- within Finance and Banking topic(s)

- with Finance and Tax Executives

- in Australia

- with readers working within the Banking & Credit, Retail & Leisure and Securities & Investment industries

In the modern age, public REITs use derivative instruments to manage risk, raise capital and manage their sources and uses of capital based on future commitments. REITs have long used interest rate and foreign exchange (FX) derivatives to hedge or mitigate risks associated with debt obligations or owning and operating properties outside of the U.S. More recently, public REITs have expanded their use of derivatives to raise equity capital with forward share sales, and to protect against dilution in convertible and exchangeable note offerings. In addition, REIT founders and insiders are now able to hedge or monetize their operating partnership (OP) unit holdings with derivative transactions. This article highlights the issues that REITs should consider with respect to derivative transactions, including applicable accounting treatment and tax characterization for purposes of the IRS' REIT qualification tests.

1. Equity Forward Sales Transactions

Forward sales of equity by publicly-traded REITs have expanded dramatically in recent years. Once a relatively niche tool used primarily by large-cap REITs with sophisticated treasury operations, forward sales have become a standard feature of capital raising programs for a broad range of issuers. REITs increasingly view forward executions as strategic tools for capitalizing on favorable pricing environments while deferring both earnings per share (EPS) dilution and cash receipt. REITs use the proceeds of forward sales to fund future acquisition and development needs, as well as to optimize assets and liabilities management while minimizing dilution and negative arbitrage.

In an equity forward, one or more banks, either directly or through affiliates, borrow REIT shares from institutional securities lenders and sell the borrowed shares to investors. The bank(s) offset their short position in the shares by simultaneously entering into one or more equity forward contracts, or confirmations, with the REIT pursuant to which the REIT agrees to sell an equal number of shares to the bank(s) at a future date. When the REIT elects to settle the forward, it delivers the shares to the banks, and the banks use the shares they receive to close out their short positions.

Most REITs settle forward sales physically by issuing primary shares to the forward counterparty in exchange for a cash payment equal to the applicable forward price multiplied by the number of shares under the forward contract. However, confirmations for forward sales will also include an option for the issuer to settle the transaction through net shares or with cash. The tax treatment of a payment to the REIT in cash settlement of a forward sale is not clear, and it may not qualify as "good" income under the REIT income tests. Therefore, most REITs avoid cash-settling forward sales if the payment received would exceed their available "bad" income basket.

In contrast to traditional equity offerings, a key advantage is that EPS dilution (and therefore FFO dilution) only occurs when the issuer elects to settle the forward sale in shares and receives cash upon settlement. If the issuer elects to cash settle the forward offering, no such dilution occurs. Additionally, forward equity offerings may have favorable equity accounting treatment compared to interest rate and FX hedging transactions.

Forward equity sales can be quickly executed, assuming suitable market conditions, in a traditional marketed offering or in conjunction with an at-the-market (ATM) program:

- Marketed Forward Offerings. A marketed forward equity offering is executed and documented in substantially the same way as a traditional follow-on offering but differs in that the REIT doesn't immediately deliver the shares sold in the offering and does not receive cash proceeds. Instead, the REIT can elect to settle the transaction by delivering shares to the bank, and receiving the cash for the forward sale, at any time before maturity of the forward. Most forward sale contracts are scheduled to mature within one year of the trade date but may be extended in certain cases. The initial forward price for the marketed forward offering is the price paid to the banks for the sale of the borrowed shares. Thereafter, the forward price for the sale will change based on a daily rate. The daily rate is calculated as the rate equal to the "overnight bank funding rate" for each day during the forward contract minus the agreed spread, divided by 360.

- ATM Forward Offerings. Most REITs now include a forward offering component in their ATM program documentation. Unlike a typical marketed offering, the initial forward price for ATM forward offerings is based on the volume-weighted average price of the shares borrowed and sold by the sales agent or forward seller on the exchange during the hedge execution period, which can be days or weeks as agreed by the REIT. The forward price changes on a daily basis in the same manner as a marketed forward. During the term of an ATM forward offering, REITs may continue to execute regular way ATM sales or with additional forwards. For more information on forward ATM sales, please see Goodwin's alerts on: "Developments in the Use of "At-the-Market" Offering Programs by REITs" (2019) for a more detail description of forward ATM mechanics and our "Recent Developments in the Use of ATM Offering Programs by REITs" (2025), which includes updates on sizing, pricing, structuring and accounting considerations for REIT ATMs and forward sales.

The bank's initial hedge sales under the forward contract may be offered on a "block" or "agency" basis. As noted above, the banks are typically fully hedged during the term of the forward by being simultaneously short the borrowed shares and long the shares they will receive under the forward confirmation. After the bank sells the number of shares under the forward contract into the market, the bank may freely hedge its exposure under the contract and deliver the shares received under the forward to close out its hedge positions at settlement.

The forward contract is documented under an ISDA-based confirmation that contains the key economic terms and conditions of the transaction, including settlement elections and mechanics, and applicable adjustments for dividends and other corporate actions. Marketed forwards, like forward ATM offerings described below, are registered offerings conducted in accordance with the 2003 Registered Hedging No Action Letter, pursuant to which the offering of the bank's initial hedge sales under the contract is registered under the issuer's effective registration statement on Form S-3 and related prospectus supplement.

Dividends. When the REIT pays a dividend on the shares subject to the forward contract, the forward counterparty bank—that has borrowed and sold the shares short for its hedge position—will owe the dividend payable on the shares to its stock lender. To account for the forward counterparty's obligation to pay any dividends on the borrowed shares to its stock lender, the forward confirmation will include a schedule with the REIT's anticipated quarterly per-share dividend amounts and dividend payment dates during the expected term of the forward. These are termed "Forward Price Reduction Dates" because the forward price payable by the forward purchaser upon settlement will be reduced by a corresponding amount. Accordingly, the anticipated dividend amounts, and dividend payment dates are priced into the cost of the forward sale.1

Accounting for Forward Equity Sales. ASC 815-40-25 "Derivatives and Hedging—Contracts in Entity's Own Equity," governs the accounting treatment of forward equity sales, which addresses contracts in an issuer's own equity. While derivatives are generally classified as assets or liabilities, and marked to market each quarter, ASC 815-40-25 allows derivatives on an issuer's own equity securities to be classified as a change in equity if the contract meets specific criteria. These criteria include, among other requirements, that:

- the contract must always give the issuer the right to settle in shares or net shares;

- no netting or set-off with other obligations;

- although the contract may allow for cash settlement, this option must be solely at the issuer's discretion—there can be no forced cash settlements;

- the issuer must have sufficient authorized and unissued shares to complete full physical share settlement;

- the contract must permit settlement in restricted shares;

- the contract must include a cap on the number of shares to be delivered; and

- it must not include any cash-settled top-off or make-whole provisions.

The impact on EPS is calculated using the Treasury Stock Method. If the forward contract is "in-the-money" for the dealer counterparty—meaning the REIT's current stock price is greater than the forward price—then the number of shares outstanding is increased only by the number of shares the REIT would need to deliver to the dealer. If the REIT's current stock price is less than the forward price, meaning the forward is not in-the-money, then the number of shares outstanding for EPS purposes is not increased.

2. Convertible and Exchangeable Note Offerings and Call Spread Transactions

Due to market volatility and favorable accounting changes, more public REITs are using convertible and exchangeable bonds to raise capital and refinance debt. Convertible debt securities generally do not contain onerous financial or other covenants, typically carry significantly lower coupons than traditional unsecured debt securities, and can be less dilutive overall than follow-on equity issuances. For REITs in the UPREIT structure, convertible debt securities are technically "exchangeable" instruments (not "convertible") since the debt is issued by the operating partnership but is exchangeable for the parent REIT's common stock.

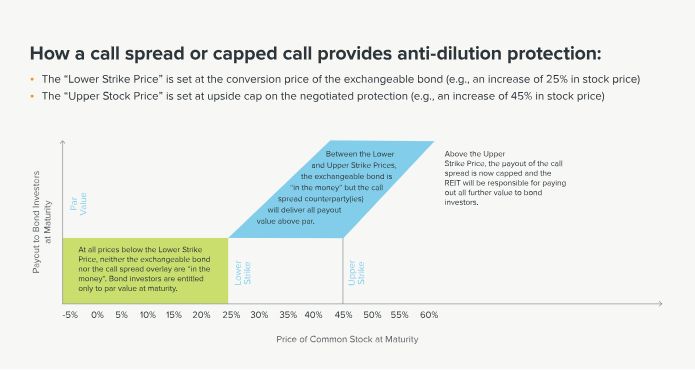

In recent periods, public REITs have issued exchangeable notes with interest rates ranging from 2.00% to 3.50%, and initial exchange prices up 20% to 30% from the reference price for the offerings. When considering the combined impact of the meaningful coupon rate plus relatively low initial exchange price, the all-in cost of capital for convertible or exchangeable notes may be less favorable when compared to other available funding alternatives. This is where the use of sophisticated derivative instruments could allow REITs to improve the all-in cost of convertible or exchangeable debt through a call spread overlay. As described below, call spread transactions executed in connection with convertible or exchangeable notes can effectively nearly double the initial exchange price, as well as mitigate equity dilution and/or offset cash payments due upon conversion or exchange of the notes.

In a call spread transaction, the issuer uses a portion of the bond proceeds towards purchasing a call option on its own shares, with a strike price equal to the initial exchange price applicable to the bonds. If the REIT's share price appreciates to the point where the convertible/exchangeable bonds are in the money, then, instead of issuing new shares to satisfy conversions/exchanges by bondholders, the REIT becomes entitled to receive shares under the terms of its call option and uses those shares to settle its obligations to the bondholders. Because an unlimited call option on its own shares would be prohibitively expensive, most often the REIT will agree to cap its entitlement to shares under the call option to a price equal to, say, 40% up from the reference price for the offering.

Call spread transactions are typically documented in one of two ways:

- "Bond Hedge plus Warrant" — a long-form confirmation that documents the call option purchased by from the dealer with a strike price equal to the exchange price on the bonds, plus a separate confirmation that documents the higher strike call option (i.e., a warrant) sold by the REIT to the dealer; and

- "Capped Call" — a long-form confirmation that documents both the call option purchased by from the dealer with a strike price equal to the exchange price on the bonds, and the offsetting higher strike call option (i.e., the cap for the higher strike call option).

While the economic effect of a bond hedge plus warrant transaction and a capped call transaction is substantially similar, there are some differences of note. As a practical matter, a bond hedge plus warrant transaction can take incrementally longer to negotiate than a capped call because the bond hedge plus warrant structure consists of two separate confirmations, each with different terms and conditions. More substantively, as described in more detail below, bond hedge plus warrant transactions can generally provide larger tax deductions over the life of the transaction when compared to capped calls. However, bond hedges plus warrants can also be more dilutive for EPS accounting purposes if the REIT's share price is greater than the warrant strike price at settlement. Additionally, if the issuer announces a fundamental change or other material corporate event before maturity of the warrant, and the issuer elects to early terminate the bond hedge and warrants, the warrants can be expensive to unwind prior to their scheduled maturity date.

In both structures, the lower strike call option provides a hedge that mitigates equity dilution and/or offset payments due upon conversion or exchange of the notes, subject to the payout being capped at the higher strike. The higher strike call option represents the new effective exchange price for the notes. Outside the REIT sector, many convertible issuers elect a higher strike price (the cap price) of 100% or more above the reference price of the notes. Conversely, in the REIT sector many issuers elect a cap price between 25% and 75% above the reference price of the notes, often because REITs pay relatively high dividends and REIT common stock is typically less volatile than those of issuers in the technology and healthcare spaces.

Tax Treatment. While a convertible/exchangeable note with a call spread transaction is economically comparable to a convertible/exchangeable note with a higher exchange price, under current market conditions the lower cost of capital resulting from a lower exchange price will often more than offset the cost of entering into the call spread transaction.

Because of this economic equivalence, bond hedges and capped calls can be "tax integrated" with the notes by closely aligning certain terms of the call spread with the notes as defined in the indenture for the notes. Integrating the call spread with the convertible or exchangeable notes can, for tax purposes, create a synthetic debt instrument where the premium paid for the bond hedge or capped call can be added to the total interest expense. This effectively results in the tax treatment of the note, and the integrated call spread aligning with the tax treatment of an exchangeable note issued with a higher conversion price. Thus, if the terms of the instruments support tax integration, a REIT would not suffer adverse tax consequences from pursuing the call spread approach (as opposed to issuing exchangeable notes with a higher conversion price).

In the bond hedge plus warrant structure, the full premium paid to purchase the bond hedge from the banks can be deducted over the term of the notes. On the other hand, the warrants sold to the banks are generally treated as transactions in the issuer's own stock for tax purposes, such that any taxable income or loss on the warrants should not affect the tax integration analysis. In a capped call structure, only the net cost of the capped call (which offsets the premium payable for the lower strike call against the cost of the upper strike sold) can be amortized as OID over the life of the debt. The total deductions under the capped call are thus usually less than the deduction under a bond hedge plus warrant structure.

3. OP Units: Hedging and Monetization Solutions

Beyond raising equity capital with derivatives, certain holders of common limited partnership units in the REIT's operating partnership ("OP units") may be able to use derivatives to hedge and monetize their holdings in a tax-efficient manner. OP units are typically received in REIT formation transactions by contributing founders or in subsequent transactions by property contributors.

(While the derivative tools described below are theoretically equally available to all holders of OP Units—such as REIT directors and senior officers, including those who may have received OP units upon conversion of other partnership interests granted as equity incentive compensation—in practice it may be difficult for current insiders of a public REIT to implement derivatives-based hedging arrangements due to internal corporate policies and external governance concerns. See discussion below under "—Rule 144 Compliance; Internal Approvals".)

In the classic OP unit transaction, owners of appreciated real estate contribute their property(ies) directly to the REIT's operating partnership on a tax-deferred basis (i.e., no recognition of gain or loss) in exchange for OP units. Following an initial lockup period, commonly 12 months, OP unitholders can tender their units for redemption, in whole or in part, in exchange for cash equal to the value of a REIT share or, at the election of the REIT, for a like number of REIT shares. In either case, redemption is a taxable event that triggers gain to the extent of appreciation in the redeemed units and any built-in gain inherent in the contributed assets at the time of contribution. For further details on the tax and liquidity aspects of OP unit transactions, see Goodwin's recent publication Unlocking the UPREIT Structure: OP Unit Transactions for REITs.

In addition to an immediate triggering of built-in gain, the exchange of OP units for REIT shares historically also presented liquidity timing issues. As "restricted securities" for purposes of the federal securities laws, OP units and the REIT shares into which they may be exchanged can only be resold pursuant to registration or an available exemption. The most commonly available exemption, resales by non-affiliates following a six-month holding period pursuant to Rule 144 under the Securities Act of 1933, as amended, was not historically practical for OP unitholders since the exchange of OP units for REIT shares, securities of a nominally different issuer, served to reset the Rule 144 holding period requirement. This position meant that exchanging OP unitholders would trigger built-in gain immediately upon exchange but still have to wait at least six months before being able to monetize their shares.

In a 2016 No Action Letter, however, the SEC updated its guidance to provide that the Rule 144 holding period would not restart upon exchange of OP units for REIT shares; rather, holders would be able "tack" their REIT shares holding period to the date they first acquired the OP units. The SEC's new position has thus helped solve the timing and liquidity mismatch between exchanging OP Units for REIT shares and being able to freely sell the REIT shares, but the exchange into REIT shares (with or without their resale) will still trigger a taxable event for holders.

It is with these considerations in mind that derivative instruments can provide OP unitholders with valuable tools to help bridge the gap between risk and reward.

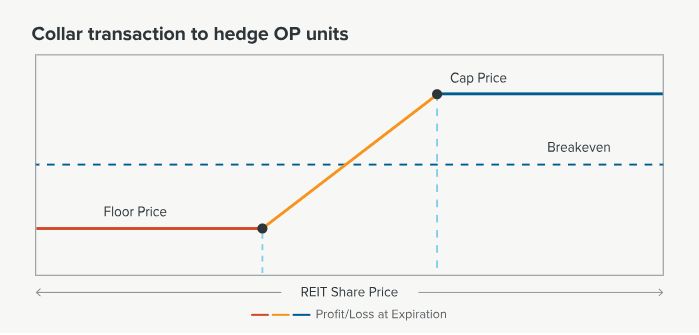

Cashless Collar Transactions. In a collar transaction, the investor purchases put options at a price below the reference price (the floor price) and sells call options above the reference price (the cap price). The premium for the purchased floor price is typically offset by the premium received for the sold cap price, thereby making the collar "cashless." A collar limits downside risk below the floor price while allowing for appreciation up to the cap price.

As with many equity derivatives hedging transactions, when implementing a collar the bank/counterparty will sell short an equivalent number of shares of the REIT common stock as its hedge. In the case of Section 16 insiders (i.e., directors, senior executives and/or owners of greater than 10% holders), the bank's short hedge position would historically cause the insider to violate the Section 16(c) prohibition on net short positions since the insider was considered to own the OP units, but not the underlying REIT common stock sold short by the bank. Section 16(c) prohibits "net short" positions by an insider in an issuer's common stock. Likewise, Rule 16c-4 prohibits insiders from establishing or increasing a short derivative or put equivalent position in an issuer's common stock.

However, in a 2019 No Action Letter the SEC agreed that, for purposes of Section 16(c) and Rule 16c-4, ownership of OP units is economically the same as owning the underlying shares of REIT common stock. Accordingly, when the bank sells short the REIT's common stock as its hedge for the collar transaction, there would be no net short position and thus no violation of Section 16(c) or Rule 16c-4.

As a result, with a properly structured collar transaction, REIT investors that are also Section 16 insiders now have access to the same tools as outside OP unitholders who are not subject to Section 16. They can now hedge risk, maintain some upside appreciation, and potentially access liquidity but not trigger a constructive sale of the OP Units for tax purposes. However, as noted above, even without the Section 16 concerns, internal policies and external governance concerns may in practice limit the availability of these tools to insiders. See discussion below under "—Rule 144 Compliance; Internal Approvals".

Additional Hedging Derivatives. Holders of OP units, restricted REIT shares or other restricted securities have additional solutions to hedge and monetize their holdings:

- Prepaid variable share forward (PVSF or VPF). In a prepaid forward transaction, the holder sells shares of REIT common stock on a forward basis to a counterparty bank and receives upfront proceeds in an amount equal to approximately 80% - 90% of the notional value of the put strike of the transaction. In exchange, the holder agrees to deliver a variable number of shares to the bank at a future settlement date, with the exact number of shares to be delivered contingent on the REIT's share price at time of settlement. The OP units or REIT shares underlying the transaction are pledged to the bank to secure the holder's future delivery obligations.

- Funded collar. In a funded collar, the holder executes a collar with a cap price and floor price, and enters into a loan agreement with the bank counterparty. The loan is linked to the floor price of the collar and the loan amount typically provides upfront funding of approximately 80% - 90% of the notional value of the floor price (similar to economics of the prepaid forward transaction described above). The loan agreement can be documented as a separate agreement or included in the terms of the collar confirmation. While the economics of the upfront funding of the prepaid forward or funded collar are economically similar, the loan from a funded collar is subject to the margin rules, including maximum loan-to-value ratios and restrictions on the use of loan proceeds, but the interest expense on the loan proceeds may also be deductible for certain taxpayers.

Real estate owners and investors should consider hedging and monetization strategies before contributing property in exchange for OP units from an UPREIT. For example, when negotiating transactions to contribute appreciated real estate to a REIT's operating partnership in exchange for OP units, investors should preserve the right to transfer, pledge and hedge their OP units. Mitigating risk and generating liquidity can be critical to meeting the investor's tax, estate planning and financial objectives. The ability to access liquidity for the property being contributed will likely impact decisions on timing, pricing, and legal structure of the deal. For more information about negotiating and structuring OP unit deals with UPREITs, please see Goodwin's recent publication on Unlocking the UPREIT Structure: OP Unit Transactions for REITs.

Rule 144 Compliance; Internal Approvals. Prepaid forwards, collars and other hedging and monetization transactions on OP units and restricted REIT stock are generally executed pursuant to the SEC guidance set forth in a 2011 No Action Letter. The no-action letter provides that an investor that is an affiliate of the issuer, or holds restricted securities eligible to be sold pursuant to Rule 144, can execute any forward and option-based derivative contracts (prepaid forwards, collars, covered calls, etc.) so long as the transaction is structured, and bank's initial hedge sales are executed, in accordance with the conditions of Rule 144. Specifically, the transactions must be structured so that maximum number of shares deliverable under the contract does not exceed the applicable Rule 144 volume limitation, and the bank's initial hedge sales (the maximum number of shares deliverable under the contract) must be sold on the exchange or through a block transaction. If required under Rule 144, seller must also file a Form 144 notice on the day of execution (plus a Form 4 and Schedule 13D, as applicable) to disclose the transaction and its material terms.

Before executing any hedging or monetization, insiders and others covered by the REIT's insider trading policy must ensure that any proposed transaction is permitted under the policy and that all prior authorizations have been obtained. For example, most hedging and monetization transactions will require the holder to pledge and deliver the securities underlying the transaction to one or more counterparty banks. These transactions will require coordination with the REIT, its counsel and transfer agent to transfer the OP units or shares into the bank's collateral account and grant a security interest to the bank to secure the investor's potential obligations under the transaction.

In addition, as noted above, internal policies beyond the REIT's insider trading policy and other considerations may limit the practical ability of a Section 16 insider (or other insider) to utilize hedging and monetization strategy. Many public REITs have flat prohibitions on the hedging or pledging of company securities, which are publicly disclosed in their filings with the SEC, or policies that can only be waived by the REIT's board of directors or an independent committee of the board.

4. Interest Rate Risk Management

REITs manage exposure to interest rate fluctuations by using swaps, caps, and other derivatives.

Interest Rate Swaps

REITs with floating-rate debt can use interest rate swaps to effectively convert variable interest payments into foreseeable fixed interest payments. Rate swaps can thus lower overall REIT borrowing costs and align interest rate expense obligations with forecasted revenues. In a swap, the borrower under a loan or debt obligation agrees to exchange future interest payments based on a specified notional amount (typically the loan amount) over a series of dates that match the payment dates on the loan being hedged. In a floating-to-fixed swap, one party (the borrower with a floating-rate loan) agrees to pay a fixed interest rate to a swap dealer counterparty, and in return, the borrower receives payments from the swap dealer based on a floating interest rate (e.g. SOFR), which is the same benchmark interest rate used in the loan.

Rate swaps are structured so that the notional amount of the debt obligation equals the notional amount of the swap, and the payments paid or received by the hedging party will off-set. In a floating to fixed rate swap, if on a reset date (the date when the floating benchmark rate is measured against the fixed rate (known as the swap rate)), the variable interest rate is greater than the swap rate, the bank pays the hedging party (the REIT or operating partnership) an amount equal to the additional interest expense above the swap rate. Conversely, if the variable interest rate is less than the fixed rate on a reset date, the REIT must make a similar payment to the bank. The amount of the swap payment is the difference between the variable rate and the fixed rate (either positive or the absolute value of such difference) multiplied by the notional amount of the swap. Swap payments are settled on a T+2 basis after each reset date, which should be the same date as the loan's schedule interest payment date. Swap contracts are likewise structured to expire on the same day as the credit agreement or debt instrument being hedged.

Interest rate swaps are priced based on the difference between the swap rate and the U.S. Treasury note with the most equivalent term, as indicated on the forward interest rate curve, known as the yield curve. The yield curve is the plot of U.S. Treasury yields across different maturities (from 30 days to 30 years). Most loans and swaps are priced off the 10-year Treasury yield. Generally, the steeper the yield curve and longer the term, the more expensive the swap rate.

Interest rate swaps create credit risk for both the REIT and its bank counterparty(ies) because either party could owe the other payments during the term of the swap. These payments can be significant depending on the notional amount of the swap, time to maturity and volatility of the reference interest rate for the swap. The credit risk of the swaps can be mitigated by property documenting swaps under an ISDA Master Agreement including the Schedule thereto. As discussed in more detail below, ISDA Master Agreements can take time to negotiate, including the applicable termination events and incorporating the terms of the credit agreement or debt instrument being hedged.

Interest Rate Caps

Interest rate caps offer a different form of protection than that provided by a swap. In a cap, the hedging party (e.g., the REIT or operating partnership) buys a call option on the relevant rate in the obligation being hedged. The strike price of the call option (i.e., cap) will be the maximum rate that the hedging party will be required to pay over the term of the contract. If the interest rate at the cap's maturity is greater than the cap price at maturity, the hedging party receives a payment equal to the notional amount of the cap contract multiplied by the relevant rate at maturity, minus the rate cap price. If the interest rate at the cap's maturity is less than the cap price at maturity, no further payments are due by either party. Real estate lenders often require that borrowers execute a cap in connection with certain loans to enhance credit risk by protecting against rising interest rates and increased interest expense that would be payable by the borrower. The premium for a cap can be paid either upfront or at the contract's maturity.

Like swaps, interest rate caps are usually structured to align with the loan amount, interest rate and maturity date of the loan being hedged. If the cap is prepaid, there is no credit risk to the cap provider. Consequently, interest rate caps can be executed quickly because the hedging party doesn't need to negotiate an ISDA Master Agreement with the cap provider (just the customary know your customer (KYC), anti-money laundering (AML) and Dodd-Frank onboarding documentation described below).

When considering whether to use a swap versus a cap to hedge interest rate risk, it is essential for REITs to consider potential breakage costs associated with swaps. As described above, pricing for swaps and caps is primarily driven by the steepness of the yield curve over the expected term of the transaction. Swap breakage fees are largely determined by the difference between the rate under the swap and the yield curve corresponding to the swap remaining time to maturity. REITs should bid out caps to several dealers to get the best price (the lowest premium for the selected cap price) and evaluate the risks and benefits of an interest swap hedge versus a cap. REITs should further consider the possibility that the underlying loan may be repaid or cancelled and potential costs relating to unwinding the swap, as well as the relevant accounting treatment for hedge transactions (as discussed in greater detail below).

5. "Bad" Income Considerations for REITs

The 95% Test and the 75% Test. In evaluating any hedging transactions, REITs must consider the income characterization of any payments receives under the hedges, including the IRS income tests found in Sections 856(c)(2) (the "95% test") and 856(c)(3) (the "75% test") of the Internal Revenue Code (the "Code"). Non-qualified hedges generate "bad" income—income that is included in the denominator but not the numerator of the 95% and 75% tests. Qualified hedges, by contrast, produce income that is excluded from both the numerator and denominator.

To be treated as a qualified hedge, the transaction must be properly classified as a hedge for tax purposes. The hedging transaction must be timely and correctly identified and documented and must relate to interest rate fluctuations on debt used to acquire or carry real estate assets or to foreign currency fluctuations relating to qualifying assets under the REIT income tests (or to fluctuations in the value of other qualified hedges). If a hedge fails to meet these requirements, it will be treated as a non-qualified hedge, thereby generating income "bad" income for purposes of calculating REIT qualification under the Code.

The IRS requires specific identification and documentation procedures for hedging transactions under Section 1221(a)(7). The hedge must be clearly identified on the day it is executed, and this identification must be contemporaneously recorded in the REIT's books and records. The REIT must designate the transaction as a hedge under Sections 856(c)(5)(G) and 1221(a)(7) under the Code. The documentation must indicate that the identification is for tax purposes and must include the effective date, a description of both the hedging instrument and the hedged transaction, and the amount hedged. For tax integrated capped calls, the hedge and its material terms must be identified and described pursuant to Section 1276 under the Code

If these identification and documentation requirements are met, any income received from the hedge may be excluded from the REIT's income under Sections 856(c)(5)(G) and 1221(a)(7).

6. Derivative Accounting Considerations for REITs

FASB ASC Topic 815, Derivatives and Hedging (ASC 815). Under FASB ASC Topic 815, REITs are required to record interest rate and currency derivatives on their balance sheet either as assets or liabilities, measured at fair value. Unless a hedge qualifies for hedge accounting treatment, any changes in the derivative's fair value during a reporting period must be recognized in earnings.

There are three primary types of hedging relationships under ASC 815 that may qualify for hedge accounting:

- ASC 815-40-25 - Fair Value Hedging. A fair value hedge is a hedge of the exposure to changes in the fair value of a recognized asset or liability, or of an unrecognized firm commitment, which are attributable to a particular risk.

- ASC 815-40-30 - Cash Flow Hedging. A cash flow hedge is a hedge of the exposure to variability in the cash flows of a recognized asset or liability, or of a forecasted transaction, that is attributable to a particular risk.

- ASC 815-40-35 - Net Investment Hedging. A net investment hedge is a hedge of the foreign currency exposure of a net investment in a foreign operation.

Before applying hedge accounting treatment, ASC 815 requires that hedging parties satisfy specific criteria. Before or at the time of executing a hedging transaction, the REIT must first prepare formal documentation that outlines the material terms of the derivative transaction with the swap dealer. These terms include identifying the swap dealer counterparty, trade date, effective date, maturity date, and notional amount. For interest rate hedges, the documentation must also specify the underlying debt obligation and its terms, the notional amount, the fixed or floating rate of the hedge, the applicable reference rate, and any reset dates for swaps or the cap rate for interest rate caps. For currency hedges, the documentation must identify the relevant property or properties, the foreign currency, the notional amount of the foreign currency for the hedge, the relevant maturity dates and the fixed and floating rates, forward price or strike price, depending on whether the currency hedging transaction is a swap, forward or an option. For forward equity sales the documentation should identify, among other things, the initial forward price and scheduled settlement date. For call spreads the documentation should identify, among other things, the trade date, underlying common stock, higher strike price, lower strike price, and expiration date and settlement method elections.

For hedging transactions, the documentation must state the risk management objective, that the transaction is intended to hedge or mitigate interest rate or currency risk related to specific assets or liabilities.

Finally, the effectiveness of the hedge must be assessed at the time the hedge is executed and on an ongoing basis to ensure that the hedge is "highly effective." Effectiveness is measured, upon execution and thereafter, on how closely the economics of the hedge offset the risks being hedged. If a hedge is determined to be highly effective, hedge accounting can be applied under ASC 815.

7. CFTC Compliance Considerations for REITs

Equity REITs

CFTC No Action Letter 12-13. Generally, under the Commodity Exchange Act (CEA), a commodity pool operator (CPO) is an investment trust or other entity that raises capital from others for the purposes of trading swaps and other derivatives. Historically, it was unclear whether an equity REIT that uses derivatives could be considered a CPO under the CEA and thereby become subject to registration requirements and other regulatory burdens. Following a 2012 no action letter from the CFTC, an equity REIT will not be classified as a commodity pool or a CPO for purposes of the CEA and become subject to CFTC regulations if it meets three core conditions:

- the REIT primarily derives its income from the ownership and management of real estate and uses derivatives for the limited purpose of "mitigat[ing] their exposure to changes in interest rates or fluctuations in currency;"

- the REIT is operated so as to comply with all of the requirements of a REIT election under the Internal Revenue Code, including 26 U.S.C. §856(c)(2) (the 75 percent test) and 26 U.S.C. §856(c)(3) (the 95 percent test); and

- the REIT has identified itself as an equity REIT in Item G of its last U.S. income tax return on Form 1120-REIT and continues to qualify as such, or, if the REIT has not yet filed its first tax filing with the Internal Revenue Service, the REIT has stated its intention to do so to its participants and effectuates its stated intention.

When these conditions are satisfied, an equity REIT will qualify as an operating company for CFTC and CEA compliance purposes. As a result, an equity REIT is exempt from filing requirements with the National Futures Association and is treated as a non-financial entity eligible for the commercial end-user exemptions under the Dodd-Frank swap compliance rules.

Mortgage REITs

CFTC No Action Letter 12-44. Like equity REITs, it was unclear whether mortgage REITs could be considered a CPO under the CEA. A separate CFTC no action letter issued in 2012 confirmed that mortgage REITs, like equity REITs, will not be treated as a commodity pool or CPO that would be subject to the registration requirements and related CFTC compliance obligations so long as the mortgage REIT:

- limits the initial margin and premiums required to establish its commodity interest positions to no more than 5% of the fair market value of the mortgage REIT's total assets;

- limits the net income derived annually from its commodity interest positions that are not qualifying hedging transactions to less than five percent of the mortgage REIT's gross income;

- does not market interests in the mortgage REIT to the public as or in a commodity pool or otherwise as or in a vehicle for trading in the commodity futures, commodity options, or swaps markets; and either identifies itself as a "mortgage REIT" in Item G of its last U.S. income tax return on Form 1120-REIT; or if it has not yet filed its first U.S. income tax return, but has disclosed to its shareholders that it intends to identify itself as a "mortgage REIT" in its first U.S. income tax return on Form 1120-REIT; and

- it makes a filing with the NFA to claim the relief. The filing must state the name, address, and telephone number of the mortgage REIT, for which the relief is being claimed, be electronically signed, and be filed within 30 days after it begins to operate as a mortgage REIT.

Dodd-Frank Swap Compliance Rules

REITs and other swap counterparties, together with their swap dealers, must satisfy compliance requirements under CFTC regulations implemented pursuant to the Dodd-Frank Act. The process begins with obtaining and maintaining an active Legal Entity Identifier (LEI). The LEI can be obtained from Bloomberg LEI by providing the requested entity information such as legal name, registered address, headquarters address, and other entity identifying information. New counterparties must also complete the bank-specific KYC and AML customer identification programs that usually require the clients to submit an IRS Form W-9, ultimate beneficial ownership information and organizational or corporate formation documentation.

REITs and other swap counterparties may need to negotiate an ISDA Master Agreement with each dealer counterparty. Counterparties must execute an ISDA Master Agreement, including the Schedule to the Master Agreement, before trading. The Schedule to the ISDA Master Agreement must be negotiated to limit the specified entities covered under the agreement, the specified transactions, potential cross-defaults (including the cross-default threshold amount), and to narrowly define additional termination events to be consistent with the terms of the REIT's credit agreement. Most REITs are not required to provide additional credit support under their ISDA Master Agreements, including posting cash or other collateral to the banks. This makes negotiating an ISDA Credit Support Annex and its Paragraph 13 generally unnecessary.

To comply with the business conduct and documentation rules applicable to swap dealers, swap dealers will require that swap counterparties execute the ISDA August 2012 DF Protocol, the ISDA March 2013 DF Protocol, and any other relevant Dodd-Frank documentation before trading any swaps. Compliance requires that swap counterparties make a series of representations regarding its status and activities—confirming, for instance, that it is an "eligible contract participant," it is a suitable counterparty for swap transactions, whether it elects to receive certain pre-trade information from the swap dealer and, as confirmed by the CFTC in the applicable REIT no action letters, that the REIT is not a CPO, and therefore eligible for the exemption swap from swap clearing requirements as a commercial end user.

8. Conclusion

Derivatives can play a vital role in a REIT's financial strategy, whether used to raise capital or manage risk. Understanding the implications of each derivative transaction—from a tax, accounting, compliance, and capital markets perspective—is essential. These are complex, highly technical strategies where different, often asymmetrical risks – contract, business, counterparty, reputational – must be allocated as part of an overall solution to deliver the expected benefit at a predictable cost. Equally important is understanding the relevant issues when structuring hedging and monetization transactions involving REIT common stock or OP units, especially in the context of contribution deals involving appreciated assets. With careful planning and execution, derivatives can serve not only as risk management instruments, but as multipliers of a REIT's financial flexibility and tools for greater long-term value creation.

Footnote

1. If the REIT increases its dividend during the term of the forward contract, most REITs and forward counterparties will choose to amend the forward contract to reflect the increased dividend. However, ASC 260, "Earnings Per Share," provides that adjustments by an issuer to a dividend reduction schedule could create variable economics linked to dividend timing or profitability, which may result in the contract being deemed a participating security. A participating security is any security that may participate in undistributed earnings with common stock. Participating securities must be included in the calculation of diluted EPS using the two-class method, which can have immediate and negative impacts on reported earnings metrics. As above, most issuers simply amend the dividend schedule in the forward confirmation rather than accelerate settlement and terminate. Nevertheless, REITs should discuss the accounting considerations with their advisers before making an election to amend or settle the forward sale.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.