It is a recognised principle that wealth-creating assets may well rest on Intellectual Property (IP) rights, as all companies have them, but few exploit them to their fullest extent. IP rights derive from the legal system and include registered rights, trade marks, etc.

IP rights give more value to businesses. When forming an IP Company, proper due diligence is essential in order to identify all possible IP rights that may exist. The next step is the very important consideration of finding the most suitable jurisdiction for the IP Holding Company. The jurisdiction in question must offer a wide range of agreements for the avoidance of double taxation (DTT) so that IP rights can be exploited in a number of countries. In addition, due to the DTT a favourable withholding tax (WHT) if any will be imposed on the royalty income that the IP Holding Company is entitled to receive. Above all, however, the country of tax residence of the IP Holding Company must offer a beneficial tax regime.

There is no perfect jurisdiction for an IP Company. Each case should be assessed on its own merits as all jurisdictions offer advantages and disadvantages. What a skilled tax advisor should do is to ensure that the benefits his/her client receives exceed the costs to the greatest possible extent.

Cyprus, is a jurisdictions that offers many more advantages rather than disadvantages.

Taxation of Royalty Income

Taxation of royalty income is regulated by the Income Tax Law 118(I)/2002 (as amended), in accordance with which the Cyprus IP Company will be subject to WHT if it receives royalty income from the use of intellectual property in Cyprus.

In most cases however, when a Cyprus IP Company is used for the purposes of international tax structures, the IP rights are not used in Cyprus, but they are used outside the territory of the country. If the IP rights are not used in Cyprus, no WHT will be imposed in Cyprus when the Cyprus IP Company, in its capacity as sub-licensee, proceeds with making a payment from the sublicensing of the IP rights to the licensee located abroad.

The House of Representatives passed the amendments to the aforementioned Income Tax Law in May of 2012. These new amendments amongst all, intend to establish Cyprus as a favourable jurisdiction for IP rights, by creating an appealing tax regime for an IP company.

The amendments to the law provide that 80% of any income generated from IP rights will be exempt from Corporate Income Tax (CIT); therefore only 20% of the profits generated from IP rights (royalties) will be subject to CIT at the rate of 10%.

This tax treatment is also applicable to any profit made from the future sale of the IP rights.

Furthermore, the law permits the deduction of all expenses resulting from the production of the royalty income, so, the amount to be paid may be reduced even further.

With regard to capital expenditure it should be noted that the Cyprus IP Company will be able to write off any capital expenditure for the purpose of the acquisition or development of the IP rights. Such a write off will be permitted for the initial five years of use. Straight line capital allowances at the rate of 20% will be applicable for the first five years of use. Consequently, a Cyprus IP Company will effectively be liable to a maximum tax of 2%, as it is only taxed on 20% of its profits in case of royalty income.

The amendments to the law have come into force on 6 July 2012 and have a retroactive effect as of 1 January 2012.

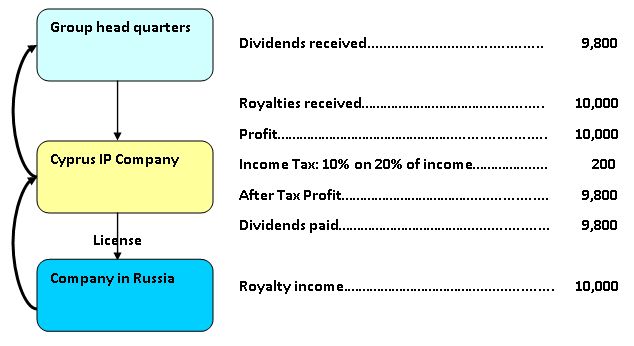

The benefits gained when using a Cyprus IP Company are shown in the illustration below, which uses Russia as an example.

The illustration shows an initial royalty income of €10,000 before any taxes are imposed. We have indicated that the Cyprus IP Company has gained a profit of €10,000 from licensing the IP rights. Applying the favourable tax regime, the Cyprus IP Company will be liable to an amount of € 200 tax on the royalty income. It will then distribute its profits by way of dividends to the Group headquarters, free of any WHT in Cyprus.

As noted, the right jurisdiction for an IP Company needs to offer a range of treaty network as well as the lowest possible tax. Cyprus satisfies all the requirements of a very beneficial IP Company jurisdiction; a non offshore jurisdiction that offers a flat tax rate of 10% only on 20% of the royalty income. Moreover, Cyprus has an extensive DTT network with leading countries as well as with the emerging economies. To be more precise Cyprus has signed treaties with the G20 countries (USA, France, UK etc), with the former Eastern Bloc countries (Ukraine, Azerbaijan, Armenia etc), with the EU countries, and the BRICs (Brazil, Russia, India, China) as well as with the countries of the Arab World (UAE, Egypt etc). Cyprus has over 46 treaties that are currently in force.

Eurofast's Take

Tax complexity arises when a company is involved in international operations, due to their multi-jurisdictional nature. With the correct structuring however, international operations will offer greater flexibility. When it comes to IP rights the lowest possible tax makes a Cyprus IP company one of the best tax planning tools in the hands of a tax advisor in the area of IP rights.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.