- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in European Union

- with readers working within the Metals & Mining industries

Trusts offer a tried and tested fiscal vehicle for those seeking to split the legal title and equitable rights to defined assets for specific purpose. The versatility of Trusts has meant that they have been utilised for over a thousand years in one form or another, continuing to this day.

Establishing a Trust in a foreign jurisdiction can offer additional benefits under the correct circumstances. In this short article, we take a look at the what, how and why of offshore Trusts.

What is a Trust?

It is important to understand that a Trust does not have separate legal personality and does not benefit from limited liability. A Trust is simply a Fiduciary arrangement.

A Fiduciary relationship is characterised as one of trust and confidence between two or more parties, where the Fiduciary is obligated to act in the best interest of another party.

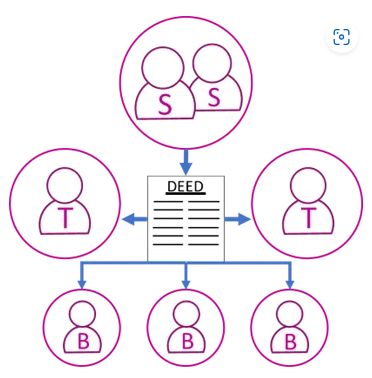

The Trust Deed sets out all of the key details of the Trust, including the three main parties:

- Settlor: The individual or entity that transfers assets into Trust and which make up the Trust Fund.

- Trustee: The Fiduciary appointed by the Settlor can be an individual or incorporated entity. The Trustee holds the legal title to the Trust assets and administers them in accordance with the Trust Deed. The role of Trustee can be demanding and incur legal liability, so choosing the right Trustee is vital. You can read more about the choice between Lay Trustees and Professional Trustees here.

- Beneficiary: Specific Beneficiaries or classes of Beneficiaries must be clearly identified within the Trust Deed. This party holds the equitable rights to Trust assets as defined within the Trust Deed. They are entitled to enforce any rights they have under the Trust against the Trustees.

You can read more in our introduction to Trusts here.

There are pitfalls to avoid when it comes to Trusts, but many of these can be avoided by appointing a good quality Professional Trustee. You can read more about best practices and some of the most common pitfalls here.

Discretionary Trusts

There are many types of Trusts used in offshore planning, but the Discretionary Trust is by far the most commonly utilised. The Discretionary Trust's defining features include:

- The Settlor can only select Beneficiaries or classes of Beneficiaries (e.g. children of the Settlor), that have the potential to benefit from the Trust. Beyond this, they have no control over how, when, or to whom distributions are made.

- The Settlor can provide a Letter of Wishes throughout their lifetime, which provides the Trustees with additional insight into the Settlor's intentions. This can be updated regularly. For instance, setting out how they would like the Trust Assets to be distributed. It is important to note that the Letter of Wishes is persuasive but not legally binding.

- As broad classes of Beneficiary tend to be named, and none have fixed entitlements, Trustees can exercise a wide discretionary power, so that they can consider additional Beneficiaries, such as future generations.

- The Trustees have complete discretion regarding distributions. This empowers the Trustees to consider Beneficiaries' personal circumstances e.g. to manage tax liabilities, protect vulnerable Beneficiaries, provide for education or medical treatment etc.

- It is important to understand that whilst the Trustees have complete control over the Trust assets, the income generated and distributions, their actions must still be compliant with the Trust Deed and in line with their duties e.g. to always act in the best interests of the Beneficiaries.

These qualities make the offshore Discretionary Trust a mainstay for Estate and Succession planning and asset protection, for instance, where HNWI's and their families are moving to the UK or another Common Law jurisdiction.

You can read more about the types of offshore Trust available here.

Why are Offshore Discretionary Trusts Used?

Discretionary Trusts are used for a huge variety of purposes. Settlements can include any number of asset types settled, including Cash, Property, Shares, Land etc. Often the Discretionary Trust forms part of planning for:

- Asset Protection

- Estate Planning

- Succession Planning

- Wealth Management

- Family Affairs e.g. Provision of School Fees or for vulnerable Beneficiaries

- Corporate Structuring e.g. Employee Benefit Trusts or Pension Vehicles

- Tax Planning e.g. UK Prearrival Planning

- Privacy

- Charitable or Philanthropic Objects

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.