- within Media, Telecoms, IT and Entertainment topic(s)

- in United States

- with readers working within the Property and Retail & Leisure industries

- with readers working within the Property industries

- within Compliance topic(s)

The Big Story

In 2025, labor issues will remain one of the most critical challenges facing the U.S. hotel industry. Although ADRs are inching upward and the occupancy is projected to improve slightly from 2024, the industry is operating below pre-pandemic performance levels.1 At the same time, labor supply remains insufficient to meet operational demands. Hotels are projected to employ about 2.17 million people this year, well below the 2.37 million employed in 2019.3 More than 71% of hotels report unfilled positions, and turnover remains alarmingly high, exceeding 70% annually in many frontline roles. Several structural constraints are driving these labor shortages.

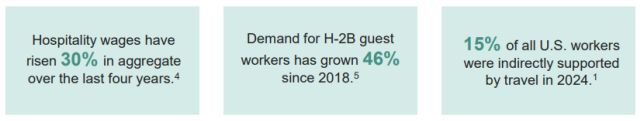

Younger workers continue to avoid the industry, citing low wages and limited career stability, even as hospitality wages have risen over the last four years by nearly 30%. Immigration bottlenecks are another key factor in the U.S. Demand for H-2B guest workers has grown 46% since 2018, but despite the Department of Homeland Security authorizing over 64,000 supplemental visas in 2025, demand continues to outpace supply.4,5 Major hotel chains' aggressive expansion is worsening hiring and retention challenges in an already tight labor market. In 2024, travel supported the jobs of 15 million U.S. workers and directly employed 8 million. According to the U.S. Travel Association and American Hotel and Lodging Association, approximately 2.7 million, or one-third, of those workers are immigrants.1,2

To address these challenges, hotel operators are investing in retention and efficiency strategies. These include signing bonuses, expanded mental health benefits, flexible scheduling, and tech-enabled training.6 At the same time, automation is playing a growing role — with mobile check-ins, AI concierges, and robotic room service helping to reduce labor reliance. Employers are placing emphasis on purpose-driven culture, career development opportunities, and operational flexibility within hospitality careers to recruit new talent. Although labor remains a top vulnerability, these shifts reflect a broader rethinking of how the industry attracts, supports, and retains its workforce.

The Ankura Advantage

HOTEL EXPERTISE

From multi-billion-dollar franchises to startups seeking seed-capital, we understand and solve for the issues hotels are facing at all stages of the business lifecycle. We partner with our clients to unlock value by automating processes, optimizing technology solutions and bringing visibility into hospitality specific financial metrics fast.

ACCOMPLISHED TEAM

We deliver experienced talent to the table – leaders that have sat in the chairs and experienced issues first-hand in the industry. These operational leaders dig in and get their hands dirty to resolve pressing issues, uncover and fix inefficiencies, and bring strategic initiatives to the finish line.

RESILIENT AND LASTING SOLUTIONS

We don't just plug holes… but we don't try to boil the ocean either. Our mandate is to deliver rapid, sustainable, and repeatable improvements to support long-term growth.

PEOPLE FIRST

To succeed, the team needs to be deeply involved in the process. Change management, training, and coaching aren't workstreams; it's our philosophy and the key to sustained improvement.

How We Support Travel & Leisure Clients

✓ Finance Resiliency & Performance Improvement

Increase efficiency and effectiveness of Finance; improve business partnering; drive initiatives across people, process, and technology; automate key processes; decrease cost of finance

✓ People

Fill interim or surge resource needs; align finance organization to support operations; structure processes for transparent and controlled headcount management

✓ Liquidity Management

Improve working capital and liquidity with dynamic financial modeling and scenario analyses; dive deep into the cash conversion cycle to minimize impacts of seasonality; Optimize net working capital

✓ FP&A

Provide transparency and visibility; deliver insights into performance and leverage advanced analytics to drive decision-making, particularly as hotel/leisure navigates customer price sensitivity in a high inflationary environment. Creation of dashboards to monitor trends and KPIs related to strategy execution.

✓ Transaction & Valuation Support

Structured integration and subject-matter expertise to drive process amidst continued industry consolidation

✓ Accounting

Remediate accounting; streamline close; manage risk profile

Footnotes

1. AHLA: U.S. hotel occupancy & ADR, guest spending, employment forecasts

2. Business Travel News

3. CBRE: 2025 Hotel Outlook

4. Reuters: American Immigration Council, DOL

5. USCIS: Supplemental H-2B

6. Reuters: Marriott & Hilton

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]