Missouri businesses can claim a 50%, or in some cases 70%, credit against Missouri income tax for donations to approved Neighborhood Assistance Program (NAP) projects. In addition, Missouri not-for-profits, and in some cases Missouri businesses, can receive allocations of credits from the Missouri Department of Economic Development (DED), which administers the NAP, that can be used to raise funds for approved NAP projects. The NAP is designed to provide assistance to targeted communities and their residents through public-private partnerships.

The NAP

NAP helps organizations raise private-sector funds by offering partial state tax credits to donors that make contributions to approved community improvement projects. Eligible applicants apply to the DED for allocations of credits for an eligible project. Subject to applicable limits, Missouri businesses that are eligible donors can then claim credits based on the amount of the donations to NAP projects.

The DED is currently accepting applications for Fiscal Year 2017

NAP Round 2 credits from eligible applicants. Applications must be

post-marked by September 23, 2016, and approved projects must start

by January 1, 2017.

What May Be Donated to NAP Projects

Donations can be in the form of cash, materials, supplies, or equipment; technical assistance and professional services; labor; real estate; or stocks and bonds. Credits can equal up to 50 percent of the total amount contributed or up to 70 percent for projects located in some rural areas. The tax credit is used to offset an eligible donor's income tax liability and is claimed when the donor files their Missouri tax return.

Credits for Donations to NAP Projects

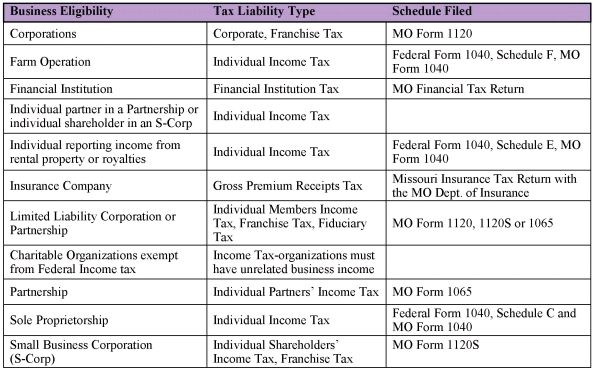

To claim credits against income tax for donations to an approved

NAP project, a donor must be a business or an individual with

Missouri business income. The following table summarizes the types

of eligible donors and the taxes against which credits can be

claimed:

Source: NAP FY 2017 Guidelines and Application

The determination of the amount of the donation for purposes of calculating the credit depends on the type of donation made:

- Cash - the amount of the cash donation;

- Materials, supplies, equipment – the lesser of either the fair market value or the cost to the donor (may include the reasonable costs incurred by the donor in receiving the contribution);

- Professional services - standard billing rate;

- Labor – employee's hourly wage plus fringe;

- Real property – the property must be directly used by the organization for the project and be included on the approved NAP budget;

- Publicly-traded stocks - stock market price upon transfer (the organization must sell within a year from the date of contribution before tax credits are approved); and

- Bonds – face value. The bond must be mature at the time of transfer (organization must sell the bond within a year from the date of contribution before tax credits are issued).

Who Can Apply for an Allocation of NAP Credits?

To be eligible to apply for an allocation of NAP credits, an applicant must be one of the following:

- Missouri Business: A person, firm, partner in a firm, corporation, or shareholder in an S corporation doing business in Missouri, and subject to state income, conducting a project that is outside the scope of normal business operations; or

- Neighborhood Organization: An

organization located (and incorporated to do business) in Missouri

that:

- is incorporated as a non-profit corporation pursuant to Chapter 355, RSMo;

- is designated as a community development corporation under Title VII of the Economic Opportunity Act of 1964; or

- holds a 501 (c)(3) IRS tax exempt ruling (and is incorporated as a nonprofit in Missouri).

What Types of Projects Are Eligible for NAP Credit Awards?

In order for a project to be eligible, it must involve one of the following:

- Community Services: Counseling; health or mental health services; child day care services; senior citizen services; recreational opportunities; nutrition services; emergency shelters for persons suffering from physical abuse or rape; services for the handicapped; vocational counseling; substance abuse counseling, or referral services;

- Crime Prevention: Services to ex-offenders; civilian services to help prevent crime and/or aid victims of crime; mediation services aimed at resolving conflicts before they become crimes; or services to juveniles who have had contact with the court or police;

- Education: Literacy programs; adult basic education and high school equivalency programs; educational services for the physically/mentally challenged; or educational services for persons otherwise disenfranchised;

- Job Training: Activities that provide specific vocational skills including special apprenticeship or on-the-job training programs not otherwise available; or

- Physical Revitalization: Commercial revitalization; construction or rehabilitation for community purposes; or non-profit infrastructure for community purposes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.