- within Corporate/Commercial Law topic(s)

- with readers working within the Aerospace & Defence industries

- within Corporate/Commercial Law topic(s)

Global logistics have been forever altered by the onset of COVID-19, and the supply chain is still trying to recover from pandemic production roadblocks. What started as an industrial problem affected by supply and demand has turned into a true threat to global economic stability. With increased demand, ongoing trade restrictions, inflation, and material shortages raging on, many manufacturers and market participants struggle to find their footing. And as the country races towards net-zero, electric vehicle (EV) providers are pushing hard for a secure future surrounding EV supply chain component production.

As gas prices continue to fluctuate and talks of a recession loom, many automakers are trying to pivot US consumers towards a more electrified future. But current supply chain struggles impede their ability to provide enough EVs to meet the growing demand, forcing firms to reevaluate their manufacturing and sourcing methods.

Players in the space should be planning for problems now by configuring a well-informed litigation strategy alongside experienced experts who understand supply chain production gaps and challenges associated with the accessibility of materials. Additionally, industry experts in electric vehicle manufacturing and components can provide insight on issues at the forefront of the legal and technical landscape related to the electric vehicle supply chain.

As the United States scrambles to catch up and create EV supply chain success at home, we have heard conflicts surrounding human rights violations, mergers & acquisitions, intellectual property, breach of contracts, and more are driving disputes in the space. But what are the current supply chain challenges, and how are government policy updates fueling litigation?

Electric Battery Material Scarcity

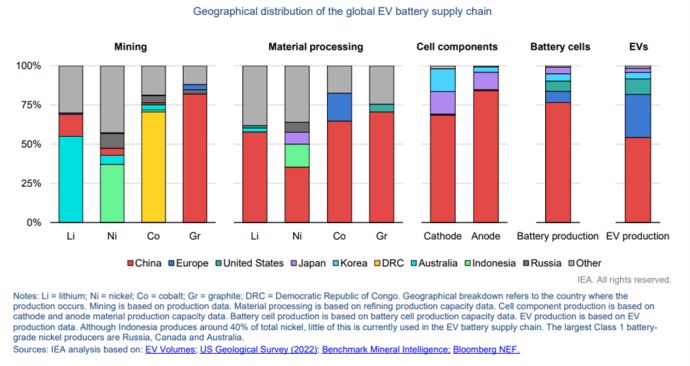

When it comes to EVs, their batteries make up close to 40% of their value. And unfortunately, they are also the main component being affected by supply chain blunders. The issues mainly lie with the inability to secure the raw materials needed to create electric vehicle batteries, which are being produced and mined en masse overseas by countries like China as they lead in battery production worldwide. As EV sales continue to surge after a record-breaking 2021, the United States is moving to fight this long-term materials challenge as access to critical minerals and components remains uncertain.

China is a dominant presence in the EV supply chain, having mined, processed, and generated more materials and vehicles than any other country. China produced 12 times the number of batteries as the US last year and if production levels remain consistent, the country will likely account for more than 55% of global battery production in 2025.

The material struggle doesn't end there. Many industry insiders like Elon Musk have been sounding the alarm on potential material shortages and processing constraints around lithium and graphite, which makes up nearly 30% of battery cell mass. In 2021, China reigned as the world's leading producer of natural graphite with a global market share of 79%. While companies like Tesla and Volkswagen are making deals with international manufacturers to secure their supply, it is inefficient to rely on our neighbors to process our materials. And with graphite demand projected to outpace supply by as early as 2023, the American supply chain needs to adapt.

The Current American Supply Chain

As we now know, there is no true great American supply chain for EVs. But the government and automakers alike are trying to change that. Following President Biden's pledge to provide $3.1 billion in funding to support EV battery manufacturing on US soil, many manufacturers began looking at ways to create new factories and retrofit existing ones in the wake of additional supply chain complications brought on by Russia's invasion of Ukraine. Over the summer, many market players have been investing in supplier deals and constructing production plans to boost their supply in the face of skyrocketing demand. What do these efforts look like?

Manufacturer's Investments

Rather than waiting on the supply chain to sort itself out, manufacturers are taking matters into their own hands and creating supply chains right on American soil. Toyota has now pledged to spend more than $3 billion on its North Carolina battery production facility that is set to supply hybrid and electric vehicles with batteries. Panasonic, Tesla's battery supplier, is also investing close to $10 billion to create two new battery production facilities of their own.

Next, companies like GM, Tesla, and Ford have made a myriad of new battery supplier agreements to expand their sourcing pools, allowing them to keep up with production goals on account of increased access to lithium, graphite, cobalt, and nickel stock.

Finally, acquisitions and joint ventures in the space are supporting manufacturers' supply. Nikola acquired energy storage company Romeo Power, bringing the company's battery pack production in-house, and giving them greater operation and cost control over its supply chain. Additionally, Honda entered a partnership with LG Energy Solutions to produce lithium-ion batteries for the US market with a joint investment of $4.4 billion.

Government Grants

Earlier this October, the Biden Administration awarded $2.8 billion in grants to help bolster the US supply chain in at least 12 states: Alabama, Georgia, Kentucky, Louisiana, Missouri, Nevada, New York, North Carolina, North Dakota, Ohio, Tennessee, and Washington state. 20 companies across the nation will receive funds for mineral extraction and processing projects, hoping to improve manufacturing and the US's supply of critical minerals. This is a big step in the right direction as more data reveals that over the next 13 years, we need to significantly increase the number of mines producing and extracting these materials to meet demand.

These companies need to match the federal investment to support Biden's 2030 goal and "leverage a total of more than $9 billion to boost American production of clean energy technology, create good-paying jobs". But this isn't all the government is doing to support the EV industry.

The CHIPS and Science Act Meets the Inflation Reduction Act

President Biden and his administration have been working hard to reach their 2030 electrification goals, pushing legislation that will both encourage consumers to buy EVs and encourage automakers to keep manufacturing them. And now, with the introduction of the CHIPS and Science Act, he is hoping to do more of this manufacturing on American soil. With this investment, he looks to strengthen the American supply chain and elevate industry innovation, especially concerning semiconductor production. Since the passage of the Act, companies like Micron, Qualcomm, and GlobalFoundries have helped pledge nearly $50 billion in additional funding for American semiconductor manufacturing, making the total investment close to $150 since the current administration took office.

The law looks to bolster semiconductor research, development, and production to put the United States ahead of the competition in chip manufacturing. Though the semiconductor hails from America, the country only produces around 10% of the world's supply, relying on East Asia for 75% of chip production worldwide. The $52.7 billion provided by the act will fund American semiconductor research, development, manufacturing, and workforce development, including $39 billion in manufacturing incentives, $2 billion for legacy chips, $13.2 billion in R&D and workforce development, and $500 million to provide for international information communications technology security and semiconductor supply chain activities.

These funds come with their own set of rules that prevent the creation of certain facilities in China and 'other countries of concern' while also stopping companies from using taxpayer funds for stock buybacks and shareholder dividends. Overall, this Act hopes to promote US innovation in wireless supply chains and advance the country's global leadership in future innovation. And when paired with the Inflation Reduction Act's $7,500 in consumer tax credits for new electric vehicles (with $4k for used EVs) assembled in the US, the nation could fast become one of the largest manufacturers and sellers of EVs and their components.

Legal Landscape

To stop the EV gap from widening, the US needs to take drastic action to improve its supply chain. But with this, extreme caution is necessary as legal battles in the space have already begun.

Earlier this year, the SEC filed a lawsuit on account of a mining tragedy in Brazil after 270 people were killed in a dam collapse. As automakers race to supplement material shortages, they need to be cognizant of the risks involved with scaling these facilities and operations quickly. The pressure to increase production could put at risk the stability of mines and refineries with possible unskilled workers. Human rights violations have the potential to run rampant if safe and proper processes are not identified.

Mergers, acquisitions, and impending partnerships will also be an area to watch as more companies attempt to band together to improve manufacturing operations. M&As in this sector hit a historic high in 2021, but that also means litigation regarding these mergers will continue to grow. EV- related SPAC litigation has been prominent with securities suites over suits alleging that shareholders were misled by inflated claims during de-SPAC transactions (see Rico v. Lordstown Motors). Further, breach of contract conflicts will likely begin to crop up as more companies navigate supply chain hurdles and evolving demands.

Lastly, battles over patents for EV components are sure to ignite disputes as the amount of intellectual property around extraction technology, battery technology, and more increases at a rapid rate. With many players in the space trying to create their proprietary technology to achieve the same goal, protecting innovation is essential. And as JD Supra reported, "Patent holders must also beware of challenges from competitors and demands for interoperability from consumers. A comprehensive IP strategy must cover all bases – prosecution, enforcement, defense, and transactions."

If your company needs help preparing for challenges surrounding the EV supply chain reach out to WIT for the best experts who can advise you on your strategy. Our electric vehicles expert team was created to address what we expect to be the key areas of litigation in the move to electric fleets, and their knowledge covers all aspects of manufacturing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.