Stock Market Commentary

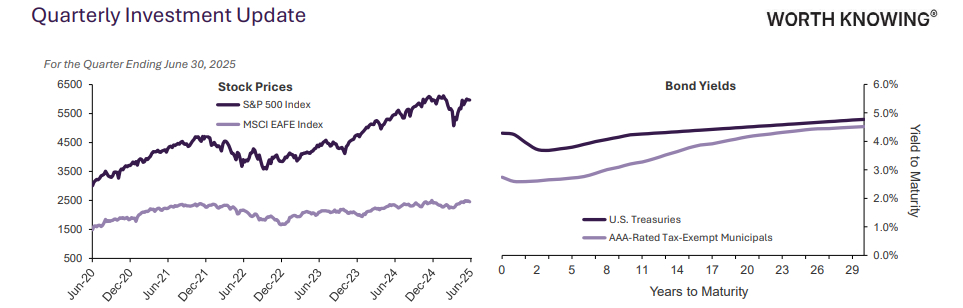

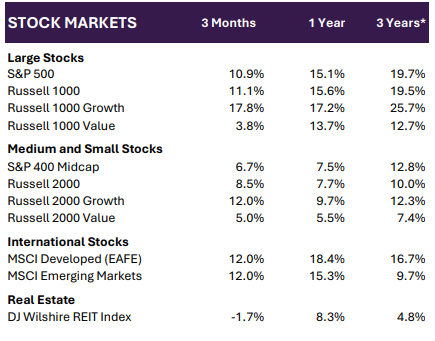

U.S. stocks rallied during the second quarter, with the S&P 500 finishing up 10.9% reaching new all-time highs. The beginning of the quarter, however, was marred by a precipitous drop following the "liberation day" tariff announcements that sent stocks spiraling, the dollar plunging, and capital fleeing to investments abroad.

The de-escalation of trade disputes mid-quarter helped the industrial, technology, and communication service sectors to rebound. The consumer discretionary sector rose 11.5% despite trade spats and increased tariffs weighing on the sector. The energy sector surprised analysts by falling -8.56% even as tensions in the Middle East soared. International and emerging market stocks, tracked by the MSCI EAFE Index and MSCI Emerging Markets Index, continued their record-breaking returns posting 12.0% and 12.0%, respectively, as the U.S. dollar weakened. Germany fueled the market further when the newly formed coalition government agreed to more expansive fiscal policies to boost growth.

Despite ongoing policy uncertainty and market volatility, we reiterate that diversification remains crucial for insulating portfolios against sudden shocks. The market's swift rebound to new highs after the brief downturn demonstrates the perils of reacting to short-term volatility.

Bond Market Commentary

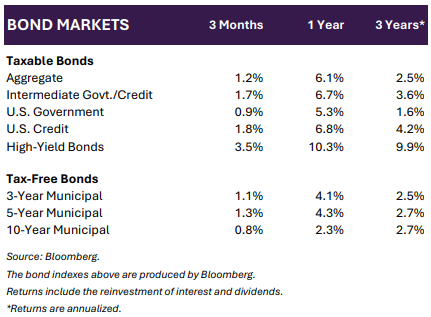

During the second quarter, fixed income markets saw dynamic activity shaped by evolving data, geopolitical turmoil, and central bank signals. Bond yields, particularly for longer-dated U.S. Treasuries, rose in April and May, reflecting concerns about tariffs, inflation, and rising debt levels. However, a notable shift took place as we moved into June. Signs of easing inflationary pressure and a softening labor market led to a modest decline in yields. The Bloomberg US Aggregate Bond Index ended up 1.2% for the quarter.

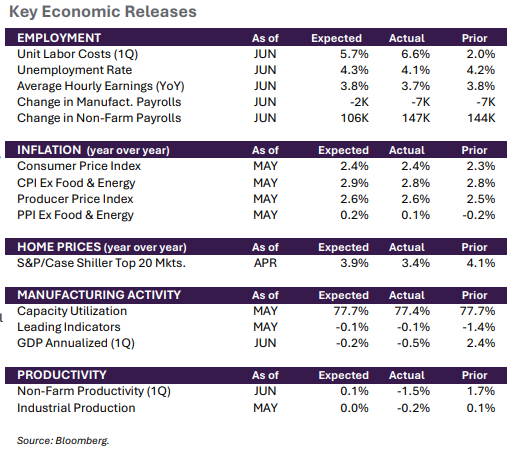

As widely expected, the Federal Reserve held the federal funds rate steady at its April and June meetings. The Federal Open Market Committee emphasized a datadependent approach, noting persistent, albeit moderating, inflation and a solid labor market. While some projections had anticipated multiple rate cuts earlier this year, the Fed's "dot plot" in June signaled two cuts to come in 2025.

In the municipal bond market, state and local governments sold a record amount of debt during the second quarter. While states are generally in good credit shape with healthy rainy-day funds, factors including increased construction costs and potential changes to future federal policy caused a surge in issuance.

Economic Commentary

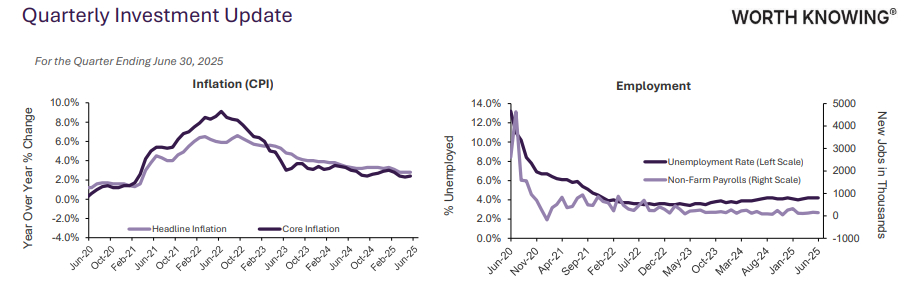

On April 2nd, a significant policy shift occurred when President Trump announced reciprocal tariffs impacting nearly all of America's trading partners. Since then, policy uncertainty has caused some businesses to delay projects, with roughly 20% of Russell 3000 companies – an index of the 3,000 largest publicly traded U.S. firms – lowering or withdrawing investment as of the end of May. Following the initial negotiations on tariff rates and a subsequent 90-day pause, there has been a period of reduced policy volatility. This relative stabilization appears to have positively influenced consumer sentiment. The University of Michigan's Consumer Sentiment Index recorded its first increase this year in June, though it remains 20% below December 2024 levels.

The U.S. dollar weakened considerably this quarter, trading near its lowest level since 2022. U.S. Gross Domestic Product saw an annualized decline of 0.5% in the first quarter of 2025. This was largely influenced by a notable surge in imports as businesses and consumers accelerated purchases of foreign goods in anticipation of new tariffs. However, the second quarter showed a slight reversal as these goods were sold, with the Atlanta Federal Reserve estimating 2.9% growth for the full year. Unemployment held steady at 4.1%, and inflation, as measured by the Consumer Price Index, saw a slight monthly increase. While uncertainty has been a defining characteristic of this past quarter, we maintain a cautiously optimistic outlook as we move into the second half of 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.