In Part 1 of this article, we discussed the pillars that once elevated hi-lo as the pre-eminent pricing strategy in grocery — and the hazards of pretending those pillars still stand. In Part 2, we make the case for a new model and how to implement it.

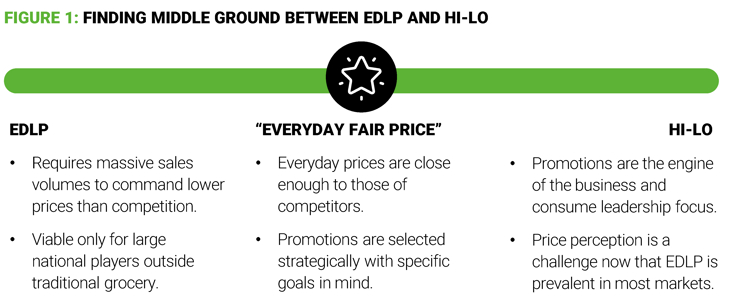

Hi-lo isn't the answer for grocers, and neither is EDLP. We recommend an alternative model in which everyday prices are close enough to competitors and promotions are focused on specific goals — like driving traffic or increasing trial of private brand — rather than offered indiscriminately as a mechanism to paper over unreasonable everyday prices. We call this "everyday fair price."

Grocers that want to validate whether they could serve their customers better with this approach should start with a hard look at the numbers. Cutting the cord is scary in the short term but should allow for greater independence, flexibility, profitability and resilience in the long term, and analysis and forecasting will show it.

Grocers should also carefully study how their customers shop. If they've been conditioned for decades to rely heavily on coupons and specials, shopper insights and communication on the transition from the old model to the new will be especially critical.

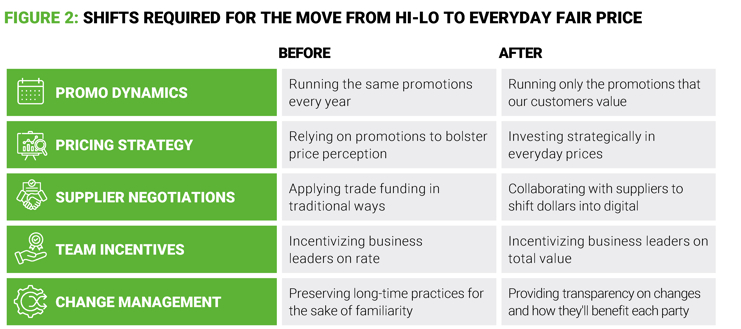

When grocers take the leap, they will make the following shifts as part of the process:

Promo Dynamics

Under the old model, insights about how well different promotions actually performed — How many of these items are contributing to full shops? How often are these items included in baskets with a desirable margin? How much did this promotion cannibalize sales of the private brand? — were largely irrelevant because running them came with compensation other than sales.

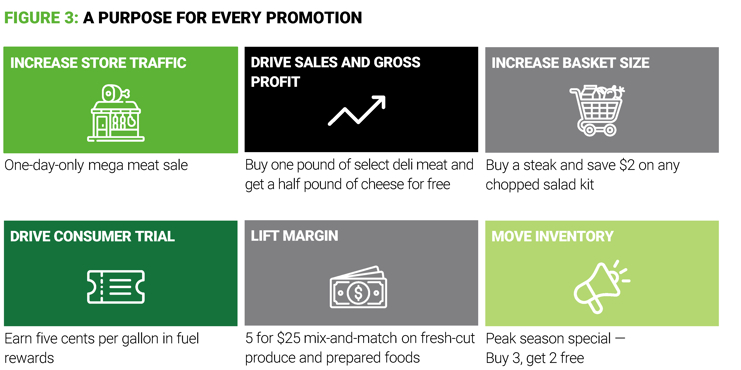

In a modern model, every promotion has a purpose. Grocers that take a traditional approach to promotional calendars are likely promoting too many products, too frequently, at discounts that are too steep. How responsive shoppers are to a given promotion varies dramatically based on the category and the item.

For example, meat promotions often drive trips; promotions of canned vegetables rarely do. It follows that canned-vegetable promotions should be infrequent, fully funded and low-discount, whereas meat should be promoted on the cover, at aggressive price points, for all occasions.

Pricing Strategy

The opportunity to focus less on promotions and more on everyday prices will be especially important in markets heavily penetrated by discounters, but even in other markets, most grocers will find their price perception needs retooling.

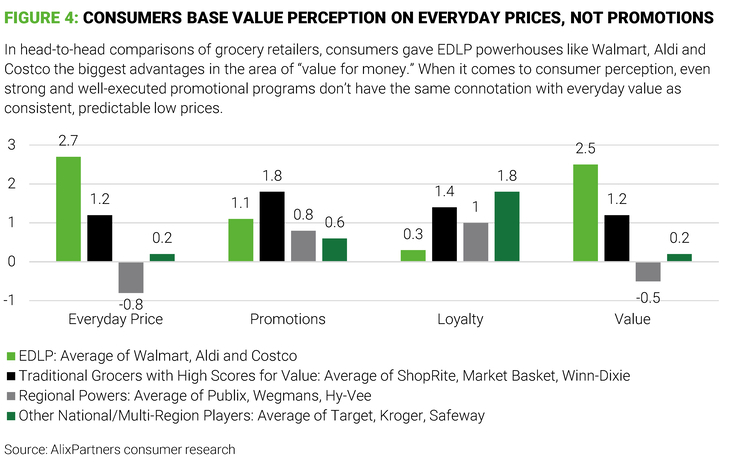

Our research shows that overall "value for the money" perception generally comes down to everyday prices rather than promotions, so more focus needs to go to the former than the latter.

Supplier Negotiations

Dialing back the role of hi-lo doesn't mean turning away all trade funding. When promotional opportunities come along that fit the grocer's strategy, it makes sense to take the money.

At the same time, grocers should open conversations with their vendors about participating in their retail media network. Digital investment allows for more precise targeting, less waste, consumer insights, and clearer ROI. It's a reasonable argument that hi-lo isn't serving anyone particularly well and that more personalized tactics will deliver better results.

Team Incentives

Incentives may need to evolve along with the business model. Sales and margin dollars should matter more than rate. Dollars are what will allow you to invest in strategic initiatives that differentiate your business. In addition, fixation on rate can get grocers sideways with their customers, exacerbating the exodus to alternative channels.

Also, metrics on which incentives are based should capture true contribution to the business. For example, produce buyers should be compensated on total category margin dollars: sales minus cost minus shrink. Driving more volume isn't valuable to the company if shelf life is subpar, fresh perception is compromised, and shrink is excessive as a result.

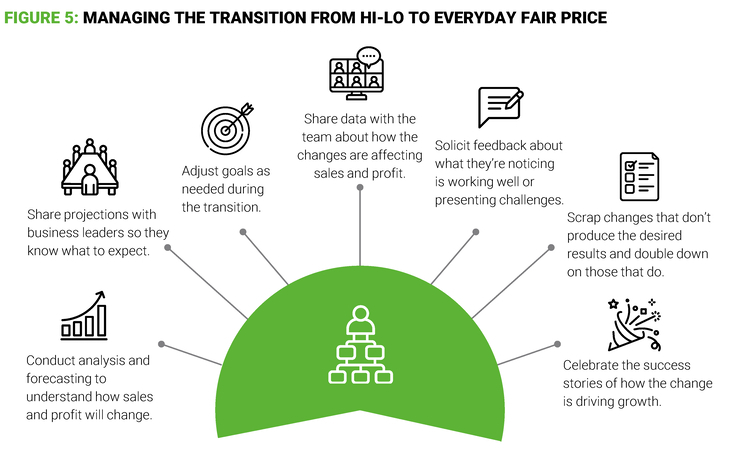

Change Management

For companies that make this move, fear of change will arise as a complicating factor both internally and externally. Team members will be nervous that pulling back on longstanding promotions will keep them from hitting their numbers. A segment of customers will worry because they have always associated frequent deals with value.

Time to Start Building

Any homeowner who has done foundation repair can tell you it's not a short, easy process. No one wants to spend time and money on a project that, to the rest of the world, is basically invisible. Yet anyone who has the wherewithal to fix such an issue does so because failing to invest now will mean disaster later. So it is with pricing strategy. What once was solid is no longer, and investment must be made to strengthen the foundation of the business.

Consumers have fundamentally changed how they shop, and grocers need to follow their lead.

Originally published by EnsembleIQ

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.