- within Immigration, Media, Telecoms, IT, Entertainment and Intellectual Property topic(s)

- in Europe

For years, high-net-worth individuals (HNWIs) and global professionals have pursued favourable tax jurisdictions and second residencies. But for many, their priorities have evolved. Today, relocation isn't just about tax - it's about lifestyle security, geopolitical stability, and smart positioning for the future. Malta delivers all of this with subtlety, substance, and sun.

Recognising this shift, CSB Group has become the trusted advisor for families seeking more than just a residency - but a refi ned, intentional way of living. With deep local expertise and a bespoke, client-first approach, CSB Group helps global families navigate Malta's opportunities with clarity and confidence.

Malta's appeal extends far beyond its climate and coastline, where relocation is not about fleeing, but about choosing. Malta is a country where English is widely spoken, education and healthcare adhere to rigorous EU-standards, personal safety is a quiet constant, not a headline concern and business operates within a transparent, EU-compliant framework. For global citizens, Malta represents more than a practical move – it is an intentional investment in lifestyle, structure and legacy where family and lifestyle are positioned to thrive.

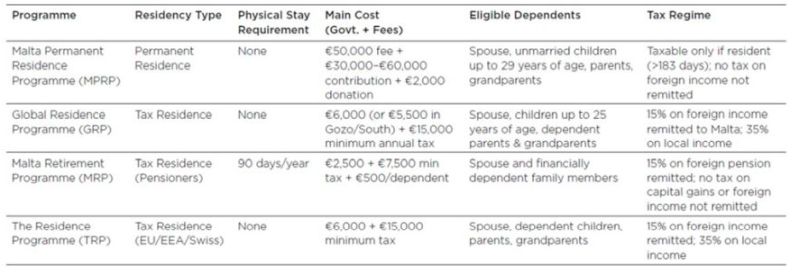

At the heart of this is a residency system that combines clarity with flexibility, offering families the certainty they need and the freedom they desire through the Malta Permanent Residence programme (MPRP).

The MPRP, a highly sought-after residency by investment programme, is designed for individuals who value long-term EU access, without the burden of mandatory relocation or bureaucratic complexity.

Key features of the MPRP are:

- Permanent residence from day one;

- No physical stay requirement;

- Tax Residency only if you spend more than 183 days within a given calendar year;

- Access to the Schengen area; and

- Fixed financial contribution and real estate thresholds.

Unlike other programs with shifting timelines or unclear permanence, Malta offers a clear path with no performance-based obligations.

For families managing multi-jurisdictional wealth, Malta's tax system is a strategic advantage. Its straightforward tax regime enables families to maintain control over global financial structures, without sacrificing compliance or clarity. Some of the most prominent tax advantages include:

- Remittance-based taxation: Only pay tax on foreign income brought into Malta;

- Flat 15% rate under special programmes like the Global Residence Programme (GRP) or Malta Retirement Programme (MRP);

- No tax on foreign capital gains, even if remitted; and

- No wealth, inheritance, or municipal taxes.

This approach provides planning flexibility for families and family offices who want to optimise their global structures.

These advantages continue to attract international families who value Malta's unique combination of strategic location, regulatory clarity, and lifestyle excellence. Together, these elements create a setting where wealth, family, and future ambitions are positioned to grow in harmony. Some of the key demographics of those flocking to Malta's shores include:

- UK nationals post-Brexit looking for a stable EU base;

- South African entrepreneurs seeking a family-friendly tax regime;

- Middle Eastern and Asian families who want English-speaking education without the pressure of full-time relocation; and

- US nationals seeking EU residency with tax transparency, investment flexibility, and long-term peace of mind.

For families with global footprints, the seamless integration of legal certainty and lifestyle quality is paramount and Malta delivers both. The country's residency model imposes no lifestyle restrictions, allowing families to maintain full international mobility while benefiting from secure EU access and the credibility of a well-established, rules-based system.

There is no requirement for full-time residence, no hidden obligations, and absolute clarity around the permanence of status. This transparency is crucial for families planning across generations, not just financial years. Malta offers a strategic home base that safeguards privacy, facilitates long-term succession planning, and supports effortless integration into European life.

For those looking beyond the typical brochure, Malta offers

enduring substance and strategic foresight. CSB Group combines deep

local knowledge with international expertise to guide families

through the residency application process. With a focus on

discretion, efficiency, and tailored support, to help you navigate

every stage with clarity and confidence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.