- in United States

- in United States

- with readers working within the Property industries

- with Senior Company Executives, HR and Finance and Tax Executives

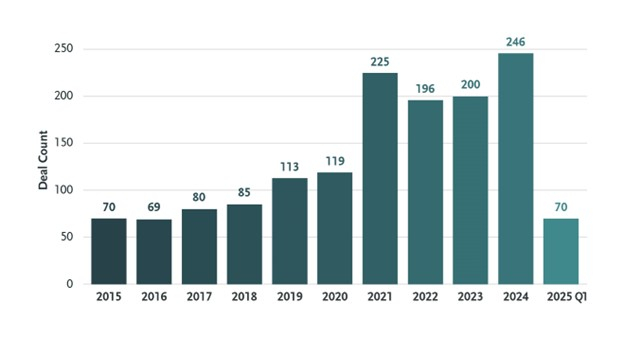

Private equity investment in the food and beverage industry continues to steadily increase, driven in part by evolving consumer preferences and a heightened focus on sustainability. In 2024, private equity deal activity in North America in the beverage sector alone saw a 45 percent increase compared to the previous year, with notable investments in plant-based and health-oriented brands. Deal activity in 2025 is currently on track to surpass previous highs, indicating continued confidence and investment in food and beverage-related businesses. We expect these recent trends to continue and for a new catalyst–consumer desire to increasingly seek out and buy locally made products–to continue to drive private equity interest in this space.

Strategic Shifts and Investment Patterns

While overall consumer discretionary spending remains cautious in 2025, certain industries are experiencing growth. Private equity investment in the food and beverage industry has experienced a significant resurgence since 2021, with 2024 marking a notable peak in deal activity.

Private Equity Deal Activity

North American Food and Beverage Industry

Source: PitchBook data

In North America, the number of private equity deals in the food

and beverage industry increased by 29.6 percent in Q1 2025,

compared to the same quarter the previous year. This uptick

partially reflects a strategic response to evolving consumer

preferences and market dynamics, with private equity buyers

focusing more on health-conscious, sustainable and innovative

business models to drive growth and shape the future landscape of

the industry.

New Opportunities for Private Equity to "Buy Local"

Recent geopolitical events have been driving a surge in consumer nationalism, with a significant focus in Canada and other countries towards directing purchases to locally-owned companies and supporting domestically produced goods. In our experience, this trend is particularly evident in the food and beverage industry. Recent surveys conducted by the Angus Reid Institute indicate that 85 percent of Canadians are actively replacing American products with Canadian alternatives. This buy local global movement presents private equity firms with strategic opportunities to invest in Canadian businesses poised to capitalize on this trend and potentially realize new growth opportunities. Companies that emphasize domestic production appear increasingly well-positioned for growth, offering avenues for value creation through brand strength and operational scaling. We expect this trend to continue to be an important catalyst for new private equity investment and M&A in this sector going forward.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.