- within Law Department Performance topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Media & Information, Retail & Leisure and Law Firm industries

As take privates continue to play a meaningful role in sponsor-backed transaction activity, below we compare key deal terms from sponsor-backed take private transactions announced in 2024 to those announced in 2025 (through May 2025). While the pace of sponsor-backed take-private deals has somewhat slowed, the below analysis reveals that many of the differences in deal terms across the two periods are modest. However, in some cases, we observed meaningful differences in deal terms across the two time periods which may suggest evolving market dynamics worth monitoring.

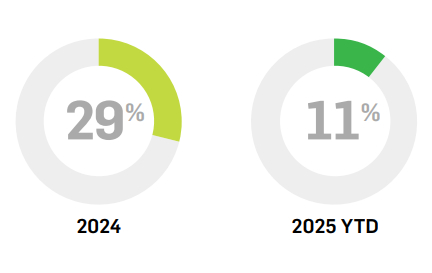

CLUB DEALS

Club deals are complex, as they involve multiple transactions within a transaction, both to execute the take private and to organize the business effective as of closing. Club deals accounted for 29% of sponsor-backed take privates in 2024, reflecting a willingness among sponsors to partner on large transactions and driven in part by the resurgence of the so-called "mega deals" (deals of at least $1 billion). By contrast, we have only observed one club deal so far in 2025, suggesting a possible shift toward single-sponsor funded transactions (and perhaps smaller transactions), though the trend may normalize as the year progresses.

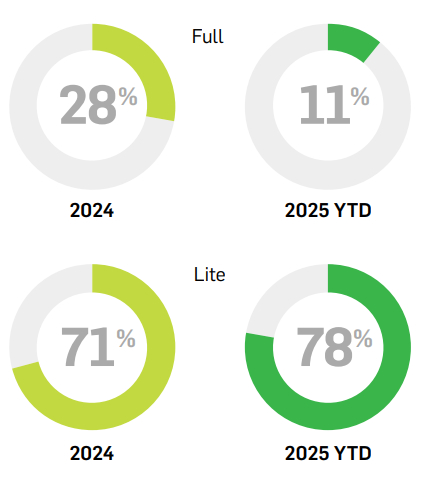

SPECIFIC PERFORMANCE

In 2024, the "specific performance lite" construct (allowing the target to compel sponsor's equity financing only if buyer's debt financing is available) reemerged as the preferred market remedy to address an acquirer's financing failure and a target's closing risk in sponsor-backed going private transactions, due in part to the increase in debt-financed transactions. Among 2024 deals, 28% provided for full specific performance (whereby the target can force a closing upon satisfaction or waiver of the applicable closing conditions, regardless of whether an acquirer's debt financing is available) while 71% contemplated specific performance lite. As we predicted in Weil's 2024 Going Private Study, the prevalence of specific performance lite over full specific performance has continued in 2025 - with 11% of deals contemplating full specific performance and 78% using specific performance lite. This seems to indicate a continued, and perhaps growing, ability of sponsors to limit financing risk.

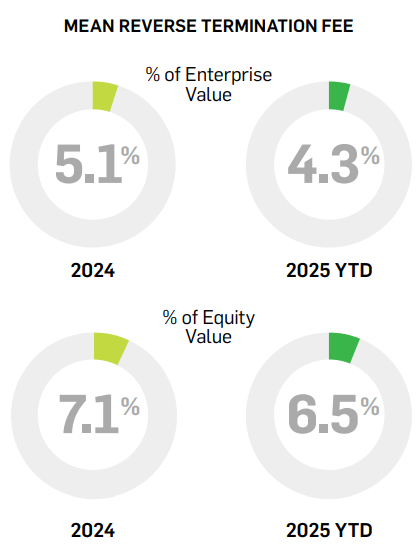

REVERSE TERMINATION FEES

The average reverse termination fee ("RTF") as a percentage of enterprise value and equity value in 2024 was 5.1% and 7.1%, respectively. For 2025 deals, those averages significantly declined to 4.3% and 6.5%, respectively. The mean RTF of 4.3% of target enterprise value is much lower than expected, and moreover, much lower than the mean amounts observed over the past few years (since 2018, the mean RTF as a percentage of enterprise value has been between 5 and 6% except in 2021 where it exceeded 6%). While these changes may normalize as the year progresses, they may reflect slightly more sponsor-favorable risk allocations or changes in deal leverage.

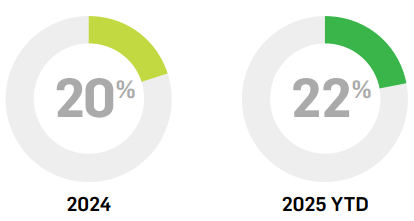

GO-SHOPS

Go-shop provisions appeared in 20% of 2024 deals and 22% of 2025 deals. The negligible increase suggests continued selectivity in their use, which is typically tied to the target's process. As we've previously noted in our annual Weil Going Private Study, the use of go-shop provisions in take private transactions generally fluctuates over time due to the fact specific nature of whether a target company's board feels compelled to include a go-shop provision, which is often driven by the extent to which the company has engaged in a pre-signing market check.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.