- in United States

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Basic Industries and Business & Consumer Services industries

On November 21, 2024, the Supreme Court of Canada confirmed that it would not grant leave to appeal from the Federal Court of Appeal decision in 3295940 Canada Inc.1 In that decision, the Federal Court of Appeal had concluded that a circumvention of subsection 55(2)2 on a cross-redemption of shares (resulting in the reduction of the capital gain on a subsequent sale) did not result in abusive tax avoidance.

To reach that conclusion, the Federal Court of Appeal relied on the availability of alternative transactions that would have allowed similar tax results. While there was no dispute that alternative transactions may play a role in the analysis a court is required to undertake in a general anti-avoidance rule (the "GAAR") case,3 3295 provides long-awaited clarifications4 on the relevant factors to determine the relevance of alternative transactions to support the absence of abuse, the most contested matter in GAAR litigation.

Key Facts

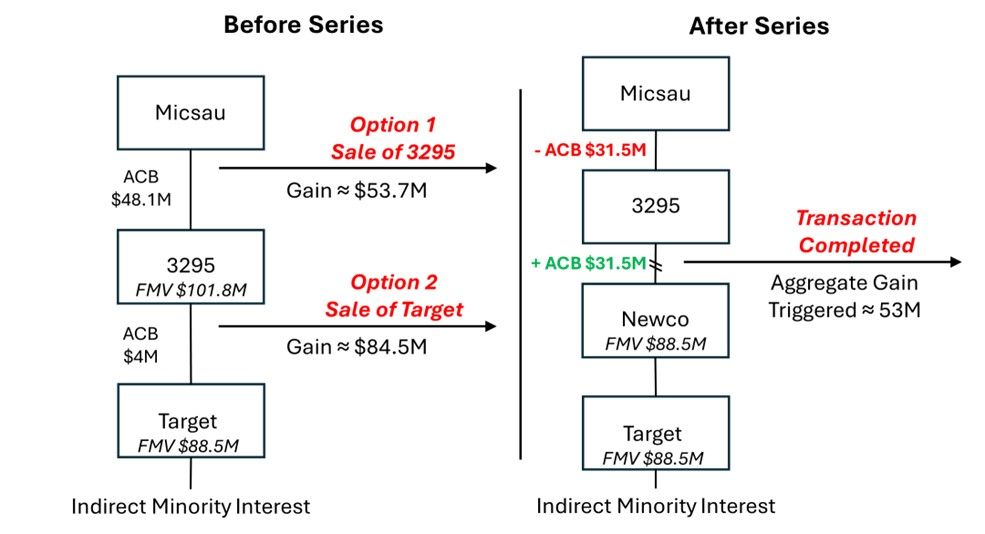

The case involved the sale of a generic drug business held by two shareholders to a third party, Novartis Pharmaceuticals Canada Inc. ("Novartis"). The minority shareholder, Gestion Micsau Inc. ("Micsau"), held its shares in the operating target through 3295.5

Since the adjusted cost base ("ACB") of the shares of 3295 was higher than the ACB of the shares of its subsidiary,6 Micsau wanted to sell 3295 directly to Novartis, but Novartis was not interested.7 Micsau entered into a series of transactions in order to replicate the lower capital gain it would have realized through the direct sale of 3295.8

The plan involved transferring the balance of 3295's capital dividend account ("CDA") on the redemption of its shares, which was then transferred back to it on a subsequent redemption immediately thereafter.9 Through "CDA recycling", 3295 increased the ACB of the shares of its subsidiary by $31.5M prior to their sale without triggering a corresponding gain, in a context where a paragraph 88(1)(d) "bump" was otherwise unavailable.10

Summary of Findings

The trial judge focused on the cross-redemption of shares to find that it was a way for Micsau to declare a dividend that would reduce the capital gain resulting from the sale of the generic drug business, contrary to the object, spirit and purpose of subsections 55(2), 83(2) and 89(1). The application of subsection 55(2) was avoided in the process as capital dividends are not targeted by that provision.11 The Court also found that no double taxation resulted from the fact that the taxpayer was not able to benefit from the cost in its own shares as part of the sale of its assets,12 although the increase in cost in 3295's assets was compensated by a corresponding decrease in the cost of its shares.

Justice Goyette did not agree with those conclusions. Instead of focusing on the cross-redemption, her analysis was based on the whole series of transactions:13 the final capital gain realized on the sale to Novartis was not materially different than the gain that would have been realized on a direct sale of 3295 shares.14 Therefore, the object, spirit and purpose of the capital gains regime, i.e., the taxation of real economic gains, was still accomplished through the series of transactions.15

Furthermore, the Federal Court of Appeal emphasized that the difference between the capital gain that would have resulted from the sale of the target shares compared to the sale of 3295 shares did not escape Canadian taxation. The difference came from Micsau isolating its higher ACB in the 3295 shares, not from the cross-redemption in itself.16

Relevance of Alternative Transactions for the GAAR Abuse Analysis

Since Univar, it is understood that alternative transactions can be considered in determining whether there is abusive tax avoidance. As stated in Univar:

In my view, these alternative transactions are a relevant factor in determining whether or not there has been an abuse of the provisions of the ITA. If the taxpayer can illustrate that there are other transactions that could have achieved the same result without triggering any tax, then, in my view, this would be a relevant consideration in determining whether or not the avoidance transaction is abusive.

(...) [T]he alternative means by which the same result could have been realized is a relevant consideration in determining whether or not the avoidance transaction was abusive.17

Before Justice Goyette's decision in 3295, there were no clear indications as to what types of alternative transactions would be relevant. For example, at trial, the judge found that the four alternative transactions proposed by Micsau were not relevant because (1) the sale of the operating target shares was essential to the transaction since Novartis refused to buy 3295 shares and (2) the purpose of the sale, the price, and the business implications would have been different.

Beyond the rejection of the Tax Court's holdings on this point, the Federal Court of Appeal established five criteria to take into consideration when determining if alternative transactions can be considered for the purposes of the abuse analysis under the GAAR:

- They are available under the Income Tax Act;

- They are not so remote as to be practically infeasible;

- They have a high degree of commercial and economic similarity;

- They generate tax consequences approximately as favourable as the series at issue; and

- They are not abusive of the GAAR.18

These criteria were all satisfied by the alternative transactions that Micsau proposed. This reinforced the conclusion that there was no abuse.19

All the alternative transactions presented involved the sale of 3295, which was ultimately not sold by Micsau. Assets of 3295 were. In concluding that the sale of a corporation's assets is comparable to the sale of its shares, 3295 clearly invites courts to be flexible in accepting comparable transactions for the purposes of the abuse analysis, provided that the alternative transactions are commercially reasonable and not aggressive.

Impact on the GAAR Framework

The GAAR abuse analysis is divided into two steps: "first, determining the object, spirit and purpose of the relevant provisions and, second, determining whether the result of the transactions frustrated that object, spirit and purpose."20

It remains unclear where the review of alternative transactions fits into this framework. The comments by the Federal Court of Appeal in Univar suggest that the recourse to alternative transactions was useful at the first step of the abuse analysis, to better identify the object, spirit and purpose of a transaction.21 The Tax Court also seemed to embrace that conclusion in 3295 TCC.22 However, the framework proposed by Justice Goyette appears to fit better into the second portion of the abuse analysis, where the overall result of the series is examined.23

In practice, 3295 should allow taxpayers to compare transactions irrespective of the statutory provisions relied on to secure the tax results. For instance, in 3295, the alternative transactions considered relevant did not involve the payment of pre-closing inter-corporate dividends, nor the conversion of the ACB of shares of a corporation to ACB in its assets where the "bump" is not available. This should allow increased flexibility in selecting alternative transactions to support that transactions in dispute should not be subject to the GAAR.

Footnotes

1 3295940 Canada Inc. v. Canada, 2024 FCA 42 ("3295"); reversing 2022 TCC 68 ("3295 TCC").

2 All references to statutory provisions herein represent references to the Income Tax Act (Canada).

3 For a recent illustration, see Magren Holdings Ltd. v. His Majesty the King, 2024 FCA 202, para. 199.

4 The potential relevance of alternative transactions for the purposes of the abuse analysis had first been raised in Lehigh Cement Ltd. v. R., 2010 FCA 124, para. 40 to 42 and discussed more extensively in Univar Holdco Canada ULC v. Canada, 2017 FCA 207, para. 16 to 22 ("Univar").

5 3295, para. 7.

6 3295, para. 8.

7 3295, para. 10. A fourth alternative also involved Micsau transferring 3295 to the other seller, which was also declined.

8 While 3295 shares' ACB was in an amount of $48.1M, the capital gain was only reduced by $31.5M as a result of the series.

9 3295, para. 23.

10 This was discussed by the trial judge, but not in appeal. See 3295 TCC, at para. 131, 136 and 143, and 3295 at para. 39.

11 3295 TCC, para. 120 and 121.

12 3295 TCC, para. 144.

13 3295, para. 46.

14 3295, para. 53.

15 3295, para. 54.

16 3295, para. 47 and 48.

17 Univar, para. 19 and 20.

18 3295, para. 61.

19 3295, para. 55 and 62.

20 Deans Knight Income Corp. v. Canada, 2023 SCC 16, para. 56.

21 Univar, para. 21.

22 3295 TCC, para. 161.

23 3295, para. 55.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.