- within Tax topic(s)

- within Transport topic(s)

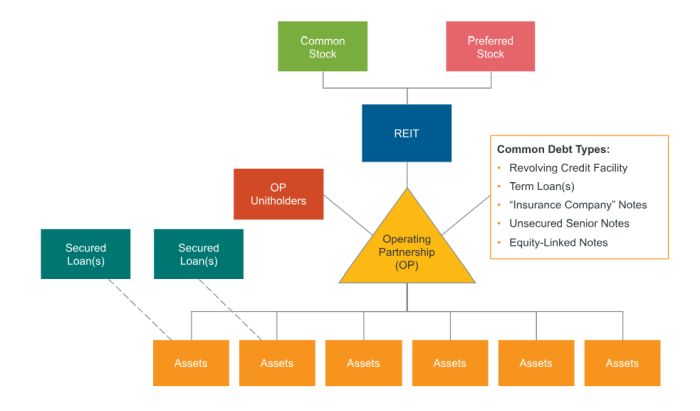

Senior credit facilities serve a critical role in the capital stack of a public real estate investment trust (REIT). To qualify as a REIT for federal tax purposes, a company must distribute at least 90% of its taxable income to shareholders, a constraint to which most corporate peers are not subject. This unique requirement limits the ability of REITs to retain earnings and maintain capital reserves, which in turn makes third-party financing essential for growth. When used in coordination with equity financing and long-term debt of various types, bank credit facilities provide REITs with the flexibility to fund acquisitions or other capital expenditures "on demand," while taking a disciplined approach to leverage over the longer term. Unsecured senior credit facilities blend features of corporate debt (i.e., debt borrowed against the REIT's balance sheet) and property-specific secured financing.

In this article, we discuss how senior credit facilities function within the REIT capital structure alongside other financing sources, and review recent market trends in the negotiation of key terms and covenants—highlighting areas where REITs may be able to obtain more borrower-friendly provisions. Finally, we discuss emerging factors such as sustainability-linked provisions and the impact of prevailing interest rates.

Overview of Bank Credit

Senior bank loans offer both advantages and disadvantages when compared to other financing sources. Compared to bonds, bank loans generally come with floating interest rates rather than fixed rates. Historically, this made them cheaper, but cyclical volatility in Treasuries can impact floating rates quickly and even push current variable rate loan pricing above the cost of bonds. In terms of maturity, bank loans are shorter term than bonds, creating risk from more frequent refinancing pressure. At the same time, senior credit facilities are an ideal source of "opportunistic" debt funding, while longer-term capital strategies are adjusted to replenish availability under the bank line. Typical structures include revolving lines of credit, which allow borrowers to draw and repay funds as needed, as well as term loans with set maturity dates, often accompanied by flexible refinancing provisions. Bonds, on the other hand, often include call protection and make-whole provisions to protect bondholders' target yield in a declining rate environment.

Simplified REIT/UPREIT Capital Structure

Both bank loans and bonds include financial and negative covenants, but bank loans tend to include more lender-protective provisions. When compared to property-level financing, bank loans at the REIT or operating partnership level offer greater flexibility since they are not tied to specific assets and can be used anywhere in the REIT structure. These loans also offer the ability to repay and reborrow. However, they come with increased downside risk because they are full recourse to the REIT or its operating partnership, unlike property-level debt, which is usually secured by specific assets.

Insurance Company Notes

So-called "insurance company" debt is a source of bond-like debt that often coexists with bank loans and bonds and shares features with both. Typically, they are privately placed senior unsecured notes with a high rating from the National Association of Insurance Commissioners that sit on the operation partnership's balance sheet on a pari passu basis with the senior credit facility and are often assisted by most favored lender clauses. Many REITs blend bank debt, bonds, and insurance company notes to ensure a diversified source of debt financing that can offer different spreads and tenor, as well as covenants and other terms.

Banks involved in this market — such as JPMorgan, Bank of America, Wells Fargo, and KeyBank — serve not only as lenders but often also as administrative agents and syndicate arrangers, managing multi-lender relationships and coordinating with the borrower on matters of ongoing compliance and reporting.

As discussed in greater detail in the next section, recent trends in REIT debt markets highlight the importance of using every available negotiating lever to align the type, tenor, and terms of debt with the REIT's business and financial strategy. Shifts in borrower demand and credit supply have meaningfully influenced lending terms in recent years, and REIT borrowers that actively manage this alignment can better take advantage of those shifts. The relative costs and benefits of different forms of debt can change quickly, creating both opportunities and risks.

|

REIT Senior Bank Credit Summary |

||

|---|---|---|

|

Structure |

|

|

|

Types of Debt |

|

|

|

Underwriting |

|

|

Recent Market Conditions

Beginning in 2022, the REIT market faced a slowdown in acquisition activity and experienced higher borrowing costs due to rising interest rates. These factors contributed to a reduced market for property acquisitions, which are the main driver of REIT debt demand. Over the full year 2022, Nareit (the National Association of Real Estate Investment Trusts) tracked approximately $52.5 billion in property acquisitions, down sharply from $127.8 billion in 2021. Despite the decline, REITs continued to act as net acquirers, with acquisitions exceeding dispositions by a margin of more than 2-to-1.

In 2023, REIT property acquisitions totaled approximately $21.7 billion, representing a further decline from 2022 and reflecting continued caution amid persistent interest rate volatility. Dispositions were comparable, resulting in a flat or slightly net seller position for the year. (REITs raised approximately $32.8 billion in debt capital over the year, focusing primarily on refinancing maturing obligations and selectively funding new investments.)

In 2024, REITs modestly reengaged in acquisitions, with full-year acquisition volume rising to about $46.5 billion, while dispositions totaled roughly $39.1 billion. This returned REITs to a net buyer position, albeit far below the acquisition pace seen in the pre-2022 environment. Total debt issuance increased to $48.1 billion, indicating sustained access to credit markets even amid elevated interest rates.

Year-to-date in 2025, acquisition and disposition volumes remain soft. Property transactions remain well below long-term trends, though selective buying continues in sectors such as industrial, self-storage, and healthcare. Unsecured debt pricing has averaged approximately 6.5%, reflecting a persistently high interest rate environment. While activity remains muted compared to the post-pandemic peak, REITs continue to maintain access to capital markets and selectively grow their portfolios through disciplined acquisitions. In the first half of the year, REITs issued $12.2 billion in the debt capital markets, which, annualized, would yield approximately 30% less in total annual issuances compared to $34.6 billion in 2024.

During this period, borrowers have consolidated the borrower-friendly terms that were increasingly entering the market between 2020 and 2022, with lenders relaxing traditional negative covenant protections and broadening the scope of asset inclusion in financial covenant calculations.

Key Considerations in Negotiating Bank Debt

REIT borrowers entering into senior credit facilities must consider four primary dimensions when evaluating and negotiating debt:

- Pricing: In a volatile interest rate climate, the pricing of financing options relative to the yield curve and Treasury rate expectations is highly important. As previously noted, bank debt is typically floating rate, providing risk in the short term but also upside opportunity relative to bonds. REIT borrowers must evaluate both headline interest rates and all-in borrowing costs, including up-front fees, commitment fees on undrawn amounts, and any other ongoing charges.

- Flexibility: REITs need to ensure their growth strategy is compatible with the restrictions under bank debt. Credit agreement restrictions around potential joint venture investments, managed funds, international expansion, and incurrence of other debt can each be critically important. Credit facilities have become considerably more flexible on these points. REIT borrowers must ensure that the facility includes sufficient covenant headroom and carve-outs to permit normal operations, including during times of market stress.

- Underwriting: How prospective lenders evaluate the REIT's financial profile and asset base is key to favorable pricing and terms. For unsecured credit facilities, this includes detailed analysis of the REIT's leverage ratios, coverage metrics, quality of unencumbered assets, and ratio of encumbered to unencumbered assets. REITs will need to be confident that their bank facility gives sufficient credit for their asset base, which can pose challenges when the REIT's properties include structuring features that may lead banks to discount the "borrowing base." If, for example, joint ventures are a key part of the growth strategy, the borrower will need to make sure it is getting sufficient credit for those investments in its leverage metric calculations. If mortgage notes are a key part of the asset pool, caps on the amount of mortgage receivables included in asset metrics will be a key consideration. If a REIT is active in "operational real estate" segments, banks may assess differently the asset-based features and the cash flow contribution of investments in ways that can impact loan underwriting.

- Cash flow impact: Beyond interest expense, REIT borrowers need to understand how interest payments (typically, at least quarterly), unused line fees, or other payments may affect liquidity. The goal is to avoid a structure that could inadvertently constrain operational cash flow or force suboptimal financial decisions simply to remain in compliance.

REITs should seek to negotiate terms with prospective bank lenders that achieve the REIT's economic and pricing objectives. Leveraging awareness of market-leading bank debt terms to secure flexibility and favorable financial covenant formulations will support the REIT's long-term growth.

Financial Covenants

Financial covenants allow banks to monitor the overall health of the REIT's business and the availability of assets to service the debt. Financial covenants are a key differentiator between senior bank debt and unsecured bonds — bank debt subjects the borrower to a wider range of financial covenant restrictions, typically on a "maintenance" basis, whereas bonds typically rely more on "incurrence" (restrictive) covenants plus a few leverage tests to ensure prudent balance sheet management and moderate all-in leverage. The REIT borrower's need to maintain financial covenant compliance at all times provides banks with the ability to directly monitor deteriorating loan quality and become proactive in case of balance sheet stress, a significant reason for the lower pricing in bank deals. Generally, financial covenant levels in senior bank debt are calculated on a quarterly basis, with additional testing upon certain material events like asset sales and debt incurrences.

As illustrated in the simplified structure chart included above, unsecured bank lenders will be pari passu with all other unsecured creditors and junior to lenders that have liens on specific assets. As a result, unsecured bank lenders scrutinize carefully — both at the time the loan is made and on an ongoing basis — the amount of total debt, the ranking (contractual and structural) of other unsecured debt, and the priority of property-secured debt on the REIT's balance sheet. A well-structured package of financial covenants protects unsecured bank lenders from a borrower becoming

Subsidiary Guarantees

To the extent that a REIT incurs unsecured debt at the level of asset-holding subsidiaries — and those subsidiaries do not guarantee the credit facility — unsecured subsidiary debt ranks, on a practical if not contractual basis, "senior" to the credit facility (this is often referred to as "structural seniority"). Subsidiary guarantees of unsecured debt, if required by bank lenders, can have ripple effects throughout the balance sheet in case obligations, such as insurance company unsecured notes, and have "springing guarantee" requirements to ensure that they remain on a pari passu basis with the credit facility, both contractually and structurally. The complexity of "upstream" guarantees can be compounded when the borrowing subsidiary is not consolidated and/or constitutes a joint venture with contractual restrictions for the protection of joint venture partners.

While there are market norms for financial covenants and related metrics, REITs have considerable flexibility for negotiation to ensure they receive full and fair credit for their assets and revenues. Recent years have seen a considerable increase in flexibility in common financial covenants, as well as a reduction in the number of financial covenants REITs are subject to (including the widespread removal of the once-prevalent minimum tangible net worth financial covenant). This has provided REIT borrowers material additional flexibility.

In negotiating covenant packages, the devil truly is in the details. Often, the same "base" covenant means different things, depending on the fine, sometimes very fine, print. Definitions that feed into quantitative ratios can provide both headroom and downside flex in specific circumstances. When a lender sees a deteriorating picture, timing and reference period terms with respect to minimum and maximum ratios can make the difference between having to deal with a notice of default and having a "difficult conversation" with the bank about future steps. Likewise, a complex topic can be whether key financial terms are customized or determined strictly in accordance with generally accepted accounting principles (GAAP). Bespoke definitions that include, for example, carve-outs, add-backs, and averaging, can prove to be significantly more favorable to the REIT, though negotiating these terms can be a delicate and time-consuming exercise.

A summary discussion of some of the most prominent financial covenants in REIT senior credit facilities is set forth below.

|

Financial Covenants in REIT Senior Bank Facilities |

||

| Nearly Always Included | Sometimes Included | Rarely Included |

| Total Leverage Ratio | Unsecured Interest Coverage Ratio | Minimum Tangible Net Worth |

| Secured Leverage Ratio | Secured Recourse Leverage | |

| Unsecured Leverage Ratio | ||

| Fixed Charge Coverage Ratio | ||

Total Leverage Ratio

Total leverage ratio is the ratio of total indebtedness to "total assets" of the consolidated group. The defined term "total assets" in the credit agreement is meant to generally approximate GAAP total assets less intangibles but, in most cases, is further negotiated to include properties — valued at capitalized NOI or EBITDA for mature properties and book value or other bridging metrics for development assets — plus cash, plus other equity and debt investments.

Caps on the proportion of total assets attributable to development or joint venture assets are common; investments in excess of those caps are permitted but don't receive financial covenant credit. This is a negotiated point that should reflect the REIT's growth strategy.

The public REIT market overwhelmingly uses a 60% maximum total leverage ratio. Nevertheless, many credit agreements now allow total leverage to surge to a maximum of 65% for several quarters after a material acquisition to allow for the temporary use of acquisition debt.

Secured Leverage Ratio

Secured leverage ratio is the ratio of secured debt (e.g., secured credit facilities and mortgage debt) to total assets of the consolidated group. The ratio is commonly set at a maximum of 40%, although there are instances as high as 50% for certain REITs with material mortgage debt and as low as 30% in certain other circumstances.

Unsecured Leverage Ratio

Unsecured leverage ratio refers to the ratio of total unsecured debt to unencumbered assets. This is a critical metric to unsecured creditors, as the unsecured creditors are all pari passu with respect to unencumbered assets (and junior to secured lenders on everything else).

The definition of "unencumbered assets" for purpose of this covenant has historically meant unrestricted cash and investment properties not subject to a lien. However, many REITs have recently been more successful at getting credit for a wider range of assets, such as first lien mortgage receivables and mezzanine debt, unencumbered marketable securities, noncommercial real estate (i.e., headquarters locations), and GAAP book value of other unencumbered assets. The credit agreement typically provides for a cap on the portion of unencumbered asset value attributable to these additional asset classes.

While credit agreements historically included numerous covenants regarding composition of the "unencumbered pool" of properties (e.g., minimum aggregate occupancy, minimum number of properties in the "unencumbered pool"), these have become increasingly uncommon. Public REITs refinancing their credit facilities in recent years have often successfully negotiated the removal of these requirements.

The unsecured leverage ratio is typically set at a maximum of 60%, sometimes with a material acquisition surge allowance to 65% for several quarters after a material acquisition. In some cases, REITs have successfully negotiated for their credit agreements to provide for a flat 65% base covenant with no further material acquisition surge allowance.

Fixed-Charge Coverage Ratio

Coverage ratios are another standard financial covenant found in REIT credit agreements and used by banks to monitor credit quality on a continuous basis. These ratios measure the REIT's ability to cover interest or fixed charges with recurring income. The fixed charge coverage ratio is the ratio of EBITDA to total fixed charges (e.g., interest, scheduled amortization, required distributions under preferred equity).

Senior credit facilities in the public REIT sector typically provide for a minimum fixed charge coverage ratio of 1.5x.

Unsecured Interest Coverage Ratio

Unsecured interest coverage ratio is the ratio of net operating income on unencumbered properties to interest expense on unsecured debt. Insofar as unsecured lenders rely on the unencumbered pool (with respect to which all unsecured lenders' claims rank pari passu), the ability of the unencumbered pool to generate sufficient cash for unsecured debt service on a current basis is a priority for bank lenders, as it is a leading indicator of balance sheet stress.

In the public REIT sector, the market standard for the minimum unsecured interest coverage ratio ranges from 1.5x to 2.0x coverage. In recent years, however, particularly given the number of other metrics available to lenders, many REITs have successfully negotiated to exclude unsecured interest coverage in their credit facility refinancings.

Minimum Tangible Net Worth

The minimum tangible net worth covenant requires the REIT to maintain a minimum tangible net worth (e.g., a fixed level set at closing plus 75% of equity issuances thereafter).

While historically common, tangible net worth covenants have become disfavored in the public REIT market. Lenders are persuaded by the argument that, if the REIT has both sufficient assets and cash flow for its debt service, the decline of aggregate net worth is not an important trip wire. Many REITs successfully negotiated to remove tangible net worth covenants in their more recent credit facility refinancings.

Secured Recourse Leverage

Secured recourse leverage is the ratio of secured debt, which is direct recourse against the borrower or any guarantor, to total assets. Lenders extremely disfavor the incurrence of other debt secured by the same assets supporting the credit facility. If the lender for a property-secured loan, in addition to priority with respect to the value of the collateral, has recourse to the REIT, or even the subsidiary borrower on a pari passu basis with unsecured creditors, that lender in effect enjoys a "super-senior" position that accrues to the detriment of credit facility lenders without the benefit of typical non-recourse debt (standard non-recourse debt carve-outs are commonly allowed). In the public REIT sector, when applicable, this covenant is typically set between 5% and 15% of total assets.

In our view, a secured recourse leverage covenant is unnecessary in REIT credit facilities because the combination of (i) needing to maintain a sufficient unencumbered pool to satisfy the unsecured leverage ratio, and (ii) the secured leverage ratio is sufficiently protective of lenders. For this reason, secured recourse leverage covenants are only occasionally included in REIT credit agreements.

The inclusion of minimum tangible net worth and secured recourse leverage covenants depends on the lender's underwriting model, the borrower's prior precedent (it is always harder to remove covenants a lender group is accustomed to), and the borrower's willingness to accept additional monitoring and constraints. Like the more common covenants, they are subject to negotiation and are often adjusted or removed during the drafting process. The ideal time to determine the scope of financial covenants is in initial discussions with lenders or at the term sheet stage; once included in the term sheet, it is typically difficult to remove financial covenants from the ultimate documentation entirely, although specifics can still be negotiated.

Negative Covenants in REIT Credit Agreements

In addition to financial covenants, REIT bank credit agreements include negative covenants. These provisions restrict the REIT and its consolidated group from engaging in certain transactions, typically subject to numerous exceptions and dollar thresholds. Lenders focus on two primary risks when drafting these covenants: ensuring that cash is not diverted to parties beyond their reach, and preventing changes in the REIT's asset base that would make it less creditworthy overall. Accordingly, standard negative covenants include limitations on incurring additional debt or liens, making investments, paying dividends, engaging in non–arm's length affiliate transactions, and selling assets.

Negative covenants typically do not apply to unconsolidated joint ventures, which are free to operate and incur debt outside of the credit facility. However, certain practical limits still remain. To the extent the REIT relies on credit for joint venture assets, either on a pro rata basis based on ownership or as the book value of its joint venture equity, transactions at the joint venture may still impact the REIT's financial covenant position. The REIT will also be subject to asset sale covenants that apply to exits from joint venture positions. On rare occasions, unconsolidated joint ventures may find themselves subject to negative covenants, typically in connection with giving upstream guarantees or entities fully under the control of the REIT, including with respect to "major decisions," but such scenarios are few and far between due to the understandable reluctance of joint venture partners to permit their entities to provide credit support to REIT-level debt or concede that level of control.

Public REITs, however, have specific sensitivities to many negative covenants. A REIT's business model is typically centered around making investments, so flexibility to deploy cash is essential. Moreover, because REITs must pay out regular dividends to shareholders to maintain REIT status, cash outflows to shareholders must be preserved, even during challenging times. Selling profitable assets must also remain opportunistic and free from excessive lender control. These realities require REITs to negotiate aggressively for borrower-friendly negative covenant provisions, steering lenders to rely more heavily on financial covenants to manage their risk.

In most cases, REITs are permitted to make required shareholder distributions in cash even during an event of default or when they are out of compliance with financial covenants. Lenders that are familiar with the REIT space understand that jeopardizing REIT status is not a tenable position.

A striking development in the post-2020 market is the outright removal of certain traditional negative covenants from many REIT credit agreements, particularly for investment-grade or near investment-grade borrowers. For instance, numerous facility refinancings over the past few years have omitted investment covenants entirely, meaning these REIT borrowers have no contractual limitations on their ability to make investments. This is particularly meaningful in the context of joint ventures,1 where prior credit agreements in the sector often capped investments in noncontrolled entities.

The increased flexibility in today's senior credit agreements means that many higher-rated REIT borrowers can now undertake joint venture investments, extend loans to tenants, and make off-model investments with no restrictions beyond compliance with financial covenants at quarter-end. REITs also have greater freedom to incur new debt or sell assets, provided they remain in compliance with financial ratios at the time.

Similarly, insurance companies that invest in REIT senior unsecured notes are often willing to rely on contractual parity with the REIT's primary credit facility as their protection, in some cases allowing "fall-away" covenants if that credit facility is refinanced with more lenient restrictive covenants or automatic waivers/amendments to the extent that credit facility lenders are willing to give their REIT borrower latitude under specific circumstances. These provisions are intensely negotiated and can be very bespoke, depending on how a REIT uses financial leverage broadly to fund its investments and operations.

The flexibility provided by senior credit facilities comes with trade-offs and requires discipline on the borrower's part to avoid seeing sources of debt that have become important to it "seize up" due to perceived higher risk. From the lenders' perspective, these dynamics reduce the ability to detect problems in advance and create potential intercreditor issues that limit the lenders' ability to be proactive in avoiding distress. Lenders may not have early warning of material changes in the borrower's financial condition until the quarter-end compliance certificate is delivered. This increases lender risk. From the borrower's perspective, the lack of guardrails is advantageous but also requires vigilance. As discussed previously, financial covenant components are heavily negotiated and borrowers should be mindful of whether assets they acquire or invest in will receive credit under previously negotiated financial covenant calculations, as directing material cash into assets that do not receive credit may imperil compliance in future quarters.

Looking Ahead

Sustainability

In recent years, sustainability-related provisions have become more prevalent in REIT credit agreements, particularly among larger and publicly traded REITs, as lenders and borrowers seek to align financing terms with sustainability objectives. Bank lenders have been incorporating environmental, social, and governance (ESG) criteria into pricing, offering modest interest rate reductions based on the borrower's performance on selected key performance indicators (KPIs). Typical KPIs include greenhouse gas emissions reductions (primarily Scope 1 and 2); energy-efficiency improvements across the portfolio; LEED (Leadership in Energy and Environmental Design) or ENERGY STAR certification targets; and ESG scores from third-party ratings agencies, such as the Global Real Estate Sustainability Benchmark. Sustainability-linked terms should be carefully vetted to ensure KPIs are achievable and reflect operational realities.

In recent years, many publicly filed REIT credit agreements and refinancings included some form of ESG provision that, in some cases, wasn't even linked to pricing. These provisions varied from clearly defined metrics to "agree-to-agree" clauses, where the REIT and the administrative agent commit to later amending the agreement to include an ESG metric. While asset efficiency and climate resilience are arguably important considerations in a REIT's long-term business strategy, lenders and borrowers alike might become more cautious in structuring ESG provisions given current regulatory and political anti-ESG pressures. As in other areas, we recommend establishing a clear nexus between KPIs and financial outcomes/objectives, such as energy savings and lower utility costs, reduced tenant turnover, and vacancy losses.

Prevailing Interest Rates

Volatility in interest rates, and certainly an uncertain environment with respect to long-term Treasury rates and their relationship to the yield curve generally, presents challenges for all borrowers. REITs are not immune, but their prevailing strategy of matching long-term liabilities to their long-term assets creates additional risks. When maturing fixed-rate bonds need to be refinanced at higher rates or spreads, pressure can build for a REIT's acquisition and development activities, which may be difficult to adjust at a time of interest rate volatility. However, we believe that REITs are generally well-positioned to withstand this pressure due to their moderate leverage and access to a variety of sources of equity and debt capital to mitigate "stress" in any particular quadrant of the market. Net interest expense remains under 20% of net operating income, implying an interest coverage ratio of more than 5x. This suggests most REITs can remain in compliance with their coverage covenants, even in a rising interest rate environment.

Conclusion

While the overall financing environment may be challenging from time to time due to macroeconomic or cyclical conditions, senior bank lending remains an attractive option for REITs. Its flexibility, especially the ability to refinance without prepayment penalties, makes it an effective tool for managing the debt side of the balance sheet under most circumstances.

The long-standing trend toward more borrower-favorable terms has not abated. Institutional lenders have become more sophisticated in understanding REITs' unique needs, and they have adapted accordingly by allowing greater flexibility in credit terms. As a result, REIT borrowers can now access capital with fewer restrictions and greater autonomy than in previous years.

Footnote

1. To learn more about joint venture structures for public REITs, see Goodwin's July 2025 alert, "Joint Ventures for Public REITs: Opportunities and Challenges."↩

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.