- within Strategy, Food, Drugs, Healthcare, Life Sciences and Transport topic(s)

April began with important topics that could potentially be defined by the Superior Courts (STJ and STF).

Below is a brief summary of these cases, some of which are already in progress and awaiting final judgment.

STJ

REsp 1955120

Topic: Possibility of deducting from the calculation base of the

Corporate Income Tax (IRPJ) and Social Contribution on Net Profit

(CSLL) the amount paid as interest on equity from previous fiscal

years.

Date of judgment: April, 04

Virtual session

Reporting Judge: Minister FRANCISCO FALCÃO

After the judgment denying the Special Appeal filed by the National Treasury, that is, validating the possibility of taxpayers deducting from the calculation base of the Corporate Income Tax (IRPJ) and Social Contribution on Net Profit (CSLL) the Interest on Equity (JCP) from previous fiscal years, the National Treasury filed an appeal that will be judged by the Second Panel.

REsps 1945110 e 1987158 – Theme

1.182

Topic: Discuss the possibility of excluding ICMS tax incentives

from the calculation base of IRPJ and CSLL

Judgment date: April 26

Virtual session

Reporting Judge: Minister BENEDITO GONÇALVES

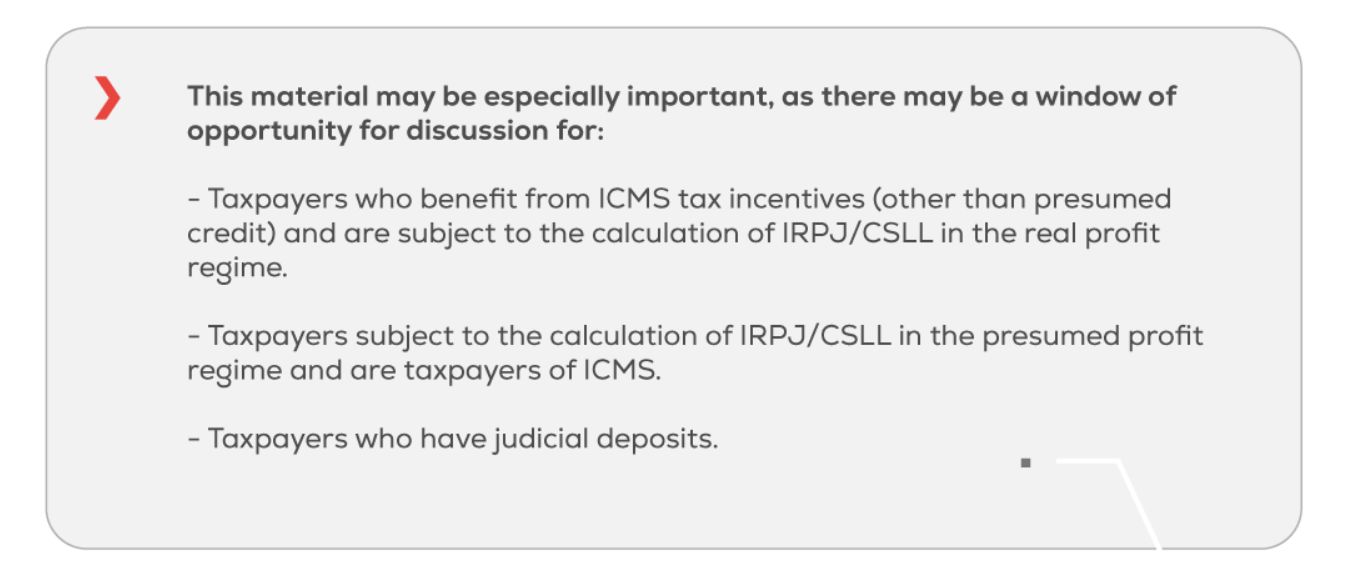

The Ministers will analyze whether ICMS tax incentives, such as reduction in the calculation base, reduction in the tax rate, exemption, deferral, and immunity, should be excluded from the calculation base of IRPJ and CSLL, applying the understanding already established by the Court in the EResp 1.517.492/PR, which dealt with the exclusion of ICMS presumed credits from the basis of such federal taxes.

Although low, there is a risk of eventual modulation of effects of the future decision to be adopted by the Court, which is why it is advisable to evaluate the relevance of filing a lawsuit to discuss the topic before the judgment.

REsp 1138695 – Tema 504

Topic: Levying of IRPJ and CSLL on the Selic rate in judicial

deposits.

Judgment date: April 26

Virtual session

Reporting Judge: Minister MAURO CAMPBELL MARQUES

After the unfavorable ruling for the taxpayer on May 22, 2013, which validated the levying of the IRPJ and CSLL on the Selic rate in judicial deposits, the case was returned to the agenda for judgment. This was because the Brazilian Supreme Court, through the judgment of Extraordinary Appeal No. 1,063,188, excluded the incidence of IRPJ and CSLL on the SELIC applicable on the refund of undue taxes. As the Brazilian Supreme Court understood that the SELIC rate on judicial deposits was a matter of infraconstitutional nature, the Superior Court of Justice (STJ) may review its previous position, considering the grounds of the simmilar matter decided by the Brazilian Supreme Court.

Although low, there is a risk of eventual modulation of effects of the future decision to be adopted by the Court, which is why it is recommended to evaluate the relevance of filing an action to discuss the matter before the judgment.

REsps 1767631 e 1772470 – Tema 1008

Topic: Exclusion of the ICMS from the IRPJ/CSLL basis in the

presumed profit regime.

Judgment date: April 26

Virtual session

Reporting Judge: Minister REGINA HELENA COSTA

Minister Regina Helena Costa announced a favorable vote for taxpayers by stating her understanding that "the ICMS highlighted in the invoice is not included in the calculation basis for IRPJ and CSLL, when determined by presumed profit". On October 26th, 2022, Minister Gurgel de Faria requested more time to review the case. The case is now scheduled to be discussed on April 26th.

Although low, there is a risk of eventual modulation of effects of the future decision to be adopted by the Court, which is why it is recommended to evaluate the relevance of filing an action to discuss the issue before the ruling.

STF

ADIs 7066, 7070 e 7078

Topic: The discussion is whether Supplementary Law 190/22, which

regulates the collection of the Differential Rate of State VAT

(Difal/ICMS), must comply with the principle of anteriority to

start producing effects.

Judgment date: April 12

Physical plenary

Reporting Judge: Minister ALEXANDRE DE MORAES

By request of Minister Rosa Weber, the Direct Actions of Unconstitutionality 7066, 7070, and 7078 will be judged in a physical session, and all votes cast so far should be disregarded. The central point of the trial is the initial term for collecting the DIFAL, after its enacting by Supplementary Law 190/2022.

The ongoing virtual trial had a score of 5×2 to validate the collection only in 2023 – recognizing that the annual anteriority should be observed. However, Minister Rosa Weber requested that the trial restarts in the physical trial.

ADIs 7066, 7070 e 7078

Topic: Discusses the levying of ICMS on the transfer of goods

between branches of the legal entity.

Judgment date: from March 31 until April 12

Virtual session

Reporting Judge: Minister MIN. EDSON FACHIN

With the trial starting at the end of March, after Court already stated that ICMS does not levy upon the transfer of goods between establishments of the same taxpayer, the virtual session is focused on the judgment of the declaration appeals to modulate the temporal effects of the decision. The score is currently tied.

Justice Edson Fachin, followed by Justices Ricardo Lewandowski, Roberto Barroso, and Carmen Lúcia, partially accepted the appeals, establishing that the effects of the decision would take effect from 2023 onwards. If there is no specific legislation, the right to maintain credits on entries related to transfers between establishments should be ensured.

In dissent, Justice Dias Toffoli, followed by Justices Alexandre de Moraes, Luiz Fux, and Nunes Marques, proposed modulation of the effects so that the decision would take effect 18 months after the publication of the minutes of the declaration appeals trial.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]