- in North America

- within Technology topic(s)

- in North America

- with readers working within the Banking & Credit and Technology industries

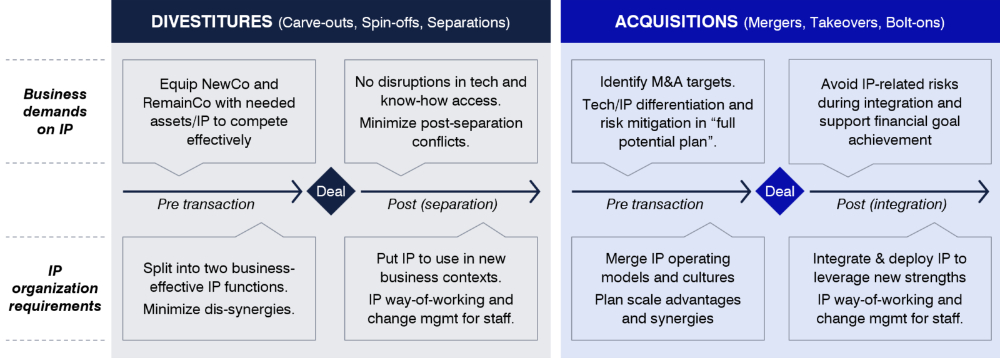

Acquisitions and divestitures – whether adding new capabilities or carving out parts of the business –are powerful tools for corporate growth and transformation, marking critical moments in a company's evolution. However, as many companies have learned, they come with risk. Poorly executed transactions can lead to operational disruption, loss of critical assets and capabilities, and long-term strategic misalignment. Intellectual property (IP) is an important but often overlooked factor in determining whether major corporate restructurings succeed or fall short.

Across both divestitures and acquisitions, IP plays multiple critical roles in turning strategic intent into lasting competitive advantage. Before and during an M&A transaction, IP can help shape the deal by informing target selection and supporting due diligence and valuation. In divestment transactions, IP is central to reducing organizational dis-synergies, enabling the clear separation of assets and rights, and ensuring that both NewCo and RemainCo are equipped for success.

Post-transaction, the focus shifts to execution and long-term value creation. This includes establishing new IP operating models aligned with business needs, guiding change within IP teams, integrating portfolios to eliminate overlaps, or managing shared assets and rights between separated businesses. Most importantly, it means putting IP to work in new business contexts to achieve the financial and strategic outcomes the transaction was meant to deliver.

Figure 1

Business demands on IP and IP organization requirements during corporate restructurings

In this article, we explore four real-world cases where IP played a key role in acquisitions and divestitures. These cases, based on Konsert's experience, provide actionable insights into delivering business value, managing risks, and ensuring portfolio and organizational effectiveness. While details have been adapted to protect confidentiality, the lessons remain highly relevant for business executives and IP leaders facing similar challenges.

Overview of the 4 cases

DIVESTITURES

Company: Industrial equipment provider BLOOM splitting into NewCo and RemainCo

Need: NewCo and RemainCo needed a clean split without conflict over common assets

- Repeatable, scalable framework for efficient, unbiased asset allocation

- Control measures to minimize risk and avoid conflicts

- Alignment with intended business plans for unbroken continuity

Outcome: NewCo and RemainCo were equipped with the assets needed to operate independently and competitively, and primed for carve-out success.

Company: Diversified technology company MORPH carving out a Division

Needs: Splitting a single IP organization into two teams, each meeting its business' needs

- Talent assessment and allocation to equip both Co's with needed IP capabilities

- Minimal dis-synergies, and no delays in executing on strategies after the split

- A natural logic for IP operations, allowing for separate and equivalent cultures

Outcome: Two fully operational and business-effective IP functions, each tailored to and ready to execute on the needs and ambitions of their separate businesses.

ACQUISITIONS

Company: European industrial company GRAVITY, growing through rapid M&A

Needs: Bringing IP into M&A process at the right time, keeping the process lean

- Understanding the risks of failing to consider IP

- Balancing limited IP resources and executive attention with effective IP support

- A flexible framework to support increasingly IP and tech-intensive M&A

Outcome: An in-depth risk understanding and updated gated M&A process allowing executives to involve IP at the right time, building an IP narrative throughout M&A.

Company: Chemistry companies ALLOY and INGOT, merging into one company

Needs: Integrating two distinct IP organizations, transforming them into a joint IP team

- Full understanding of integration obstacles and ways forward

- A co-created, organizationally anchored model and disciplined change rollout

- A forward-looking team retaining all key talent

Outcome: Successful integration of both functions into one a business-oriented approach, designed and launched within 100 days despite late-stage involvement.

Managing intellectual assets during and after a company split

Background: Splitting into two separate companies for long-term value creation

The board of directors at BLOOM, a leading industrial equipment company, initiated a carve-out of one of its two primary business divisions. The carve-out was guided by the strategic rationale that creating two independent entities would unlock long-term value and position both businesses to better benefit customers, employees and shareholders. The separation aimed to sharpen the business focus and improve competitiveness for both RemainCo and NewCo.

As an innovative, technology-driven and knowledge-intensive organization, much of BLOOM's value resided in intellectual assets (IAs)*. Recognizing their strategic importance, executive management identified the need to systematically map and allocate these assets to RemainCo or NewCo. In addition, control measures had to be defined to safeguard these assets and regulate their future access and use, especially for assets needed by both RemainCo or NewCo and therefore had to be replicated or shared.

Approach: Ensuring access to key intellectual assets for RemainCo and NewCo

BLOOM established a dedicated IA workstream within the broader separation project to systematically manage the allocation of assets. The IA workstream's objectives were to:

- Ensure that both RemainCo and NewCo retained access to critical technologies, know-how, and intellectual property rights necessary for continued business operations and long-term competitive positioning.

- Restrict access to certain assets to differentiate the two companies and support their unique strategic directions.

- Support financial valuation of assets and ensuring compliance with tax regulations.

- Avoid post-separation conflicts over shared or contested IA's.

The IA workstream focused on mapping and evaluating assets across both Operations and R&D. A structured and repeatable IA mapping framework guided the process, ensuring that assets were clearly defined, transactable, and appropriately allocated to either NewCo or RemainCo.

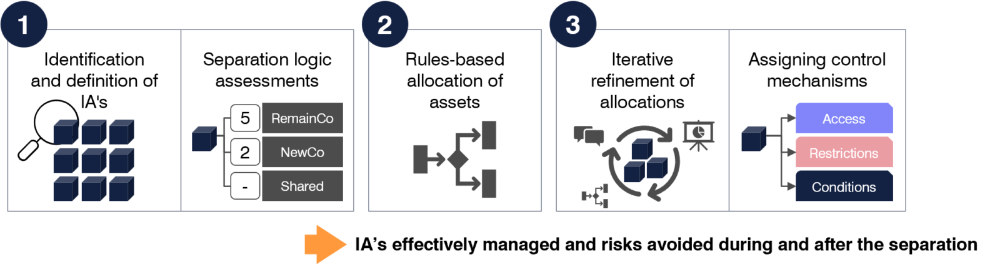

The process followed three main steps: 1) Identification and definition of IA's, including separation assessment, 2) Rule-based allocation of assets between NewCo and RemainCo, and 3) Iterative refinement of allocations and assigning control mechanisms to manage assets during and after the separation.

The identification and definition phase was the most straightforward but also the most time-consuming. It involved describing the assets created and used across R&D and Operations, and assessing each asset based on its relevance to the business operations and long-term competitive positioning of NewCo and RemainCo. The team also identified any risks associated with allocating an asset to one party or sharing it between both.

To enable objective and efficient allocation, the team used a technology reference architecture combined with clear, rule-based criteria derived from the separation logic assessments. This approach provided consistent guidance for asset decisions, including how to handle assets critical to both entities but difficult to duplicate or replicate – referred to as shared assets. The rule-based framework simplified the definition of control mechanisms for clear-cut assets that could be cleanly separated or duplicated. This allowed the team to concentrate on the more complex shared assets through iterative workshops that clarified control mechanisms and addressed potential political tensions or disagreements.

Figure 2

BLOOM's process for managing intellectual assets in the company split

Control mechanisms were tailored to ensure and restrict access to shared IA's by both RemainCo and NewCo, and to specify the conditions under which that access would occur. Examples included:

- Standard service-level agreements to govern normal access protocols and restrictions

- Higher service-level commitments with compensation models for assets requiring ongoing maintenance and updates

- Expert access and training provisions for assets dependent on tacit knowledge or significant knowledge transfer

- Strict, personal confidentiality agreements when direct use of assets could expose related trade secrets

- Conditional transfer mechanisms for assets involving third-party agreements

Given the complexity and sensitivity of IA allocation, BLOOM applied iterative refinement cycles anchored in strict deadlines. This structured approach enabled informed decision-making, secured stakeholder alignment, and ensured timely progress without risking any delays to the larger carve-out timeline.

Outcome: Equipping two independent companies with the needed assets

BLOOM's proactive and structured management of IA's yielded benefits for both NewCo and RemainCo. During the separation process, the use of a repeatable mapping and assessment framework streamlined the separation process, saving time and resources. This systematic approach enabled unbiased allocation of assets according to the strategic goals of both entities, based on which final allocation decision-making could be made in an efficient and consistent way across a large set of assets, while enabling resolution of any separation conflicts as they arose.

More importantly, in the post-separation phase, the result of this process was positioned to play a critical role in managing access to key technologies and know-how, with access granted or restricted based on the specific needs of each entity. At the same time, risks were identified and mitigated, with mechanisms defined in advance for how to govern and resolve any disagreements that would arise. This proactive approach prepared the entities to prevent operational disruptions and protect the long-term competitive positioning of both RemainCo and NewCo.

By carefully implementing control measures, BLOOM's IA workstream effectively minimized post-separation conflict risk and helped foster a cooperative relationship between the two separate businesses. BLOOM's approach to managing IA's ensured a successful separation but also provided both NewCo and RemainCo with the tools they needed to thrive independently in their respective markets.

Building two business-effective IP functions in a division carve-out

Background: Securing independent IP strength for RemainCo and NewCo

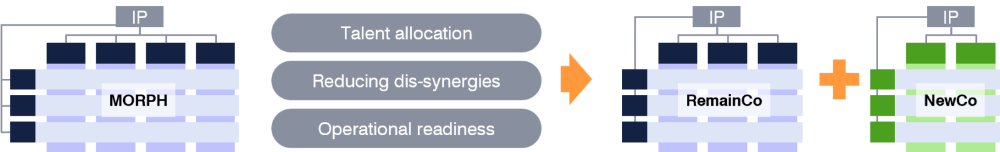

European diversified technology company MORPH decided to carve out a business unit generating over €10 billion in revenue, creating two separate entities (RemainCo and NewCo). This strategic move aimed to accelerate NewCo's growth, adapt to agile market dynamics, and deliver enhanced value for all stakeholders. However, the transition posed significant challenges, particularly in the realm of IP management.

Given MORPH's identity as a highly innovative and science-driven company, IP was a cornerstone of competitive advantage for both RemainCo and NewCo. Much of the company's value was rooted in its ability to leverage cutting-edge technologies, proprietary know-how, and a robust IP portfolio. This made it critical to establish two strong and independent IP capabilities, each tailored to the strategic direction of the respective business.

To achieve the carve-out's strategic and financial goals, minimizing operational disruptions and controlling separation costs were key priorities. MORPH was well aware of the risks of operational disruption, including the fact that when key IP capabilities are missing or not fully operational after separation, it can delay critical activities, weaken governance, and erode the competitive position of the newly independent entities.

Similarly, MORPH recognized that carve-outs often introduce inefficiencies, as reduced economies of scale drive up costs. Both RemainCo and NewCo would have to establish separate IP management systems, IP intelligence functions, and inventor remuneration processes – at a risk of generating duplicated efforts, higher costs from redundant systems, and missed opportunities to share expertise and resources.

A major challenge was separating the tightly integrated IP backend – paralegals, intelligence functions and IT tools – from the attorneys and business units they supported. NewCo's executive management initially underestimated this interdependency, complicating the separation process.

Approach: Controlling costs and minimising disruptions

As part of its broader carve-out program, MORPH launched a focused, intensive effort to prepare a clear and actionable plan for separating the IP function into two fully operational and strategically aligned organizations. The objective was to provide the Board of Directors with a robust decision-making basis for the IP carve-out and transition, with particular focus on talent allocation, minimizing dis-synergies, and ensuring operational readiness from day one.

The first step was a detailed analysis of the existing IP organization and the business ambitions of NewCo, in order to define the scope of needed IP activities. This was translated into an estimate of the full-time equivalents (FTEs) needed to support the NewCo effectively. For each function of the existing IP organization, it was assessed where existing FTEs were already fully dedicated to the activities of NewCo (allowing a straightforward "lift-and-shift"), and where the resources were intertangled between NewCo and RemainCo roles. Shared resources required further evaluation to decide whether to divide, duplicate, or redesign roles. This sensitive topic required structured discussions, particularly with function leaders but also top management of both RemainCo and NewCo, to align expectations and future needs.

Joint workshops with representatives from RemainCo and NewCo provided a platform to address key areas like attorney-paralegal relationships and the implementation of a new IP management system (IPMS). Interim solutions and service-level agreements were evaluated to maintain continuity during the transition.

Figure 3

MORPH's IP org carve-out, equipping both RemainCo and NewCo with the right IP capabilities

Using FTE models, the dis-synergies were calculated with the aim to keep them as low as possible for both companies. For roles that were unique or specialized, such as single contributors supporting an entire region, decisions were made on whether to establish these positions in-house or outsource them. Plans were also developed for hiring new talent, both internally and externally, to fill gaps. In some cases, additional hiring for RemainCo was necessary to avoid leaving NewCo without sufficient resources.

With talent and operational plans in place, a timeline was developed to prevent bottlenecks. This included building NewCo's IPMS, managing union negotiations, and coordinating HR processes to ensure smooth transitions and timely hiring.

These steps culminated in a clear decision-making framework for the Board of Directors, presenting a recommended path forward including FTE requirements for all IP functions in the NewCo and RemainCo, along with a detailed transition timeline. With stakeholder alignment and key options thoroughly assessed, the Board was equipped to make informed, confident decisions on the IP carve-out.

Outcome: Two independent and effective IP organizations

The carve-out successfully resulted in two fully operational and business-effective IP organizations. A well-structured organizational plan defined precise FTE requirements for each function, provided realistic cost estimates for separation, and ensured both entities would have the right resources to operate efficiently. By proactively addressing shared resources, the transition minimized inefficiencies and reduced dis-synergies.

A detailed transition plan ensured a smooth separation. This included designing and implementing a new IPMS, developing a communication strategy to align stakeholders, and managing HR activities, including negotiations with unions, to avoid delays. Immediate staffing needs were also proactively addressed, ensuring that both teams were equipped to function effectively from the outset.

The careful planning allowed both RemainCo and NewCo to start strong and remain focused on their long-term goals.

Finding the right narrative for IP in the acquisition process

Background: Need to bring IP into the acquisition process at the right time

GRAVITY, a European industrial leader undergoing digital transformation, was engaged in a rapid expansion process through acquisitions in targeted growth verticals. The primary goal was increased market share and new customer channels, taking existing proven businesses and integrating them in the larger portfolio with minimal disruption to existing activities. Traditionally, GRAVITY had focused its acquisitions on companies with proven customer bases and retail channels in mature markets, and had only rarely prioritized acquisitions of unique technologies or IP.

As GRAVITY's industry evolved, its acquisition candidates increasingly offered connected and digital products, and were in many cases dependent on IP to maintain their market positions. The traditional GRAVITY model for assessing and conducting acquisitions prioritized robust financials over IP, and when speed of growth was prioritized, it became difficult to be sure that IP and innovation were given sufficient attention and support.

GRAVITY recognized the potential risk of not considering IP sufficiently in the acquisition process, but needed to balance this potential risk with the need to quickly and effectively assess and conclude acquisitions. A process was needed not just to consider IP in acquisitions (including scouting, negotiation and integration) but also to identify when and how IP considerations and the IP function should be brought into the IP process, to ensure that IP was not excluded from important transactions while still maintaining operational and transactional efficiency.

Approach: Developing IP risk scenarios and adding IP narrative to the M&A process

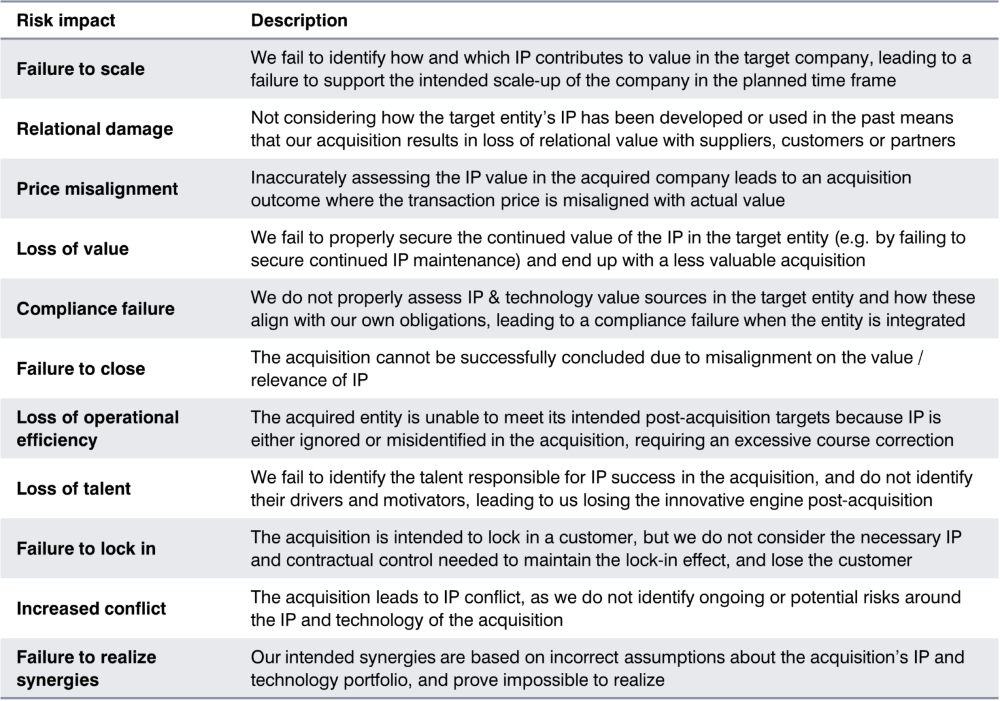

GRAVITY needed to upgrade its acquisition approach to properly address IP at the right times in each deal stage (including scouting, negotiation and integration), and make it clear when and how the IP team should engage. GRAVITY initiated an internal investigation to identify how IP could be made more visible in the acquisition process, and potential risks of failing to do so.

The investigation focused on finding the most relevant contribution points for IP, while balancing the risks of neglecting IP in acquisitions and the need for a lean, fast, and uncomplicated acquisition process. Three main steps were carried out to help GRAVITY achieve its goals:

- Building an overview of common risks: To underline the need for change, an overview of typical risks from failing to consider IP appropriately in acquisitions was put together with real-world examples. Interviews were carried out with CTO's, acquisition managers, and business heads to scope the problem and develop a case library of IP risks encountered in actual acquisitions.

- Developing the case for change: Capturing the identified risk case examples and showing how they can impact the ultimate value of an acquisitions if not properly addressed. As executive level attention in the process was limited, it was first necessary to make the case for change, and to help both M&A and IP departments show the need for changing the way of working.

- Updating the acquisition process: Finally, a new process was recommended, taking into account the need for a lean 'as-needed' IP consideration process, as well as applying a longer-term integration and evaluation process to capture the value of IP in new acquisitions.

Throughout the risk overview interviews it became clear that the one common need to address with the most potential to drive positive change was the IP narrative in the acquisition. The importance of a narrative throughline in the acquisition process was well understood by GRAVITY when it came to issues of growth, market potential, integration, and synergies, but IP did not have its own narrative, nor was there a clear process for when and how to develop this narrative.

To address their IP narratives, GRAVITY developed a lean but responsive process for formulating the IP narrative, beginning with a single question at top-level management decisions, able to scale into a full assessment of IP at the operative levels. The IP narrative included the purpose and rationale IP in the acquisition, a strong vision for what the IP portfolio and capabilities of the acquired company should contribute in the future (particularly to synergies with other acquisitions), and a sense of urgency for managing IP not only in the integration phase but throughout the assessment, negotiation, and integration of the acquired company.

Importantly, the process allows IP to be prioritized when relevant, but just as easily ruled out when not, helping avoid unnecessary complexity or loss of momentum later in the deal process.

Figure 4

Note: Not all risks had impacted GRAVITY in practice, as most were successfully addressed when identified.

Outcome: Updated M&A process, managing IP risks without compromising deal speed

By clarifying the potential risks from losing the IP narrative, GRAVITY managed to implement the new IP perspective without creating unnecessary hurdles or slowing down the acquisition process. Top-level management had access to a simple toolbox for bringing IP into the process and maintaining the IP narrative throughout the acquisition process, while those operatively responsible for the acquisition could trust that there was a clear vision for IP and not worry over its inclusion / exclusion from the agenda.

From late M&A-involvement to success in 100 days

Background: IP late in M&A planning, creating post-merger integration challenges

When ALLOY and INGOT announced their strategic merger, the deal promised to create a global powerhouse by combining ALLOY's strengths in bioengineering with INGOT's expertise in applied chemistry and molecular innovation. Together, the two companies aimed to expand their market leadership, enhance their innovation capabilities, and strengthen their global footprint.

Despite IP being central to both companies' business models, the IP functions had been excluded from merger planning. The Heads of IP were not involved in pre-merger discussions and had no role in designing the future operating model of the combined company. While antitrust regulations required both companies to continue operating as competitors – limiting the exchange of certain information – organizational design in other areas was still addressed at high-level before closing to ensure a smooth transition. However, IP was considered too sensitive by the executive leadership and M&A advisors to include in these preparations, leaving a critical gap in the integration process.

Nearly a year passed between the closing of the merger and the first briefing on how to integrate the two IP organizations. By then, the two departments – comprising nearly 100 professionals – were expected to transition immediately into post-merger integration (PMI) mode, despite having had no prior involvement in the planning. Adding to the challenge, leadership only decided which of the two Heads of IP would lead the newly combined organization a few weeks before the official merger date. As a result, structured PMI planning could only begin at the last minute, leaving the team to navigate a complex integration under intense time pressure.

Approach: Fast-tracking integration to merge minds and ways of working in 100 days

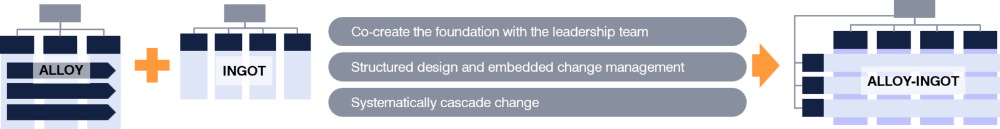

Starting at Day 1, the two IP organizations of ALLOY and INGOT had 100 days to move from an interim solution where they worked side-by-side to a new unified IP operating model. To successfully deliver on this, an integration team was formed. This team, composed of selected members from both legacy organizations followed three key principles in their work: co-creating the foundation with the leadership team, embedding change management into the integration process, and systematically cascading the transformation across the organization.

Principle 1: Co-create the foundation with the leadership team

As soon as the two IP teams could start interacting with each other, the new Head of IP, working with the integration team, scheduled a series of workshops with the existing IP management teams of ALLOY and INGOT. Since no information had been exchanged so far, the theme of the workshops was on understanding each other's structures, strategies, cultures, and ways of working. In preparation for the merger, both organizations independently compiled materials on their IP functions, governance models, and operating frameworks as a basis for mutual understanding – not just reviewing organizational charts and metrics but delving into why each IP organization had evolved the way it had.

These conversations helped establish a shared vocabulary, bridging differences in decision-making styles and cultural norms. The new Head of IP set the tone from the beginning and guided the dialogue in such a way that focus remained on collaboration rather than competition.

Figure 5

Principle 2: Structured design and embedded change management

The integration team took the approach of defining the new IP operating model through co-creation, with change management embedded throughout the integration process rather than as a separate workstream. Key priorities included:

- Balancing two distinct IP cultures – The ALLOY IP organization had recently transformed into a proactive, business-oriented function, while INGOT followed a more traditional, reactive approach. The integration process required careful storytelling, communication, and stakeholder engagement to ensure that neither side felt they were being forced into the other's way of working.

- Running operating model design workshops – Leaders and key stakeholders within and outside of the IP organization reviewed, critiqued, and refined the proposed structure, building alignment with the new company's strategic direction. These sessions also defined the leadership behaviors and values required for success.

- Embedding change management from the start – Clear communication and transparency were prioritized to minimize resistance and help employees understand the rationale behind integration decisions. By offering clarity on the future operating model, organizational design, and role selection process, the aim was to reduce uncertainty, prevent rumors, and encourage key talent to engage actively in the transition.

Principle 3: Systematically cascade change

Integration success depend on widespread adoption – not just leadership buy-in. Simply sending presentations or hosting top-down townhalls wouldn't be enough. To truly embed change, the integration followed a structured cascade approach, ensuring that every level of the organization could digest, contribute to, and take ownership of the transformation.

The dedicated integration team orchestrated this effort, ensuring alignment across the different parts of the new IP organization, taking into consideration the different functional units, geographies, teams etc. They established a disciplined integration rhythm – a structured cadence of meetings and deadlines – that maintained momentum and facilitated rapid decision-making. The team also provided ongoing support, addressed resistance, and ensured the IP organization remained focused on business priorities while adapting to the new reality.

Outcome: Overcoming PMI challenges to establishing a best-in-class IP function

By applying structured leadership co-creation, systematic design, and a disciplined change rollout, ALLOY-INGOT successfully transformed two distinct IP organizations into a unified, strategically aligned function – within just 100 days. The newly integrated IP organization went live on schedule, ensuring no disruptions to ongoing IP operations, R&D support, or business-critical initiatives. While the integration began as a reactive response to a lack of pre-merger planning, within those 100 days, ALLOY-INGOT established a solid foundation for transformation. After going live, the organization focused on further integration and continuous transformation to ensure long-term success, building on the strong groundwork laid during the initial phase.

The new IP organization adopted the business-oriented, proactive approach that ALLOY had been transitioning toward pre-merger. Rather than maintaining two parallel, competing mindsets, the new IP team was fully aligned with corporate strategy, ensuring that IP efforts actively supported commercial objectives.

Conclusion

The four cases in this article highlight IP's role as a strategic enabler that can influence the success of a divestiture or acquisition. Proactively addressing both the business's demands on IP and the IP organization's own needs is essential to unlocking value and mitigating risk – whether by:

- Equipping both NewCo and RemainCo with the critical assets needed to compete in their respective markets, while minimizing post-separation conflicts,

- Reducing dis-synergies when splitting one IP organization into two fully operational functions, each able to support their new business contexts effectively,

- Avoiding IP-related integration risks – such as failure to scale, loss of value, or talent attrition – to achieve financial targets and realize intended synergies, or

- Merging IP organizations effectively and aligning them with joint business objectives to actively drive commercial success.

Companies that overlook IP in divestitures or acquisitions risk operational misalignment, loss of competitive advantages, and costly inefficiencies. In contrast, those that embed IP early and throughout the process are better positioned to succeed in the acquisition or divestiture process and strengthen their long-term competitiveness.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.