- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy industries

- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy industries

According to Magren Holdings Ltd. v. Canada (2024 FCA 202, at paragraph 156), "a sham

exists when acts are done or documents are executed with the

intention of giving the appearance of creating legal rights and

obligations that differ from the actual legal rights and

obligations that the participants intend to create."

The CRA and the Crown have been accused by practitioners of

inappropriately treating sham as an alternative argument to GAAR in

support of reassessments. A statistical analysis sheds light on

four key questions in this regard: (1) Is sham a successful legal

argument for the Crown? (We measure success by the Crown by the

outcome at the final stage of the appeal process, if any.) (2) Is

sham a successful argument when combined with GAAR? (3) How

commonly is sham raised alongside GAAR (and vice versa)? (4) Is

sham argued more often in certain types of cases?

Canadian Abridgement Digests classifies judicial decisions

according to the issues addressed in each case. We used this source

to identify 99 cases in which sham, GAAR, or both sham and GAAR

were raised as issues. For this analysis, we examined the period

1988 to the present (the period during which GAAR has existed). A

supplementary table (which includes certain

explanatory notes) provides the underlying data. We examine two

overlapping subgroups of the 99 cases—one relating

predominantly to sham and one relating predominantly to GAAR.

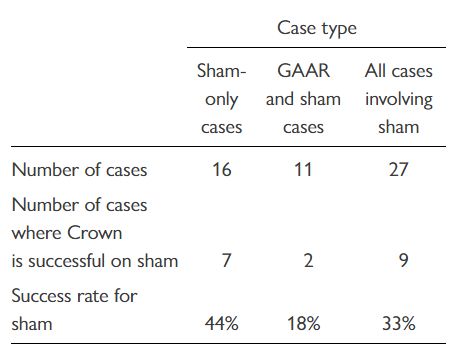

To answer the first question—"Is sham a successful legal

argument?"—we examined the 27 cases in which sham is one

of the issues. In the accompanying table, we show that the success

rate for the Crown is 33 percent ([7 + 2]/[16 + 11]) in arguing

sham. However, this aggregate figure conceals an important

distinction that answers the second question: where both GAAR and

sham are raised, the Crown's success rate in arguing sham is

low (18 percent); in contrast, where the Crown argues sham alone,

the success rate is higher (44 percent).

Thus, the courts seem to be more open to accepting sham where

GAAR is not also raised. Perhaps the courts view the sham-GAAR

double argument as a last-ditch strategy that the Crown uses when

it does not have a truly persuasive argument to make.

The third question asks how commonly sham is raised alongside GAAR

(and vice versa). For this, we examine a second subgroup of the 99

cases: the 82 cases in which at least one of the issues is GAAR. We

find that sham was raised infrequently (in 12 percent of the cases,

calculated as 10/82). This is perhaps less often than practitioners

would expect. In contrast, in cases involving sham as one of the

arguments, it was common for the Crown to also raise GAAR (in 41

percent of the cases, calculated as 11/27).

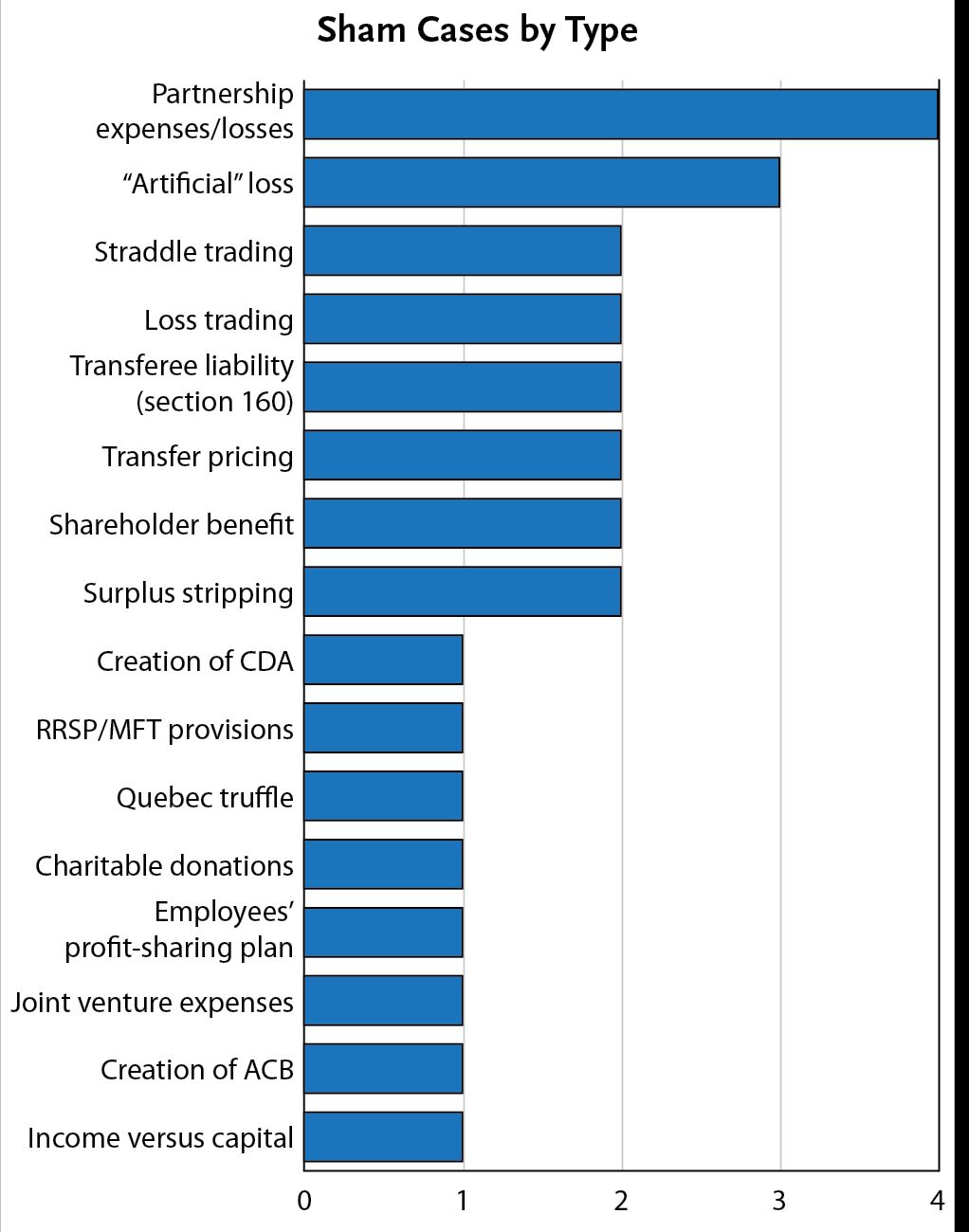

The last question is whether the Crown's assertion of sham in

the 27 sham cases is concentrated in cases dealing with certain

subjects (loss trading, surplus stripping, manipulation of tax

attributes, etc.). Each case is assigned to a single category. The

graph shows that there did not appear to be any discernible

pattern, although sham appeared somewhat more frequently in cases

dealing with impugned partnerships and losses.

The author would like to thank Samantha Curry, Summer Student-At-Law, for her assistance writing this article.

Originally published by CTF FCF.

The content of this article does not constitute legal advice and should not be relied on in that way. Specific advice should be sought about your specific circumstances.