- within Antitrust/Competition Law topic(s)

- with Inhouse Counsel

- with readers working within the Business & Consumer Services and Law Firm industries

On 19 December 2025, the Australian Government released legislation making significant changes to the rules governing the new Australian mandatory and suspensory merger control regime, which comes into force on 1 January 2026.

The key changes, which were subject to limited consultation but are now final:

- provide for a broader range of situations where acquisitions of shares will be notifiable (voting power thresholds);

- simplify rules to assess the notifiability of acquisitions of assets that do not comprise all or substantially all of the assets of a business, particularly land and other real property acquisitions;

- clarify when minority, non-controlling shareholders can be considered 'associates' of acquiring entities for the purposes of assessing notifiability under the new regime;

- provide for a new and updated exception for leases and other acquisitions of interests in land or property in the ordinary course of business;

- streamline notification requirements for serial acquisitions; and

- clarify and expand a range of additional exceptions and carve-outs relating to debt finance and financial market activity, and certain acquisitions connected with superannuation funds (which will be the subject of a future more detailed and specific update).

The 'core' merger control regime, including the 'main' notification thresholds, and the refinements to the exceptions, will commence on 1 January 2026.

The new thresholds for discrete asset acquisitions and the voting power thresholds will not commence until 1 April 2026.

Voting power thresholds

As a result of the new rules, acquisitions of shares will be potentially notifiable if either they result in a change of control or new voting power thresholds are exceeded.

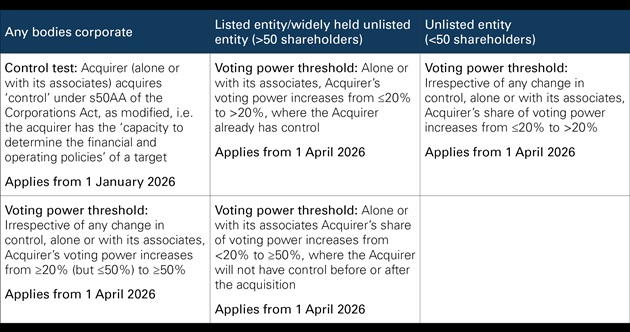

- Control test. Acquisitions of shares in a body corporate are notifiable if they result in a controlling interest (defined by reference to the Corporations Act 2001 (Cth) (Corporations Act), i.e. the capacity to determine the financial and operational policies of another entity). However, acquisitions of less than a 20% interest in a publicly listed company or unlisted but widely held company are exempt. That 'control test' applies from 1 January 2026.

- Voting power thresholds. Acquisitions of shares that complete on or after 1 April 2026 will also be notifiable if certain 'voting power thresholds' are exceeded, regardless of whether there is a change of control. Part of the rationale for this change is to capture acquisitions that confer 'material influence' even if they do not result in a change of 'control' over a target entity.

The control test and the voting power thresholds that will apply under the new regime are set out below:

Unlike the other changes introduced in this latest legislative instrument, which seek to narrow the application of the regime through useful clarifications and carve-outs, this change will result in significant additionalcapture.

In particular, we anticipate that the new rule requiring notification of increases in voting power from≤20% to)20% in unlisted entities with fewer than 50 shareholders will require notification of a wide range of additional acquisitions. This is inconsistent with many other jurisdictions with comparable merger control regimes, and will increase both the costs for smaller acquisitions and the risk of missed filings.

The explanatory memorandum seeks to justify this change by suggesting the acquisition of over 20% of the voting power could 'alter market dynamics'. However, without additional governance rights, such as one or more board seats or the ability to veto key decisions, it is not clear how acquiring 20% of the voting power in an entity is potentially competitively significant. It is also not clear why acquisitions of minority and non-controlling interests are more deserving of scrutiny in relation to private rather than public targets.

Amended asset acquisition thresholds

The new rules simplify the monetary thresholds for acquisitions of assets, which is a helpful change that addresses a significant concern expressed by a range of market participants, particularly in relation to acquisitions of interests in land.

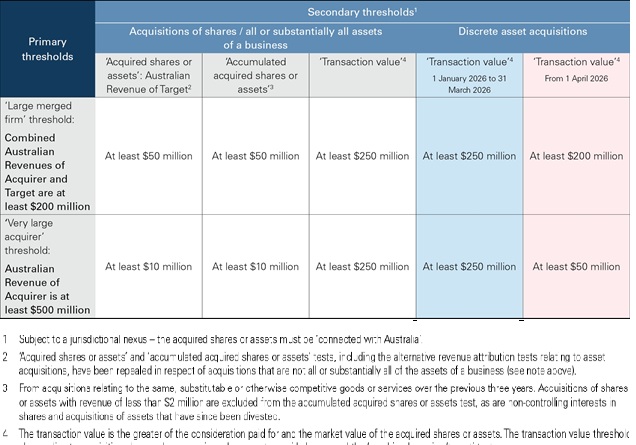

The changes differentiate between acquisitions that involve 'all or substantially all the assets of a business' and asset acquisitions that do not involve all or substantially all the assets of a business (discrete asset acquisitions).

While acquisitions of all or substantially all of the assets of a business will still be subject to the 'main' notification thresholds, including the secondary 'target revenue' and 'transaction value' tests, discrete asset acquisitions will no longer be subject to the secondary 'revenue' tests and will only be subject to the secondary 'transaction value' test. In addition, from 1 April 2026, a new transaction value test will apply to discrete asset acquisitions. The repeal of the secondary revenue tests, which required a complex attribution of the seller's revenue to the assets being acquired, will make the assessment of whether asset acquisitions need to be notified significantly simpler. The transaction value test is easier to calculate, and the change is likely to slightly reduce the number of benign land and real property-related acquisitions that will require notification.

The 'main' notification thresholds that commence on 1 January 2026 are set out in the table below. The transaction value thresholds that will apply to discrete asset acquisitions between 1 January and 31 March 2026 are highlighted in blue below. The transaction value thresholds that will apply to discrete asset acquisitions from 1 April 2026 are highlighted in pink below.

When are entities 'associates' for revenue allocation purposes?

To calculate whether an acquisition is above the notification thresholds, the revenue of the transaction parties and their 'connected entities' must be assessed.

Under the regime as previously drafted and implemented, there was uncertainty as to the circumstances in which minority, non-controlling shareholders could be considered 'associates' (and therefore connected entities) of acquiring entities where they could not exercise a degree of negative control over that acquiring entity.

The new rules address this uncertainty by introducing the concept of 'minority shareholder protection rights' to the new regime. The intention is to exclude from the definition of 'connected entity' those 'minority shareholder protection rights' that a minority non-controlling shareholder has only through being party to a shareholders agreement (or similar). Minority shareholder protection rights means a bundle of rights that:

- are consistent with the rights that are normally accorded to minority shareholders in order to protect their financial interests as investors;

- are reasonably appropriate and adapted to achieving the purpose of protecting a minority shareholder's financial interests, in their capacity as an investor, and not for some other purpose; and

- do not include any of the following:

- the capacity to control or practically influence (whether alone or in concert with others) the composition of a company's board;

- the capacity to control, practically influence or prevent (whether alone or in concert with others) the appointment or termination of senior managers of a company; or

- the capacity to control or practically influence (whether alone or in concert with others) decisions about a company's financial and operating policies (consistent with the language used for the meaning of 'control' in section 50AA of the Corporations Act).

This helpful change clarifies that entities with customary minority shareholder protection rights are not caught by the definition of 'associates', which will generally mean that they are not required to be treated as connected entities of the acquiring entity. It brings the new regime closer in line to most other jurisdictions and appropriately narrows the scope of the entities the 'Australian Revenues' of which need to be aggregated for the purposes of applying the new regime.

New and updated land and property-related exceptions

The new regime already provides for several exceptions for land and property-related acquisitions. In particular, it exempts acquisitions:

- made for the purpose of developing residential premises;

- by businesses primarily engaged in buying, selling, leasing or developing land for any purpose other than to operate a commercial business on the land that is not ancillary or incidental to the primary purpose of buying, selling, leasing or developing the land;

- of a land entity whose only non-cash asset is land, which is held for either of the purposes set out in the first two bullets above;

- involving the extension or renewal of an existing lease (but not the grant of a new lease);

- of a legal or equitable interest following a previous acquisition of an equitable interest in the same land (e.g. an agreement for lease) (multi-stage land acquisitions) that was notified to and approved by the Australian Competition and Consumer Commission (ACCC);

- of land development rights, which if they were an equitable interest would fall within another exception; and

- involved in the sale and leaseback of land.

The new rules add the following new exceptions:

- Acquisition of a legal or equitable interest in land or property in the ordinary course of business. The new rules apply to acquisitions of interests in land or property an exception for asset acquisitions made in the ordinary course of business (from which those types of acquisitions were previously excluded). The guidance materials provide a range of helpful examples as to the meaning of 'ordinary course of business' in this context, which make clear that there will be significant overlap between the 'ordinary course of business' exception as it relates to property and other property exceptions. These include e.g. the acquisition of an interest in land or property for the purpose of an office, headquarters or other routine trading activities, the acquisition of office towers for the purposes of commercial property investment, or a property development company acquiring land to develop residential or commercial property. Further examples include retailers leasing or acquiring land or property for a warehouse to store their inventory, a manufacturer leasing or acquiring land for a new manufacturing facility, an energy generator acquiring land for a solar farm, or an energy distributor acquiring land on which to build pylons. However, a transaction-by-transaction assessment will always be required.

- The exception for multi-stage land acquisitions has been broadened. The original exception applicable to multi-stage land acquisitions (described above) has been broadened to cover subsequent acquisitions of a legal or equitable interest in land or property after the ACCC has granted a notification waiver (as well as a full clearance) for the previous acquisition of an interest in the same land. The exception has also been extended to apply to acquisitions of quasi-land rights, such as mining, quarrying or prospecting rights, water entitlements, or forestry operations rights. As previously, the exception applies where the interests are acquired by the same acquirer, the interests are materially the same, and the proportion of ownership interests are the same. Minor incidental changes (e.g. routine title changes or boundary changes) will still be within the scope of the exception.

- Grandfathering for multi-stage land acquisitions in-flight prior to 1 January 2026. This is a new and helpful exception that exempts multi-stage acquisitions of land, property and quasi-land rights that take place either side of the start of the new merger control regime on 1 January 2026. As for the multi-stage land acquisition exception described above, this exception will only apply where the acquirer previously acquired an equitable interest in the land or property prior to 1 January 2026, the same acquirer then acquired a subsequent legal or equitable interest that relates to that same parcel of land or property (such as obtaining legal title or acquiring an additional equitable interest over it), the size of the land or property to which the interests relate is materially the same, and the proportion of the ownership interests are the same. Minor adjustments in land or property size that may be outside the acquirer's control (e.g. a minor increase in the size of land in a lease as a result of a store redevelopment in a shopping centre or a boundary adjustment) will still be within the scope of the exception.

Serialacquisitions

The new rules introduce minor, but important and helpful, changes to the accumulated acquired shares or assets tests. Previous acquisitions in the three-year 'lookback' period are now excluded from the calculation of aggregate revenue if either of the following apply:

- No controlling interest. Neither the acquirer nor its connected entities have (or can begin to have) control of the body corporate. This is intended to exclude from the calculation previous acquisitions of non-controlling interests in shares of a body corporate, and previous acquisitions of a controlling interest where the acquirer (or its connected entities) no longer has control (for example, where the shares have since been divested).

- Assets have been divested. Where the previous acquisition was of assets (other than shares) and neither the acquirer nor its connected entities continue to hold an interest in those assets. This would exclude previously acquired assets that have since been divested from the calculation.

The changes are intended to better target the accumulated acquired shares or assets thresholds, by excluding previous acquisitions where the entity that made those acquisitions is unlikely to have, or no longer has, the ability to use those assets or shares in a way that may affect competitive dynamics.

Expanded financial sector and superannuation exemptions

There are a range of new and updated exceptions for:

- external administration, i.e. acquisitions made by a person acting in an external administration or analogous statutory capacity;

- financial market infrastructure, such as acquisitions that occur under contractual rights to close out, set off or combine accounts, acquisitions of derivatives or that result from derivatives, acquisitions under foreign exchange contracts;

- acquisitions that arise in the context of debt funding, credit provision, liquidity management, collateralisation, balance-sheet management, and structured-finance activities, as distinct from acquisitions of operational businesses; debt instruments (whether or not contingent or conditional), including loans, debt interests in an entity, asset securitisation arrangements, and securities financing transactions;

- acquisitions by nominees and other trustees to cover acquisitions upon the conversion of a capital instrument that occurs in connection with prudential loss-absorption mechanisms under the Australian Prudential Regulation Authority's (APRA) prudential standards;

- acquisitions that arise from the transfer of the benefits of one or more members of a superannuation entity from one superannuation entity to another; and

- acquisitions resulting from the appointment of a new trustee to a superannuation entity as part of a change of trustee for that superannuation entity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Lawyers Weekly Law firm of the year

2021 |

Employer of Choice for Gender Equality

(WGEA) |