- within Real Estate and Construction, Intellectual Property and Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Business & Consumer Services, Consumer Industries and Insurance industries

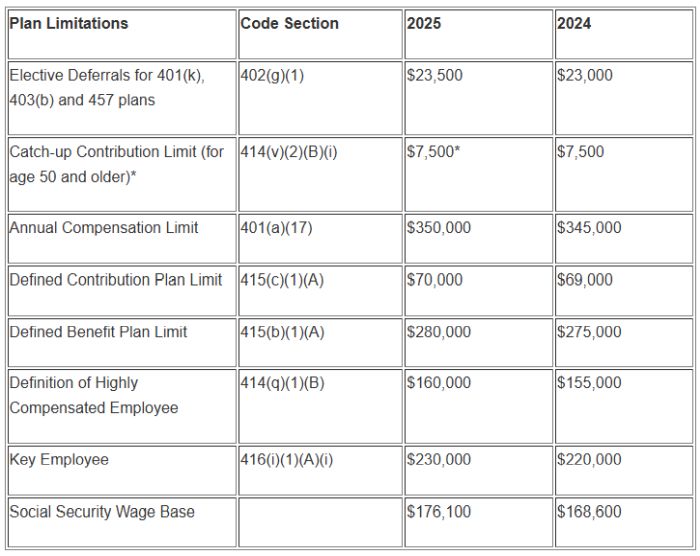

On November 1, 2024, the Internal Revenue Service (IRS) released Notice 2024-80, which announced the dollar limitations for benefits and contributions under qualified retirement plans for 2025, as adjusted for cost-of-living under Internal Revenue Code Section 415.

Separately, the Social Security Administration also announced the taxable wage base for 2025.

Generally speaking, the amounts increased from 2024 to 2025, with the catch-up contribution limit being the exception.

One noteworthy addition for 2025 is the introduction of the "super catch-up" contribution opportunity for plan participants ages 60 to 63.

The chart below shows the limitations effective January 1, 2025, as compared to those for 2024:

*Beginning in 2025, those between ages 60 and 63 will be eligible to contribute up to $11,250 as a catch-up contribution.

If you sponsor a qualified retirement plan that is not a calendar-year plan, care must be taken in applying these limits, because some limits are calendar-year limits (for example, the limit on elective deferrals), while others are plan-year limits (for example, the annual compensation limit).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.