI) (–1.06%) turned negative – all marking a 6-year low since January 2019. Highest inflation was recorded in oil and fats (17.75%); personal care and effects (14.76%); fruits (12.61%); health (4.43%); and education (4.37%). Conversely, lowest inflation was observed in vegetables (–19.01%); pulses and products (–11.76%); spices (–3.03%); meat and fish (–1.62%); and footwear (2.23%).

- India's overall trade deficit narrowed to USD 3.51 billion in June 2025, significantly improving from USD 6.62 billion in May 2025. This was led by the export of electronic goods, which recorded its highest growth at 46.93%, followed by tea (32.64%); jute (23.44%); meat, dairy and poultry products (19.7%); and cereals (13.39%).

- The top 5 positive contributors for industrial production in May 2025 were manufacture of machinery and equipment (11.8%); rubber and plastic products (10%); electrical equipment (7.6%); non-metallic mineral products (6.9%); and motor vehicles, trailers and semi-trailers (6.3%).

SEBI's revised industry standards for Related Party Transaction disclosures

Streamlined disclosure framework for audit committee and shareholder approval

The Securities and Exchange Board of India (SEBI) has streamlined the disclosure requirements relating to Related Party Transactions (RPTs) for audit committee and shareholder approval (Circular). The Circular will not apply to RPTs below the INR 1 crore threshold and those transactions exempt under Regulation 23(5) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, including intragroup transfers among wholly owned subsidiaries, transactions with government entities or Public Sector Undertakings (PSUs), and statutory payments.

The Circular structures the disclosure requirements in the following waterfall mechanism:

- Part A: Basic details of the related party and its relationship with the company, details of previous transactions with the related party, and basic details of the proposed transaction, such as its value, must be disclosed for all RPTs.

- Part B: Tailored disclosure requirements, such as pricing basis, security terms, repayment schedules, and peer comparison, must be incorporated for RPTs that fall within any of the 7 categories:

-

- Loans and advances (other than trade advances) or inter-corporate deposits given by the listed entity or its subsidiary

- Investments made by the listed entity or its subsidiary

- Guarantees (including a performance guarantee in the nature of a security/contractual commitment which could have an impact in monetary terms on the issuer of such guarantee), sureties, indemnities or comfort letters, by whatever name called, made or given by the listed entity or its subsidiary

- Borrowings by the listed entity or its subsidiary

- Sale, lease, or disposal of assets of a subsidiary or of a unit, division, or undertaking of the listed entity or disposal of shares of a subsidiary or an associate company

- Transactions relating to payment of royalty

- Sale, purchase, or supply of goods or services or any other similar business transaction and trade advances

- Part C: For RPTs in the first 6 categories of Part B where the value crosses the 'materiality threshold' (prescribed by the company, subject to the statutory threshold of INR 1000 crore or 10% of the annual consolidated turnover, whichever is lower), additional details such as credit ratings and default history, solvency and ongoing concern status, impact on financial ratios and segment reporting, and historical royalty trends must be disclosed.

Other key changes in revised standards

- Financial disclosures of transactions with the related party have been reduced to the past 1 year.

- Trade advances, along with sale, purchase or supply of goods or services, and performance guarantees in the nature of security contractual commitment must be expressly disclosed.

- Latest credit ratings are now required only for material RPTs.

- The exemption from disclosure of transactions, previously limited to listed banks and non-banking financial companies, has been extended to insurance and housing finance companies.

- Shareholder notices for material RPTs must follow the disclosure standards for the audit committee and include key transaction terms, pricing basis, and a justification of the transaction's alignment with the company's interest. If a valuation or external report is relied on, a QR code or link must be provided. Redaction of sensitive information is allowed with prior audit committee and board approval, provided sufficient context is retained for informed shareholder voting.

The revised framework marks a shift toward proportionate, risk-based governance. By calibrating disclosure requirements to transaction type and materiality, and easing compliance for non-material RPTs, the Circular reduces procedural burden without compromising transparency. With tighter alignment to shareholder interests and improved consistency with the legislative framework, the revised approach is set to strengthen governance, enhance uniformity, and boost investor confidence in RPTs.

Pledged shares form part of the corporate debtor's resolution estate

NCLT holds pledged shares are protected assets once CIRP commences

In a recent ruling that recognises the broad scope of the moratorium under the Insolvency and Bankruptcy Code, 2016 (Code), it was held that shares pledged by the corporate debtor are part of its resolution estate and cannot be foreclosed after the commencement of Corporate Insolvency Resolution Process (CIRP).1

Asset Reconstruction Company (India) Ltd (ARCIL) had extended financial assistance to a subsidiary of Vijay Group Realty LLP (VGRL). As security, VGRL pledged its shareholding in its subsidiary in favour of ARCIL. Upon default by the subsidiary, ARCIL sought to enforce its rights over the pledged shares. However, before the pledge was invoked, CIRP had been initiated against VGRL, triggering a moratorium under Section 14 of the Code, due to which ARCIL's enforcement action was restrained. ARCIL, therefore, approached the National Company Law Tribunal, Mumbai (NCLT), seeking exclusion of the pledged shares from VGRL's resolution estate and the scope of the moratorium.

The NCLT rejected this request, observing that since ARCIL did not invoke the pledge prior to the commencement of CIRP, VGRL continued to be the owner of the pledged shares, over which AIRCL holds a security interest. This view was fortified by the following:

- The resolution professional is obligated to take custody and control of the assets of the corporate debtor, including shares held in any of its subsidiary companies, including the pledged shares.

- The moratorium under Section 14 prohibits any action to foreclose, recover, or enforce a security interest created by the corporate debtor in respect of its property, and therefore, bars ARCIL from enforcing or invoking the pledge.

- Clause 16.2 of the Share Pledge Agreement, which insulates the obligations of VGRL from insolvency proceedings, would not operate in view of the overriding effect of the Code over any inconsistent law or instrument, including an agreement, as per Section 238.

However, since a pledgee is a secured creditor under Sections 52 and 53 of the Code (even though it may not qualify as a financial or operational creditor), ARCIL continued to hold a security interest over the pledged shares and could file its claim before the resolution professional in the prescribed form. The invocation of the pledge is not a precondition for filing the claim.

This decision underscores the broad ambit of the moratorium under the Code and clarifies that pledged assets, unless invoked prior to CIRP, form part of the resolution estate. Creditors holding security interests should proactively assess enforcement timelines and consider initiating enforcement before insolvency proceedings commence. Pledgees should also promptly file claims with the resolution professional to preserve their rights and ensure recognition of their security interest during CIRP.

Proceeds of crime are not part of the resolution estate

No conflict between IBC and PMLA where tainted assets are involved

In a significant ruling that reinforces the independent operation of insolvency and money laundering frameworks, the National Company Law Appellate Tribunal (NCLAT) has held that assets attached by the Enforcement Directorate (ED) under the Prevention of Money Laundering Act, 2002 (PMLA) do not fall within the scope of the Insolvency and Bankruptcy Code, 2016 (Code), and hence are excluded from the resolution estate of a corporate debtor undergoing insolvency.2

Subsequent to the initiation of Corporate Insolvency Resolution Process (CIRP) against Dunar Foods Ltd, the ED had provisionally attached its properties valued at INR 177 crore, alleged to be proceeds of crime traced to an associated company under investigation. The NCLAT dismissed the resolution professional's request to release the attached properties, holding that moratorium under the Code does not extend a shield to assets allegedly derived from criminal conduct, and is designed to only protect legitimate business assets. The NCLAT clarified that while Section 32A of the Code does offer immunity post-resolution, it cannot retrospectively invalidate lawful pre-resolution attachments under PMLA. Further, the Code's overriding effect under Section 238 is not triggered as the Code, an economic legislation, and PMLA, a penal law targeting financial crimes, operate in different spheres.

While the ruling emphasises that attached assets are removed from the general asset pool for commercial resolution purposes under the Code, further clarity may be warranted in light of recent rulings holding that bona fide purchasers (such as a successful resolution applicant) may seek release of the attached property.3 As attachment under the PMLA does not confer ownership rights but merely prevents alienation of assets, it must take a back seat, allowing the bona fide claimant to enforce its claim by disposal of the subject property.4

SEBI broadens ESG framework to include social and sustainability bonds

ESG norms now in sync with international standards

The Securities and Exchange Board of India (SEBI) has introduced a structured framework under the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (ICDR Regulations) for the issuance and listing of Environment, Social, and Governance (ESG) debt securities. While norms for green bonds already exist (SEBI's Circular on the disclosure requirements for issuance and listing of green debt securities, revised in 2023), the new framework broadens the ESG taxonomy in India by formally including social bonds, sustainability bonds, and sustainability-linked bonds.

Following are the key features of the new framework:

- Disclosure requirements

-

- Pre-issuance stage: Offer documents must detail ESG objectives, intended benefits, target populations, project eligibility criteria (including applicable standards/taxonomies), tracking mechanisms for fund deployment (such as an ESG Committee), and potential risks with mitigation plans.

- Post-listing: Issuers must provide annual disclosures on fund utilisation, including unutilised amounts, and publish impact assessments in their annual reports.

- Sustainability-linked bonds: Issuers must report on progress against predefined Key Performance Indicators (KPIs) and Sustainability Performance Targets (SPTs), with implications on the bond's financial or structural characteristics if targets are not met.

- Defined ESG instruments

-

- Social bonds: Debt securities issued to finance or refinance projects aimed at addressing or mitigating social issues, such as affordable housing, food security, and healthcare.

- Sustainability bonds: Instruments that combine both green and social objectives.

- Sustainability-linked bonds: Bonds whose financial or structural terms are tied to achieving specific sustainability targets, measured through defined KPIs and SPTs.

- Adoption of global standards: Debt securities not complying with the above-mentioned definitions, may be labelled as social, sustainability, or sustainability-linked bonds, if they align with any of the following international standards – International Capital Market Association (ICMA) Principles, Association of Southeast Asian Nations (ASEAN) Green/Social Bond Standards, and ESG regulations of the European Union (EU).

- Inclusion of Small and Medium Enterprises (SMEs): Eligible SMEs under ICDR Regulations are permitted to issue ESG debt securities and must make bi-annual disclosures.

- Third-party review: Independent verification by a third-party is mandatory for pre- and post-issue disclosures. These reviewers are responsible for confirming alignment with recognised frameworks, verifying internal controls, and evaluating the integrity of performance-based instruments.

The framework aims to combat 'purpose-washing' (misleading or overrepresenting a product or brand as being environmentally friendly) by mandating detailed disclosures, independent verification, and compliance with global norms, thereby boosting investor confidence and market integrity. In this regard, issuers would be well-advised to actively monitor project outcomes and quantify any adverse impacts or trade-offs that could undermine ESG goals. Internal controls must be robust enough to prevent misleading labelling or selective disclosures that could distort sustainability performance. Further, proceeds must be strictly deployed within eligible categories, with any misuse being promptly disclosed, as issuers may face early redemption demands from the majority debenture holders in the event of deviations.

RBI sets out framework for sustainable infrastructure lending

RBI (Project Finance) Directions, 2025

Based on a comprehensive review of extant regulatory norms and banks' experience with project loan financing, the Reserve Bank of India (RBI) has issued a framework to strengthen the regulatory network of project finance in India, harmonising the extant guidelines for all regulated entities (Directions). The Directions are effective from October 1, 2025 (Effective Date).

Key features of the Directions

- Applicability: The Directions apply to:

-

- Commercial banks (including small finance banks but excluding payments banks, local area banks and regional rural banks)

- Non-banking financial companies (including housing finance companies)

- Primary (urban) cooperative banks

- All India financial institutions (AIFIs)

- Existing projects: The Directions will not apply to projects that have achieved financial closure before the Effective Date, which shall continue to be governed by the existing guidelines. However, any resolution of a fresh credit event and/or change in material terms and conditions in the loan contract in such projects, after the Effective Date, shall be governed by the Directions.

- Phase-division: The projects have been divided into 3 phases:

-

- Design phase: This phase starts with the genesis of the project, and includes designing, planning, and obtaining all applicable clearances/approvals till its financial closure.

- Construction phase: This phase begins after financial closure and ends on the day before the actual Date of Commencement of Commercial Operations (DCCO).

- Operational phase: This is the last phase, which starts on the actual DCCO and ends with full repayment of the project finance exposure.

- Stress resolution: Lenders must continuously monitor project performance for build-up of stress and proactively initiate a resolution plan under RBI's Prudential Framework for Resolution of Stressed Assets, 2019. The occurrence of a credit event – financial default, need for DCCO extension, need for additional debt, or financial difficulty – shall also trigger resolution and must be followed by a review of the debtor account.

- Preserving account standard: Lenders have flexibility to extend DCCO under a resolution plan while maintaining the account classification as 'standard' if the following conditions are fulfilled:

-

- The shift in DCCO is less than 3 years for infrastructure projects and 2 years for non-infrastructure projects

- Cost overrun associated with DCCO extension is within 10% of the original project cost, in addition to Infrastructure Development Charges (IDC)

- The extension is due to a change in the scope or size of the project

- Data maintenance and disclosure: Within 3 months of the effective date, the lenders must establish an electronic database of project exposures, which must be updated bi-monthly. Lenders must disclose resolution plans in their financial statements under 'Notes to Accounts'.

The finalisation of the Directions marks a paradigm shift in infrastructure and project financing, introducing a structured life-cycle regulation that promotes greater discipline, transparency, and early stress detection. By rationalising provisioning norms for under-construction projects and offering flexibility in handling project delays and cost overruns, while maintaining prudential safeguards, the regulations strike a balance between easing lender stress and ensuring robust risk mitigation. These reforms have been positively received by the market, as reflected in the significant rally in the shares of Power Finance Corporation (PFC) and REC (formerly, Rural Electrification Corporation), signalling investor confidence in the improved governance framework and its potential to curb future NPAs.

IBBI tightens norms for assignment and disclosure of avoidance transactions

IBBI (Insolvency Resolution Process for Corporate Persons) (Fifth Amendment) Regulations, 2025

The Insolvency and Bankruptcy Board of India (IBBI) has introduced the following changes to the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 (CIRP Regulations), particularly with respect to avoidance transactions:

- Mandatory disclosure of avoidance transactions: The Information Memorandum (IM) must include details of all identified avoidance, fraudulent, or wrongful transactions.

- Restriction on assignment: Resolution plans cannot assign avoidance transactions unless such transactions were disclosed in the IM and shared with prospective applicants before the plan submission deadline.

RBI prohibits pre-payment charges on retail and MSE loans

RBI (Pre-payment Charges on Loans) Directions, 2025

The Reserve Bank of India (RBI) recently notified a framework to promote borrower mobility and foster competition by prohibiting pre-payment charges on most categories of retail and Micro/Small Enterprise (MSE) loans (Directions). The Directions will come into effect from January 1, 2026.

Historically, pre-payment and foreclosure charges were common across various loan categories, often disincentivising borrowers from refinancing their loans at more favourable terms. While earlier RBI guidelines discouraged such charges, especially for floating-rate loans, inconsistent practices continued even in cases of fixed-rate loans, joint borrowers, or loans to proprietorships and MSEs. Vide the Directions, the RBI has introduced a borrower-centric framework addressing Regulated Entities (REs) as well as specific loan categories to alleviate stakeholder grievances on the lack of uniformity, arbitrary levy of charges, and borrower inflexibility.

The Directions impose strict prohibitions on pre-payment charges in the following categories:

- Retail loans: No pre-payment or foreclosure charges shall be levied by any REs on individual borrowers, irrespective of the nature of security, interest rate type (fixed or floating), or whether the loan was held individually or jointly.

- Loans to MSEs: Loans extended to individual borrowers for business purposes, including MSEs, are also exempt from pre-payment charges when availed from scheduled commercial banks (except regional rural banks, small finance banks, and local area banks), Tier-IV urban cooperative banks, upper-layer non-banking financial companies, and All India financial institutions.

- Business loans up to INR 50 lakh: Loans for business purposes up to INR 50 lakh sanctioned by small finance banks, regional rural banks, Tier-3 urban cooperative banks, State/Central co-operative banks, and middle-layer non-banking financial companies shall also not attract pre-payment penalties.

The Directions represent a well-calibrated policy move that balances borrower rights with market discipline by eliminating switching costs, compelling lenders to revisit traditional customer retention and pricing strategies while ensuring strict internal compliance. This is particularly impactful for MSEs, which typically operate on tight margins and face challenges in accessing cost-effective credit. Additionally, the Directions also ensure standardisation and transparency in the disclosure of prepayment terms, thereby reducing information asymmetry and the risk of hidden costs. As the shift also requires meticulous internal alignment by REs to avoid compliance gaps, lenders should proactively audit existing loan templates and implement real-time updates to digital lending platforms to address the nuances of the new framework.

However, the effective implementation of the Directions may pose practical challenges. REs might need to revisit and, where necessary, renegotiate existing loan agreements to ensure alignment with the new norms, particularly in cases where borrowers seek renewals or modifications after January 1, 2026. Additionally, the selective applicability to certain categories of lenders, exempting regional rural banks, small finance banks, and local area banks, risks creating regulatory inconsistencies that may warrant further clarifications by the RBI.

NSDL tightens share transfer norms for private companies

Consent letter now mandatory for oP-market transfers of demat shares

The National Securities Depository Ltd (NSDL) recently enhanced compliance requirements for the off-market transfer of dematerialised shares in Private Limited Companies (PLCs) vide its Circular dated June 3, 2025 (Circular). While this requirement has currently been notified only by NSDL, it is reasonable to expect that the Central Depository Services (India) Ltd (CDSL) may introduce a similar requirement in due course.

In India, PLCs are governed by Section 2(68) of the Companies Act, 2013 (Act), which restricts the transfer of shares through provisions in their Articles of Association (AoA). Despite these restrictions, shares of such companies, once dematerialised, could still be transferred off-market by simply instructing the Depository Participant (DP), vide a Delivery Instruction Slip (DIS), to debit the shares from the seller's demat account and credit the same to the buyer's account, thereby dodging the statutory limitations.

The Circular introduces the following changes:

- The DIS would now have to be submitted along with a consent letter from the PLC.

- The DIS must also state compliance with the Act and the AoA, such as board approvals.

- The consent letter must also include the demat account and PAN details of the transferor and transferee, the number of shares that are proposed to be transferred, and the purpose of the proposed transfer.

By requiring prior confirmation from the issuing PLC, the Circular is likely to enhance transparency and corporate control over shareholding, addressing concerns of fraudulent and unauthorised share transfers, while aligning the transfer process of demat shares with the nature of PLCs under the Act.

Despite its intent, the Circular presents procedural challenges, most notably the slow transfer process and lack of clarity on steps to be taken when companies delay or deny confirmation without valid reasons. Compounding this is the absence of a prescribed timeline for issuing confirmation letters. These issues are particularly relevant for private equity and venture capital investors, who rely on free share transferability and timely exits. Companies would be well-advised to establish clear, transparent, and time-bound internal protocols to manage such requests efficiently and minimise operational uncertainty.

New framework proposes online registration and digital land records

Draft Registration Bill, 2025

The Ministry of Rural Development has released the draft Registration Bill, 2025 (Bill) to replace the century-old Registration Act, 1908 (Act) that was designed for a paper-based system, and usher in a tech-enabled, time-bound, and streamlined registration framework.

Salient features of the draft Registration Bill, 2025

- Broader registration mandate: To strengthen land record integrity, the Bill mandates registration of key conveyancing documents such as the agreement to sell, sale certificate, and power of attorney. Their legal validity will be linked to completing the registration process, thereby reducing grey areas that arise from missing or poorly maintained physical records, and aligning the law with a recent ruling that mere registration of a sale deed does not prove ownership.5

- Online registration: Buyers and sellers will be able to submit and register property documents through a central digital portal, eliminating physical presence, verification, and approval. This will significantly reduce reliance on agents or intermediaries.

- Time-bound process: The Bill introduces strict timelines, aiming to complete registration within hours instead of days or weeks.

- Digital repository: Registered documents will be e-certified and archived digitally for easy retrieval, verification, and sharing.

- Aadhaar-based verification: Parties to a transaction will authenticate identity via Aadhaar-linked OTP or biometrics, enhancing security and traceability.

- Revised administrative structure: A new tier of institutional officers – Assistant and Additional Inspectors General of Registration – will provide oversight and streamline functioning across jurisdictions.

By introducing digital registration, the Bill seeks to modernise a legacy system and is likely to curb red tapism and reduce reliance on intermediaries. While initial challenges may arise in onboarding citizens to the digital system, the long-term benefits are significant. A digitised land registration framework offering enhanced transparency, legal certainty, and accessibility is key in an era where verified property documents are essential for both commercial due diligence and individual transactions.

MNRE formulates framework for hydrogen certification

Green Hydrogen Certification Scheme of India

To facilitate the development of a green hydrogen market in India, the Ministry of New and Renewable Energy (MNRE) recently launched the Green Hydrogen Certification Scheme (GHCS) under the National Green Hydrogen Mission. The certificate issued under GHCS serves as a label that guarantees the origin of the green hydrogen production and the chain of custody, ensuring that the hydrogen produced is genuinely green and contributes to reducing carbon emissions.

Key features of the GHCS

- § Scope: The scope of the certification encompasses all stages of green hydrogen production, including compression, purification, and on-site storage of hydrogen for transport, but does not extend to off-site transportation and storage, conversion into hydrogen carriers, reconversion, and utilisation.

- Accredition: Green hydrogen producers must engage an Accredited Carbon Verifier (ACV) to verify GreenHouse Gas (GHG) emissions, and the reports must be submitted on the official GHCI portal. GHG encompasses both direct emissions and indirect emissions (such as those emanating from the electricity/fuel consumed).

- Types of certification: GHCS provides for the following 2 types of certifications, each involving 2 levels:

-

- For the production facility: Concept certificate issued after design/concept/FEED (front-end-engineering design) approval (initial stage); and facility-level certificate issued after obtaining consent to operate the facility (commissioning stage)

- For the hydrogen produced: Provisional certificate guaranteeing compliance with the emissions standard. The guarantee of the provisional certificate is subject to the final certificate (annual) issued after verification by the ACV. The final certificate contains a unique identifier for every 100kg of green hydrogen produced, specifying the project specifics, production year, and emission intensity. The production certificates are not mandatory for facilities operating at 100% export capacity without government subsidy or incentive; however, such facilities are still required to report their quantity of production and emissions per the importing country's standards

- Withdrawal: Certificates shall be withdrawn if:

-

- Verified emissions exceed the permissible threshold, which is 2 kilograms of carbon dioxide-equivalent for every kilogram of hydrogen produced

- Final certification is not applied for within the deadline

- Exemption: Facilities with an annual production capacity of 10 tons or less are exempt from the requirement of mandatory certification.

The Scheme is a crucial step towards building a credible and export-ready green hydrogen ecosystem in India. By mandating emission thresholds, independent verification, and traceable certification, the GHCS aligns domestic production with global decarbonisation standards while curbing greenwashing. The framework is expected to enhance investor confidence and promote transparency across the value chain. However, for effective implementation, capacity-building of ACVs and robust digital infrastructure will be critical. Going forward, harmonisation with international certification frameworks, such as those adopted by the European Union (EU) or Japan, could help unlock cross-border trade opportunities. Early compliance with GHCS will position Indian producers to benefit from preferential access to global markets and climate finance, making green hydrogen a viable pillar of India's clean energy future.

Footnotes

* As per the latest available data for July 2025

1. Bhanu Navin Nisar v. Vijay Group Realty LLP, Interlocutory Application No. 1161 of 2022 in Company Petition (Insolvency) No. 4359 of 2019

2. Anil Kohli, resolution professional for Dunar Foods Ltd v. ED, Company Appeal (Appellate Tribunal) (Insolvency) No. 389 of 2018

3. Directorate of Enforcement v. Axis Bank, 2019 SCC OnLine Del 7854

4. Rajiv Chakraborty, resolution professional for EIEL v. Directorate of Enforcement, 2022 SCC OnLine Del 3703

5. K Gopi v. Sub-Registrar, 2025 SCC OnLine SC 740

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.