Executive Summary

Over the last six years, investment management professionals have steadily increased their use of alternative data to improve decision-making, optimize portfolios, improve due diligence, and boost returns. Now, with widely available artificial intelligence-powered tools at their fingertips, they are poised to analyze exponentially more data to extract more valuable insights.

Since 2019, Lowenstein Sandler has surveyed investment advisers for hedge funds, private equity firms, and venture capital funds to understand their use of alternative data. Now a global market estimated at over $9 billion, alternative data includes forms of information not contained in company filings, press releases, analyst reports, or other traditional sources, such as credit card transactions, geolocation, and mobile device data.

This year's survey results offer a valuable snapshot of alternative data's evolution and integration into the investment management industry. Notably, 67 percent of respondents1 say they are using alternative data, an increase of five percentage points from 2023 and more than double the 31 percent from 2022. Moreover, 94 percent of current alternative data users plan to increase their budgets allocated to it.

The results confirm that alternative data has entered a more mature phase of growth. No longer a novelty, investment professionals see it as an essential, albeit imperfect, tool needed to compete.

The range of alternative data used by investment firms remains wide. The sources that saw the biggest percentage point increases from earlier surveys came from cloud platforms (+17), app usage (+17), biometric data (+16), and web scraping (+20).

| Alternative Data Sources with Largest Percentage Point Increases from Previous Surveys | |

| +17 cloud platforms | +16 biometric data |

| +17 app usage | +20 web scraping |

Merger of Alternative Data and AI

Of course, alternative data is only as valuable as the analysis that can be extracted from it. The emergence of generative AI has dramatically increased its potential utility.

When we surveyed respondents last time, it had only been a year since ChatGPT's public debut in November 2022. Still, investment professionals expressed widespread bullishness about AI's potential to make alternative data more valuable through its ability to recognize patterns and draw insights.

Results from this year's survey show that their optimism has not waned. Over half said they use AI for investment research/portfolio optimization/ trading (61 percent) and summarizing research and materials (58 percent). Among respondents using AI for investment research/portfolio/trading, 85 percent believe they will be using it much or somewhat more in the coming year. Among those not using AI, 43 percent plan to adopt it for next year.

Another sign that AI has become deeply embedded in investment management: 87 percent of respondents said their firm has a formal policy about its use, suggesting firms have made it central to operations. In addition, 68 percent reported having policies regarding the use of AI with alternative data.

The rapid adoption of the use of AI, including around investments and trading, highlights the need for robust policies and procedures governing the use of AI by investment firms. These policies and procedures need to be tailored to the firm's uses of AI in its operations and provide for legal and compliance approval and oversight over the use of AI, particularly where AI may be used as part of the investment decision-making process.

Alternative data is no longer novel, but the combination with AI creates the possibility for original insights at a scale and speed that was previously unattainable. We have entered a new era of investment that will be shaped in large part by technology's exploitation of data.

— Scott H. Moss

Co-chair, Investment Management Group

Chair, Fund Regulatory & Compliance Lowenstein Sandler LLP

Key Findings

| 67% of respondents said they are currently using alternative data, compared with 62% in 2023 and 31% in 2022. | 61% of respondents are using AI to help with investments and trading. |

| 94% of current alternative data users plan to increase their 2025 budgets for alternative data, with more than six in ten of those projecting an increase between 11–25%. | 85% of respondents using AI for investment research/portfolio/trading believe they will use it much or somewhat more in the coming year. |

Alternative Data's Place in the Mainstream

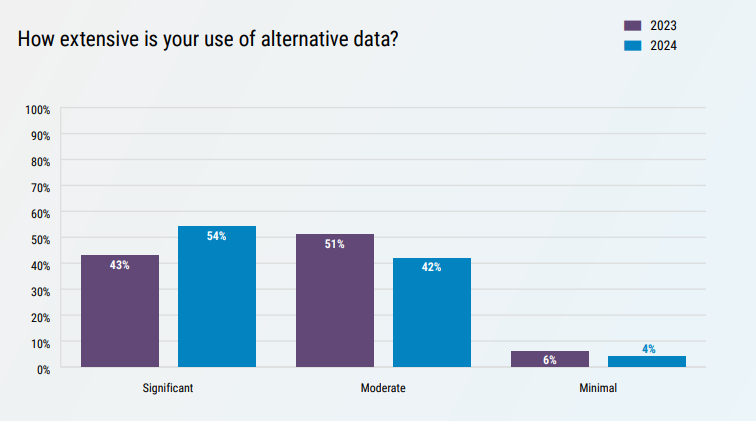

Like the last survey's results, these provided additional evidence of alternative data's place in the mainstream of the investment management industry. For the second straight year, more than 60 percent of survey respondents said they currently use alternative data; moreover, 54 percent indicated they use it extensively.

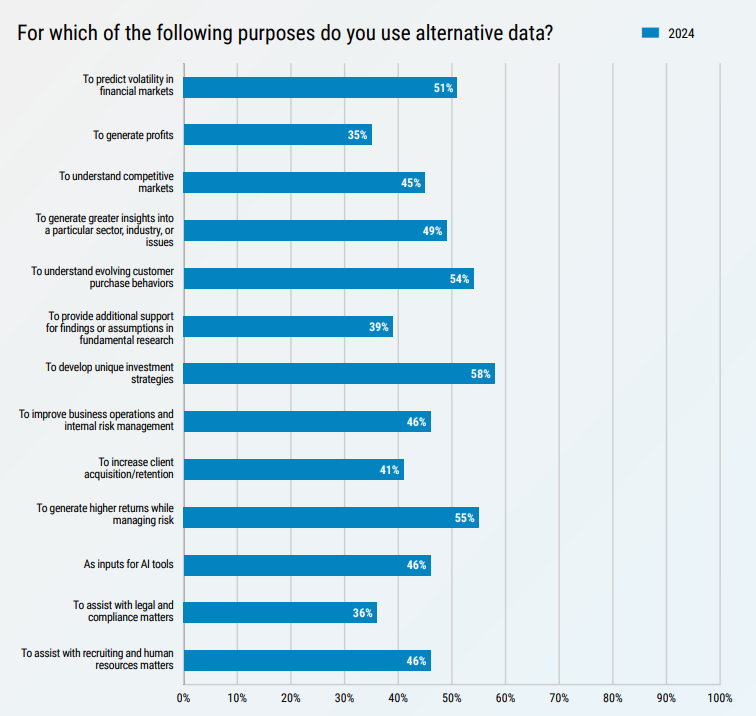

Another indication of alternative data's staying power is the many purposes for which respondents use it. Among the most popular purposes cited in this year's survey were developing unique investment strategies (58 percent), generating higher returns while managing risk (55 percent), understanding evolving customer purchase behavior (54 percent), and predicting volatility in financial markets (51 percent).

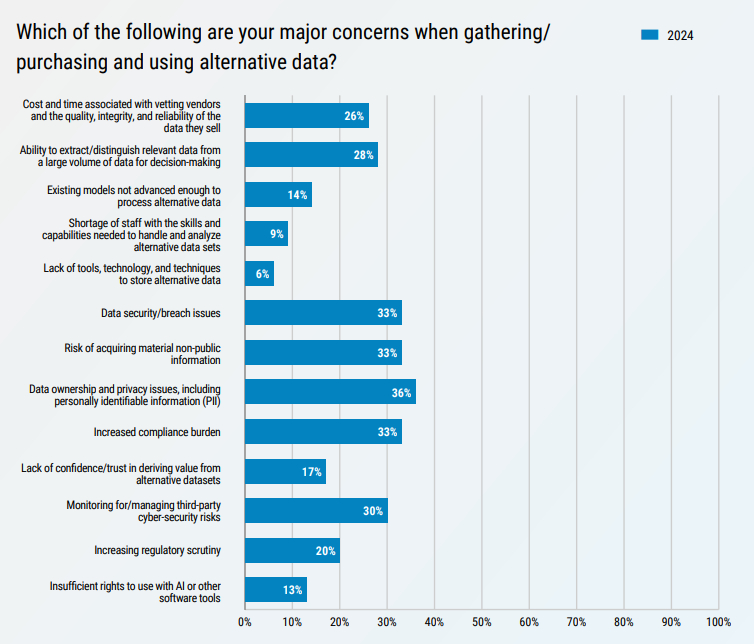

The many risks of using alternative data have not disappeared with more regular usage. In this year's survey, the most frequently cited concerns with alternative data were ownership and privacy (36 percent), increased compliance burden (33 percent), data security/breach issues (33 percent), and risk of acquiring material non-public information.

Notably, some worries about using alternative data have decreased from previous surveys. Concerns over a shortage of qualified staff needed to analyze the data and lack of tools to store it, for example, seem to have become less salient as alternative data has become more mainstream. Among those respondents whose firms have not used alternative data, trust in the quality of the data remains a key reason.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.