- within Consumer Protection topic(s)

- with readers working within the Oil & Gas and Construction & Engineering industries

- within Antitrust/Competition Law topic(s)

Highlights from the2025 Consumer Sentiment Index | Beauty

Consumers no longer shop for beauty; they shop for "self-care"—everything from topicals, infusions, injectables, and ingestibles to tools, wearables, therapies, and trainings. What used to be a clear-cut sector is now one with seemingly no boundaries.

The integration of beauty, health, and wellness defines how retail players win in this space. Our tool for understanding the new industry is the Consumer Sentiment Index, which surveyed 5,000 U.S. beauty consumers on purchase factors across five pillars: access, experience, price, product, and service.

The key finding? Beauty consumer approval comes down to efficacy accompanied by a strong health and wellness play. Individuals want results, honesty (and your recco for a good plastics consult).

Treat this like your cheat sheet to major industry shifts. First, let's meet the ultimate trendsetter for this era ...

The Consumer PhD is the new FDA

What we call the "Consumer PhD" is a self-educated, chemically savvy and exacting shopper who is looking for more than just something pretty: they're about efficacy, and about holistic beauty x health x wellness offerings.

Gen Z and Millennials in particular prioritize retailers that offer beauty, health, and wellness, while Gen X and Boomers anchor on detailed ingredient transparency. Almost 8 in 10 consumers say ingredient and benefit information is important to purchase decisions—ranking more important than "clean" claims. Consumers are increasingly buying products through med spas/salons and doctor/derm offices, which now rank #4 and #5 among specialty beauty destinations.

Wellness is the new flex

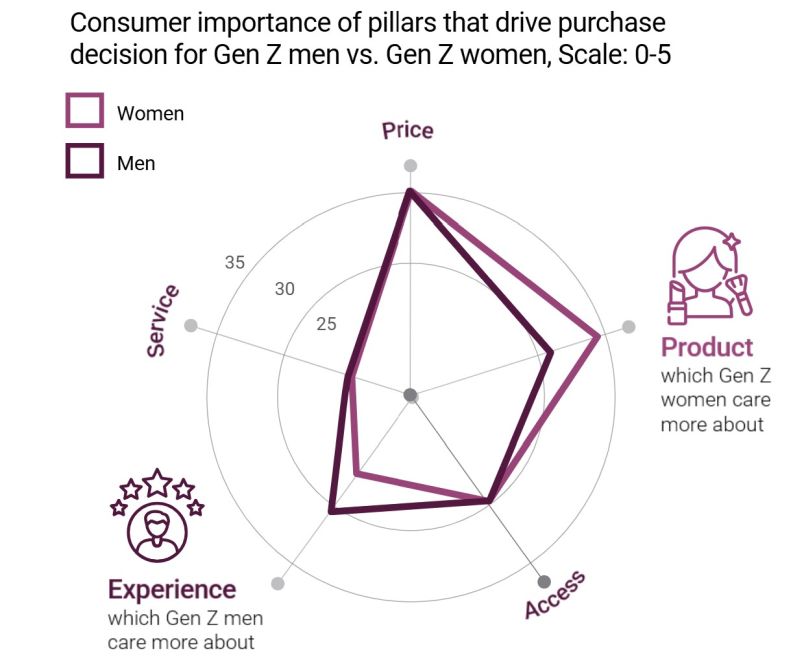

Male performance optimization culture has infiltrated the space, but it looks like experimentation with performance supplementation, wearables, and protocols, and hasn't been fully harnessed by brands yet: Our data show that they're bigger on experience than women.

Over half of men now use facial skincare, up from just 31% in 2022, per Mintel, signaling rapid adoption, but there is a disconnect in the way they are marketed to. Our study found that men value brand resonance 63% more than women, especially in monobrand settings where belonging is reinforced. Reflecting this, 77% of men shopped beauty at monobrand stores in the past six months, compared to just 61% of women—suggesting potential for monobrands to capitalize on identities that are either not targeted or not captured by multi-brand retailers.

'Loyalty' is an ode to revenues past

Today, loyalty looks less like emotional connection and more like isolated conveniences—going to Amazon for two-day free shipping, Target for protein powders and prestige brands, and TikTok Shop for instantaneous purchase post-discovery. Truthfully, the concept of retailer or brand loyalty can feel like an ode to beauty's past.

Product availability is 40% more important than loyalty programs in driving purchase decisions, highlighting reliability—not loyalty—as the primary trigger. Just 7% of consumers say a loyalty program they feel connected to is their most important experience driver.

Mega-influencers are getting 86'd

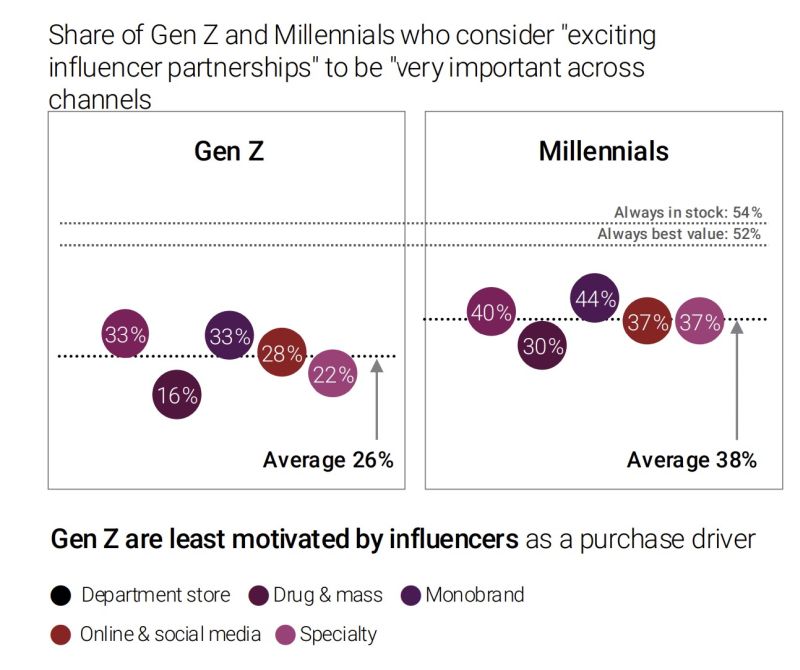

Gen Z—the first generation of digital natives—has led the charge toward authenticity, developing parasocial connections to influencers and, in turn, demanding honesty and vulnerability. For them, authenticity looks like embracing breakouts with a Hero Cosmetics Starface selfie; for older generations, it looks like real talk and a #sponsored disclosure.

Influencer relationships rank last in consumer purchase motivators, with only 57% considering them important. But nearly three-quarters of online and social consumers say ratings and reviews are an important driver of purchase decisions. Brand identity resonance is also rising sharply, with the share of consumers valuing it "very important" jumping from 23% in 2024 to 36% in 2025.

You can't swatch a serum through a screen

The journey that leads customers to swipe a product onto the back of their hands in-store is very different than the reveal on their phone of a limited-edition color drop. Accordingly, discovery needs to be strategized differently for in-person and online spaces. Discovery is play; the medium is the playground.

Twenty-eight percent of consumers begin their beauty search online or on social, with women over-indexing compared to men. For Millennials in particular, access to new brands and products ranks as the #1 purchase driver in monobrand and specialty channels, making newness critical to conversion.

The value equation is getting a makeover

You can get your staple Too Faced Better Than Sex Mascara at Ulta, Revolve, Macy's, Shein, Sephora, QVC, Walmart ... the list goes on. The pricing differs by a couple of dollars—not enough for most customers to price shop, but enough for them to get annoyed. Enter: the elusive, internal, subjective "value" conversation.

Fully loaded, or true, value is an individualized perception that weights price, service, access, experience, and product. As chaos in the beauty industry unfolds with a proliferation of brands, new retailer entrants, and uncertain macro dynamics, consumers are adopting a measure of control in determining the value of an item rather than simply accepting its price.

Eighty percent of consumers say consistent pricing builds brand trust, and 85% cite it as the #1 purchase driver. Notably, 42% would even pay more if price stability were guaranteed, per CXM, underscoring consistency as a core lever of value.

Where to for beauty?

Sixty percent of beauty, health, and wellness sales still occur in-store, per NielsenIQ, and executives need to be there IRL to understand how access, experience, price, product, and service play out among their customers. Retail theater becomes particularly powerful during the holiday season as people shop with high needs, looking for guidance and a bullseye.

We explain what that means for digital, marketing, programming, and pricing strategy, as well as for brand assortments and partnerships, in the full report here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.