- within Insurance, Real Estate and Construction and Consumer Protection topic(s)

Introduction

The current estate planning landscape is drastically different than it was at the beginning of this year. After an extended period of historically low rates of interest and inflation, this year the Federal Reserve began aggressively raising interest rates to combat inflation. At the same time, valuations have become depressed. Although Democrats still control the Executive Branch and the Senate, they lost control of the House in the midterm elections. While it is unlikely that significant gift, estate or generation-skipping transfer (GST) tax reform will be enacted in the next two years, the current environment provides several compelling reasons to consider engaging in wealth transfer planning now.

Estate Planning Landscape

Increases in Exemption Amounts.

Currently, you can transfer up to $12,060,000 ($24,120,000 per married couple) during life or at death without incurring federal gift, estate or GST tax. Transfers in excess of that amount are subject to federal gift, estate and/or GST tax at a rate of up to 40%. In 2023, the amount that you can transfer without incurring federal gift, estate or GST tax is increasing to $12,920,000 ($25,840,000 per married couple), an increase over the 2022 exemption amount of $860,000 ($1,720,000 per married couple). Importantly, effective January 1, 2026, unless further legislation is enacted, this historically high exemption amount will revert to $5 million per person, as adjusted for inflation.

Increases in the Annual Exclusion Amount.

In addition to your exemption amounts, you can transfer up to $16,000 ($32,000 per married couple) annually to any number of individuals and certain types of trusts without consuming any of your gift, estate or GST tax exemption amount. Effective January 1, 2023, the annual exclusion amount increases to $17,000 ($34,000 per married couple).

Increases in IRS Interest Rates.

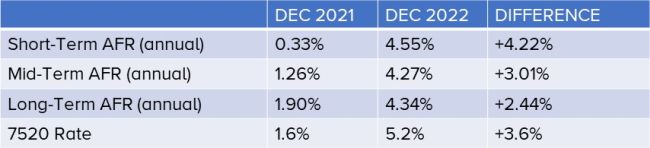

Every month, the IRS publishes various rates known as the Applicable Federal Rates (AFR) that are used for various tax purposes. For example, the AFR determines the minimum interest that must be charged on certain intrafamily loans to avoid making a gift of foregone interest. Every month, the IRS also publishes what is known as the "7520 rate," which is used to value certain annuities, term interests and remainder or reversionary interests and is relevant for many common estate planning techniques, such as GRATs, CRTs and QPRTs. As the Federal Reserve has raised interest rates this year, the AFRs and 7520 rate have risen dramatically. The chart below compares the AFRs and 7520 rates for December 2021 and December 2022:

Depressed Valuations.

Many asset classes have seen sharp declines in valuations since the beginning of 2022. The S&P 500 is down over 16% and the Nasdaq is down nearly 29%. Bitcoin is down approximately 62% and over 70% from its all-time high. Real estate valuations in some areas are depressed, and private equity valuations are low.

New York Estate Tax.

This year, a New York decedent can transfer up to $6,110,000 without incurring New York estate tax, and the increase expected for 2023 has not yet been announced. Notably, however, due to what is widely referred to as the "New York estate tax cliff," New York estates that exceed 105% of this amount do not benefit from this exemption and are subject to New York estate tax on the entire estate at a rate of up to 16%. Although New York does not impose a separate gift tax, certain gifts made within three years of death are added back to the estate when computing the value of the donor's estate for New York estate tax purposes.

Planning Suggestions

Make Gifts Prior to 2026.

Gift your enhanced exemption amount now, before it is reduced, effective January 1, 2026. Even if you have already exhausted your current gift tax exemption, in 2023 you can give an additional $860,000 ($1,720,000 per married couple). Also, be sure to increase your annual exclusion gifts to current levels. Gifting now is made more attractive because values are depressed, allowing you to leverage the use of your exemption amounts and/or pay less gift tax. As is always the case, lifetime gifting is more tax effective than bequeathing assets at death due to the favorable way gift taxes are calculated and also because all post-gift appreciation avoids gift, estate and GST tax. The main countervailing consideration is that, for income tax purposes, a gifted asset does not receive a step-up in basis at the donor's death, as it would have had if the donor died owning it; however, sometimes this can be managed.

Ameliorate Existing Planning.

Prior to 2026, consider using your enhanced exemption amount to forgive existing intrafamily loans or to allocate your GST exemption to prior transfers to which your GST exemption was not previously allocated, such as a GRAT. It is also a good idea to review provisions that use formula clauses, which, due to the historically high exemption amounts, may no longer reflect your wishes.

Use High Interest Rates to Your Advantage.

Consider planning techniques that work best in higher interest rate environments. One such technique is a Qualified Personal Residence Trust (QPRT), where the donor transfers his residence to his descendants while retaining the right to live there for a term of years. For gift tax purposes, the value of the gift is the value of the remainder interest calculated using the 7520 rate. As the 7520 rate increases, the value of the interest retained by the donor increases and, in turn, the value of the remainder interest decreases, reducing the amount of the taxable gift. Another technique is a Charitable Remainder Annuity Trust (CRAT), where the donor transfers assets to a trust that pays an annuity to an individual for a specified period of time and then to charity. The donor receives a deduction equal to the value of the remainder interest passing to charity. Because the annuity is a fixed amount, as the 7520 rate increases, the value of the remainder interest passing to charity becomes more valuable and, consequently, the amount of the deduction increases.

Conclusion

The current environment provides compelling reasons to engage in estate planning and revisit your current plan. Please contact us if you wish to discuss doing so.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.