- within Antitrust/Competition Law topic(s)

- in Canada

- with readers working within the Law Firm industries

- within Antitrust/Competition Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Business & Consumer Services, Insurance and Media & Information industries

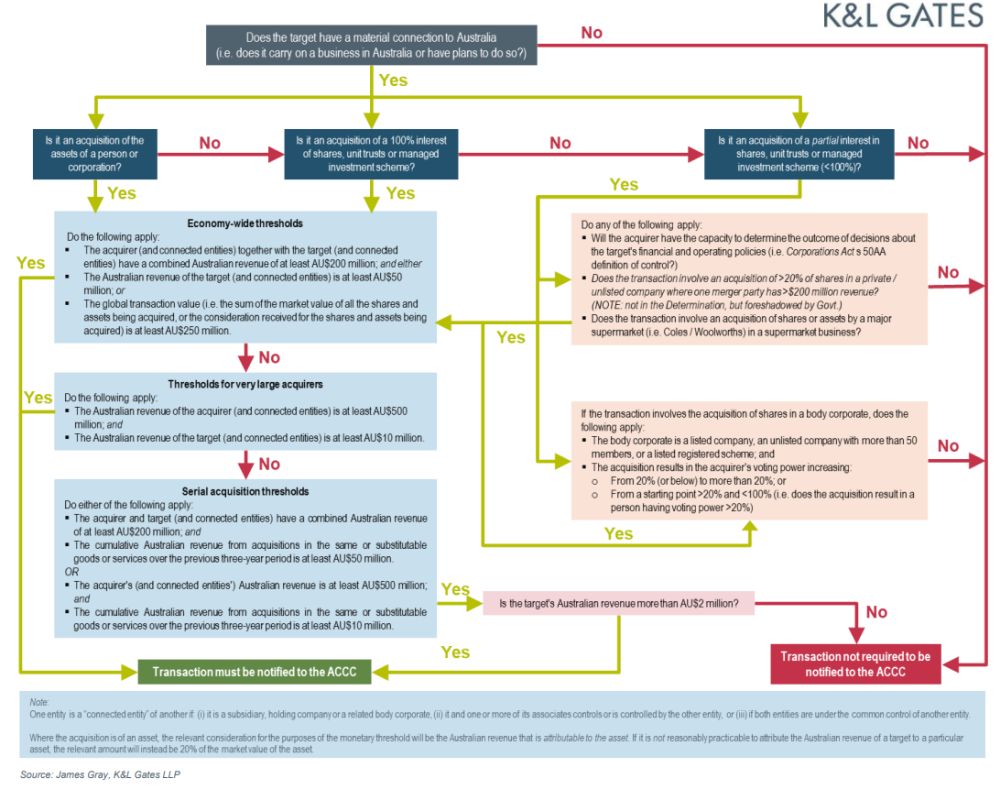

From 1 January 2026, significant reforms to Australia's merger clearance regime will come into effect. The amended regime will operate on a mandatory and suspensory basis. Parties must notify the Australian Competition and Consumer Commission (ACCC) of any acquisition of shares or assets that satisfies the monetary and "control" thresholds set out below, provided that the target carries on business in Australia. Acquirers can voluntarily make notifications under the new regime from now.

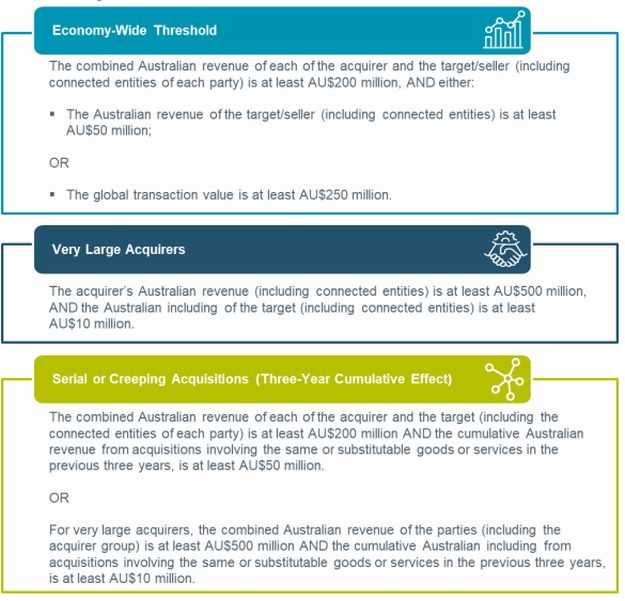

The Monetary Thresholds

Source: K&L Gates, 2025

Note: Serial or creeping acquisitions do not need to be reported if the target's Australian revenue is less than AU$2 million.

What Is Control?

Transactions must be notified to the ACCC if the acquirer gains "control" over the target, and if the monetary thresholds displayed left area met. Control will be assessed according to the test in section 50AA of the Corporations Act 2001 (Cth). The acquirer will have control over the target if it has the capacity to determine the outcome of decisions about the second entity's financial and operating policies.

Acquisitions do not need to be notified if the acquirer had control of the target immediately prior to completion of the acquisition.

Notification is not required for acquisitions of shares in a Chapter 6 entity if the acquirer will hold less than 20% of voting rights postcompletion.

What Is a Connected Entity?

One entity is a ‘connected entity' of another if: (i) it is a subsidiary, holding company or a related body corporate, (ii) it and one or more of its associates controls or is controlled by the other entity, or (iii) if both entities are under the common control of another entity.

How Is Australian Revenue Calculated?

Australian revenue refers to the relevant entity's gross revenue, determined in accordance with accounting standards, for the entity's most recently ended 12-month financial reporting period, which is attributable to transactions or assets within Australia, or transactions into Australia.

How Is the Revenue of an Asset Calculated?

Where the acquisition is of an asset, the relevant consideration for the purposes of the monetary threshold will be the Australian revenue that is attributable to the asset.

If it is not reasonably practicable to attribute the Australian revenue of a target to a particular asset, the relevant amount will instead be 20% of the market value of the asset.

Exceptions to the Mandatory Notification Requirements

- Certain Land Acquisitions

Acquisitions of land for the purpose of developing residential premises (or operating a land development or management business), lease extensions and renewals, equitable interests in land in the form of land development rights, and sale and leaseback arrangements. - Liquidation, Administration, Receivership,

etc

Acquisitions by a person in their capacity as an administrative, receiver or liquidator. - Financial Market Infrastructure

Including transactions that arise in the ordinary course of clearing and settlement activities, and acquisitions of shares or assets that occur under a contract as a result of the exercise of a right to close out a transaction, or otherwise set off or combine accounts. - Financial Securities

Acquisitions relating to the capital-raising process, e.g., acquisitions resulting from rights issues, dividend reinvestment or share bonus plans, underwriting of fundraising, buy-backs and derivatives. - Debt Instruments, Money Lending, etc

Acquisitions of debt instruments, asset securitisation arrangements, debt interests, securities financial transactions, security interests, etc — provided that the acquisition does not lead to "control" or the acquisition of all, or substantially all, of the assets of a business. - Nominees and Other Trustees

Acquisitions of interests in securities by a person acting as a bare trustee for a beneficiary, where the beneficiary has a relevant interest in the securities arising from a presently enforceable and unconditional right to acquire them. Acquisitions made by a provider for custodial or depository services in the ordinary course of providing that service are also exempt (see section 766E of the Corporations Act 2001 (Cth)). - Acquisitions Occurring by Operation of

Law

This exemption refers to acquisitions which happen automatically based on principles set out in a statebased or Commonwealth law, without any specific action or agreement by the parties involved. Parties have no discretion as to whether or how the acquisition occurs.

Fees for Notification Under the New Regime

Documentary Requirements

Notifying parties will need to adopt prescribed short- and long-form notifications.

The long-form notification requires notifying parties to provide additional information relating to:

- Barriers to entry and expansion in the relevant market (including real-world examples);

- Responses to specific questions about market dynamics, depending on whether the transaction is a horizontal, vertical or conglomerate acquisition;

- Third-party data sets or reports used to estimate and analyse market shares;

- Documents relating to the acquisition presented to the board / senior management; and

- Most recent versions of all transaction documents.

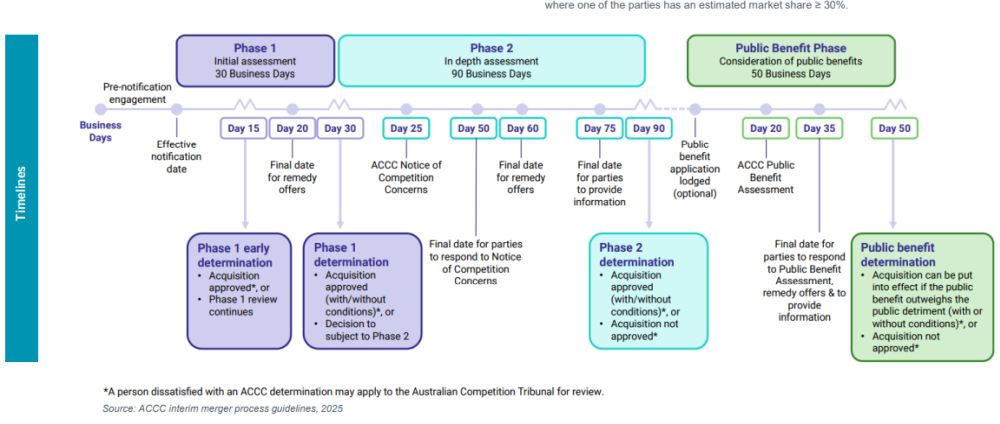

The ACCC expects that the long-form notification will be used in the following circumstances:

- Horizontal acquisitions resulting in a combined

post-completion market share of:

- ≥ 40%, and where the increment resulting from the acquisition is ≥ 2%; or

- 20 − 40%, and where the increment resulting from the acquisition is ≥ 5%;

- Vertical acquisitions where the party active in the upstream market has a market share ≥ 30% and the other party has a downstream market share ≥ 30% and vice versa; and

- Conglomerate acquisitions where the parties supply adjacent goods or services, where one of the parties has an estimated market share ≥ 30%.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]