- within Tax topic(s)

- within Tax, Employment and HR and Finance and Banking topic(s)

- with readers working within the Insurance industries

A. Introduction

1. Circular E.2094/2025 (the Circular) provides guidelines for the imposition of a Digital Duty on Transactions (DDT) in accordance with the provisions of Law 5177/2025 (the DDT Law).

B. Key Provisions of the New Law

1. Exemptive provisions concerning the imposition of stamp duty remain in force and going forward are to be construed as exemptions from the DDT.

2. DDT is imposed on transactions/acts, whether executed in written form, electronically or evidenced in any other manner, indicatively, written agreements or contracts between the parties, receipts of payment or collection and accounting entries in accounting records (books) provided for by Law 4308/2014.

3. DDT is imposed irrespective of the place where the transaction was carried out or the place where the contract was executed or performed. Specifically, it is imposed on:

a. transactions under Articles 6–20 of the DDT Law, where at least one of the contracting parties is a Greek tax resident or has a permanent establishment in Greece subject to the provisions of relevant Double Tax Treaties, provided the transaction relates to the activity of the permanent establishment in Greece;

b. transactions under Articles 21–28 of the DDT Law with the State and entities of the General Government;

c. acts under Article 29 of the DDT Law relating to the issuance and renewal of the licenses and relevant documents.

4. Contracts, transactions and acts subject to the following legislation are excluded from the imposition of the DDT:

a. the Value Added Tax (VAT) Code;

b. the Property Taxation Code;

c. the Capital Concentration Tax; and

d. the Motor Vehicle Transfer Tax.

5. The imposition of the above taxes/duties excludes the imposition of the DDT, even in cases where contracts, transactions or acts fall within the scope of the above laws but are exempted from those taxes.

6. Significant transactions previously subject to stamp duty are exempted from the DDT, such as loans for use (χρησιδάνειο) and increases in capital of non-profit legal persons or entities.

C. Liability for Declaration and Payment of the DDT

1. Specific criteria are examined in order of priority to determine who is obliged to remit the DDT:

a. Where a party to the transaction is a tax resident abroad without a permanent establishment in Greece, the DDT is remitted by the contracting party who is a tax resident of Greece, even if they would not normally be subject to the DDT.

b. Where the transaction involves a legal entity and a natural person, the DDT is remitted by the legal entity, provided that it is a tax resident of Greece or maintains a permanent establishment in the country.

c. Where the transaction involves a self-employed professional operating a sole proprietorship and a private individual, the DDT shall be remitted by the professional.

2. In all other cases, the person liable for remittance is the recipient of the monetary consideration or the beneficiary of the transaction. Where the contracting party is the State or an entity of the General Government, the liable party is the counterparty, subject to certain exceptions where liability is assigned to the State or the General Government entity.

3. The allocation of the payment is determined by agreement between the contracting parties, irrespective of who is subject to the DDT or who remits it, with the exception that no agreement may impose the burden upon the State, entities of the General Government or the Deposits and Loans Fund.

D. Refund of the DDT

1. The DDT is refunded in the following cases:

a. initial undue payment; and

b. non-performance of the transaction due to unforeseen change of circumstances.

E. General Principles

1. DDT is imposed exclusively on acts and transactions expressly stipulated in the law.

2. Where an ancillary agreement is executed for the purpose of securing the principal contract, as well as in the case of a penalty clause, the DDT shall be imposed only if it has not been paid for the principal contract, although it was in principle due, applying the rate of the principal contract.

3. If the principal contract does not fall within the scope of the DDT or is exempt from it, no DDT is imposed on the ancillary agreement.

4. Where the ancillary agreement secures an amount greater than that of the principal contract (which falls within the scope of the DDT), the DDT is levied on the difference.

5. The DDT is imposed in all cases at a rate of 3.6% on the registration of a mortgage or conversion of a prenotation into a mortgage on immovable property pursuant to law or judicial decision, irrespective of whether the underlying relationship was subject to or exempted from the DDT, or subject to another tax.

6. Where multiple contracts are incorporated into the same document, DDT is levied on each of them individually.

7. In the case of a contract modifying a prior contract before its expiration, DDT is imposed only on the amount by which the economic value of the original contract is increased. The modification of an expired contract constitutes a new contract. The same treatment applies to modifications of original contracts which were subject to or exempt from stamp duty or outside its scope, and which, at the time of modification, fall within the scope of the DDT.

F. Lease of Real Property

1. DDT of 3.6% is imposed on commercial leases of real property calculated on the agreed rent where the lease is used for business activity, is not subject to VAT and the property is located in Greece.

2. DDT is remitted through the income tax return of natural or legal persons or entities in conjunction with the completion of the detailed statement of real property leases for the relevant tax year. For the 2024 tax year only the agreed rent for December is subject to DDT.

3. DDT also applies to leases of warehouses or parking spaces when used for business purposes.

4. Where part of a residence is used for the lessee's business needs, DDT is imposed on the corresponding proportion of the rent.

5. In the case of sublease of a residence, the initial lease is examined independently as to its liability to DDT.

6. DDT is not imposed on residential leases or leases of warehouses or parking spaces when these form part of the residence.

7. The exemption also covers cases where a business leases a residence to provide housing for its employees.

8. The individual lease of a warehouse or parking space by a private individual is not subject to DDT.

9. Liable parties declare rent in their income tax return for the imposition of DDT even if they are exempt from income tax, and in the event that a tax credit balance arises, the DDT is offset against such balance.

G. Loans

1. DDT is imposed on:

a. loans subject to interest or interest-free;

b. credits of any kind assimilated to loans, including credit cards, but not generally on every form of credit, such as financial leasing agreements, factoring contracts, derivatives, repos, securities lending or sales on credit, which fall within the scope of VAT or other taxes; or

c. conversion of the total outstanding debt arising from a loan agreement (principal and interest) into a new loan, provided that the original loan was not subject to DDT or was lawfully exempted from it, with the DDT calculated on the entire amount of overdue obligations, namely principal, interest and any expenses capitalized.

2. The capitalization of contractual interest is subject to DDT as it constitutes part of a new principal amount.

3. The above cases under 1 and 2 are exempt from DDT:

a. Where the lender or borrower is a credit institution, a payment institution under Law 4537/2018, an electronic money institution under Law 4021/2011, or a credit servicer under Law 5072/2023 duly licensed or supervised by the Bank of Greece. The exemption also covers documentary credits.

b. Bond loans issued under Law 4548/2018 by a company established in a country within or outside the EU/EEA/EFTA are exempt from the DDT, pursuant to the general principle of EU law on the free movement of capital between Member States of the European Union and between Member States and third countries (Article 63 TFEU). The DDT does not apply regardless of the registered seat of the issuing company, the governing law of the bond loan, or the registered seat of the credit or financial institution granting the loan.

c. Where the lender is a foreign bank within the meaning of Article 36 of Law 3220/2004.

d. Where a loan is obtained by a legal person and the amounts are paid to its permanent establishment abroad for the needs of its activity, provided that the transaction relates to the activity of such permanent establishment.

4. No DDT is imposed on loans granted by insurance companies under life insurance policies.

5. Amendments to loan agreements are not subject to DDT, provided that the principal amount is not increased and the original contracting parties remain unchanged.

6. The rate of the DDT depends on the type of loan:

a. for loans between natural persons engaged in business activity or involving a company, where the purpose is business-related, the rate is 2.4%; and

b. for all other cases, including loans between natural persons for non-business purposes, the rate is 3.6%.

7. In a loan agreement, DDT is calculated on the contractual amount and must be remitted by the end of the following month, irrespective of the time of disbursement of the loan.

8. In the case of open credit facilities, where each drawdown is deemed a separate loan, the DDT declaration is submitted by the end of the month following each drawdown.

9. Where loan amounts exceed the agreed amounts, DDT is calculated on the total amount including the excess portion, which must be declared and remitted by the end of the month following its disbursement.

10. Contractual interest paid up to 30 November 2024 is subject to stamp duty.

11. For contractual interest paid from 1 December 2024 onwards, no DDT is imposed as such interest is outside the scope of the law.

12. DDT imposed may not exceed €150k per loan. Where more than one contract is executed under the same instrument, this limit applies separately to each contract. The same applies to open credit facilities up to a specified credit limit, with the DDT cap of €150K applying per drawdown.

13. Borrowers are liable to declare and remit DDT.

H. Current Account / Mutual Accounts

1. DDT up to the limit of €150k is imposed on loans operated as current or mutual accounts, whereas loan or mutual accounts in which one of the contracting parties is a credit institution or a foreign bank are not subject to DDT.

2. DDT is calculated for each tax year on the greater debit or credit balance of the account, taking into consideration only transactions in the same year and not balances carried forward from previous years. Interest accrued on the current account is not included in the calculation of the highest debit or credit balance.

3. The concept of credit also includes the concentration of a group's cash reserves into a single account (cash pooling), which is subject to DDT depending on the type of transaction (loan, withdrawal/deposit, current account).

4. The DDT 2.4% rate applies to loan current accounts where all contracting parties are natural persons engaged in business activity and the account is used for their business activity, or where one of the contracting parties is a company (domestic or foreign). The same rate applies to transactions between a company and its shareholders or partners.

5. In all other cases, the DDT 3.6% rate applies.

6. DDT must be remitted by declaration within the first month following the preparation of the financial statements of the tax year in which the balance arose, and in any event no later than seven months after the end of the year.

7. Contracting parties in whose books the credit balance appears are liable to declare and remit DDT (subject to exceptions where the contracting party is the State or the Deposits and Loans Fund).

I. Deposits and Withdrawals

1. DDT is imposed on deposits and withdrawals to and from legal persons and entities, carried out by partners, shareholders or other persons, provided that these withdrawals do not constitute profit distributions during the fiscal period, and subject to the condition that the deposits or withdrawals are not made under a specific agreement. This provision covers deposits or withdrawals evidenced solely by entries in accounting records or by an equivalent document (eg bank account statement – Extrait).

2. Where withdrawals by shareholders or partners during the year exceed the profits attributable to them, the difference is subject to DDT and must be remitted by the end of the month following approval by the General Meeting.

3. Deposits made by shareholders, partners or third parties for a future capital increase are not subject to DDT, provided that the amounts are used exclusively for that purpose.

4. The DDT rate for deposits and withdrawals is 1.20% for capital companies or partnerships (domestic or foreign) and 3.6% for all other legal entities.

5. DDT is borne and remitted by the legal person or entity whose funds are deposited or withdrawn. Where the transaction is carried out between two legal persons or entities, the liable party is the recipient or beneficiary of the monetary consideration.

6. No DDT is imposed on deposits or withdrawals made to licensed and supervised credit institutions, payment institutions or electronic money institutions regulated by the Bank of Greece, as well as on foreign banks pursuant to Law 3220/2004.

J. Sale of Movable Property or Intangible Assets

1. Sales of movable property are subject to DDT, provided that such transactions do not fall within the scope of VAT.

2. The DDT rate is set at 2.4% where at least one of the contracting parties is a company or partnership (domestic or foreign). A rate of 3.6% applies in all other cases. In sales of vessels or ships by private individuals outside the scope of business activity and outside the transfer tax regime, the DDT rate is always 2.4%.

3. Sellers of moveable properties are liable to DDT. Where the seller is a tax resident abroad without a permanent establishment in Greece, or a private individual transacting with a person engaged in business activity and constituting an entity under Article 1 of Law 4308/2014, the liable party becomes the purchaser.

4. Where an obligation arises for withholding and remittance of income tax, DDT is remitted simultaneously and through the same procedure as the declaration and payment of the withheld tax.

5. No DDT is imposed on the following sales:

a. shares and securities sales of all types of shares, partnership interests of any kind in companies and associations, founders' shares, bonds, coupons and other securities, as well as banknotes and any other form of money constituting legal tender in the place of issuance, together with all negotiable instruments, whether registered, bearer or order instruments;

b. sales of ships under the Greek flag, provided that their transfer is subject to transfer tax; and

c. sales of motor vehicles and motorcycles of any category and use (passenger cars, trucks and buses), provided that the sale falls within the scope of VAT or the vehicle transfer duty.

K. Transfer of Business

1. DDT is imposed on the transfer of a business (provided that the transaction lies outside the scope of VAT) where such transfer is effected for consideration, whether as a whole, in part, as a branch, or as a division of a branch of a business. DDT also applies to the transfer for consideration, of passenger vehicles, trucks, buses and motorcycles for public use together with their operating licenses, provided that they are independently used for the conduct of a business engaged in the transport of persons or goods.

2. No DDT is imposed in the following cases:

a. where the transfer of a business is effected to cover a contribution to the share capital of a legal person or entity (as such transaction falls under the regime of Capital Concentration Tax);

b. where the transfer of a business is effected gratuitously; and

c. where the transfer occurs in the context of business transformations.

3. The DDT rate is set at 2.4% on the consideration for the transfer or on the net equity of the transferred business, where such net equity exceeds the consideration for the transfer.

4. The transferor of the business, is liable to DDT unless otherwise agreed with the purchaser.

L. Distribution of Inheritance, Legacy and Common Property

1. DDT is imposed on contracts of voluntary and partial distribution of inheritance, legacy or common property that include movable assets located in Greece or abroad, as well as immovable property located abroad, and on distributions effected through the sale of common movable property by public auction.

2. The DDT rate is 2.4% where the distributed property includes movable assets (in Greece or abroad) or immovable property abroad. The DDT rate is 3.6% in all other cases.

M. Other Contracts Subject to the DDT

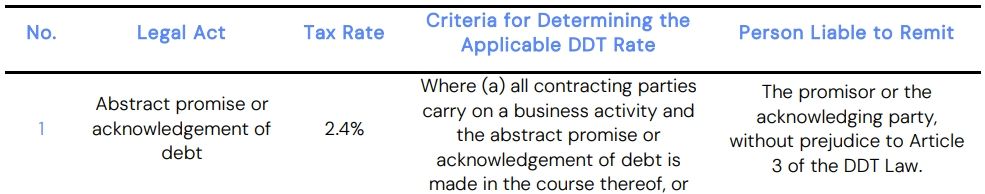

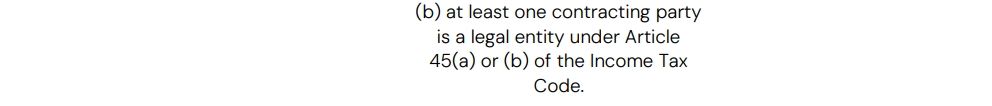

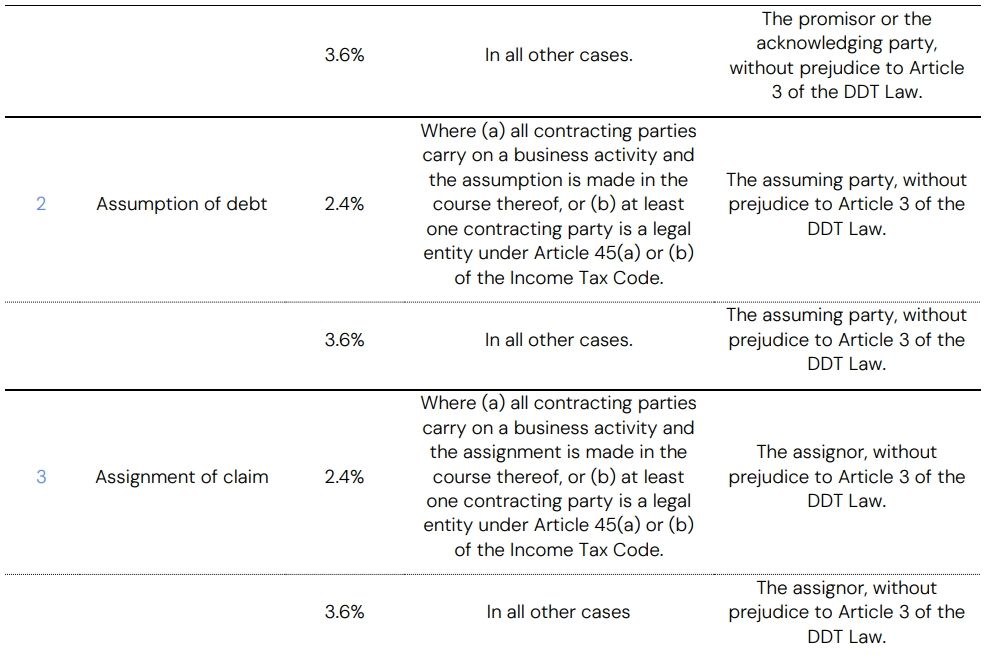

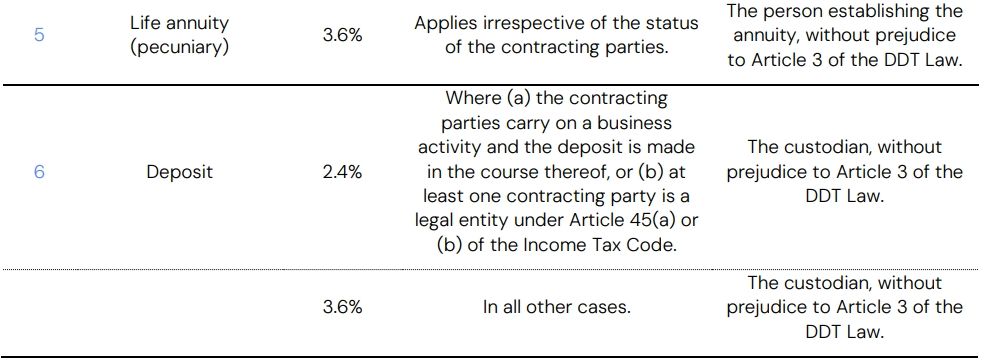

1. The DDT is levied separately on the following contracts:

2. All the above contracts are subject to DDT, irrespective of any prior liability, exemption or taxation of their economic object under the DDT, VAT or any other tax.

3. Contracts of assignment of claims and assumption of debt are subject to DDT, provided that such contracts do not fall within the scope of VAT or the Property Tax Code.

4. Only assumption of debt on a depriving basis falls within the scope of the DDT, while cumulative assumption of debt does not.

5. DDT is imposed in the case of simple deposit (παρακαταθήκη), specifically on the fee paid to the custodian, provided that the custodian is not subject to VAT.

6. Where no fee is agreed, no DDT is due.

N. Settlement Agreements

1. DDT is imposed on settlement agreements for a monetary amount agreed to be paid, calculated on the agreed amount and not on the originally claimed amount.

2. DDT is also payable where the claims subject to settlement arise from transactions under the VAT regime or another tax.

3. In the case of settlement agreements involving mutual counterclaims, each settlement act concerning each claim is examined separately.

4. The DDT rate is 2.4% where the parties are engaged in business activity or where at least one contracting party is a capital company or partnership (domestic or foreign). In all other cases, such as between private individuals or between a private individual and a sole proprietorship, the rate is 3.6%.

5. The debtor of the claim being settled is liable to DDT and responsible for its remittance.

O. Compensation

1. DDT is imposed on all compensations, including those awarded by court decision, when paid to or by:

a. a natural person who is a tax resident of Greece;

b. a legal person that is a tax resident of Greece, except where the funds relate to its permanent establishment abroad and activities thereof; and

c. a permanent establishment in Greece of a foreign legal person.

2. No DDT is imposed in the following cases:

a. on insurance compensation and any related payments made by an insurance undertaking for insurance of any kind, on the contractual interest arising therefrom, as well as on settlements relating to such compensations;

b. on compensation paid by the Auxiliary Fund (Επικουρικό Κεφάλαιο) to beneficiaries of liability insurance arising from the circulation of motor vehicles;

c. on payments of compensation for work-related accidents or due to termination of employment;

d. on compensation paid by the State or entities of the General Government to property owners for the expropriation of their immovable property;

e. on compensation received for expropriated or re-zoned immovable property by heirs or donees; and

f. on compensation or allowances paid, either in lump sum or periodically, by an insurance fund or organization due to the death of the insured, as such payments fall within the scope of the Property Tax Code.

3. DDT is calculated on the amount of compensation paid at a rate of 3.6%, which applies in all cases.

4. The recipient of the compensation (subject to the criteria set out above) is liable to file the declaration.

5. In cases where compensation is paid by or to the State or an entity of the General Government, the party liable for remitting the DDT is the payer of the compensation, while the burden of the DDT falls on the counterparty of the State or the General Government entity.

P. Remunerations

1. DDT is imposed on remunerations corresponding to monetary consideration paid as compensation for services rendered, where such services are not provided within the framework of dependent employment and do not fall within the scope of the VAT Code.

2. DDT applies when such remunerations are paid by:

a. a natural person who is a tax resident of Greece;

b. a legal person that is a tax resident of Greece, except where the monetary consideration is attributed to a permanent establishment of such legal person abroad and is connected with the activity of that permanent establishment; or

c. a permanent establishment in Greece of a foreign legal person.

3. Remunerations include those paid to members of the boards of directors of Sociétés Anonymes (SAs), to administrators of limited liability companies (ΕΠΕ) and private companies (ΙΚΕ), as well as to cooperatives, associations and clubs.

4. Remunerations paid in the form of profit distributions are not subject to DDT.

5. DDT is calculated on the full amount of remuneration, without deduction of withholding income tax.

6. The DDT rate is 1.2% for:

a. remunerations paid to members of boards of directors of SAs, administrators of limited liability companies (ΕΠΕ), private companies (ΙΚΕ), cooperatives, associations and clubs;

b. business remunerations of general partners and co-owners;

c. remunerations paid by the State and entities of the General Government for participation in councils and committees; and

d. remunerations received by mayors, deputy mayors and presidents of municipal councils.

7. For all other remunerations, the DDT rate is 3.6%.

8. The liable party for the DDT is the payer of the remuneration, who withholds and remits it simultaneously with withheld income tax.

Q. Default Interest and Legal Interest

1. DDT is imposed at a rate of 3.6% on default interest and on legal interest awarded by court decisions or arising from enforceable titles, irrespective of whether the act or transaction from which the principal claim derives falls within the scope of the DDT or another tax.

2. The party to DDT is the recipient of the interest.

R. Bank Cheques

1. DDT is imposed at a rate of 30 on the registers (πινάκια) in which cheques must mandatorily be recorded when presented to credit institutions established in Greece for collection, pledge or safekeeping, except where the cheque is presented for immediate payment.

2. The person subject to the DDT is the holder of the cheque, while the party liable for filing the declaration and remitting the DDT is the credit institution. The obligation arises upon the registration of the cheque in the register (πινάκιο).

S. Membership Subscriptions to Chambers, Associations, Clubs and Societies

1. No DDT is imposed on monetary amounts or subscriptions paid to chambers, associations, clubs and societies by their members for participation.

2. The exemption from the DDT applies as of 1 December 2024.

T. Prizes and Awards

1. DDT is imposed at a rate of 3.6% on prizes and awards, whether monetary or in movable or immovable property, except where monetary awards fall within the scope of the Property Tax Code.

U. Subsidies, Financial Aid and Grants from the State or Entities of the General Government

1. DDT is imposed at a rate of 3.6% on unilateral transfers of resources from the State or an entity of the General Government for the financial support of the recipient, calculated on the amount paid.

2. DDT is withheld at the time of payment and remitted by the paying entity.

3. DDT applies to any subsidy, financial aid or grant paid after 1 December 2024.

V. Collection of Fines and Related Revenues of the State and Entities of the General Government

1. DDT is imposed at a rate of 2.4% on fines imposed by decision of the competent authority.

W. Transactions Conducted in Land Registry Offices

1. DDT is imposed at a rate of 1.2% upon the registration of a lease agreement of immovable property with a duration exceeding 9 years in the transcription book of the competent mortgage registry or land registry office of the region where the property is located.

2. DDT is calculated on the total rent of the lease agreement and is remitted in a lump sum with the declaration filed by the notary.

3. DDT is imposed at a rate of 3.6% on the act of registration of a mortgage or the conversion of a pre-notation into a mortgage on immovable property, pursuant to law or court decision, irrespective of the origin of the debt secured by the mortgage registration. DDT is remitted by the applicant of the act by means of a fee through the e-Paravolo application.

4. No DDT is imposed:

a. on the act of registration of a mortgage or the conversion of a pre-notation into a mortgage on immovable property for the securing of debts certified by the Tax Administration or debts owed to social security institutions;

b. on the registration of a mortgage over immovable property of agents of the National Lottery or of third parties, for the securing of payment of the consideration for state lottery tickets delivered to them by the State; and

c. on the registration of a mortgage or the conversion of a pre-notation into a mortgage made to secure a loan from a financial institution or a bond loan under Law 4548/2018.

X. Issuance of Enforceable Copies and Evidentiary Documents Before Courts

1. DDT is imposed upon the issuance of an enforceable copy (απόγραφο) for the enforceable titles.

Y. Cases of Imposition of Fixed DDT

1. Article 29 of the DDT Law specifies the licenses and documents for the issuance of which the prior payment of a fixed DDT is required and determines the amount thereof in each case.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.