- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Turkey

- with readers working within the Accounting & Consultancy, Banking & Credit and Business & Consumer Services industries

FOREWORD

Australia's private debt market is undergoing a revolution. Once a niche segment of the financial landscape, it has now emerged as a central pillar of capital deployment, with assets under management reaching an impressive A$224 billion. This growth is not just quantitative, it reflects a qualitative shift in how capital is being structured, accessed, and aligned with the evolving needs of borrowers and investors alike.

At Alvarez & Marsal, we see this transformation as both a recent market trend and a long-term investment thematic. Institutional investors are increasingly drawn to private debt for its compelling risk-return profile, its adaptability across sectors, and its growing regulatory maturity. The rise of direct lending, specialist finance mandates, and the re-emergence of listed investment trusts all point to a market that is innovating with intent.

This report offers a timely lens into the forces shaping Australia's private debt ecosystem. It highlights the consolidation among top-tier managers, the evolution of capital raising channels, and the increasing role of private capital in financing corporate growth and commercial real estate. More importantly, it underscores the opportunity for private debt to play a foundational role in Australia's economic future.

As traditional funding channels recalibrate, private debt is stepping up not just as an alternative, but as a preferred solution. We hope this review provides valuable insights for investors, borrowers, and policymakers navigating this dynamic landscape

SEBASTIAN PAPHITIS

MANAGING DIRECTOR

NEW INVESTOR CHANNELS AND PRODUCT INNOVATION DRIVING AUSTRALIA'S $224 BILLION PRIVATE DEBT LANDSCAPE

Welcome to A&M's annual review of the Australian private debt market for 2025. We are pleased to share our latest markets insights, expectations for the coming year and the results of our Annual Australian Private Debt Survey, that has sized the market at A$224bn, a 9% increase on 2024.

The rise of private debt, as part of the broader universe of private capital markets, remains one of the key emerging trends in investment markets globally, and activity this year has continued to support this long-term thematic. Both the demand and supply sides of the market continue to mature, with the supply side seeing an expansion of capital raising channels across institutional investors, pension funds, insurance companies, family offices, high-net-worth and retail investors. The current increased regulatory and investor focus on the structure, governance and valuation of private debt should also support this supply side trend in coming years, as it serves to provide a baseline expectation for the way these assets are managed.

The demand side is being supported by an increasing breadth of private debt lending product solutions, including a wide spectrum of investment grade lending through to high-yield and venture debt spread from the Small and Medium Enterprises (SMEs) right through to the corporate and institutional borrower universes. This is helping on the deal front, where there is renewed optimism as well as an improvement in the corporate credit outlook, seeing strong appetite, competitive tension and tighter margins across the lending market. This competition is prompting dealmakers to capitalise on current conditions by revisiting M&A plans, investing in property, equipment, and infrastructure, and restructuring or refinancing existing capital.

Overall, the long-term outlook remains positive for private debt in the Australian context, with our market continuing to attract new capital and the attention of both domestic and offshore investors who now see private debt as a core asset class of investment. Therefore in this years' review, we've provided the findings of our annual review and comment on the continued maturation of the market, its importance to economic growth and the emerging sub-segments likely to support future growth.

AUSTRALIAN MARKET SIZE AND MANAGER COMPOSITION

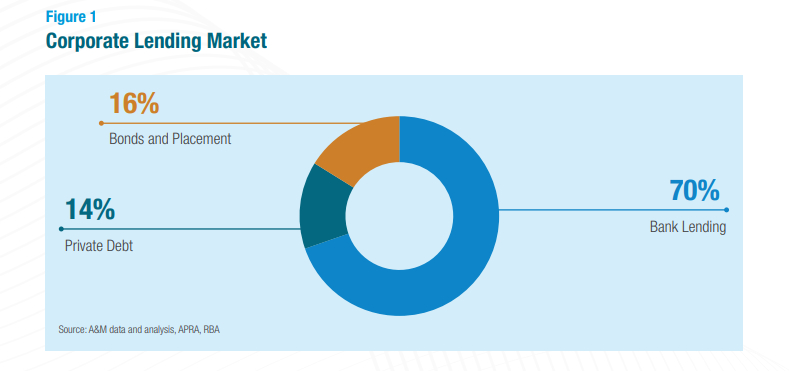

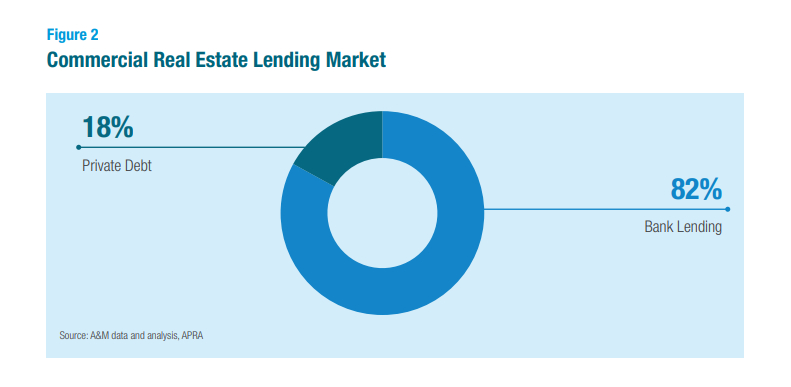

Our 2025 annual review has sized the private debt market at A$224bn in assets under management (AUM) – an increase of 9% on 2024. This total is comprised of A$132bn allocated to corporate and business-related lending, representing ~14% of this lending market in Australia. Meanwhile, A$92bn is allocated to commercial-real-estate lending, accounting for ~18% of this lending segment domestically. These compositions have been outlined in the charts below with the only change being a small increase in the private debt market share for commercial-real- estate lending.

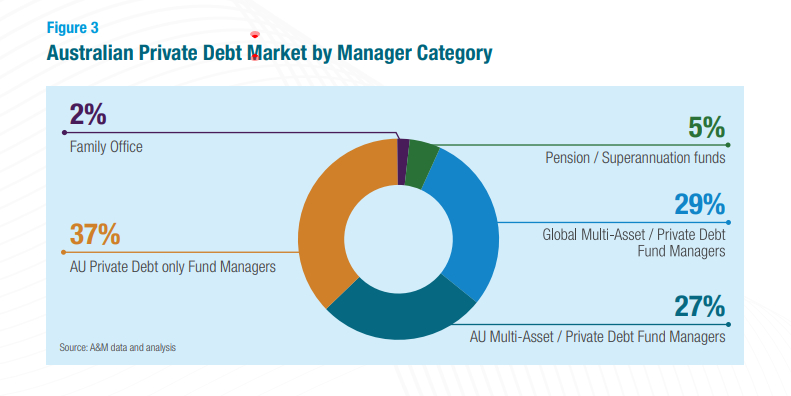

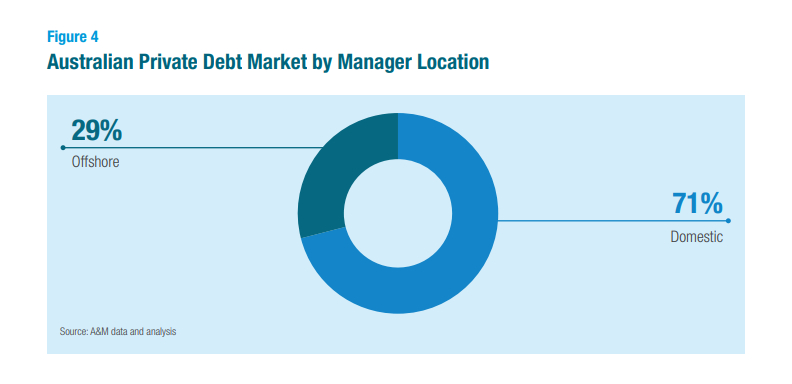

We have also segmented the private debt manager categories below by AUM, outlining manager type and location of ownership to assist in understanding the mix active here in Australia. Following the trend of mature offshore markets, the number of private debt managers continues to grow. However, market consolidation is seeing a core group of scale lenders emerge which is reflected below in our findings with domestic multi-asset fund managers increasing AUM by 20% of the market last year to 27% this year. This consolidation also reflects the requirement of investors and regulators to improve transparency and governance in coming years, with larger platforms better able to meet these expectations.

As in previous years, our market review has involved both public information sources and confidential discussions with a diverse range of private debt lenders. Our analysis spans the entire debt return spectrum and targets a wide variety of markets, including lending to businesses of different sizes, industry sectors and with a range of funding needs. However, we've excluded commercial bank lending, non-bank lenders financed through warehouse or securitisation markets, and investors in public market bonds and securities.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.