1. Executive summary

2. About the Consumer Sentiment Index

3. Consumer trends

- What stagnant home sales mean for home décor

- Even with inflation and tariffs, it's not just about the cheapest product

- Millennials want help on their first big-ticket purchases, and Gen Z could be loyal for life

- Gift-giving and the emotional shopper

- Rent-to-own is here and B2B is a major opportunity for home retailers

4. Data deep dives

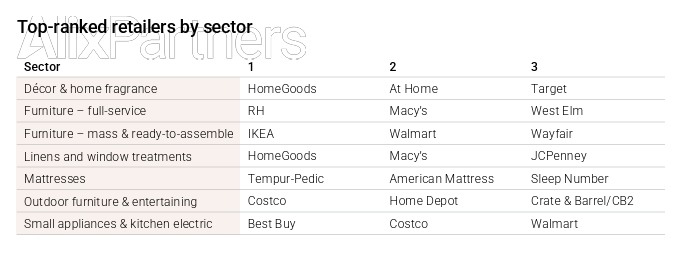

- Sector deep dives − Décor and home fragrance − Furniture – full-service − Furniture – mass and ready-to-assemble − Linens and window treatments − Mattresses − Outdoor furniture and entertaining − Small appliances and kitchen electric

- Attribute analysis

5. Putting the CSI to work

Executive summary

There isn't room for a bigger couch. Baby Boomers are sitting on 42% of U.S. housing stock, while younger generations don't have the capital to enter the housing market. People are locked into their existing homes, unable to upgrade.

It's a challenging backdrop for the Home sector, but the 2025 AlixPartners Home Consumer Sentiment Index shows opportunities around key trends, particularly a desire for people's homes to reflect their aspirations and identities. In brief:

Young shoppers want to love retailers

Younger generations are largely confined to "refreshing" their apartments or rentals, but we see desire for expert input and designer appeal around their first big home purchases: 52% of Gen Z want help finding product, near Millennials (55%) and above Gen X (49%). Over half of the generation reared on product drops and social activations—Gen Z—are interested in loyalty programs, and 43% want early or first access. Meanwhile, Millennials want all these things the most of any gen.

Older shoppers value brand legacy and stalwarts like Macy's

The Bank of Mom and Dad (Baby Boomers) are more likely to be homeowners, and to have the financial bandwidth to prioritize additional features and service levels at higher price points, if a low interest in digital features. While they're agnostic around loyalty programs and a personal connection, 43% want personalized help finding product. Department stores like Macy's that can cater to multiple categories at once remain a firm favorite.

Price isn't everything; consumers are highly aspirational

When we look at the competitive landscape between retailers, we find that price pressures (inflation, tariffs, debt) have not sent consumers chasing rock-bottom prices. Rather, consumers are prioritizing specialty retailers in sectors like mattresses (where Tempur-Pedic was the top-ranked retailer by consumers) and appliances (where Best Buy was ranked second), where long-term performance or pitches of "wellness" or "sleep fitness" are more obvious. Of consumers who are cutting spending, mass and ready -to-assemble (RTA) furniture and mattresses are their top targets, cited by 55% and 61%, respectively, of those cutting spending due to price, rather than trading down. When we looked at gift-giving behaviors, we found that big-ticket gift-givers in full-service furniture and mattresses care more about sustainably sourced product, clear product marketing collateral, and a wide range of products.

The in-store experience is a differentiator across sectors

Walmart's dominance across sectors and income brackets (ranked #3 retailer by those making over $150,000 a year) reflects its strengths: assortment, and the impressive Walmart+ same-day fulfilment offering, backed by its brick-and-mortar presence in towns across America. In full-service furniture, RH (formerly Restoration Hardware), which has gallery-style showrooms and no social media presence, wins among high-income shoppers, while IKEA is beloved by women shoppers (74% of whom ranked the retailer #1, versus 26% of men shoppers)and Millennials (68% vs. all others),and treated as an outing by those lucky enough to live near one.

Smart financing can win over cash-strapped consumers

Millennials and Gen Z are 50% more likely to use BNPL, and will one day be big-ticket shoppers—just as soon as they can afford a home. Nearly 7 in 10 Gen Zers say BNPL or financing options are important or very important, increasing to 77% of Millennials.

Perhaps the broadest takeaway was a desire to move toward the next upgrade. We found that Millennials value more than just cheap furniture; they are beginning to trend toward full-service higher quality pieces that may take them to and through the next stage of their life. This fits with a key finding from the 2024 CSI: Fashion that Millennials are now looking to feather their nests after hard-won gains in the job market and a delayed entrance to the home market. Beds (where we spend 30% of our lives) are seen as a greater investment even by customers in the mid-level of income.

Now more than ever, home is what you make of it, and the emotional resonance of key purchase drivers offers a key to the consumer, whichever stage they are at. Read on for analyses of top-ranked retailers and sector-specific deep dives, as well as an overview of the defining trends in Home.

"High mortgage rates and rising consumer debt are freezing housing mobility—delaying first time purchases and slowing turnover. That's continuing to put pressure on the home-goods sector, as are ongoing tariff pressures. But there are actionable growth levers. Our data points to resilient demand in multifamily and commercial sectors, untapped value in loyalty ecosystems, and rising consumer spend on wellness-oriented offerings. These are increasingly becoming more than just bright spots—they're strategic footholds." - Amol Shah, Global Co-Leader of General Merchandise, Home & Specialty Retail at AlixPartners

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.