- within Technology topic(s)

- in Canada

- with readers working within the Healthcare, Technology and Retail & Leisure industries

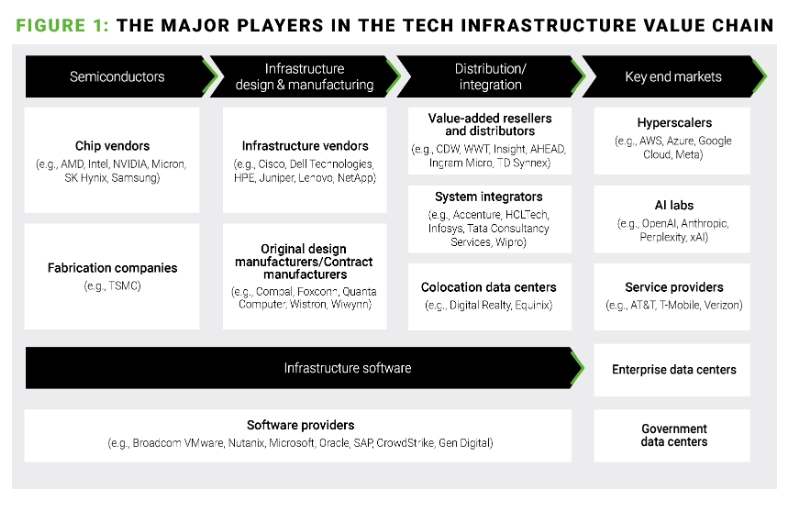

As AI adoption accelerates, tech infrastructure vendors face a strategic paradox. Despite recent positive earnings reports and surging demand for AI infrastructure, profitability is increasingly captured elsewhere in the value chain.

Semiconductor companies are capturing a disproportionate share of the margins, while hyperscalers are vertically integrating by developing custom silicon and in-house infrastructure. Meanwhile, ODMs (original design manufacturers) are driving scale by delivering cost-efficient, white-label AI hardware. This leaves tech infrastructure vendors caught between high-margin chipmakers, powerful cloud platforms, and cost-driven ODMs—and struggling to maintain dominance in an ecosystem rapidly evolving beyond traditional market structures.

Past disruptions in the tech infrastructure value chain

This is not the first time an industry-defining disruption has threatened the tech infrastructure value chain. Over the past 30 years, the rise of the internet, transition to mobile-first ecosystems, and emergence of public clouds have all reshaped market dynamics.

- Internet and digitization: Standardized architecture in the late 1990s and the internet boom of the early 2000s sparked a surge in demand for infrastructure, driving x86 as the de-facto standard computer architecture and rapid on-premise enterprise IT buildouts. Industry players such as Dell and HPE expanded aggressively and capitalized on the shift, as servers became strategic assets in the enterprise stack. From 1995 to 2007, Dell's revenue grew at ~26% CAGR—its fastest-growth era to date, according to CapitalIQ data. Infrastructure vendors wielded significant negotiating power by serving a fragmented set of enterprises.

- Public cloud: The rise of public cloud systems in the early 2010s marked a shift as hyperscalers like AWS, Microsoft, and Google started designing their own infrastructure, reducing dependence on traditional infrastructure vendors. For example, between 2007 and 2015, Dell's infrastructure business achieved a lower revenue CAGR of ~8%, while margins stalled amid weakening pricing power. As hyperscalers internalized more of their tech stacks, infrastructure player influence in enterprise IT declined.

- Data-centric and ML workloads: From 2016 to 2022, the growing adoption of data-centric and machine learning (ML) workloads accelerated the shift toward software-defined and cloud-native infrastructure. Value shifted to data platforms and orchestration layers. Both infrastructure players and hyperscalers benefited from this growth. HPE's server segment achieved a CAGR of ~2%, while Dell's Infrastructure Group posted a CAGR of ~10%. Meanwhile, the leading cloud providers grew even faster with AWS reporting ~37% CAGR and Microsoft Azure's ~20% CAGR. Infrastructure vendors started to lose control of the software stack, while Supermicro began to stand out by delivering modular AI systems tailored to emerging enterprise needs.

AI boom marks a pivotal inflection point for infrastructure players

The recent boom in generative AI is rapidly shifting computing demand towards large-scale GPU clusters and vertically integrated systems. The following key trends are combining to impact infrastructure vendors:

- Semiconductor giants expanding downstream: Chipmakers such as NVIDIA (CUDA, DGX, AI Foundry) and AMD (ROCm) are moving beyond silicon to full-stack platforms, including software libraries, reference designs, and AI frameworks—putting them in direct competition with traditional infrastructure vendors. They are also collaborating with AI native providers like CoreWeave (in which NVIDIA holds a ~7% equity stake as of March 2025) to extend their ecosystem around modular AI infrastructure.

- Hyperscalers are moving upstream: Cloud giants such as AWS (Trainium, Inferentia), Microsoft (Athena), and Google (TPU) are developing custom silicon and vertically integrating hardware / software stacks, reducing reliance on traditional infrastructure vendors, and consolidating control over AI infrastructure.

- ODMs are driving commoditization: Companies such as Foxconn, Quanta, Inspur, and Supermicro are delivering white-label, cost-efficient AI hardware at scale, pressuring traditional infrastructure providers. Supermicro, acting as both a vendor and ODM, is fueling its growth (78% revenue growth between 2022 and 2024) by meeting demand for ready-to-deploy, modular GenAI servers.

- AI demand is concentrated among a few large customers: Hyperscalers and frontier AI labs like OpenAI, Meta, and Anthropic are consuming a disproportionately high share of AI computing, resulting in concentrated buying power and making it harder for vendors to diversify revenue.

- Rise of edge computing: The need for low-latency AI inference in retail, industrial, and telecom environments is accelerating demand for AI-capable edge devices—opening new growth markets for lightweight, energy-efficient hardware.

- Focus on energy efficiency: With skyrocketing compute demand, energy use has become a bottleneck. Infrastructure vendors can gain an advantage by innovating in cooling, packaging, and chip design that is optimized for AI power / performance trade-offs.

To remain relevant, we believe infrastructure vendors must commit to a clearly defined and well understood strategy.

What can infrastructure players do?

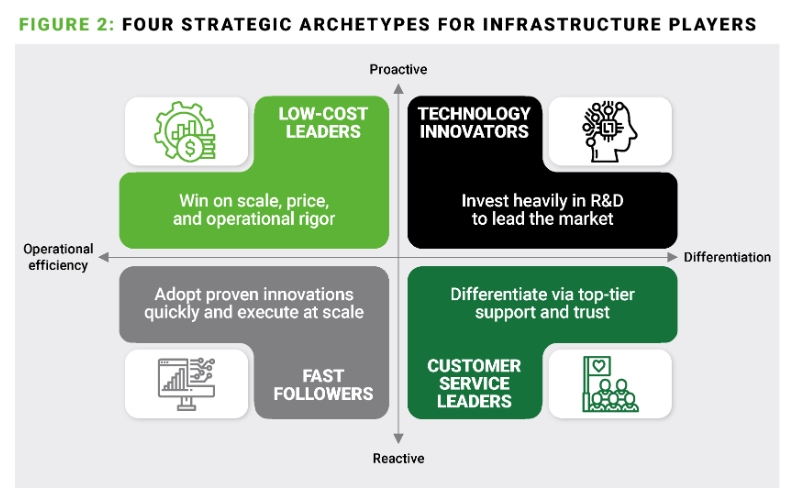

We see four strategic archetypes that can help infrastructure vendors chart a successful path forward in this evolving infrastructure value chain.

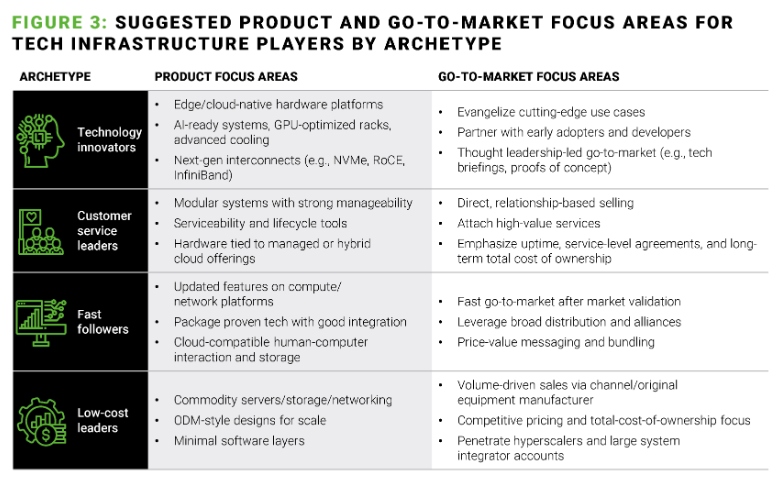

Each archetype—whether focused on innovation, customer service, speed of execution, or cost leadership—requires distinct choices in product design, go-to-market strategy, and investment priorities. Mixing elements from multiple archetypes may appear attractive but often results in weak differentiation and organizational inefficiency.

This is a tried and tested matrix, honed across industries over time. Infrastructure vendors can now leverage it to navigate this disruptive moment.

- Technology innovators invest heavily in R&D and differentiated designs to maintain a competitive edge. Tesla is a great example of a technology innovator redefining a mature industry, through relentless investment in electric vehicle technology, autonomous driving, and battery innovation. Another example is Airbnb, which disrupted the hospitality industry by leveraging digital platforms and data to create a scalable, user-driven marketplace.

- Customer service leaders leverage strong customer relationships and offer industry-focused solutions built on trust and long-term value. Costco built its reputation through consistent customer value, generous return policies, and a membership model that fosters loyalty and long-term relationships. Similarly, American Express differentiates itself through premium customer service, concierge offerings, and strong fraud protection, positioning itself as a trusted partner for both consumers and businesses.

- Fast followers rapidly replicate emerging trends and scale operations in growing markets. Their success depends on effective go-to-market execution, leveraging broad distribution and partnerships, and differentiating through price-value messaging. Inditex, the parent company of Zara, mastered fast fashion by rapidly translating runway trends into affordable retail offerings, supported by agile supply chains and frequent inventory refreshes.

- Low-cost players compete primarily on price and high-volume sales, maintaining a very low-cost structure. For example, Ryanair became the European budget airline market leader by stripping down services to essentials, maximizing aircraft utilization, and maintaining ultra-low operating costs. In the retail industry, Temu gained traction by offering low-priced goods sourced directly from manufacturers, leveraging aggressive marketing and data-driven merchandising tactics.

As the tech infrastructure market evolves under AI-driven demands and margin pressure, many players may need to turn to M&A to solidify their position within a chosen archetype. Innovators may acquire specialized IP or AI infrastructure companies to deepen their differentiation. Hewlett Packard Enterprise (HPE)'s recent acquisition of Juniper Networks, in a deal valued at $14 billion, will allow HPE to strengthen its portfolio with Juniper's AI-native networking expertise. Palo Alto Networks' planned acquisition of CyberArk for $25 billion will allow Palo Alto to expand its platform into identity security and lead the next generation of cyber defense.

Customer service leaders can enhance their value by acquiring service platforms or vertical-specific solutions. Cisco's acquisition of Splunk in March 2024 for $28 billion will allow Cisco's networking and security solutions to incorporate Splunk's data analytics capabilities to offer enhanced visibility and insights for customers. Fast followers might use acquisitions to quickly adopt validated technologies or expand into adjacent segments like software-defined networking. Meanwhile, low-cost leaders may consolidate with peers or acquire automation and supply-chain capabilities to further drive scale and operational efficiency. In each case, focused M&A can help vendors fill capability gaps and defend their strategic position.

The AI evolution introduces both disruption and opportunity for tech infrastructure players. Those that effectively align their product focus areas and commercial strategies can secure their position in the value chain.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.