- within Employment and HR topic(s)

- in United States

- within Employment and HR topic(s)

- in United States

- within Finance and Banking, Energy and Natural Resources and Accounting and Audit topic(s)

Minimum Wage in Turkey: Latest Updates and Regulations 2024

The minimum wage in Turkey plays a critical role in determining the standard of living for millions of workers and impacts various sectors of the economy. Understanding how it is set, what factors influence it, and its broader economic implications is essential for employers, employees, and investors alike. This article provides a comprehensive guide to the minimum wage in Turkey, covering current rates, updates, and related legal considerations for emloyee' & emloyers.

What is the Minimum Wage in Turkey?

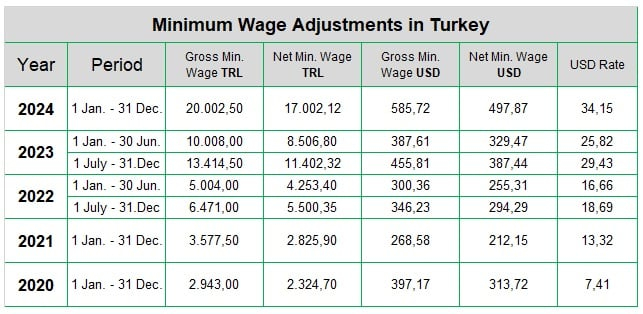

The minimum wage in Turkey refers to the lowest legally permissible wage that employers must pay their workers. The Ministry of Labor and Social Security anonse the rate, and it is revised periodically, typically once (in December) or twice ( in July & December) a year. This wage is intended to protect workers from exploitation and ensure they can meet basic living expenses.

How to Determine Minimum Wage in Turkey?

In Turkey, the decision regarding the minimum wage is made by the Minimum Wage Determination Commission. In the relevant commission, there are 3 different parties, each with one vote, including the employee, employer and state representatives. The clear determination regarding the minimum wage in Turkey is made in this commission. In order for the relevant decisions to be final in the commission, a majority vote is required instead of unanimity.

What is Minimum Wage in Turkey for 2024

As of 2024, the gross minimum wage in Turkey is TRY 20,002.50 per month, with a net take-home salary TRY 17,002.12 after deductions such as taxes and social security contributions. This rate reflects Turkey's response to inflationary pressures and cost-of-living increases. The minimum wage is reviewed biannually, meaning employers and employees can expect updates in both January and July.

Factors Influencing the Minimum Wage in Turkey

The minimum wage in Turkey is determined by several economic and social factors:

- Inflation Rate: Inflation has been a major factor in recent wage hikes, as the cost of living in Turkey has risen significantly.

- Economic Growth: Turkey's overall economic performance, measured by GDP growth, also impacts decisions on wage increases.

- Labor Market Dynamics: Unemployment rates and labor demand influence the minimum wage, as higher competition for jobs can lead to wage adjustments.

- Currency Fluctuations: The depreciation of the Turkish Lira against major currencies, such as the US Dollar and Euro, impacts workers' purchasing power, pressuring policymakers to adjust wages accordingly.

Legal Framework for Minimum Wage in Turkey

The Turkish government enforces strict regulations to ensure that all employees receive at least the minimum wage. Key legal aspects include:

- Wage Adjustments: Employers must adjust their workers' salaries in line with official minimum wage increases.

- Penalties for Non-Compliance: Businesses that fail to pay the minimum wage can face heavy fines and legal action.

- Sectoral Differences: While the general minimum wage applies across all sectors, some industries have sector-specific agreements that may offer higher wages.

- Overtime Pay: Turkish labor laws require overtime work to be compensated at 1.5 times the regular wage, ensuring that employees are fairly compensated for extra hours.

Minimum Wage and Employee Rights

In Turkey, minimum wage employees are entitled to various benefits beyond their base salary. These include:

- Social Security Contributions: Employers are required to pay social security contributions on behalf of their employees, ensuring access to healthcare and retirement benefits.

- Bonuses: Many Turkish companies offer bonuses on top of the minimum wage, particularly during religious holidays and the end of the year.

- Paid Leave: Employees on the minimum wage are entitled to paid annual leave, sick leave, and maternity/paternity leave, as per Turkish labor laws.

The Cost of Minimum Wage to Employers in Turkey

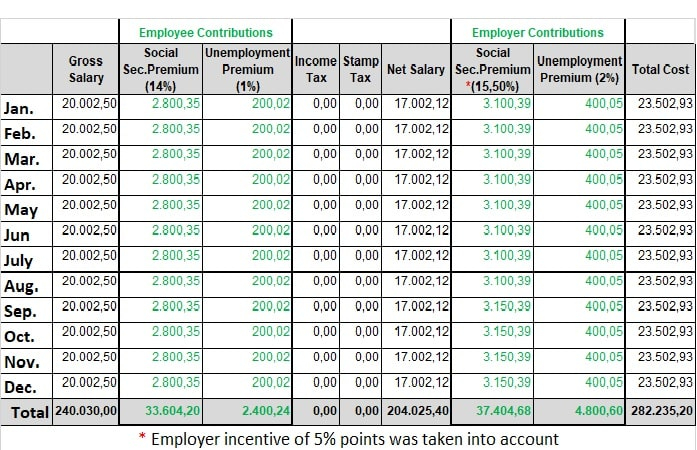

To calculate the employer's cost for the minimum wage, the gross minimum wage amount must be taken into account. This gross amount represents the wage before deductions for taxes, insurance, and union fees. For 2024, the gross minimum wage is set at TRL 20,002.50. When adding the employer's social security premium and unemployment insurance premium contributions, the total cost for an employee earning the minimum wage is determined. The factors considered in calculating the employer's total cost include:

| Gross Minimum Wage | : | TRL 20,002.50 |

| Social Security Premium (20.5% employer contribution) | : | TRL 4,100.51 |

| Unemployment Insurance Premium (2% employer contribution) | : | TRL 400.05 |

| Total Cost to the Employer | : | TRL 24,503.60 |

Note: In Turkey, employers who do not have any unpaid social security premium debts are provided with a 5% premium support by the treasury. With a 5-point treasury support, the total cost for the employer is reduced to TRL 23,502.94 . Thus, the cost of the new minimum wage for the employer amounts to TRL 23,502.94 , factoring in the gross wage, insurance premiums, and other legal requirements.

In 2024, with the gross minimum wage set at TRL 20,002.50 , the employer's total cost, including contributions, is calculated as TRL 24,503.60 . The 5-point discount lowers this amount to TRL 23,502.94 .

Impact of Minimum Wage on Businesses & Employers

For employers, especially those in labor-intensive sectors like manufacturing and retail, the minimum wage impacts operating costs. Employers must plan for annual or semi-annual wage adjustments to remain compliant. While these increases can raise operational costs, they also ensure a motivated and financially stable workforce, which can lead to higher productivity.

Some businesses may choose to automate or outsource certain tasks to mitigate the impact of wage increases. However, the government's regulations aim to strike a balance between maintaining a livable wage for workers and not overburdening employers.

Impact of Minimum Wage on Inflation and the Economy

Turkey's minimum wage increases can have inflationary effects, as higher wages typically lead to increased consumer spending, pushing demand for goods and services. However, this increased spending power is often balanced by inflationary pressures, especially in times of economic volatility.

The Turkish government uses minimum wage adjustments as a tool to stimulate the economy by boosting workers' purchasing power, which in turn drives consumer demand. This has broader implications for sectors such as retail, hospitality, and real estate.

Minimum Wage Adjustments in Turkey

How to Calculate Net Salary in Turkey

To calculate the net minimum wage (after tax and deductions), be uses the following steps:

- Start with the gross salary.

- Deduct income tax (ranging from 15% to 40%, depending on the salary bracket).

- Deduct social security contributions (14%).

- Deduct unemployment insurance premiums (1%).

The result will give you the net salary an employee takes home. For the current minimum wage of TRY 20,002.50 gross, the net salary is approximately TRY 17,002.12 after deductions.

Future Outlook for the Minimum Wage in Turkey

Looking ahead, the minimum wage in Turkey will likely continue to rise in response to inflation and economic conditions. The government has indicated its commitment to ensuring that the minimum wage keeps pace with the rising cost of living, while also balancing employer concerns about increased labor costs.

With Turkey's inflation rate being one of the highest in the region, businesses and workers alike should anticipate further adjustments in the near future.

Contact Us For Payroll Services in Turkey

The minimum wage in Turkey is a vital element of the country's labor market, influencing everything from consumer spending to business operating costs. For both employers and employees, understanding the legal requirements and staying informed about updates is crucial to navigating Turkey's evolving economic landscape.

By keeping track of wage adjustments and legal obligations, businesses can ensure compliance, and employees can secure their financial well-being.

A&M Danışmanlık A.Ş. is an accounting and tax consultancy firm specializing in providing end-to-end HR and Payroll Services to global investors and foreign entrepreneurs in Turkey with its expert team having SGK (Social Security Institution) careers.

We continue to provide cost-effective HR & Payroll consultancy services to global companies and individual entrepreneurs who want to enter the Turkish market smoothly and quickly, ensure full compliance with local legislation and facilitate their access to tax refunds.

FAQs About Minimum Wage in Turkey

What is the current minimum wage in Turkey for 2024?

The gross minimum wage in Turkey for 2024 is TRY 20,002.50 per month, with a net take-home salary of approximately TRY 17,002.12 after deductions.

How often is the minimum wage updated in Turkey?

The minimum wage is typically reviewed and updated twice a year, in January and July, to account for inflation and economic changes.

Who sets the minimum wage in Turkey?

The Minimum Wage Determination Commission is responsible for setting the minimum wage in consultation with trade unions, employer representatives, and government officials.

Does the minimum wage vary by industry in Turkey?

The general minimum wage applies across all sectors, though certain industries may have collective bargaining agreements that offer higher wages.

What deductions are made from the minimum wage in Turkey?

Deductions include income tax, social security contributions and unemployment insurance premiums.

Are employees on minimum wage entitled to overtime pay?

Yes, Turkish labor law mandates that overtime work be compensated at 1.5 times the regular wage.

How does inflation affect the minimum wage in Turkey?

Inflation plays a significant role in determining wage increases, as rising living costs often lead to wage adjustments to ensure workers' purchasing power.

What are the penalties for employers who don't pay the minimum wage?

Employers who fail to pay the minimum wage face fines, legal action, and may be subject to further penalties from labor courts.

Is the minimum wage different for part-time workers in Turkey?

Part-time workers receive wages based on the number of hours worked, but they must still be paid at least the hourly equivalent of the minimum wage.

What benefits do minimum wage employees receive in Turkey?

In addition to salary, employees are entitled to social security benefits, paid leave, severance pay, and other rights as per Turkish labor laws.

Can the minimum wage vary by region in Turkey?

No, the minimum wage is standardized nationwide, although living costs may vary from region to region.

How does the minimum wage impact business costs in Turkey?

For employers, especially in labor-intensive industries, minimum wage increases can raise operational costs, requiring financial planning for wage adjustments.

What is the impact of the minimum wage on Turkey's economy?

Increases in the minimum wage boost consumer spending but may also contribute to inflationary pressures, affecting overall economic stability.

Can an employer pay less than the minimum wage if agreed upon with the employee?

No, paying less than the legal minimum wage is prohibited, even if both parties agree, and doing so can result in fines and legal action.

How does the minimum wage impact foreign workers in Turkey?

Foreign workers in Turkey are entitled to the same minimum wage protections as Turkish citizens, with no exceptions based on nationality.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.