- within Litigation and Mediation & Arbitration topic(s)

MARKET REVIEW AND OUTLOOK

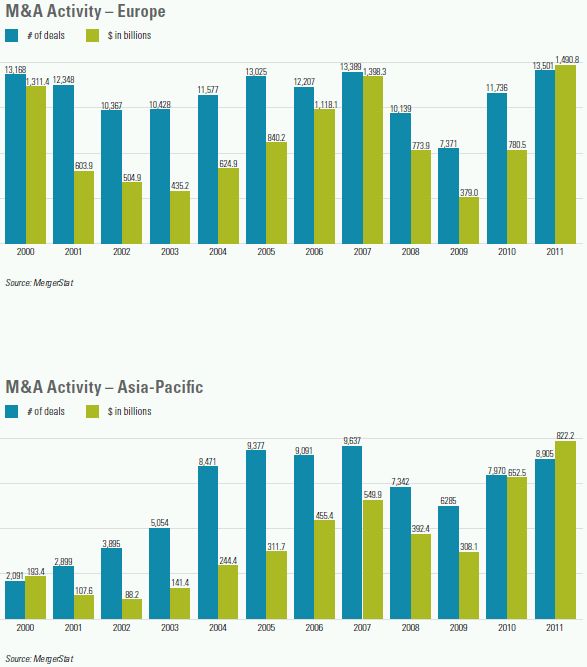

M&A activity increased significantly in 2011, marking the second consecutive year of growth after the market decline of 2008 and 2009.

Global M&A deal volume rose from 27,460 transactions in 2010 to 30,366 in 2011, an 11% increase. Similarly, global M&A deal value increased 53% to $3.11 trillion in 2011, up from $2.03 trillion in 2010. Average global deal size grew to $102.6 million in 2011, up from $73.8 million in 2010.

On a global basis, deal volume grew from the first to the second quarter of the year, but dipped in the third quarter, to a level below that of the first quarter. By the end of the year, the number of deals had bounced back up to first-quarter levels. Aggregate deal value started off strong in the first two quarters of 2011, declined sharply in the third quarter, and then rebounded in the final quarter of the year.

In the United States, the volume of M&A activity was fairly steady, increasing 7%, from 9,238 transactions in 2010 to 9,923 in 2011. US deal value jumped 79%, from $887.3 billion in 2010 to $1.59 trillion in 2011, due to a spate of very large transactions.

In Europe, both deal volume and deal value continued to increase from their 2010 levels. Deal volume increased 15%, from 11,736 transactions in 2010 to 13,501 in 2011. Boosted by a number of large transactions, total European deal value increased 91%, from $780.5 billion to $1.49 trillion.

The Asia-Pacific region also experienced growth in deal volume and value. The number of Asia-Pacific deals increased 12%, from 7,970 transactions in 2010 to 8,905 in 2011, while aggregate deal value increased 26%, from $652.5 billion to $822.2 billion.

The number of worldwide billion-dollar transactions grew 36%, from 368 in 2010 to 501 in 2011. Aggregate global billiondollar deal value increased 69%, from $1.26 trillion in 2010 to $2.13 trillion in 2011. The number of billion-dollar transactions involving US companies grew, rising from 172 in 2010 to 252 in 2011. The aggregate value of billion-dollar US deals ballooned 117%, from $580.0 billion in 2010 to $1.26 trillion in 2011. The number of billion-dollar transactions involving European companies rose 74%, from 148 in 2010 to 257 in 2011, and aggregate deal value more than doubled, increasing 106%, from $515.6 billion to $1.06 trillion. Billion-dollar transactions involving Asia-Pacific companies increased 11%, from 109 deals to 121, and aggregate deal value rose 30%, from $388.8 billion in 2010 to $506.5 billion in 2011.

SECTOR ANALYSES

Results varied across principal industry sectors in 2011. Most sectors, however, enjoyed modest increases in deal volume and large increases in deal value:

- The global financial services sector saw a 6% increase in transaction volume, increasing from 1,497 deals in 2010 to 1,586 deals in 2011. Aggregate global financial services sector deal value rose 87%, from $116.3 billion in 2010 to $218.0 billion in 2011, of which $77.0 billion in transaction value occurred in the second quarter. In the United States, financial services sector deal volume declined 3%, dropping from 528 deals in 2010 to 512 deals in 2011. Even so, aggregate deal value increased 59%, from $39.6 billion in 2010 to $62.8 billion in 2011.

- The information technology sector experienced a rise in both deal volume and deal value, with the total number of IT deals increasing 8%, from 3,836 transactions in 2010 to 4,157 in 2011. Global IT deal value nearly doubled, increasing 93%, from $110.5 billion in 2010 to $213.6 billion in 2011. US IT deal volume increased 8%, from 2,042 deals to 2,199, while US aggregate IT deal value soared by 124%, from $83.6 billion in 2010 to $187.2 billion in 2011. The second quarter was particularly strong for IT deals, accounting for $88.5 billion in global transactions and $81.7 billion in US transactions.

- Global deal volume in the telecommunications sector fell 3%, from 816 deals in 2010 to 790 deals in 2011. Despite this modest dip in volume, global telecommunications deal value increased more than 27%, from $159.5 billion in 2010 to $202.8 billion in 2011. US deal volume also declined, falling 11%, from 260 deals in 2010 to 232 in 2011, but the sector experienced an 82% increase in deal value, from $64.6 billion in 2010 to $117.4 billion in 2011.

- For the second consecutive year, the life sciences sector did not fare as well as the other principal industry sectors in 2011. Global M&A transaction activity in the life sciences sector increased 3%, from 1,046 in 2010 to 1,079 in 2011, while global deal value edged down by 2%, from $167.8 billion to $164.7 billion. The US life sciences sector saw a 3% decrease in deal volume, falling from 468 transactions in 2010 to 454 in 2011, although aggregate US life sciences deal value rebounded from 2010, increasing 32%, from $94.3 billion to $124.7 billion.

- The M&A market for venture-backed companies saw a 15% decrease in deal volume, from 560 reported transactions in 2010 to 477 in 2011, although this gap is likely to narrow after all 2011 deal activity has been reported. Total reported deal value increased 23%, however, from $39.0 billion in 2010 to $47.8 billion in 2011.

OUTLOOK

Fueled by large cash holdings by strategic acquirers, the M&A market in 2011 showed continued recovery from the downturn of 2008 and 2009, despite the US debt downgrade, Europe's ongoing debt crisis, and heightened worries about global economic conditions. Overall deal activity in 2011 was strong, with quarterly fluctuations that have persisted into 2012.

In the first quarter of 2012, transaction and dollar volumes were generally lower than in the first quarter of 2011, although delayed deal reporting probably explains some of the gap. Global M&A deal volume decreased from 7,564 transactions in the first quarter of 2011 to 6,692 transactions in the first quarter of 2012, while aggregate deal value declined from $949.9 billion to $571.5 billion. US deal activity showed similar trends, with 2,235 transactions and an aggregate deal value of $225.6 billion in the first quarter of 2012, compared to 2,547 transactions with an aggregate deal value of $479.5 billion in the comparable period of 2011. First-quarter aggregate deal volume in the life sciences sector did, however, top both the global and US tallies from the same period the prior year.

Gradual improvements in economic conditions and the return of more stable debt markets with the continuation of low interest rates should help sustain the past 24 months' growth in the overall M&A market, although economic uncertainty in Europe may have some dampening effect on M&A activity. Technology companies, in particular, are likely to remain attractive targets, as evidenced by Facebook's agreement to acquire Instagram for $1 billion and Amazon.com's $775 million acquisition of Kiva Systems in early 2012.

Private equity activity should also continue to contribute to deal flow. On the sale side, many private equity firms are looking to dispose of companies acquired in the past several years as original debt financings become due. On the buy side, private equity funds have large cash holdings to invest and are encouraged by attractive conditions in the debt market.

Taken together, these factors encourage favorable expectations for the M&A market for the balance of 2012.

A COMPARISON OF PUBLIC AND PRIVATE ACQUISITIONS

Public and private company M&A transactions share many characteristics, but also involve different rules and conventions. Described below are some of the ways in which acquisitions of public and private targets differ.

GENERAL CONSIDERATIONS

The M&A process for public and private company acquisitions differs in several respects:

- Structure: An acquisition of a private company may be structured as a stock purchase or a merger. A public company acquisition is usually structured as a merger or a tender offer, since stock purchases are impracticable with public stockholders.

- Letter of Intent: If a public company is party to an acquisition, there is usually no letter of intent describing the proposed terms. The parties typically go straight to a definitive agreement, due in part to concerns over creating a disclosure obligation for a deal that is not yet ripe to announce.

- Timetable: The timetable before signing the definitive agreement is often more compressed in an acquisition of a public company, because the existence of publicly available information means due diligence can begin in advance and all parties share a desire to minimize the period of time during which the news might leak. More time may be required between signing and closing, however, because of the requirement to prepare and circulate a proxy statement for stockholder approval (unless a tender offer structure is used), and the need in many public company acquisitions for antitrust clearances that are less likely to be required in smaller, private company deals.

- Confidentiality: The potential damage from a leak is much greater in an M&A transaction involving a public company, and accordingly rigorous confidentiality precautions are taken.

- Director Liability: The board of a public target has more practical exposure to stockholder claims than a private company board and is much more likely to obtain a fairness opinion from an investment banking firm.

DUE DILIGENCE

When a public company is acquired, the due diligence process differs from the process followed in a private company acquisition:

- Availability of SEC Filings: Due diligence typically starts with the target's SEC filings—enabling a potential acquirer to investigate in stealth mode until it wishes to engage the target in discussions.

- Speed: The due diligence process is often quicker in an acquisition of a public company, reflecting the availability of SEC filings and a higher materiality threshold, thereby allowing the parties to focus quickly on the key transaction points.

MERGER AGREEME NT

The merger agreement for an acquisition of a public company reflects a number of differences from its private company counterpart:

- Representations: In general, the representations and warranties from a public company are less extensive than those from a private company, are tied in many respects to the accuracy of the public company's SEC filings, have higher materiality thresholds, and do not survive the closing.

- Closing Conditions: The closing conditions in the merger agreement, including the "no material adverse change" condition, are generally tightly drafted in public company deals, and give the acquirer little room to refuse to complete the transaction if regulatory and stockholder approvals are obtained.

- Post-Closing Obligations: Postclosing escrow or indemnification arrangements are rare.

- Earnouts: Earnouts are unusual, although a form of earnout arrangement called a "contingent value right" is becoming more common in the biotech sector.

- Deal Protections: The negotiation battleground is the deal protection provisions—the exclusivity, voting agreement, termination and breakup fee provisions.

SEC INVOLVEMENT

The SEC plays a role in acquisitions involving a public company (unlike in private-private M&A transactions):

- Form S-4: In a public-public deal, if the acquirer is issuing stock to the target's stockholders, the acquirer must register the issuance on a Form S-4 registration statement that is filed with (and possibly reviewed by) the SEC.

- Stockholder Approval: Absent a tender offer, the target's stockholders, and sometimes the acquirer's stockholders, must approve the transaction. Stockholder approval is sought pursuant to a proxy statement that is filed with (and possibly reviewed by) the SEC. In addition, the Dodd-Frank Act generally requires public targets that seek stockholder approval to provide for a separate, non-binding stockholder vote with respect to all compensation each named executive officer will receive in connection with the transaction.

- Public Communications: Elaborate SEC regulations govern public communications by the parties in the period between the first public announcement of the transaction and the closing of the transaction.

- Multiple SEC Filings: Many Form 8-K and Rule 425 filings are often required by public companies that are party to M&A transactions. (Rule 425 requires most written communications in connection with a business combination transaction to be filed with the SEC.)

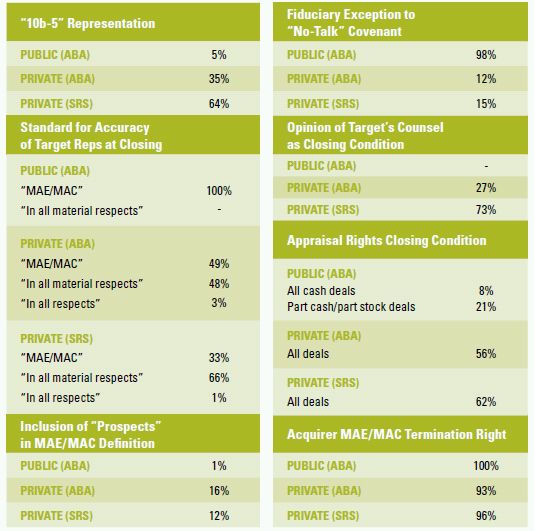

Set forth on the following page is a comparison of selected deal points in public target and private target acquisitions, based on studies from Shareholder Representative Services (a provider of post-closing transaction management services) and the Mergers & Acquisitions Committee of the American Bar Association's Business Law Section. The SRS study covers private target acquisitions that closed between July 2010 and September 2011. The ABA private target study covers acquisitions that were completed in 2010, and the ABA public target study covers acquisitions that were announced in 2010.

COMPARISON OF SELECTED DEAL TERMS

The accompanying chart compares the following deal terms in acquisitions of public and private targets:

- "10b-5" Representation: A representation to the effect that no representation or warranty by the target contained in the acquisition agreement, and no statement contained in any document, certificate or instrument delivered by the target pursuant to the acquisition agreement, contains any untrue statement of a material fact or fails to state any material fact necessary, in light of the circumstances, to make the statements in the acquisition agreement not misleading.

- Standard for Accuracy of Target Reps at Closing: The standard against which the accuracy of the target's representations and warranties is measured for purposes of the acquirer's closing conditions:

-

- A "MAE/MAC" standard provides that each of the representations and warranties of the target set forth in the acquisition agreement must be true and correct in all respects as of the closing, except where the failure of such representations and warranties to be true and correct will not have or result in a material adverse effect/change on the target.

- An "in all material respects" standard provides that each of the representations and warranties of the target set forth in the acquisition agreement must be true and correct in all material respects as of the closing.

- An "in all respects" standard provides that each of the representations and warranties of the target set forth in the acquisition agreement must be true and correct in all respects as of the closing.

- Inclusion of "Prospects" in MAE/MAC Definition: Whether the "material adverse effect/change" definition in the acquisition agreement includes "prospects" along with other target metrics, such as the business, assets, properties, financial condition and results of operations of the target.

- Fiduciary Exception to "No-Talk" Covenant: Whether the "no-talk" covenant prohibiting the target from seeking an alternative acquirer includes an exception permitting the target to consider an unsolicited superior proposal if required to do so by its fiduciary duties.

- Opinion of Target's Counsel as Closing Condition: Whether the acquisition agreement contains a closing condition requiring the target to obtain an opinion of counsel, typically addressing the target's due organization, corporate authority and capitalization; the authorization and enforceability of the acquisition agreement; and whether the transaction violates the target's corporate charter, by-laws or applicable law. (Opinions regarding the tax consequences of the transaction are excluded from this data.)

- Appraisal Rights Closing Condition: Whether the acquisition agreement contains a closing condition providing that appraisal rights must not have been sought by target stockholders holding more than a specified percentage of the target's outstanding capital stock. (Under Delaware law, appraisal rights generally are not available to stockholders of a public target when the merger consideration consists solely of publicly traded stock.)

- Acquirer MAE/MAC Termination Right: Whether the acquisition agreement contains a closing condition permitting the acquirer to terminate the agreement if an event or development has occurred that has had, or could reasonably be expected to have, a "material adverse effect/change" on the target.

TAKEOVER DEFENSES IN PUBLIC COMPANIES

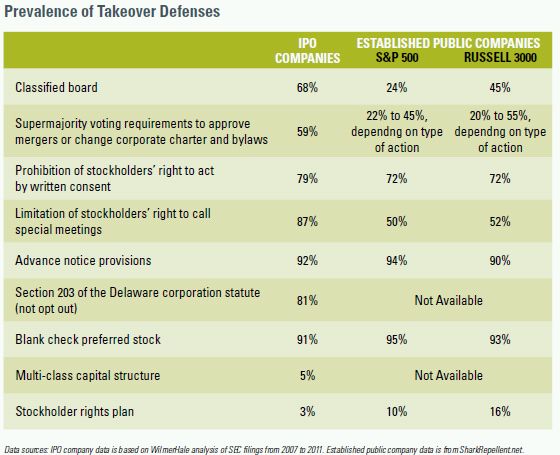

Set forth below is a summary of common takeover defenses adopted by public companies, and some of the questions to be considered by a board of directors in evaluating each technique. The accompanying chart compares the prevalence of takeover defenses in IPO companies and established public companies.

CLASSIFIED BOARDS

Should the entire board stand for reelection at each annual meeting, or should directors serve staggered three-year terms, with only one-third of the board standing for re-election each year?

Opponents of classified boards believe that annual elections increase director accountability, which in turn improves director performance, and that classified, or "staggered," boards entrench directors and foster insularity. Supporters of classified boards, on the other hand, believe that classified boards enhance the knowledge, experience and expertise of boards by helping ensure that, at any given time, a majority of the directors will have experience and familiarity with the company's business. These supporters believe classified boards promote continuity and stability, which in turn allow companies to focus on long-term strategic planning, ultimately leading to a better competitive position and maximizing stockholder value.

SUPERMAJORITY VOTING REQUIREMENTS

What stockholder vote should be required to make changes to governance provisions or approve mergers: a simple majority or a "supermajority"?

Opponents of supermajority vote requirements believe that simple-majority provisions make the company more accountable to stockholders by making it easier for stockholders to make changes in how the company is governed, and that improved accountability leads to better performance. Supermajority requirements are also viewed by their detractors as entrenchment provisions used to block initiatives that are supported by holders of a majority of the company's stock but opposed by management and the board. In addition, opponents believe that supermajority requirements can be almost impossible to satisfy because of abstentions, broker non-votes and voter apathy, thereby frustrating the will of the stockholders. Supporters, however, claim that supermajority vote provisions help preserve and maximize the value of the company for all stockholders by ensuring that important protective provisions are eliminated only when it is the clear will of the stockholders.

PROHIBITION OF STOCKHOLDERS ' RIGHT TO ACT BY WRITTEN CONSENT

Should stockholders have the right to act by written consent without holding a stockholder meeting?

Almost all private companies make use of written consents as an efficient way to obtain required stockholder approvals without the need for convening a formal meeting. In contrast, most public companies do not permit stockholders to act by written consent, and instead require that all stockholder action be taken at a duly called stockholders meeting for which stockholders have been provided detailed information about the matters to be voted on, and at which there is an opportunity to ask questions about proposed business.

LIMITATION OF STOCKHOLDERS ' RIGHT TO CALL SPECIAL MEETINGS

Should stockholders have the right to call special meetings, or should they be required to wait until the next annual meeting to present matters for action?

A requirement that only the board or specified officers or directors are authorized to call special meetings of stockholders could have the effect of delaying until the next annual meeting actions that are favored by holders of a majority of the company's stock. If stockholders are allowed to call special meetings, the percentage of the stockholders who must join in the request to call a special meeting must be specified. Among companies that allow stockholders to call special meetings, 10% is a common ownership threshold, although there is a current trend to implement a 25% threshold.

ADVANCE NOTICE REQUIREMENTS

Should stockholders be required to notify the company in advance of director nominations or other matters that the stockholders would like to act upon at a stockholders meeting?

Advance notice requirements provide that stockholders at a meeting may only consider and act upon director nominations or other proposals that have been properly brought before the meeting. In order to be properly brought before the meeting, a nomination or proposal must be specified in the notice of meeting and must be brought before the meeting by or at the direction of the board, or by a stockholder who has delivered timely written notice to the company. These provisions could have the effect of delaying until the next stockholder meeting actions that are favored by the holders of a majority of the company's stock. Investors generally do not object to advance notice requirements, so long as the advance notice period is not unduly long. Advance notice periods of 90 to 120 days prior to the anniversary of the prior year's annual meeting date are common.

STATE ANTI-TAKEOVER LAWS

Should the company opt out of any state anti-takeover laws to which it is subject, such as Section 203 of the Delaware corporation statute?

Section 203 prevents a public company incorporated in Delaware (where 93% of all IPO companies are incorporated) from engaging in a "business combination" with any "interested stockholder" for three years following the time that the person became an interested stockholder, unless, among other exceptions, the interested stockholder attained such status with the approval of the board. A business combination includes, among other things, a merger or consolidation involving the interested stockholder and the sale of more than 10% of the company's assets. In general, an interested stockholder is any entity or person beneficially owning 15% or more of the company's stock and any entity or person affiliated with or controlling or controlled by such entity or person. A public company incorporated in Delaware is automatically subject to Section 203, unless it opts out in its original corporate charter or pursuant to a subsequent charter or bylaw amendment approved by stockholders.

BLANK CHECK PREFERRED STOCK

Should the board be authorized to designate the terms of series of preferred stock without obtaining stockholder approval?

When blank check preferred stock is authorized, the board has the right to issue shares of preferred stock in one or more series without stockholder approval under state corporate law (but subject to stock exchange rules), and has the discretion to determine the rights and preferences, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each such series of preferred stock. Authorizing the board to issue preferred stock and determine its rights and preferences has the effect of eliminating delays associated with a stockholder vote on specific issuances. Having blank check preferred stock in place can facilitate the adoption of a stockholder rights plan, financings and strategic alliances. However, the issuance of preferred stock, or of rights to purchase preferred stock, can be used as an anti-takeover device.

MULTI-CLASS CAPITAL STRUCTURE

Should the company sell to the public a class of common stock whose voting rights are different from those of the class of common stock owned by the company's founders or management?

While most companies go public with a single class of common stock that provides the same voting and economic rights to every stockholder (a "one share, one vote" model), some companies go public with a multi-class capital structure under which some stockholders (typically founders) hold shares of common stock that are entitled to multiple votes per share, while the public is issued a separate class of common stock that is entitled to only one vote per share. Use of a multi-class capital structure facilitates the ability of the holders of the high-vote class of common stock to retain voting control over the company, even while selling a large number of shares of stock to the public. Critics believe that a multi-class capital structure entrenches the holders of the high-vote stock, insulating them from takeover attempts and the will of the public stockholders, and that the mismatch between voting power and economic interest may also increase the possibility that the holders of the highvote stock will pursue a riskier business strategy. Others believe, however, that, as long as the holders of the high-vote stock own a significant economic stake, they have sufficient motivation to pursue a business strategy that is ultimately in the best interests of all stockholders.

STOCKHOLDER RIGHTS PLANS

Should the company establish a poison pill?

A stockholder rights plan (often referred to as a "poison pill") is a contractual right that allows all stockholders—other than those who acquire more than a specified percentage of the company's stock—to purchase additional securities of the company at a discounted price if someone accumulates shares of common stock in excess of the specified threshold, thereby significantly diluting that person's economic and voting power. Supporters believe rights plans are an important planning and strategic device because they give the board time to evaluate unsolicited offers and to consider alternatives. Rights plans can also deter a change in control without the payment of a control premium to all stockholders, as well as partial offers and "two-tier" tender offers that can pressure stockholders to sell in the near term in order to avoid an inadequate payment after completion of a tender offer. Opponents view rights plans, which can generally be adopted by board action at any time and without stockholder approval, as an entrenchment device and believe that rights plans improperly give the board, rather than stockholders, the power to decide whether and on what terms the company is to be sold. When combined with a classified board, rights plans make an unfriendly takeover particularly difficult.

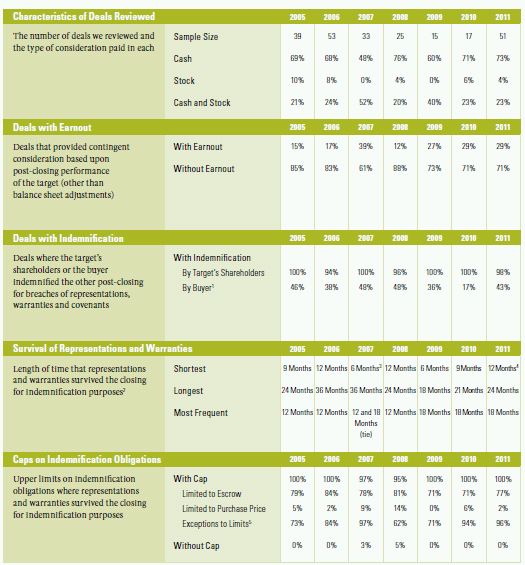

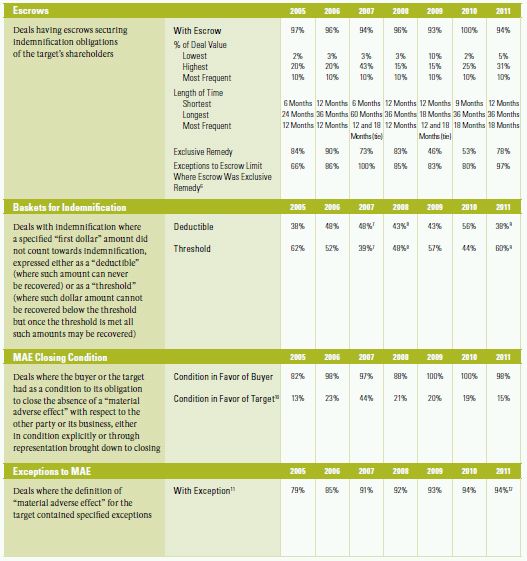

TRENDS IN VC-BACKED COMPANY M&A DEAL TERMS

We reviewed all merger transactions between 2005 and 2011 involving venture-backed targets (as reported in Dow Jones VentureOne) in which the merger documentation was publicly available and the deal value was $25 million or more. Based on this review, we have compiled the following deal data:

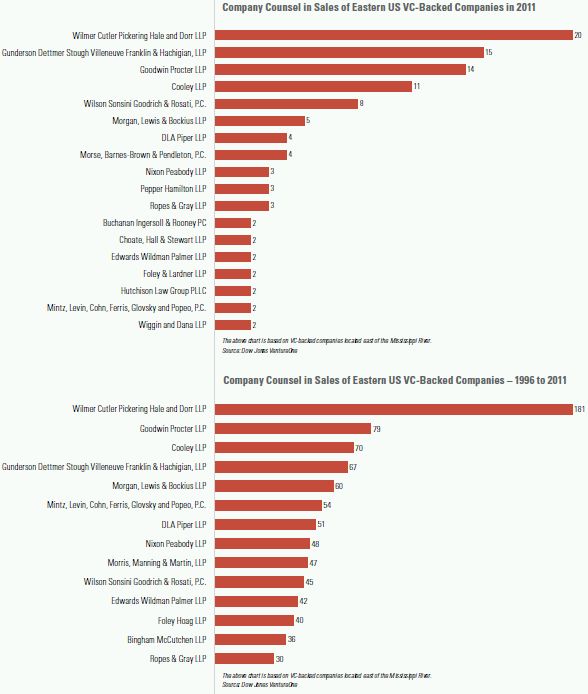

LAW FIRM RANKINGS

Footnotes

1 The buyer provided indemnification in 25% of the 2005 transactions, 41% of the 2006 transactions, 53% of the 2007 transactions, 50% of the 2008 transactions, 40% of the 2009 transactions, 80% of the 2010 transactions, and 29% of the 2011 transactions where buyer stock was used as consideration. In 17% of the 2005 transactions, 35% of the 2006 transactions, 56% of the 2007 transactions, 25% of the 2008 transactions, 40% of the 2009 transactions, 33% of the 2010 transactions, and 23% of the 2011 transactions where the buyer provided indemnification, buyer stock was used as consideration.

2 Measured for representations and warranties generally; specified representations and warranties may survive longer.

3 In two cases representations and warranties did not survive, but in one such case there was indemnity for specified litigation, tax matters and appraisal claims.

4 In one case representations and warranties did not survive.

5 Generally, exceptions were for fraud, willful misrepresentation and certain "fundamental" representations commonly including capitalization, authority and validity. In a limited number of transactions, exceptions also included intellectual property representations.

6 Generally, exceptions were for fraud, willful misrepresentation and certain "fundamental" representations commonly including capitalization, authority and validity. In a limited number of transactions, exceptions also included intellectual property representations.

7 Another 13% of these transactions used a "hybrid" approach with both a deductible and a threshold.

8 Another 4% of these transactions used a "hybrid" approach with both a deductible and a threshold and another 4% had no deductible or threshold.

9 Another 2% of these transactions used a "hybrid" approach with both a deductible and a threshold.

10 In 80% of these transactions in 2005, 83% of these transactions in 2006, 86% of these transactions in 2007, 60% of these transactions in 2008, 100% of these transactions in 2009, 67% of these transactions in 2010, and 86% of these transactions in 2011, buyer stock was used as consideration.

11 Generally, exceptions were for general economic and industry conditions.

12 Excludes one transaction where the specified exceptions do not apply for purposes of a standalone "material adverse effect" closing condition.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.