- within Government and Public Sector topic(s)

1. Stamp duty land tax

Currently, an SDLT surcharge of 3% (on top of the standard residential rates) applies, broadly, to (i) any individual purchasing an "additional dwelling" (i.e. any property other than their main residence) and (ii) any company that acquires any residential property. Chancellor Rachel Reeves announced today that this surcharge would be increased from 3% to 5% from 31st October 2024.

It was also announced that the single rate of SDLT payable by companies and non-natural persons acquiring dwellings for more than £500,000 (often known as the ATED-related SDLT charge) will be increased from 15% to 17%.

By increasing the surcharge, Labour is hoping to disincentivise acquisitions of second homes and buy-to-let properties by making them more expensive to purchase. The intention is that this will allow more properties to be acquired "for main homes and for first time buyers". The new surcharge is predicted by the government to bring in £115 million in 2024 to 2025 and intended to fund other capital investments, such as Labour's promised delivery of 1.5 million new homes.

As noted above, these changes will apply to land transactions with an effective date on or after 31 October 2024. The effective date of a land transaction is typically the completion date itself. But, in certain circumstances, the effective date will be an earlier date, the date of "substantial performance" – for example, where any payment of rent is made, or where a purchaser takes possession of the whole or substantially the whole of the residential property. So, land transactions which were substantially performed before this date should still be subject to the previous 3% rate.

Under draft legislation, the higher rate will also not apply to land transactions which exchanged before 31 October 2024 and are not excluded (broadly, if the contract is not varied on or after 31 October, the purchase is not the result of an exercise of an option, and the contract is not assigned). So, if a contract for a purchase of a residential property was exchanged prior to 31 October, but the transaction only completes or is substantially performed on or after that date, the old surcharge rates should apply.

In welcome news for some, Labour did not fulfil their manifesto

pledge to raise the SDLT surcharge paid by non-UK residents: this

remains at 2%. This 2% surcharge for non-residents can apply in

addition to the new 5% surcharge on residential property, which

means that the top band of the consideration for some transactions

could attract an SDLT charge of a sizeable 19%.

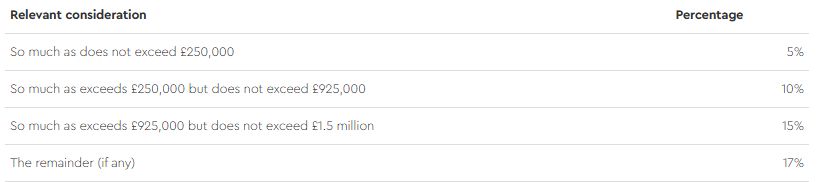

For land transactions with an effective date on and between 31 October 2024 and 31 March 2025

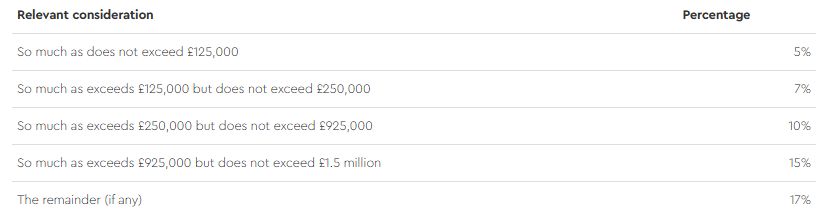

For land transactions with an effective date on or after 1 April

2025 – Expected Rates

2. Reserved Investor Fund

The Autumn Budget confirmed that the UK will introduce a new form of unauthorised fund, the Reserved Investor Fund (Contractual Scheme) ("RIF"). The RIF is a potentially exciting new addition to the UK's fund landscape and is expected to be particularly attractive for commercial real estate. For the right investors, it is expected to be a viable alternative to a JPUT.

More detailed legislation in relation to the RIF is expected to be released before April 2025. It is not clear how far the rules will depart from the draft legislation that was published for public consultation earlier in the year by the previous government.

What is a RIF and what conditions need to be met to be a RIF?

The RIF will be a co-ownership authorised contractual scheme, which broadly means that it will be based on a contractual arrangement between the operator, depositary and the investors.

On the basis that the final rules will follow the previous governments proposals, there will be a number of conditions that the arrangements will need to meet to qualify as a RIF, including, broadly:

- It is UK-based;

- It is widely held (i.e. meet the genuine diversity of ownership or non-close condition); and

- It meets one of the following three conditions (which are

designed to prevent non-residents indirectly disposing of UK real

estate free from UK capital gains tax):

- at least 75% of the value of its assets is derived from UK property;

- all investors in the RIF are exempt from tax on gains; or

- it does not invest directly in UK property or UK property rich (i.e. 75% of value) companies.

The RIF will be an Alternative Investment Fund ("AIF") and collective investment scheme for regulatory purposes and would be available to professional investors, as well as those who invest at least £1m.

What is the expected tax treatment of a RIF?

As discussed above, more legislation is due to be released but based on previous consultations and draft legislation, we are expecting that:

- It will be transparent for income tax purposes;

- It will be opaque for capital gains tax purposes, so investors should generally only pay capital gains tax on a disposal of their interest or unit in the RIF;

- It will potentially be able to make an exemption election under the non-resident capital gains tax rules in relation to companies that it owns;

- It will be treated as a company for stamp duty land tax purposes, so transfers of units in the RIF will not be subject to stamp duty land tax; and

- Transfers of units in the RIF should not be subject to stamp duty or stamp duty reserve tax.

There is currently no indication that management fees charged in relation to the RIF will be exempt from VAT. However, this may only be a cash flow cost for commercial real estate funds (unlike some other investment funds) as such funds are often able to recover such VAT.

The proposed fund has the potential to improve the competitiveness of the UK by filing a gap in the UK's existing fund offering and supporting the domestic growth agenda by facilitating greater investment in UK real estate by UK funds.

Andrew Griffith MP on the introduction of the RIF

3. No change to residential capital gains tax rates

Despite the main rates of capital gains tax being increased, the Chancellor confirmed that the rates that apply to residential property gains will remain at 18% and 24%.

4. Agricultural Property Relief

In today's budget, Rachel Reeves announced that she would reform Agricultural Property Relief ("APR") and Business Property Relief. Whilst the government did state that the scope of APR would be extended to land managed under an environmental agreement with government authorities from April 2025, landowners will likely be more focused on the changes coming into effect from April 2026. From April 2026, broadly, the existing 100% rate of relief for qualifying business and agricultural assets will apply for the first £1 million of combined agricultural and business property and amounts above that £1 million will be subject to a rate of 50%.

Further detail is expected following the technical consultation which will be published in early 2025.

5. Business Rates – an attempt to revive the high street

The Chancellor today announced a series of changes to the business rates levied on retail, hospitality and leisure ("RHL") properties in a bid to "level the playing field" with online competitors. This includes a temporary 40% relief on bills for RHL properties and (yet another) freeze to the small business multiplier in 2025/26. The Chancellor has also promised to permanently cut business rates for RHL properties from 2026/27.

In its election manifesto, Labour pledged to "fundamentally reform the business rates system" to redress the unfair advantage online retailers benefit from as compared with high streets and town centres. Looking to deliver on this promise, the Chancellor announced the following measures:

1. 40% relief for RHL properties in

2025/6

For 2025-26, eligible RHL properties in England will receive 40%

relief on their business rates liability, subject to a cash cap of

£110,000 per business. There is limited information on the

relief at this stage – other than that it will save the

average pub with a rateable value of £16,800, over

£3,300 in 2025. Although it seems generous on its face, the

measure could potentially fall short of what many were expecting,

especially as it is a reduction to the discount to rates that RHL

properties currently enjoy (eligible RHL properties benefit from a

75% discount up to £110,000 per business for 2024/25,

although the relief was set to end in 2025).

2. Frozen small business multiplier

Business rates are calculated by (a) multiplying the rateable value

of the property by either the standard multiplier or the (lower)

small business multiplier, and (b) subtracting any relevant

reliefs. The multipliers usually increase with CPI, however the

Chancellor today confirmed that the small business multiplier in

England will be frozen at 49.9p for 2025/26. This is not a new

measure – in fact, this is the fifth consecutive year that

the small rates multiplier has been frozen!

It has been confirmed that the standard multiplier will be uprated

by the September 2024 CPI rate to 55.5p.

3. Intention to permanently lower rates for RHL

properties

The Chancellor also announced that there is an intention

to permanently lower business rates for RHL properties from

2026-27. The Chancellor has not shed much light on the reliefs that

are envisaged, but has highlighted that the largest cuts will be

for THL properties that are currently subject to the small business

multiplier by introducing a permanently lower multiplier (to be set

at the Autumn Budget 2026).

But how will this be funded? The current intention is to fund this

by increasing the standard multiplier (that is, the multiplier that

applies to properties with a ratable value in excess of

£500,000) from 2026/27. The Government suggest that the

majority of this burden will therefore be borne by "large

distribution warehouses, including those used by online

giants".

4. Further reform

The changes do not stop there – in the discussion paper published by the Government on the direction of travel for transforming the business rates system, the Government confirmed that it is looking for input from business on "the government's initial areas of interest reform". Further changes to the regime therefore seem imminent.

6. Business Rates – private schools

As announced in July 2024, private schools will no longer be eligible to benefit from business rates charitable rate relief from April 2025. Private schools that are "wholly or mainly" concerned with providing full time education to pupils with an Education, Health and Care Plan will continue to benefit from relief.

Together with the introduction of 20% VAT on education and boarding services provided by private schools (effective from 1 January 2025), this change is expected to raise £1.8bn annually by 2029/30.

7. Full expensing

Read more in our analysis of Business Taxes in the Autumn Budget.

8. Annual Tax on Enveloped Dwellings

The ATED annual charges will rise by 1.7% from 1 April 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.