- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Transport industries

Advance Subscription Agreements (ASAs) and Convertible Loan Notes (CLNs) are two popular investment instruments used by venture capital funds, high-net-worth individuals, and family offices to invest in emerging companies. ASAs and CLNs are most commonly used to 'bridge' to larger equity funding rounds, providing companies with quick access to cash to support their growth. Despite serving a similar purpose, ASAs and CLNs possess distinct legal, financial, and structural differences.

Advance Subscription Agreements

What are ASAs?

ASAs are agreements under which investors commit funds to a company in exchange for shares to be issued and (usually) priced at a future date, typically in a larger funding round, company sale, or at a predetermined longstop date (collectively known asqualifying triggers).

ASAs often offer investors a discounted share price compared to that paid by participants in the subsequent funding round, providing an incentive for early commitment. Unlike CLNs, which may be repaid by the company, funds invested through an ASA are always converted into equity.

In the United States, ASAs are known as SAFEs, and were developed by the renowned Y-Combinator accelerator as a simple way for early-stage start-ups to raise money.

How are ASA shares valued?

Shares issued under an ASA will usually be priced in the event of a qualifying trigger rather than agreed up-front. For example, if shares are issued following a funding round, the issue price will ordinarily be the subscription price, less a pre-agreed discount for the advanced subscription (typically around 20%), and is also often subject to an agreed valuation cap (meaning the issue price is 'capped' even in the event of a high valuation raise).

However, if the ASA converts at the longstop date, the share issue price will need to be agreed between the investor and the company (perhaps using a previous investment valuation), or determined by a valuation expert.

How complicated are ASAs, and how quickly can they be implemented?

As ASAs do not typically include extensive warranties or pre-agreed share valuations (as above), the legal documentation required to implement an advanced subscription for shares can be relatively simple and quickly implemented; saving valuable time and cost.

What other terms are commonly included in ASAs?

(1)Information rights - allowing investors valuable insights into the company's business development, sales and accounting information on a monthly or quarterly basis.

(2) Pre-emption rights-providing investors with the option to participate in future funding round(s) pro-rata to their 'as converted' shareholdings. This is often a (tax driven) requirement for US investors.

SEIS/EIS Eligibility

ASAs can offer UK-based SEIS/EIS funds and high-net-worth individuals (HNWIs) with the additional benefit of being SEIS/EIS eligible, provided that certain qualifications are met. These include:

- the shares issued must be 'full-risk' ordinary shares without any preference rights;

- the shares must be issued within 6 months of the date of the agreement;

- the advanced subscription funds must not benefit from interest; and

- the ASA must not be able to be cancelled, varied or assigned.

In almost all circumstances, the company will seek (and the investors will demand) advanced assurance from HMRC that the investment is SEIS/EIS eligible.

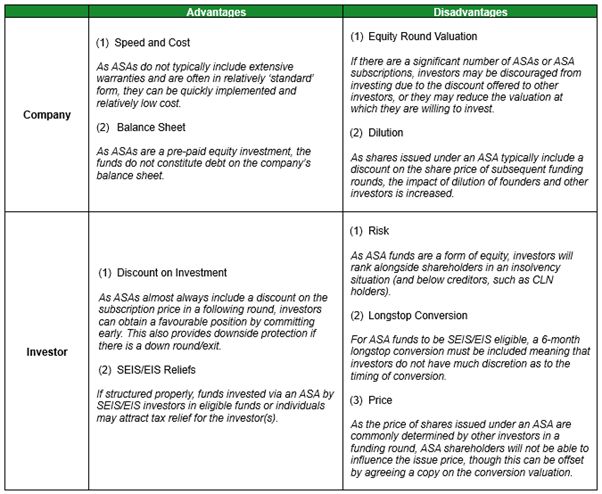

Advantages and Disadvantages of ASAs

Convertible Loan Notes

What are CLNs?

CLNs are short-term debt instruments that include the option for the debt funds to be converted into equity at some point in the future, typically in an equity funding round, IPO or sale, or repaid in cash (plus interest) at a pre-agreed longstop date. Similar to ASAs, should the CLN be converted into equity, the investors will usually receive a discounted share price compared to that paid by participants in a subsequent funding round.

Unlike ASAs, however, should the CLN funds not convert to equity by a specified longstop date, the CLN may have to be repaid in cash (plus interest), and, in the event of insolvency, the lender will rank as a creditor (meaning they will be repaidbeforeshareholders ).

How are converted CLN shares valued?

As above with ASAs, typically at a discount a future valuation (discounts are generally around 20%) with a valuation cap.

It is also important to remember that (unlike ASAs) interest will be due on the CLN funds, meaning that the lender will convert their committed capitalplusinterest at whatever valuation is achieved; this will have a dilutive effect on other shareholders.

What is the 'standard' interest payable on CLN funds?

As with all lending, the interest payable on CLN funds will vary depending on a multitude of factors, such as market interest rates, business risk and the urgency of funding, however, rates between 5% and 15% are common. As CLNs provide lenders with the additional benefit of converting at a discount in the future, the interest rate charged under a CLN may be less than a traditional (or venture debt) lending arrangement.

How complicated are CLNs, and how quickly can they be implemented?

Similarly to ASAs, as CLNs do not typically include extensive warranties or pre-agreed share valuations (with CLN lenders also typically benefitting from terms negotiated at a following funding round), the legal documentation required to implement a CLN is usually straightforward and can be negotiated and agreed quickly.

The legal documentation becomes more complicated if the CLNs are to be secured, although this is less common with venture capital investors and early stage companies.

SEIS/EIS Eligibility

As the structure of CLNs typically breach several of the SEIS/EIS eligibility criteria outlined above, they do not qualify for tax relief under either scheme from HMRC. However, this does not necessarily diminish their appeal to investment funds or HNWIs, especially if the company or investors have already exhausted their available SEIS/EIS reliefs.

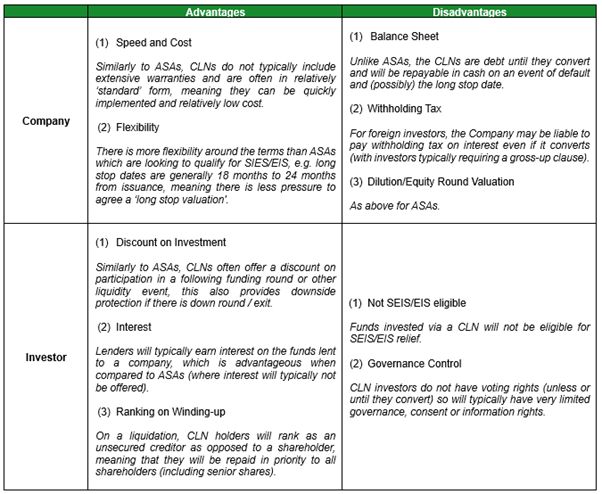

Advantages and Disadvantages of CLNs

Final thoughts

ASAs and CLNs offer companies fast and cost-effective mechanisms for raising capital - particularly when short-term liquidity is needed to bridge the gap to a full equity financing round. Their streamlined structure and relative simplicity make them attractive options for early-stage businesses seeking to delay the complexity and time demands of a priced equity round.

For companies, these instruments can provide breathing room to secure investors or finalise valuation negotiations without immediate dilution. For investors, they offer a way to participate in a company's growth with the potential for upside of obtaining favourable terms in a future funding round.

While neither ASAs nor CLNs are without risk, their flexibility and speed continue to make them popular tools in the startup financing landscape, especially in volatile or time-sensitive fundraising environments.

Hunters Corporate and Commercial

Hunters' Corporate and Commercial department has extensive knowledge and experience advising founders and investors in early-stage companies. Get in touch to discuss how to best structure your company and protect your investments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.