The Economic Crime and Corporate Transparency Act 2023 introduces a new strict liability 'failure to prevent fraud' offence (the "FTPF Offence") in the UK. The FTPF Offence will come into effect on 1 September 2025. For details on the FTPF Offence, its scope, potential penalties for failure to comply and the defences, see our full FTPF Offence briefing.

1 Failure to Prevent Fraud – The Offence

The FTPF Offence can make an in-scope party which is or is connected to a large organisation liable for base fraud offences committed by 'associated persons', which (in a notably broader approach compared to the Bribery Act) is defined to automatically include subsidiaries and employees, and this concept is the focus of this briefing. For PE Sponsors, the key question is whether liability may on this basis realistically be attributed to a PE Sponsor where a FTPF Offence is committed 'corporately' by a portfolio company.

2 Parent Company Liability

Within a general corporate setting, it is certainly possible for a parent company to be prosecuted for a FTPF Offence, where:

- the base fraud offence is committed 'corporately' by a subsidiary;

- where the beneficiary of that offence is (in whole or in part) the parent organisation or its client; and

- where the parent company did not have reasonable fraud prevention procedures in place.

For these purposes, a subsidiary will 'corporately' commit the base offence where it was committed by the senior manager of the subsidiary, or some other person who represents the 'directing mind and will' of the subsidiary, acting in their capacity as such.

As set out in the Government's FTPF Offence guidance, the parent organisation is not responsible for unrelated "activities by subsidiaries (for example, frauds that are not intended to benefit the parent organisation)".

To understand this in the context of a PE group structure, and specifically the fund and PE Sponsor's FTPF Offence exposure in respect of acts by portfolio companies, it will be important to identify:

- which entities (if any) in the structure qualify as 'large organisations', bringing these (and potentially grouped entities) into the scope of the FTPF Offence. A large organisation is an organisation which meets at least two of the following criteria (in the financial year of the organisation that precedes the year of the FTPF Offence): (i) more than £36 million turnover; (ii) more than £18 million in total assets; or (iii) more than 250 employees;

- the extent to which the portfolio group could be said to be grouped with the fund and/or the GP. For these purposes relatively broad Companies Act grouping tests apply, which are broader than for example financial consolidation for accounting purposes. Majority equity interests, rights to appoint a board, and more generally 'dominant influence' of one entity over another could group them together. It is generally accepted (but not tested before courts) that if the GP is not entrenched (i.e. it can be kicked-out by the LPs regardless of fault) it should not be a parent of a fund, and so by extension is not grouped with its portfolio entities – but this is a fact sensitive analysis; and

- if it could be said that the activities of an underlying portfolio company are intended to benefit the fund or its clients.

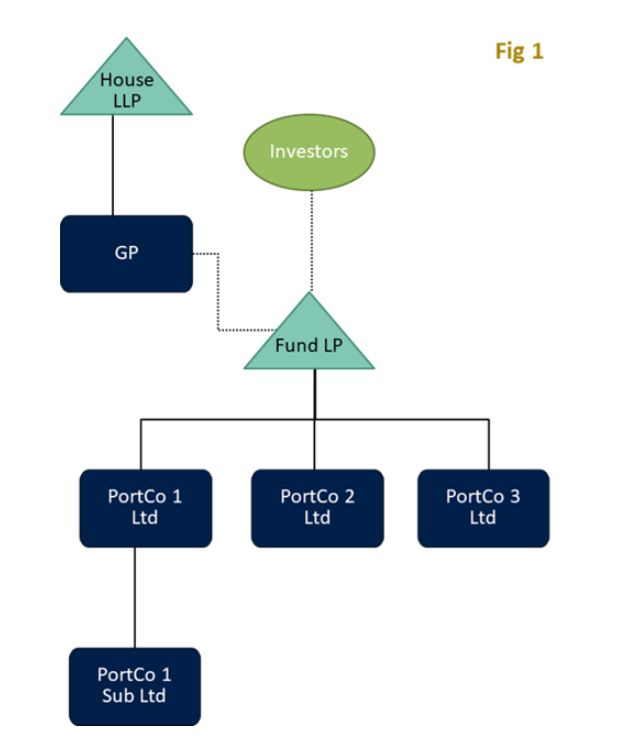

Please see below and the corporate structure chart at Fig. 1 for some typical scenarios to demonstrate the above. Note that in all these examples it is assumed that no single investor in Fund LP holds 50% or more of Fund LP.

Example 1

Where PortCo 1 Ltd alone meets the threshold to be a 'large

organisation' (and therefore may be liable for the activities

of its associates) but the GP and House LLP are outside the group

and are not entrenched (i.e. where Fund LP has GP-kick out rights),

GP and House LLP are not in scope and are unlikely to be liable for

a FTPF Offence committed by PortCo 1 Ltd/PortCo 1 Sub Ltd. PortCo 1

Sub Ltd may be liable as a subsidiary of a large organisation

(Portco 1 Ltd), if for example an employee of PortCo 1 Sub Ltd

commits fraud intending to benefit it.

Example 2

Where PortCo 1 Ltd meets the threshold to be a 'large organisation' and the GP is entrenched (i.e. where Fund LP does not have GP kick-out rights), GP and House LLP are parent undertakings of groups which in aggregate meet the thresholds for large organisations and are therefore large organisations themselves. House LLP could theoretically be liable where fraud is committed by subsidiaries or employees of subsidiaries acting on its behalf with the intention of benefitting House LLP or House LLP clients. In practice, it may only be in very narrow circumstances that a portfolio company intends to benefit House LLP's clients (or clients of the GP/fund).

We suspect it may be difficult to demonstrate - in the context

of a traditional PE fund structure, where the activities of the

portfolio company are operationally distinct from the House LLP and

the House LLP clients – that the base fraud by the subsidiary

was intended to 'benefit' the fund/House LLP. However, the

guidance in relation to the FTPF Offence is not definitive on this

point, and suggests that intention can potentially be indirect or

inferred, and therefore this risk cannot be completely ruled

out.

Example 3

Noting the above in relation to Example 2, where none of the

PortCos individually meets the threshold to be a 'large

organisation' but the PortCos together meet the group

threshold, and, as with Example 2, and the GP is entrenched (i.e.

where Fund LP does not have GP kick-out rights), Fund LP could be

liable where fraud is committed by subsidiaries or employees of

subsidiaries acting on its behalf with the intention of benefitting

Fund LP or Fund LP clients. Furthermore, each PortCo is a

subsidiary of a large organisation and can be liable where

employees commit fraud intending to benefit it.

Example 4

Where House LLP is a large organisation and meets the thresholds in and of itself, it can be liable where its associates commit fraud intending to benefit House LLP or its clients. Therefore, if GP is entrenched, if any of the group entities committed a FTPF Offence for the benefit of House LLP, House LLP could be liable for a FTPF Offence (although as outlined in relation to Example 2, showing a 'benefit' is considered a meaningful hurdle).

3 Reasonable Prevention Measures – What can you do?

There is a full defence to the FTPF Offence where an organisation can demonstrate that: (i) it had reasonable fraud prevention measures in place; or (ii) that it would have been unreasonable in to expect the organisation to have any prevention procedures in place.

Proving that it was unreasonable to have prevention procedures in place will be difficult to achieve. It will likely only apply in circumstances, where for example, an organisation's structure is such that the parent company cannot realistically establish fraud controls within the subsidiary.

While the risk of a PE Sponsor being found liable for the activities of a portfolio company are (albeit fact sensitive) typically limited, given the residual risk, and more importantly perhaps, the reputational and potential financial impacts involved they would still be well advised to ensure that (i) they have reasonable fraud prevention measures in place (protecting them against the activities of their more immediate associates – such as employees); and (ii) that their portfolio companies are made aware of the FTPF Offence, and implement tailored policies and procedures where appropriate. PE Sponsors should also have their own policies and procedures in place – where they are potentially within scope. Together, this will help PE Sponsors to avail themselves of a defence where a FTPF Offence arises by demonstrating that they have reasonable fraud prevention measures in place.

Moreover, as a 'small' portfolio company could potentially be brought into the scope of the regime by virtue of a link to a larger entity via a PE structure, it will be important to ensure that they are made aware of the implications of the regime in a PE context.

For further information see our full FTPF Offence briefing which contains recommendations on what PE Sponsors can do now to be prepared for the FTPF Offence taking effect on 1 September 2025.

Our team at Travers Smith has extensive experience in helping clients in responding to 'failure to prevent' offences – such as failure to prevent bribery and failure to prevent the facilitation of tax evasion – in a PE context. This includes advising on policies, procedures and risk assessments and assistance with responding to investigations. We are already helping clients prepare to deal with the new FTPF Offence in a way which is pragmatic, responsive and aligned with their existing wider financial crime framework. Please do not hesitate to get in touch if you have any questions or would like further assistance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.