- within Corporate/Commercial Law topic(s)

- with Inhouse Counsel

- in United Kingdom

- with readers working within the Banking & Credit, Business & Consumer Services and Technology industries

Updated compulsory merger notification rules

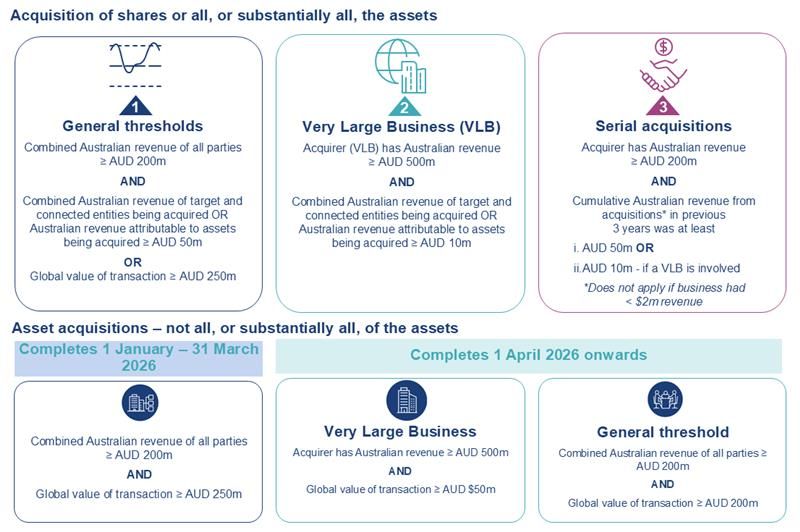

From 1 January 2026, under the new Part IVA Competition and Consumer Act 2010 (Cth) (CCA), businesses may need to notify the ACCC of any acquisition of shares or assets that meet the notification revenue and transaction thresholds.

Transactions that meet the notification thresholds (and cannot rely on any exceptions) will need to be notified to the ACCC and approved before completion. This week Treasury made a new Notification Determination that updates the rules dealing with the notification thresholds and certain exceptions. The effect of the new rules include:

- New rules on who is a 'connected entity' for private companies and non-listed trusts

- Limiting the ability to rely on the 'no control' exception based on changes in 'voting power'

- Changing the monetary thresholds for asset acquisitions that do not involve acquisitions of all or substantially all of the assets of a business (some changes commencing 1 January 2026 and some 1 April 2026)

- Making acquisitions of interests in land exempt where they are in 'the ordinary course of business'

- 'Grandfathering' agreements for lease (AFLs) in certain circumstances

- Changing how the rules for determining the revenues of the acquirer (and its connected entities) operate

- Clarifying and expanding the exemptions associated with debt instruments, money lending, financial accommodation and security interests for loan transactions involving security interests

Updated financial thresholds - staggered start dates

New rules for who is a 'connected entity' for private companies and non-listed trusts

Transactions may be notifiable where the Australian annual gross revenues of the acquirer (principal party) exceed the notification thresholds. The rules include the revenues of the principal party's 'connected entities'. Connected entities include related entities and control entities.

The related entity concept broadly corresponds to the related body corporate provisions in the Corporations Act 2001 (Cth) (Corporations Act) – and captures (with some modifications) subsidiaries, holding companies and co-subsidiaries. The control entity is a broader concept. It captures not just legal ownership, but practical control (including control together with one or more 'associates', within the meaning of Chapter 6 of the Corporations Act). This second 'control test' adopts the definition of 'control' in section 50AA of the Corporations Act and 'associates' in Chapter 6 of the Corporations Act. An entity controls another entity when it, alone or with 'associates', has the capacity to determine the outcome of decisions about the second entity's financial or operating policies.

Commonwealth Treasury has amended the rules for determining 'connected entities' in response to concerns that the inclusion of the definition of 'associates' in the 'control test' would result in the over-capture entities as having 'control' of the principal party and therefore inflate the Australian revenues for the purposes of the notification thresholds.

Where passive or largely passive shareholders or investors have agreements which include terms dealing with decision making in relation to the affairs of the principal party, the application of the 'associate' component of the control test may mean that all shareholder or investors are deemed to have 'control' and their revenues need to be included for the purposes of applying the financial thresholds (including irrespective of the size of their shareholding).

The new rules (which take effect on 1 January 2026) address this concern by expressly excluding 'minority shareholder rights' from the control analysis. The new rules mean that a shareholder or investor in the principal party will not be taken to be an 'associate' of other shareholders solely because they have an agreement that gives them 'minority shareholder protection rights'. The new rules only apply to entities that are not Chapter 6 entities under the Corporations Act (Chapter 6 entities include listed companies, companies with more than 50 members, or listed managed investment schemes).

Minority shareholder protection rights are defined as a bundle of rights that meet all of the following:

- they are consistent with rights normally accorded to minority shareholders to protect their financial interest as investors;

- they are reasonably appropriate and adapted to achieving that purpose and not for some other purpose; and

- they do not include the capacity to control or practically

influence (alone or in concert with others):

- the composition of the board,

- the appointment or termination of senior managers,

- decisions about the entities' financial and operating policies.

The practical effect of these updated rules will be to remove the risk that the Australian revenues of passive or largely passive investors in private entities undertaking acquisitions will need to be taken into account in the application of the notification thresholds.

New rules from 1 April 2026 limiting reliance on exemption for acquisitions that do not give rise to 'control'

Section 51ABS of the CCA provides that an acquisition of shares or units will be exempt from the notification obligations if the acquisition does not result in 'control', within the meaning of section 50AA of the Corporations Act (with some modification). In general terms, in determining whether the 'control exemption test' for the mergers regime applies, it requires asking whether the acquisition gives a person or entity the capacity to determine, alone or jointly with one or more associates, the outcome of decisions about the target's financial or operating policies. The term 'associates' has the meaning given to it in ss 12 and 15 of the Corporations Act and it includes persons 'acting or proposing to act in concert'.

The CCA gives the Minister power to make a ministerial determination determining a class or classes of acquisitions that will not have the benefit of the exemption in s 51ABS. The updated rules provide that, subject to satisfaction of the notification thresholds, acquisitions of shares or units in a unit trust or interests in a managed investment scheme (within the meaning of the Corporations Act) do not have the benefit of s 51ABS of the CCA where:

- Unlisted bodies corporate with less than 50 members – the acquisition results in someone's voting power increasing from 20% or below to more than 20%

- All bodies corporate - the acquisition results in someone's voting power increasing from 20% or more to 50% or more

- Bodies corporate that are listed or have more than 50 members – a person or entity already controls the target (within the meaning of s 50AA of the Corporations Act) and the acquisition increases their voting power from 20% or below to more than 20%

- Bodies corporate that are listed or have more than 50 members - a person or entity does not control the target (within the meaning of s 50AA of the Corporations Act) and the acquisition increases their voting power from below 20% or below to 50% or more

The term 'voting power' is given the same meaning it is given under s 610 of the Corporations Act and in general a person's 'voting power' in a target entity will be the sum of the voting shares in the target entity in which the person has a relevant interest plus the voting shares in the target in which the person's associates have a relevant interest, divided by the total voting shares multiplied by 100. For bodies corporate that are unlisted or have less than 50 members, when calculating the voting power of a person the voting power of any associates will be excluded where the arrangements between the person and the associate(s) only give the associate(s) 'minority shareholder protection rights' (see definition above). However, where a person is acquiring a minority shareholding in a private company and becoming party to a shareholders agreement (or similar) in relation to that company, it will still be necessary to assess whether that person is acquiring a "relevant interest" (broadly defined to cover direct or indirect control over the voting or disposal of shares) in all or a majority of shares in that company as a result of the terms of the shareholders agreement.

New monetary thresholds for asset acquisitions

Acquisitions may be notifiable when the rules for transaction value or revenue attributable to the target are met. The new rules have been made in response to stakeholder concerns that for transactions that involved the acquisition of only some of the assets of a business the rules made in July 2025 required parties to 'attribute' some of the business revenue to the assets. Stakeholders were concerned that the application of these rules was uncertain and burdensome to apply.

The new Determination made this week by Treasury repeals certain aspects of the July 2026 Notification determination and introduce new rules that will apply from 1 April 2026.

If a transaction is put into effect between 1 January 2026 to 1 April 2026 and the transaction involves only the acquisition of assets and those assets are not all or substantially all of the assets of a business the acquisition will only be notifiable if the acquirers revenues exceed $200 million and the transaction value exceeds $250 million.

If a transaction is put into effect from 1 April 2026 the new rules introduce an additional transaction value test for the acquisitions of assets that do not constitute all or substantially all of the assets of a business.

The new transaction value test means that:

- where an acquisition satisfies the combined revenue test on the contract date (combined Australian revenue is AUD$200 million or more) – and the market value of, or consideration received or receivable for, the target asset is over AUD$200 million, or

- where an acquirer satisfies the very large business revenue test (revenue is AUD$500 million or more) – and the market value of, or consideration received or receivable for, the target asset is over AUD$50 million,

the asset acquisition will need to be notified (unless it is

subject to one of the exemptions including the new "ordinary

course of business" exemption outlined below).

In this context, "market value" takes its ordinary

meaning – the price that a willing, but not anxious,

purchaser would, as at the date in question, have had to pay to a

vendor who was not unwilling, but not anxious, to sell.

"Consideration" also takes its ordinary meaning, the

amount paid for the target and includes cash and non-cash

consideration.

What is the 'transaction value' of a leasehold interest?

The Treasury Explanatory Note for the Notification Determination indicates that for a leasehold interest, consideration will generally be the total of:

- the upfront initial payments (other than taxes and regulatory charges) for the grant of the interest;

- annual lease payments including amounts as increased in accordance with a formula over the term of the lease;

- the amount likely paid for an extension or renewal of the lease (if prescribed in the lease agreement).

In determining whether the revenue tests for the notification thresholds are met, the revenue of the target attributable to the assets of the business will only be included where the acquisition is of all or substantially all of the assets of the business.

New exceptions for acquisitions of interests in land

Importantly, for businesses (excluding major supermarkets) that acquired an equitable interest in land before 1 January 2026 (previous interest), the same acquirer will not have to notify the acquisition of the subsequent interest where that occurs after 1 January 2026 (subsequent interest) provided that:

- The size of the land to which the previous interest and subsequent interest relate are materially the same; and

- The proportion of the ownership interest in the land which the previous and subsequent interests relate are the same.

This means that for parties that entered into Agreements for Lease, Option Deeds or other agreements for equitable interests in land which took effect prior to 1 January 2026, there will be no requirement to notify the subsequent legal interest acquisition (e.g. entry into the actual lease or purchase contract).

The explanatory note to the Amending Determination gives the following guidance.

- Where an acquirer entered into an agreement for lease prior to 1 January 2026, (ie an equitable interest in land) the subsequent acquisition of the legal interest on entering into the lease does not require a separate notification provided that the land remains unchanged.

- Minor, incidental changes will not exclude the acquirer from relying in this exemption. Minor, incidental changes are, for example, routine land title changes, easements, boundary adjustments or the registration of a strata plan.

- The exemption would not be available where, for example, the initial equitable interest acquired was a 20% interest in land but at settlement, that interest was increased to a 50% interest.

Acquisitions of land that are in the ordinary course of business are exempted

Under the new rules where a person acquires a legal or equitable interest in land that is in the ordinary course of business, that acquisition is exempt from notification.

What constitutes 'ordinary course of business' is critically important in this context. Only a few court cases have applied the term of ordinary course of business, the key principles of which are set out below.

- Ordinary course of business should not be interpreted as a reference to the ordinary course of the acquirer's, or anyone else's business. It refers to the ordinary course of business,1 in general.

- Case law suggests that conduct may be in the ordinary course of

business if that conduct:

- regularly takes place in a sustained course of activity or some usual process;2

- takes place as part of the undistinguished common flow of business done;3 and

- does not arise from any special or unusual circumstances and is something a business manager could undertake without special approval or reporting requirements to superiors for example a board of directors.4

The explanatory note to the Amending Determination states expressly that use of the phrase in the ordinary course of business is a deliberate decision recognising the history of the phrase in legislation and case law. It gives the following examples and notes that these types of acquisitions will qualify for the exemption even where they are large or infrequent acquisitions:

- the acquisition of an interest in land for the purpose of an office, headquarters or other routine trading activities;

- the acquisition of office towers for commercial property investment;

- a property development company acquiring land to develop residential or commercial property;

- retailers leasing or acquiring land for a warehouse to store inventory;

- a manufacturer leasing or acquiring land for a new manufacturing facility;

- an energy generator acquiring land for a solar farm;

- an energy distributor acquiring land to build pylons.

The Explanatory Note also describes examples that are not intended to be exempt. They include:

- acquisitions of land for the purposes of land-banking;

- acquisitions of land from which a competitor is operating their business;

- the transfer of production or supply capacity from one competitor to another.

Additional exceptions for subsequent land and quasi-land interest acquisitions

The new rules expand the existing exception for acquisitions of subsequent legal or equitable interests in land (where the initial equitable interest acquisition in the same land had already been notified to the ACCC) to now also cover:

- where any initial equitable interest acquisition over the same land was determined by the ACCC not to require notification pursuant to the waiver application process; and

- subsequent acquisitions of legal or equitable interests in 'quasi-land rights' which include mining, quarrying or prospecting rights, water entitlements or rights in creation to land or forestry operations.

Debt Instruments, money lending, financial accommodation and security interests

Following considerable comments from industry participants regarding the previous Determination, there have been significant changes to the rules dealing with debt instruments, money lending, financial accommodation and security interests. Whilst various core concepts remain, the changes are sufficiently substantive that the relevant section of the Determination has been repealed and replaced.

The types of transactions subject to exemptions are broad in scope reflecting the various forms of financial products and services which come under this heading. Market participants will need to consider both the wording of the Determination and the extensive comments in the Explanatory Statement. For example, the Determination exempts from notification requirements an acquisition of shares or assets which is part of an "asset securitisation arrangement". The term "asset securitisation arrangement" is not defined and may cover a wide range of activity. The Explanatory Statement provides significant guidance as to the intended scope of such concepts.

Core exemption classes

The Determination sets out a broad class of instruments, arrangements and transactions for which no notification is required (subject to the conditions discussed below). These include:

- debt instruments (whether or not contingent or conditional);

- loans;

- a debt interest in an entity;

- asset securitisation arrangements;

- securities financing transactions; and

- acquisitions that are directly connected with or occur as a result of such transactions.

Not all of these concepts are defined. There is a new definition of "loan" in the Determination. The explanatory note remarks that the definition is non-exhaustive and is broadly intended to "capture arrangements that may not strictly qualify as 'loans' in other contexts (such as in accounting or other legal contexts)." The loan exemption is intended to cover a range of loan market and financial accommodation practices, including whole of loan sales, forward flow arrangements, sale and repurchase arrangements and other types of arrangements.

Whilst the term "asset securitisation arrangement" is not defined, the explanatory note sets out over a number of pages what might be considered an asset security arrangement. This exemption is intended to cover the full lifecycle of securitisation structures used in financial markets, including, for example, acquisitions associated with the establishment of a warehouse vehicle, a securitisation vehicle, the granting, transfer, release of guarantees, the issuing of instruments, as well as range of other matters.

Limitation to exemptions

There are limitations on the operation of the above exemptions. Relevantly, the exemptions will not apply in circumstances where the acquisition has the effect that a person will begin, or can begin, to control the relevant entity (within the meaning of section 50AA of the Corporations Act, subject to the modifications set out in the CCA). Importantly, this limitation does not apply in respect of acquisitions of a share or asset which are part of, or directly connected with, or occur as a result of an asset securitisation arrangement.

Security Interests

As per the prior determination, the new determination provides for a notification exemption for acquisitions involving security interests. There have been some significant changes to the approach.

An exemption is provided for the acquisition of shares or assets taken or acquired as a security interest or where the share or asset is directly connected with the taking or acquiring of a security interest (but does not relate to the enforcement of the security interest). A change from the earlier determination is intended to ensure that an exemption applies "regardless of whether there is a change of control of an entity, or an acquisition of all or substantially all of the assets of a business".

The Determination separately considers circumstances where the acquisition of the share or asset is a direct result of the enforcement of a security interest. This exemption is narrower than the exemption considered above. In the context of enforcement of a security interest the relevant acquisition must occur in the ordinary course of business of providing financial accommodation with parties dealing with each other at arm's length or for the benefit of one or more parties to financial accommodation provided to them in the ordinary course of their business of providing financial accommodation and at arm's length terms.

A new definition of security interest has been introduced. Responding to commentary on the earlier determination, the definition now refers to the meaning of a security interest given by the Personal Property Securities Act 2009 (Cth), a charge within the meaning of the Corporations Act as well as a lien or pledge. Collateral under a credit support agreement continues to be included in the definition.

Asset Financing

A new provision exempts certain asset financing transactions from notification requirements. This is intended to avoid double notifications over the same assets. The amendment does not exempt the subsequent acquisition of a relevant asset by the client of the financier assuming that other relevant thresholds required for notification are met.

Nominee exemption

The Determination also inserts a new provision dealing with acquisitions by nominees and other trustees occurring in the context of loss absorption mechanisms under APRA prudential standards. This exemption has been included to ensure that notification requirements do not interfere with certain core APRA functions.

Footnotes

1. TPC v Gillette (No 2) (1993) 118 ALR 280.

2. Taylor v White (1963) 110 CLR 129.

3. Downs Distributing Co Pty Ltd v Associated Blue Star Stores Pty Ltd (1948) 76 CLR 463.

4. Re Bradford Roofing Industries Pty Ltd [1966] 1 NSWR 674.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]