- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Banking & Credit, Retail & Leisure and Securities & Investment industries

- within Corporate/Commercial Law topic(s)

- with readers working within the Retail & Leisure and Securities & Investment industries

- within Employment and HR and Environment topic(s)

- Introduction

The China-Switzerland Stock Connect Program ("Program"), launched on 28 July 2022, opened the gateway for Chinese companies to access the Swiss stock market, i.e., SIX Swiss Exchange (and vice versa).

The Program allows Chinese companies, already listed on either the Shanghai Stock Exchange or the Shenzhen Stock Exchange in China, to list Global Depository Receipts (GDRs) on SIX Swiss Exchange. As of 15 March 2024, 17 Chinese companies have listed GDRs on SIX Swiss Exchange (see the list in Section 5 hereunder).

This article focuses on the main regulatory requirements of the applicable Swiss listing rules relevant for the listing of GDRs and provides an update on the status of GDR listings by Chinese companies on SIX Swiss Exchange.

- What are GDRs and why list them in Switzerland?

Global Depository Receipts ("GDRs") are tradable certificates that are issued by the GDR issuer to represent deposited equity securities which are segregated and held on a fiduciary basis by a depository such as a bank or securities firm. GDRs allow for the (indirect) exercise of the membership and asset rights of the deposited equity securities1.

The deposited equity securities are the underlying shares that have been listed in the home country. Chinese listed companies are bound by strict domestic regulations for secondary listings of shares abroad, which makes the alternative route of a listing in the GDR segment of SIX Swiss Exchange more appealing.

Switzerland is one of the world's leading and most competitive and secure financial centers. It is a small country located in the heart of Europe, neighbored by Italy to the south, France to the west, Germany to the north and Austria and Liechtenstein to the east. The economic environment in Switzerland is very stable.

It is generally rather moderately affected by the dynamics of the international capital markets. In addition, Switzerland's legal and regulatory framework is well-established and appropriate, which enables the financial sector to provide high-quality services and be innovative.

Being the only country in continental Europe to have signed a bilateral free trade agreement with China, the key advantages for Chinese companies to list GDRs in Switzerland comprise, inter alia, low costs, speed and efficiency in terms of process, as well as regulatory stability.

Thus, GDR listings on the SIX Swiss Exchange offer Chinese companies access to the Swiss and European capital markets and the potential to attract investors and achieve a higher demand in an economically, legally, and socially very stable environment such as Switzerland.

- Regulatory Requirements for GDRs on SIX Swiss Exchange

The SIX Listing Rules ("LR"), last modified on 23 August 2023 and entered into force on 1 February 2024 , set out the general regulatory requirements for listings of GDR on SIX Swiss Exchange in the following 3 key aspects: 1) listing requirements; 2) obligations with respect to the listing; and 3) conditions to maintain a listing.

The revision of Art. 53 and 56 of the Listing Rules, which took place in August 2023 and entered into force on 1 February 2024, primarily concerned the conditions for maintaining a listing, including the removal of interim reporting obligations by GDR issuers. The listing requirements and obligations regarding a listing remained unchanged.

3.1 Listing Requirements

1) Requirements for GDR Issuers

The requirements for GDR issuers are very similar to those for a primary listing of shares in the main market on SIX, namely2

- Lawful foundation: The establishment and the articles of association of the issuer must comply with the national law to which the issuer is subject;

- Duration: The issuer must have existed as a company for at least three years;

- Annual financial statements: The issuer must have produced annual financial statements in accordance with the required financial reporting standard for three full financial years preceding the listing application.

- Auditors and audit report: The issuer must have an auditor and the audit reports must comply with the financial reporting standard in accordance with the general SIX listing requirements;

- Minimum equity capital: At least CHF 25 million in accordance with the applicable financial reporting standard.

2) Requirements for the Depository

The depository must fulfill one of the following criteria3

- Being a bank governed by the Swiss Banking Act, or a securities firm governed by the Swiss Financial Institutions Act; or

- Being subject to equivalent foreign supervision.

3) Requirements for the Underlying Shares to be held on a Fiduciary Basis

The general requirements for the equity securities underlying the GDRs are set out below4

- The depository agreement must provide for the underlying shares to be held by the depository on a fiduciary basis on behalf of the investors with rights to the GDR in question, so that they can be separated and segregated in favor of the investors in the event of debt restructuring or insolvency of the depository, and for the depository to exercise all property and membership rights attached to the underlying shares in the interests of those investors.

- The depository agreement must oblige the depository to provide to the Regulatory Board and/or SIX Exchange Regulation upon request all information and documentation in connection with the implementation of the depository agreement, in particular, with respect to the number of underlying shares deposited and global depository receipts issued.

4) Requirements for the GDRs

The general requirements for any other securities in the main market under the SIX Listing Rules apply mutatis mutandis to the GDRs and are primarily the following5 :

- Legal validity: The GDRs must be lawfully and validly issued.

- Listing by class: The listing of the GDRs must comprise all of the issued securities in the same category.

- Free float: The GDRs must have an adequate free float at the time of listing, i.e., at least 20% of all the issuer's outstanding GDRs in the same category are in public ownership, and the capitalization of the individual categories of GDRs in public ownership amounts to at least CHF 25 million.

- Tradability: The GDRs must be properly tradable and rules on legal ownership for the GDRs must be established by the issuer.

- Denominations: The denominations forming the total value of a GDR must enable an exchange transaction in the amount of one round lot.

- Clearing and settlement: The issuer must ensure that the GDR transactions can be cleared and settled via the systems permitted by SIX Swiss Exchange.

- Paying agent: The Listing Rules provide that services pertaining to interest as well as all other corporate actions (including the receipt and handling of exercise notice) are provided in Switzerland.

- Listing in the home country: GDRs from an issuer that has its registered office in a third state (i.e., outside of Switzerland), and that are not listed on a stock exchange either in that state or in the state in which the majority of shares are held may be listed only if there is confirmation that the absence of listings in these states is not due to non-fulfilment of investor protection regulations.

- Continued fulfilment of listing requirements: The listing requirements laid down in Art. 10, Art. 13, Art. 16, Art. 18, Art. 21, Art. 22, Art. 23 and Art. 24 LR must continue to be fulfilled for the entire duration of the listing of the GDR.

3.2 Obligations with respect to the Listing

The following obligations with respect to the listing of the GDRs apply:

- Prospectus in accordance with FinSA: The issuer must submit evidence in the listing application that it has a prospectus approved by a Prospectus Office in accordance with the Swiss Federal Financial Services Act (FinSA), or that is deemed to be approved in accordance with the FinSA6

- Official notice: The issuer must publish an official notice7

The purpose of the official notice is to inform the investors on the listing and the options for obtaining the prospectus and an addendum, if any, free of charge, each in accordance with the FinSA (including where it is available in printed form and/or where it can be accessed electronically). The official notice must be published no later than 8.00 a.m. Central European Time on the day of the listing of the GDR.

- Issuer declaration: The GDR issuer, prior to the planned listing date, must submit a duly signed declaration stating that: (1) Its responsible bodies are in agreement with the listing; (2) it has read and acknowledges the Listing Rules, recognizes or the Court of Arbitration determined by the Rules of Arbitration and expressly agrees to be bound by any arbitration agreement, recognizes the conditions for continued listing and consents to be bound by the version of the legal foundations that is in force at any given time; and (3) it will pay the listing charges8 .

3.3 Conditions for Maintaining the Listing

The following are the conditions which must be fulfilled by the GDR issuer for the maintaining of the listing of the GDRs on SIX Swiss Exchange:

- Annual reporting: The issuer should publish an annual report comprising (1) annual financial statements in accordance with the applicable financial reporting standard; and (2) the audit report9 .

- Financial reporting standards: The issuer should draw up annual financial statements in accordance with the recognized financial reporting standard10 .

- Corporate calendar: At the beginning of each financial year upon the listing, the issuer shall produce a corporate calendar covering at least the current financial year and shall keep it up to date11 .

- Management transactions: The issuer must ensure that the members of the board of directors and the executive committee report transactions in both the GDRs and the underlying shares in accordance with the Directive on the Disclosure of Management Transactions of SIX Swiss Exchange12 .

- Corporate governance: The issuer is required to declare in both the prospectus in accordance with the FinSA and the annual report that it adheres to the corporate governance standards of its domestic market. The Directive on Information relating to Corporate Governance of SIX Swiss Exchange is not applicable for GDR issuers13 .

- Ad hoc publicity: The issuer is obliged to disclose price sensitive facts, whose disclosure is capable of triggering a significant change in market prices. A price change is significant if is considerably greater than the usual price fluctuations14

- Changes to depository and depository agreement: Such changes must be reported to SIX Exchange Regulation at the same time when the holder of the GDRs are informed15

3.4 GDR Listing Process on SIX Swiss Exchange

The listing process of GDRs is regulated by the Listing Rules and the Directive on the Procedures for Equity Securities ("DPES") of SIX Swiss Exchange. The GDR listing process of SIX Swiss Exchange is fast and efficient, because it provides for well-balanced and market-oriented listing requirements.

In the context of listing GDRs by Chinese companies, the convenience provided by SIX Swiss Exchange in the listing process includes, but is not limited to, the acceptance of the Accounting Standard of the People's Republic of China for Business Enterprises (Accounting Standards for Business Enterprises, "ASBE").

Based on the above framework, the process to list GDRs on SIX Swiss Exchange contains, inter alia, the following steps:

- Submit a listing application in writing to SIX Exchange Regulation with the prospectus enclosed (see Section 3.2-i) hereabove).

- Submit a duly signed issuer declaration, the official notice, the depository agreement, evidence that the requirements for the depository of Art. 92 LR have been fulfilled, copies of the last two annual reports (for the last three full financial years) of the issuer and the last two annual reports of the depository, and for new issuers of GDRs an extract of the Commercial Register (see Art. 7 et seq. DPES and Section 3.2-ii) hereabove).

Moreover, the listing application for the GDR listing must be submitted to SIX Exchange Regulation by a recognized representation16

While the Prospectus Office (SIX Exchange Regulation AG) will review and approve the prospectus based on the FinSA, the Regulatory Board of SIX Swiss Exchange will review the listing application and decide whether to approve or refuse the listing application based on the Listing Rules.

- Regulations released in mid-2023 by the Shanghai and Shenzhen Stock Exchange on the GDR Listings for Chinese companies

Since the issuance and listing of GDRs are subject to both domestic (Chinese) and overseas (Swiss) regulatory requirements, the GDR listings will be certainly affected not only by the Swiss regulation rules but also the Chinese ones. It is therefore worth briefly mentioning the changes to the GDR listing regulations in China.

Following the release of the Guidelines on the Application of Regulatory Rules – Offshore Issuance and Listing No. 6: Guidelines on Offshore Issuance of Global Depositary Receipts by Domestically Listed Companies17 by the China Securities Regulatory Commission (CSRC) on 16 May 2023, the Shanghai and Shenzhen Stock Exchange amended their Interim Measures for the Listing and Trading of Depositary Receipts under the Connect Scheme between Shanghai/Shenzhen Stock Exchange and Overseas Stock Exchanges ("Interim Measures")18 which makes the domestic GDR listing procedure in China more sophisticated.

The main changes include, but are not limited to, the qualifications of the applicant, inter alia, the requirements for the Chinese companies planning to list GDRs on the overseas stock exchanges by issuing new domestic underlying shares. To apply to the Shenzhen/ Shanghai Stock Exchange to list GDRs overseas by issuing new underlying stocks domestically in China, the company must fulfill the following criteria19

- compliance with the issuing conditions set forth in the Measures for the Administration of Initial Public Offering Stocks Registration of the CSRC;

- when applying for GDR listing, it has been listed for more than one year at the Shanghai/Shenzhen Stock Exchange; and if it was engaged in a restructuring, it can only apply in one year after the completion of restructuring and listing; and

- the average market capitalization of A shares calculated on the basis of the closing price of the shares for the 120 trading days prior to the date of application for the issuance shall not be less than RMB 20 billion.

Notwithstanding the above changes numerous Chinese companies plan to list GDRs on the SIX Swiss Exchange in the coming years.

- Rapidly growing Number of GDR Listings by Chinese Companies on SIX Swiss Exchange

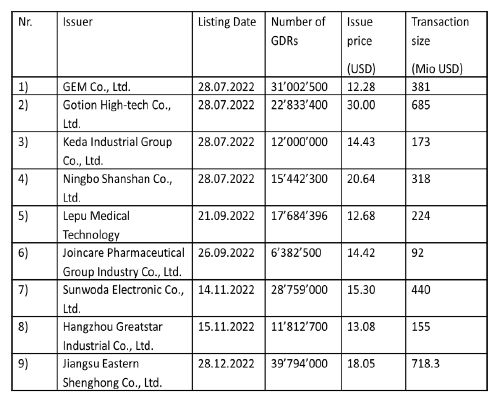

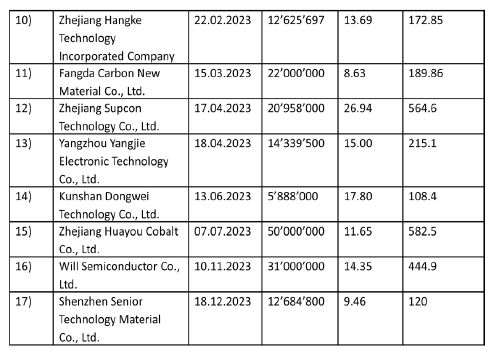

While the number is continuously and rapidly growing, as of 15 March 2024 there were already 17 Chinese companies which have listed GDRs on SIX Swiss Exchange, inter alia 9 companies in 2022 and 8 companies in 2023:

- Conclusion

The issuance of GDRs by Chinese listed companies on SIX Swiss Exchange has received a lot of attention since the launch of the Program. Due to the increased access to Swiss and European investor, adequate listing rules for GDRs as well as Switzerland's strong position in the global financial market a rapidly increasing number of Chinese companies issues and lists GDRs on the SIX Swiss Exchange.

Despite that it is foreseeable that the regulation of GDR listings in China may keep changing from time to time, listings of GDRs on SIX Swiss Exchange are expected to remain an appealing option for Chinese companies. Therefore, GDR offerings are a great way to better connect China and Switzerland.

Footnotes

2 Art. 91 and Art. 10-16 LR.

3 Art. 92 LR.

4 Art. 93.

5 Art. 94 para. 1 and Art. 17-26 LR.

6 Art. 95 para. 1 LR.

7 Art. 40a para. 1 LR.

8 Art. 98 and Art. 45 LR.

9 Art. 49 LR.

10 Art. 51 LR.

11 Art. 52 para. 1 LR.

12 Art. 100 and Art. 56 LR.

13 Art. 101 para. 1 LR.

14 Art. 103 and Art. 53 et seq. LR.

15 Art. 104 LR.

16 Art. 58a para. 1 LR.

17 http://www.csrc.gov.cn/csrc/c101932/c7408878/content.shtml

18 关于发布《上海证券交易所与境外证券交易所互联互通存托凭证上市交易暂行办法(2023年修订)》的通知 | 上海证券交易所 (sse.com.cn) and 关于发布《深圳证券交易所与境外证券交易所互联互通存托凭证上市交易暂行办法(2023年修订)》的通知 (szse.cn).

19 Art. 105 Interim Measures.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.